By now, everybody and their uncle has published a budget wish-list. Everything from what they should do, what they will do but cannot do but might do in the future has been discussed ad nauseam. Ultimately, nothing will happen because we are ruled by incrementalists afraid of losing the next elections.

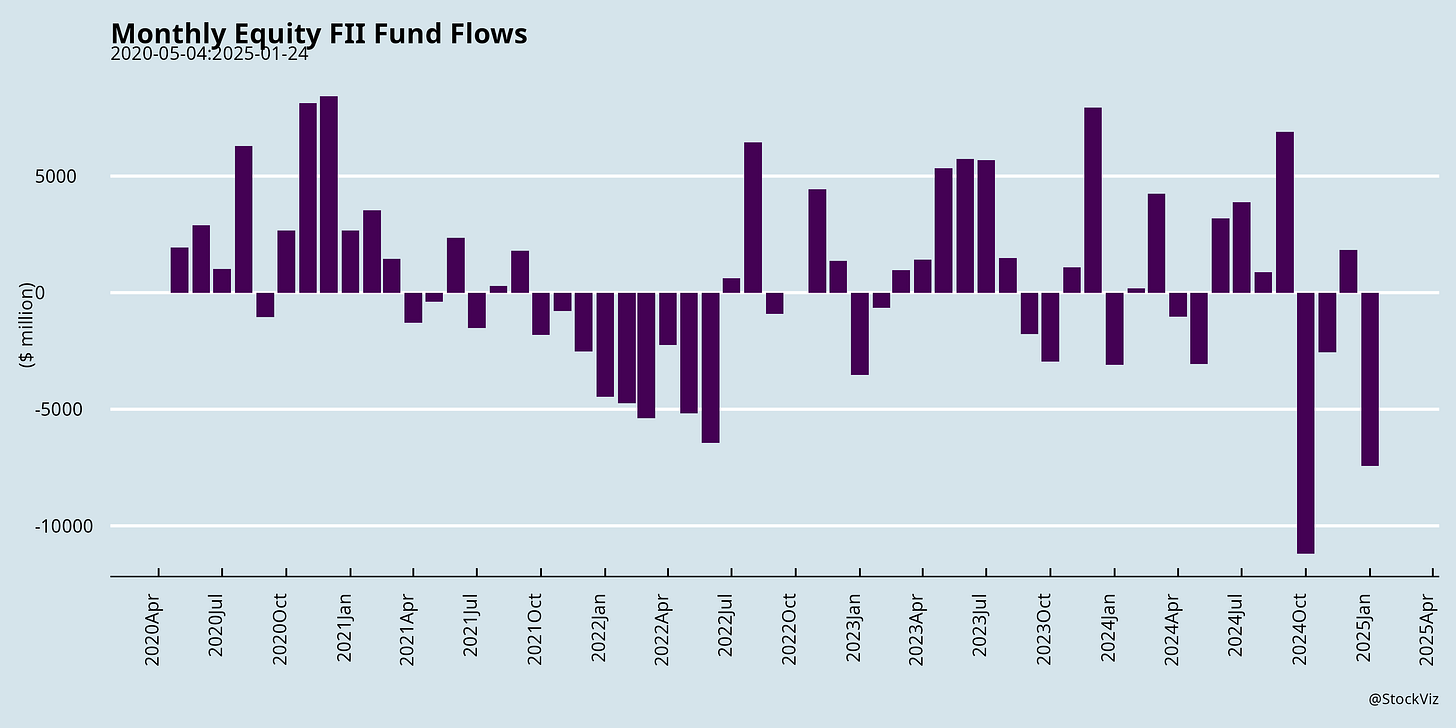

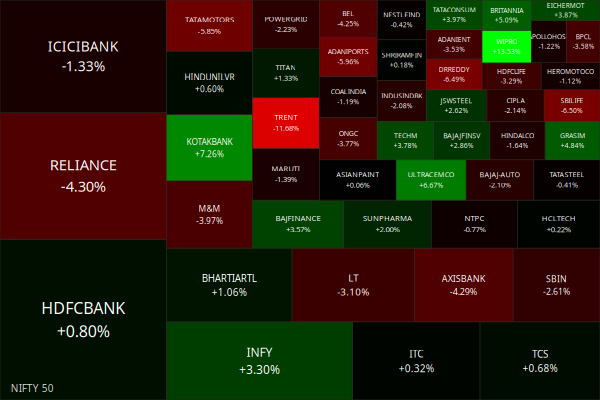

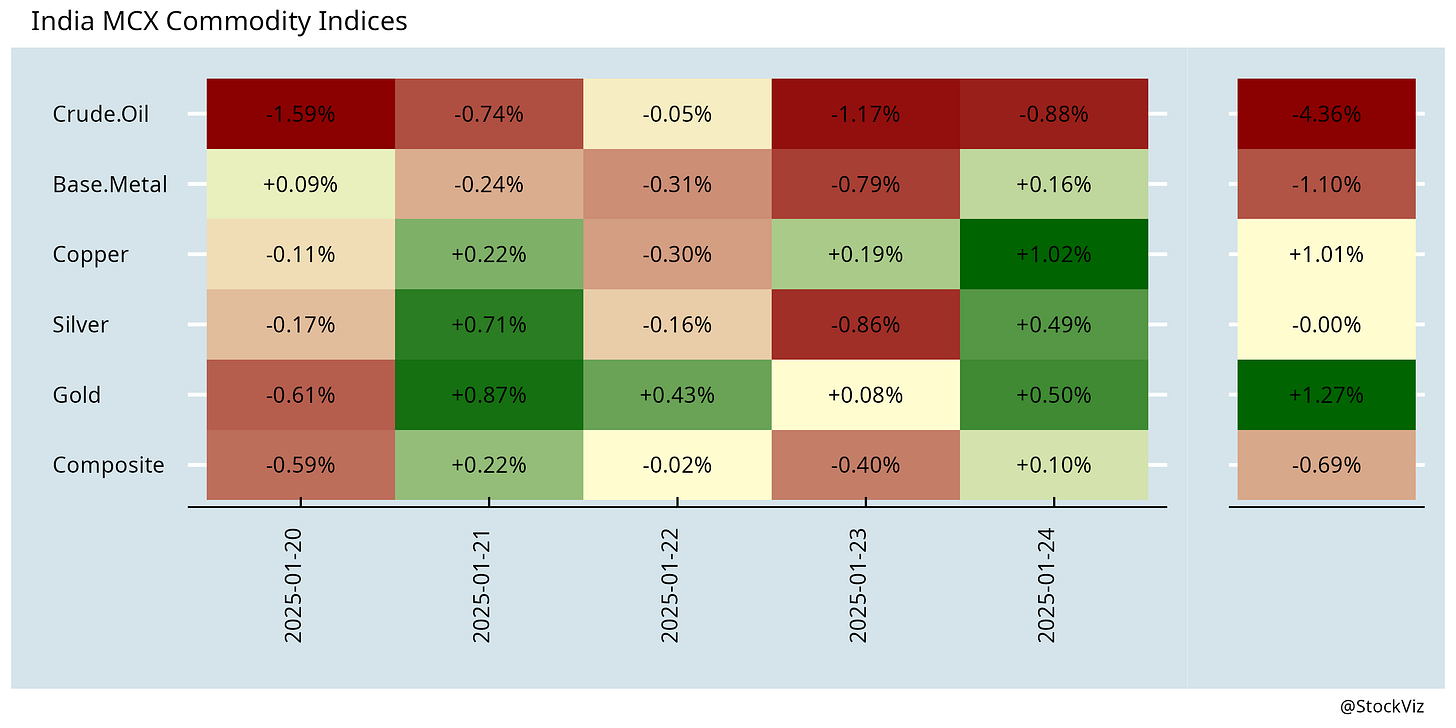

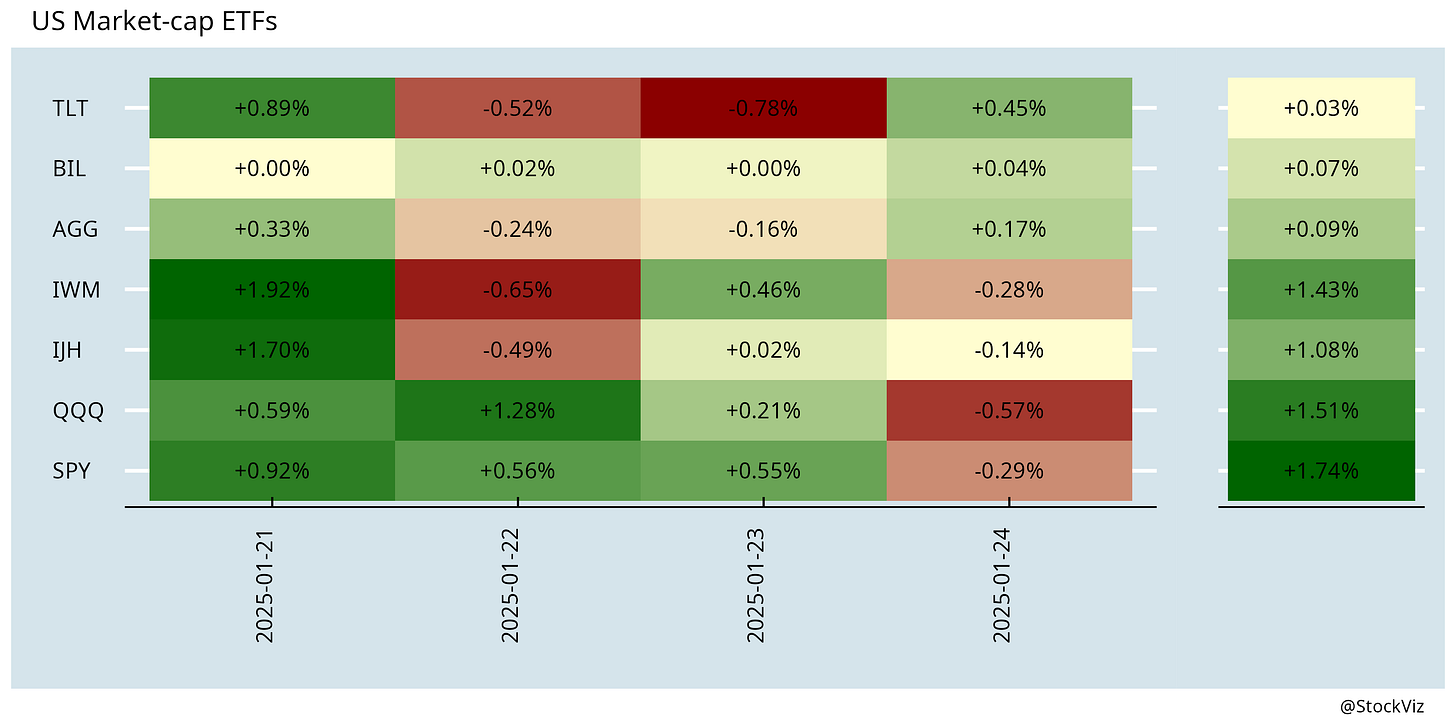

Markets this Week

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

Growth Predictions, Growth Surprises, and Equity Returns (alphaarchitect)

What matters is not the expectation of future growth, but the deviation between projected growth and realized growth, which, by definition is a surprise, and, thus, is not forecastable. In addition, because the market harshly penalizes companies that projected high growth but realized low growth, investors should minimize idiosyncratic risks. Focus not only on what is projected, but to remember that the market has already priced in expectations.

Retirees Spend Lifetime Income, Not Savings (SSRN)

There appears to be a behavioral resistance to spending down savings after retirement in a manner that is consistent with life cycle models. Retirees spend far more from lifetime income than other categories