2021 Wrap

Totally gaslit

gaslit: Manipulated by psychological means into questioning ones own sanity.

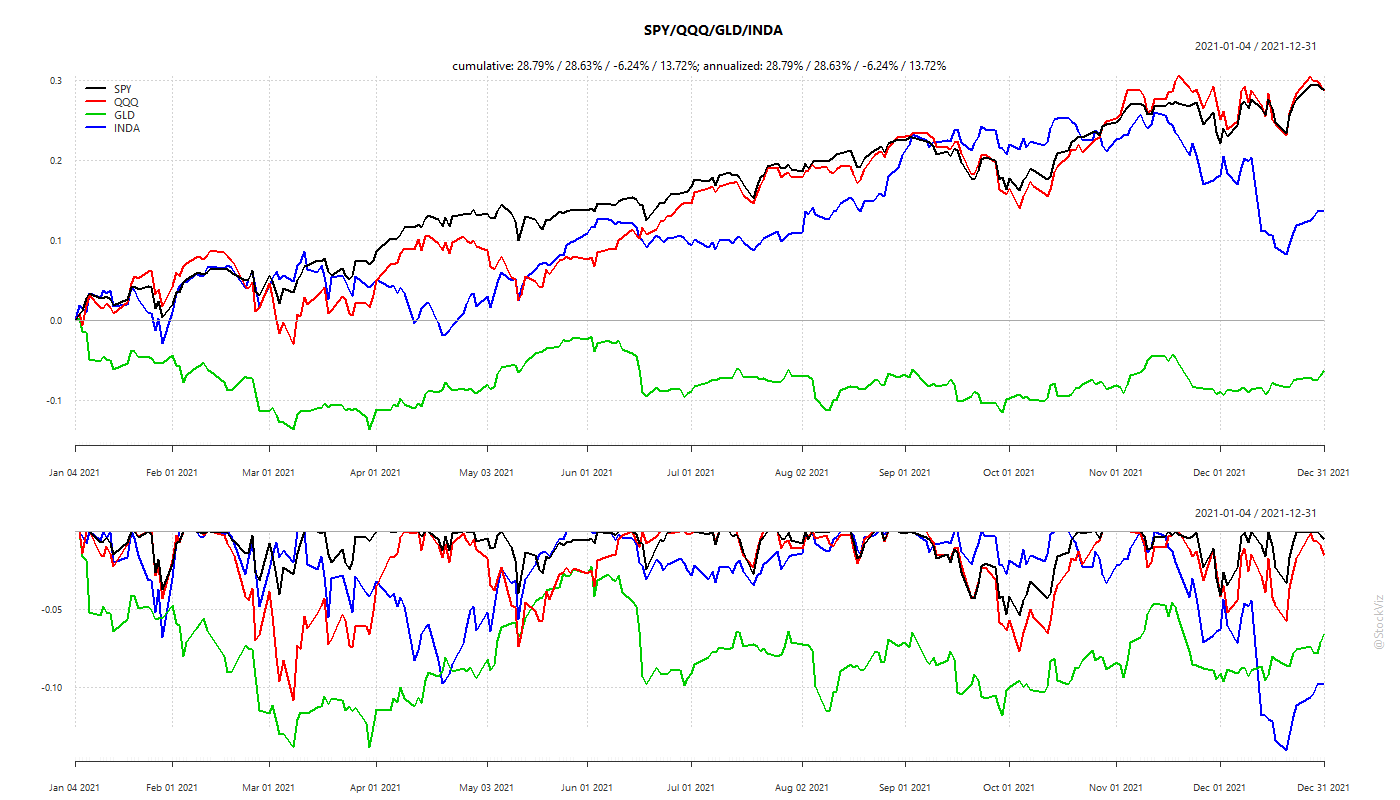

If, at the end of 2020, someone had told me that in 2021, S&P 500 would have a 2-Sharpe and end with almost 30% returns, I would’ve probably asked him to have his head checked. The joke, if there were one, would’ve been on me.

2021 was one of the best years for the S&P 500…

… While it was not the best year for the NIFTY, neither was it the worst…

… small-caps > mid-caps > large-caps…

… and of the Fama-French factors: small > value > momentum > quality > low-volatility.

The Rupee has been resilient, all said and done.

Strategy Recap

Momentum

The markets were by-and-large benign. Strategies that rebalanced on a monthly calendar schedule out-performed their momo peers.

Static: Relative > Velocity > Acceleration

Momo: Velocity > Relative > Acceleration

Quantitative Value

We did not expect our value strategies to beat our momentum/momo strategies in 2021. Since these are rebalanced only once a year and we expect them to under-perform momentum during bull markets. That was not how it worked out.

While Magic Formula did have a wild year, it ended middle of the pack. Other than Balance Sheet Strength, the other 4 Q-VAL strategies put in very strong numbers.

2022: The Year of the Taper

The US Fed gradually tapering their bond buying program and normalizing interest rates is going to challenge risk assets. However, the number of high-risk assets have exploded in recent years. Crypto (monkey jpegs worth millions of dollars,) no-revenue tech goes ($16B ARKK ETF,) etc. are way ahead of Indian stocks in terms of risk. They should bear the brunt of deflating risk-appetites and cushion EMs somewhat. It will be interesting to see how our markets behave this time around.

Meme of the Week

Happy New Year and have a great year ahead!