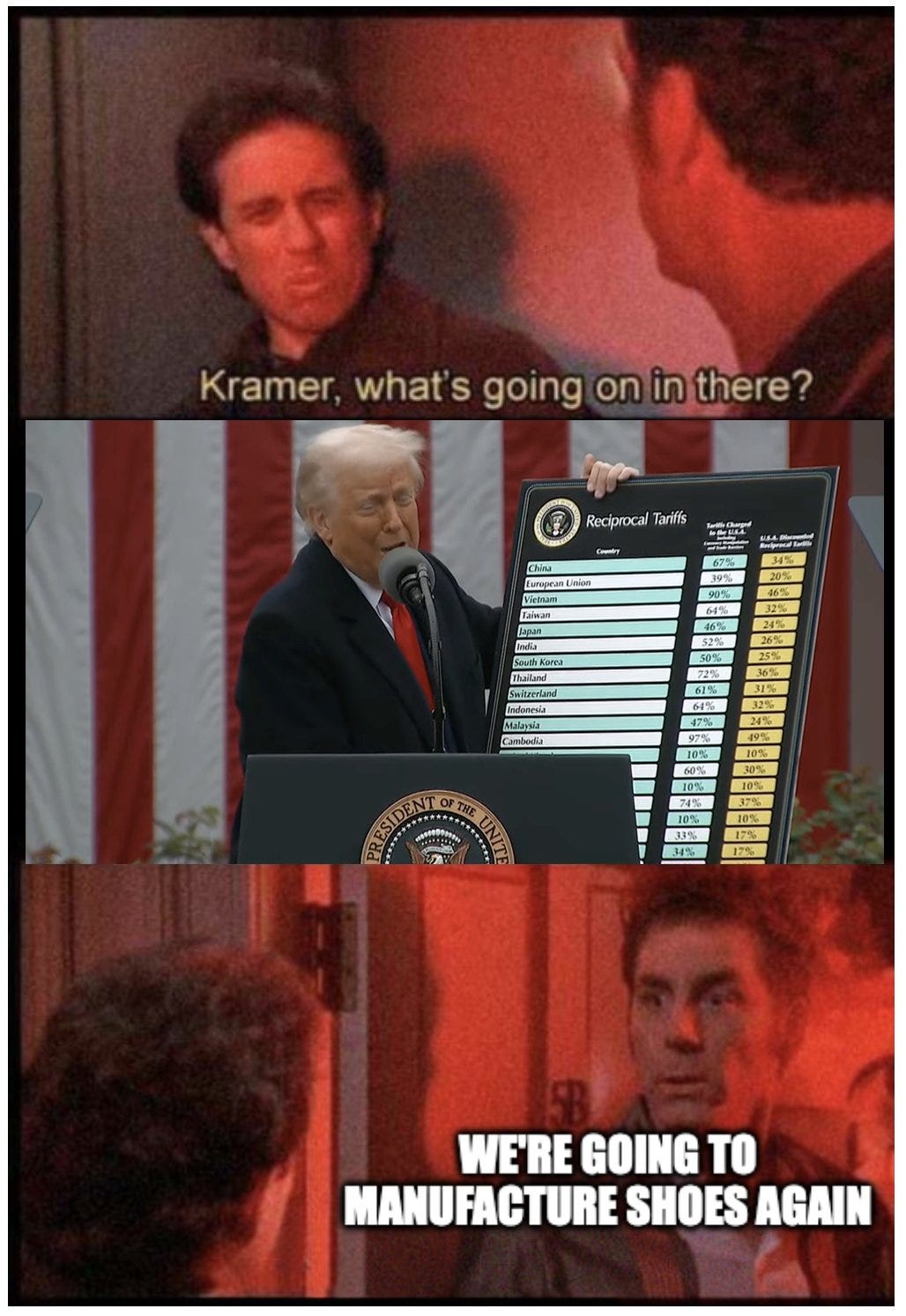

Trump cooked up some numbers and imposed tariffs on the rest of the world (usatoday). It makes no sense (reuters).