of wealth. Approximately 80% of lifetime income is consumed, on average. In contrast, only about half of available savings and other income sources are consumed. Withdrawal rates from savings are well below typical guidance and the analysis suggests that converting savings into lifetime income could increase retirement consumption significantly, especially for married households.

The $TRUMP Meme Coin: Genius, Greed, or Grift? (SSRN)

The $TRUMP meme coin represents a unique intersection of cryptocurrency, politics, and speculative investment. The $TRUMP token exemplifies a hybrid of genius in branding, greed in concentration of ownership, and the potential for grift in exploiting speculative fervor.

Investing

Investing is Hard (behaviouralinvestment)

India

Indian banks are in the throes of the worst liquidity deficit in over a decade (cnbctv18)

The latest FY 2025 ratio of all taxes to GDP for India is likely to reach upwards of 19 per cent of GDP. The advanced country average was 25 per cent of GDP in 2019, likely lower today. East Asia is at 13.5 per cent, with China and Vietnam at 15.9 and 14.7 per cent respectively. In India, it is up and away for all tax collection. (indianexpress)

Contrary to popular narrative, latest Household Consumption Expenditure Survey shows lower income consumers splurging while the affluent have cut back. (thehindubusinessline)

Over 5 crore cases are pending in courts across the country, with many taking 15-20 years to reach resolution. This delay impacts millions, including 2.5 lakh undertrials languishing in jails, and taxpayers burdened by ₹12.5 lakh crore in unresolved disputes. (livemint)

row

Waymo is safer than even the most advanced human-driven vehicles (waymo)

Britain’s net zero, green energy madness is set for a head-on collision with reality (telegraph)

China’s exports of pre-owned cars are surging, especially to Central Asia. The vehicle exports of Global-Ucar Technology, the largest Chinese firm in the used car business, jumped nearly 67 percent last year. Its second-hand car exports soared over three-fold to reach a new record. (yicaiglobal)

As the EU’s auto industry reels from a slowing Chinese economy and cutthroat competition, analysts caution the worst is yet to come (scmp)

The truth behind your $12 dress: Inside the Chinese factories fuelling Shein's success (bbc)

Odds & Ends

Hotel booking sites caught overcharging travelers from Bay Area (sfgate)

Uber, Ola Get Notices Over iPhone, Android Differential Pricing Claims (ndtv)

US FTC calls out ‘surveillance pricing’ says companies using browser history, shopping patterns to manipulate prices (livemint)