After weeks of work, aides from several government agencies produced a menu of options meant to account for a wide range of trading practices, according to three people familiar with the matter.

Instead, Trump personally selected a formula that was based on two simple variables — the trade deficit with each country and the total value of its U.S. exports.

Inside President Trump’s whirlwind decision to upend global trade (wapo)

However, that formula itself is wrong. It makes an error that inflates the tariffs assumed to be levied by foreign countries four-fold (aei).

The White House’s “reciprocity” calculation has no basis in mainstream economic analysis. Instead, it seems to have been improvised on the fly as a rationalization for Trump’s pre-existing intention of levying heavy tariffs on almost all of our trading partners.

Trump’s Tariffs Aren’t Reciprocal and Are a Massive Tax Increase on Americans (cato)

It would be funny if it weren’t tragic. The poorest countries, exporting low-value products like textiles, got hit with the largest tariffs. The stated purpose of these tariffs are to encourage re-shoring. Does America really want Vietnamese sweatshops to relocate to North Carolina?

Vietnam, a poster child for the "China plus one" strategy, risks becoming a victim of its own success, as Trump's tariffs have effectively undermined this approach for the region (nikkei).

The sheer scope and magnitude of the tariffs came as a shock to financial markets.

If businesses don’t believe that Trump will stick with his tariffs, the investment required to spur a domestic industrial revival won’t materialize. But if they do believe him, the markets will crash, because Trump’s tariff scheme will, by the estimation of the economists that investors listen to, produce substantially lower growth.

Probably the likeliest outcome is an in-between muddling through, with slower growth and higher inflation.

The Good News About Trump’s Tariffs (theatlantic)

There are two likely scenarios. One, Trump backtracks: negotiates some concessions with individual countries, declares victory and drops tariffs. This is the best case scenario.

The second, scarier scenario, is that Trump actually believes that he needs to bring down the system that has been built over the last 50 years over the next 6 months.

It’s a shocking audacious plan, an attempt to address a big and obvious problem, which is America’s inability to make vital goods we need. As I noted on Sunday, the system we’re in - neoliberalism - is designed around having living standards oriented around raising the value of financial assets through bubbles and design/finance instead of building physical things and selling them for profit. Imports and offshoring were a huge piece of neoliberalism, providing the cheap flat screen TVs that justified losing entire communities.

But is Trump breaking from that system, or is he just smashing whatever he can in the name of populism, and thus justifying a revenge tour from Wall Street?

Has Trump Ended Or Revived Neoliberalism? (thebignewsletter)

The thoughtlessness with which these tariffs were decided confirms that there are no adults in the room. There is no plan beyond the headlines.

History shows that large-scale protectionism can backfire spectacularly. Any short-term gains often vanish in the face of retaliations and global slowdowns. The 1930 Smoot-Hawley Tariff is the classic cautionary tale. It aimed to protect US jobs during the Great Depression but led to retaliatory tariffs worldwide, shrinking international trade and worsening the global downturn. It’s not a perfect parallel, but it’s a reminder that broad, giant tariffs can create unintended economic damage - and can put us in the Kindleberger downward spiral.

Tariff Q&A (kyla)

If you assume that these numbers stick, then it is equivalent to a 2% tax increase on national income.

Like all sharp budget tightenings, this will reduce living standards—and these tax increases are targeted such that the poor will suffer disproporationately. The tax increases are also sufficiently complex and arbitrary that they will create substantial costs for businesses, reducing productivity and exacerbating the direct hit to incomes.

How to Think About the Tariffs (theovershoot)

Combine this with China facing 54% US tariffs and a deflationary environment at home, it will be forced to dump its wares on the rest of the world.

China’s reduced access to American consumers could prod its companies to send even more cheap metals, chemicals and other products in Europe’s direction, worsening concerns about dumping and heightening already-high tensions on other matters.

Will Trump’s Tariffs Drive Europe Into China’s Arms, or Into a Fight? (nyt)

Were pre-Liberation Day state of affairs sustainable? Probably not.

In 1975, the three largest employers in the US were the Exxon corporation, General Motors, and Ford; in 2025, the biggest employers are Walmart, Amazon, and Home Depot. The first group made tradable goods, while the latter companies by and large sell imports domestically.

Trump, Tariffs, and the Fate of the Dollar (project-syndicate)

However, there is no plan for what might come next.

While it is easy to focus on the immediate risk to global trade from US tariffs, the bigger investment risk may be from the resulting decline in global portable capital. The more the US administration weaponises trade and the dollar, the greater the risk that it prompts active capital repatriation. Indeed, as the international structures that promoted free trade since the 1980s are unwound, the greater the risk that we return to the capital controls of the 1960s and 1970s.

How ‘weaponised trade’ could lead to ‘weaponised capital’ (ft)

Trump has taken a sledgehammer to the system. What it was was never was.

Good economic policy depends as much on process as on substance. If the US takes steps down the road toward an unchecked, personalistic system of policymaking, it will carry very steep long-term costs. America has the most prosperous economy in world history, and it is no coincidence that it was built on a relatively impersonal, rules-based system. If it’s destroyed, it may prove near impossible to rebuild.

Once an Economy Switches from Rules to Deals, It’s Hard to Go Back (bloomberg)

Markets this Week

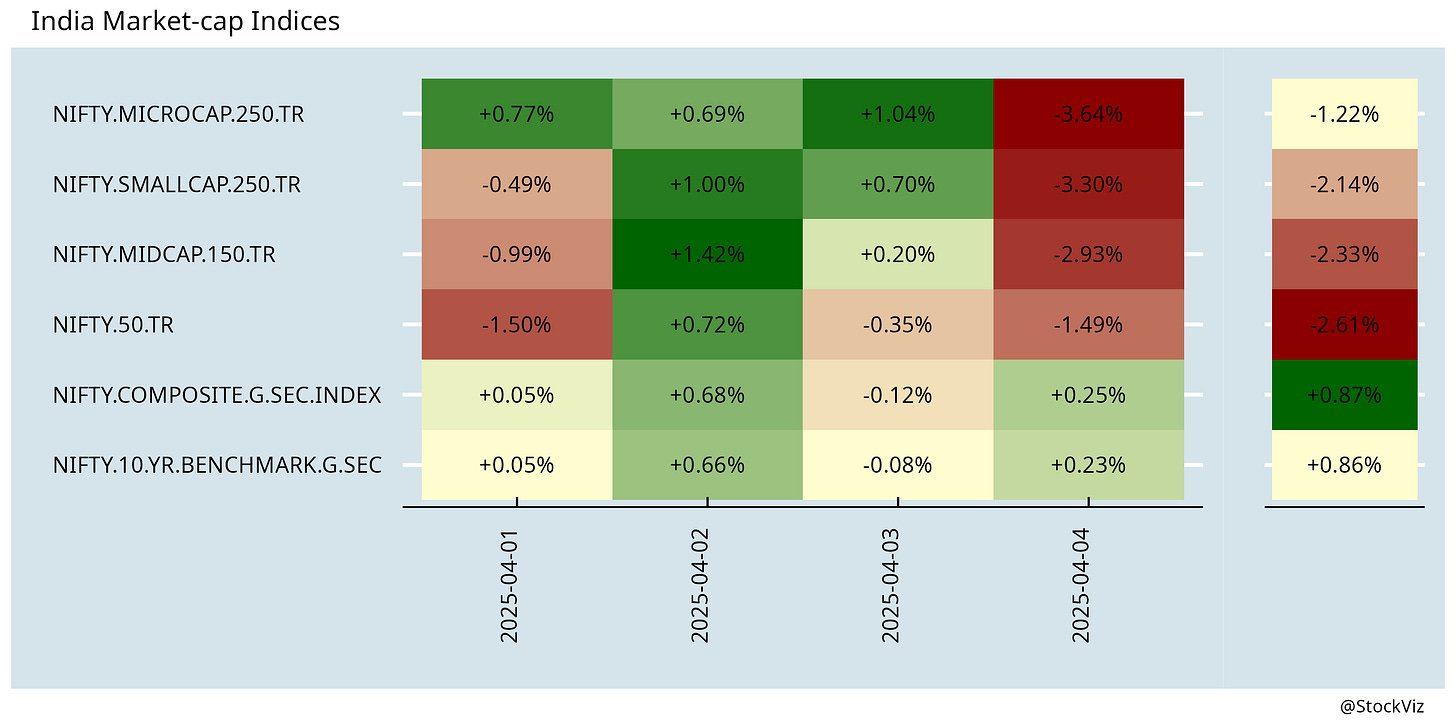

Indian markets woke up late to Trump’s handiwork…

… with IT down big due to US recession fears…

… they expected a clownshow but got a shitshow…

… energy (XLE), tech (XLK), finance (XLF), industrials (XLI), all down…

… CEOs will be making a beeline to Mar-a-Lago this weekend…

… USD down against most currencies…

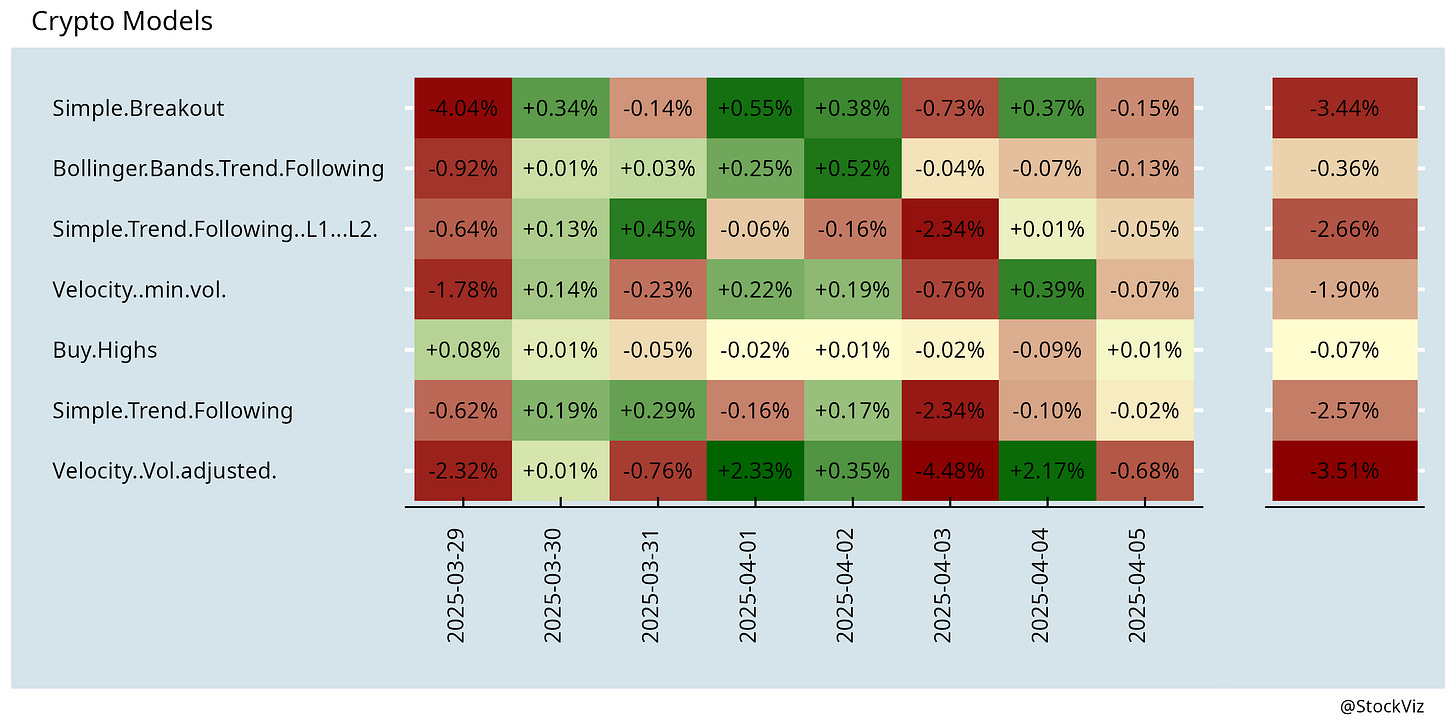

… bitcoin surprisingly resilient…

… but simple crypto strategies struggled.

Links

Research

The Research Behavior of Individual Investors (NBER)

The median individual investor spends approximately six minutes on research per trade on traded tickers, mostly just before the trade; the mean spends around half an hour. Individual investors spend the most time reviewing price charts, followed by analyst opinions, and exhibit little interest in traditional risk statistics. Aggregate research interest is highly correlated with stock size, and salient news and earnings announcements draw more attention.

Are tariffs bad for growth? Yes. (NIH)

Using an annual panel of macroeconomic data for 151 countries over 1963–2014, we find that tariff increases are associated with an economically and statistically sizeable and persistent decline in output growth. Thus, fears that the ongoing trade war may be costly for the world economy in terms of foregone output growth are justified.

The Inverted U-Shaped Relationship between Female Entrepreneurship and Economic Development (NBER)

The share of entrepreneurs who are women first rises and then falls with national income. Women face the most level playing field in middle-income countries, where the returns to entrepreneurship are high enough to offset gender-based costs.

Blocking mobile internet on smartphones improves sustained attention, mental health, and subjective well-being (OUP)

When people did not have access to mobile internet, they spent more time socializing in person, exercising, and being in nature. These results provide causal evidence that blocking mobile internet can improve important psychological outcomes

Tariffs

Warren Buffett’s letter warning about US trade deficits in 2003 (pdf).

Tariffs may drag the country’s gross domestic product growth down by 2.4 percentage points in 2025 (bloomberg).

Trump tariff shock stings Bangladesh, Sri Lanka garment giants (reuters).

Walmart is continuing to push Chinese suppliers to cut prices by up to 10% to offset President Donald Trump’s tariffs (bloomberg).

An American-made iPhone could cost as much as $3,500 (economist).

House Republican moves to rein in tariff powers (politico).

India

IndusInd Bank ignored established Indian derivative accounting practices for years as it chased profit growth, resulting in a $175 million balance-sheet hole and the biggest crisis for the lender (reuters).

IT firms were looking forward to rebound. Now all bets are off (livemint).

The government is preparing to decriminalize more than 100 offences under various laws by the end of this year to improve investor confidence and unlock potential for faster economic growth (livemint).

Trump’s tariffs should push India to double down on reforms (livemint).

row

Ukraine is not on the verge of collapse, and it is Russia, not Ukraine, that is losing the attritional war (theatlantic).

China wants to lead the world in robots (washingtonpost).

CME launching perps - the crypto crossover you’ve been waiting for (cme).

Tesla’s vehicle sales fell 13% last quarter to an almost three-year low (bloomberg).

Two More Chinese Companies Announce 'Megawatt' EV Charging (insideevs).

Odds & Ends

Intel and Microsoft staff allegedly lured to work for fake Chinese company in Taiwan (theregister).

Have humans passed peak brain power? (ft)

End-stage capitalism (pluralistic).