With the Union Budget around the corner, media talking heads and influencers are busy throwing out content about what they want our Finance Minister to do. But our budgets have always been about a cash-grab here, a subsidy there, a splattering of schemes to placate vote-banks that seem dodgy, blue-sky vision statements that would make Lenin blush, all ending with CEOs praising it as the second coming of the Christ. Are we expecting anything different this time?

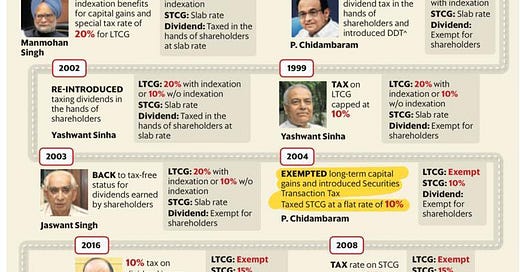

The evolution of Captial Gains Tax in India exemplifies the adhoc and capricious approach towards taxes in general.

A well thought out system would begin with ideology, leading to laws that help frame regulations that formulate taxation & incentives.

As long as our ministers and bureaucrats treat the country as a personal piggy bank that they can raid to payoff special-interest groups that help them win the next election cycle, we are not going to make sense of any of this.

Case in point: the lip service given to growing the “retail corporate bond market” over the last 20 years. The elephant in the room is the tax differential between buying a bond mutual fund (growth) vs. buying a bond straight up. Until this gap is fixed, the whole thing is an exercise in keeping retired bureaucrats busy in chai-samosa committees.

Color me a cynic, but this Cirque du Soleil act is getting old.

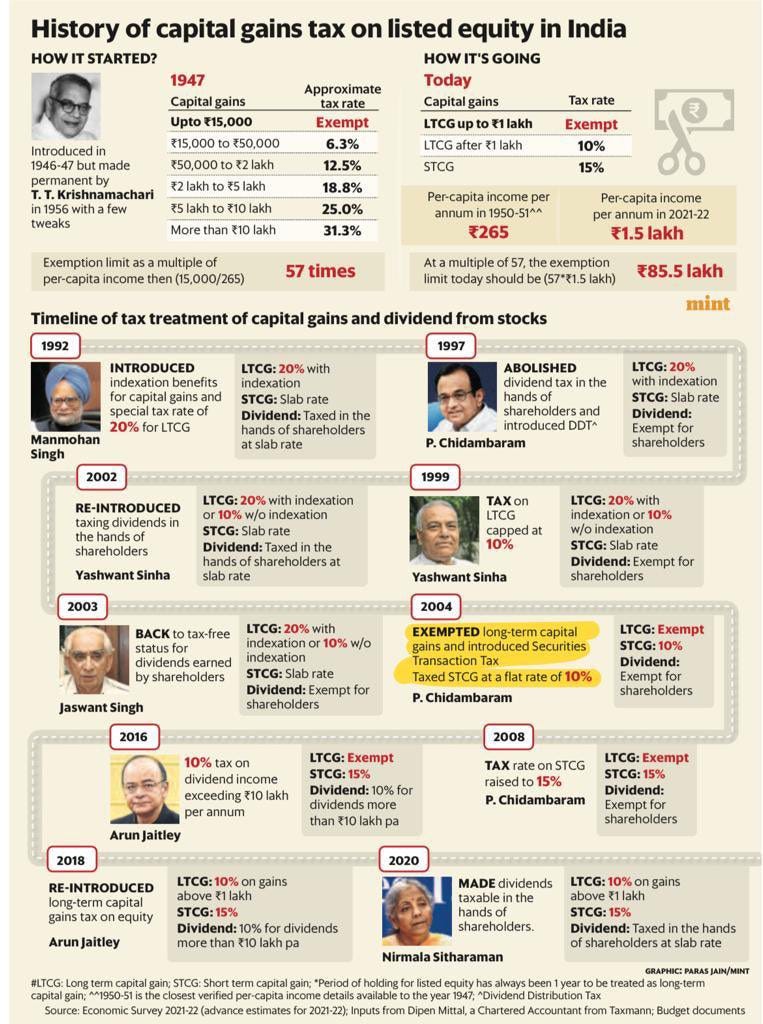

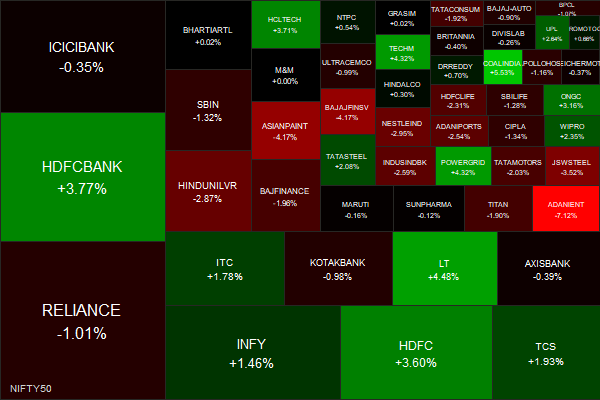

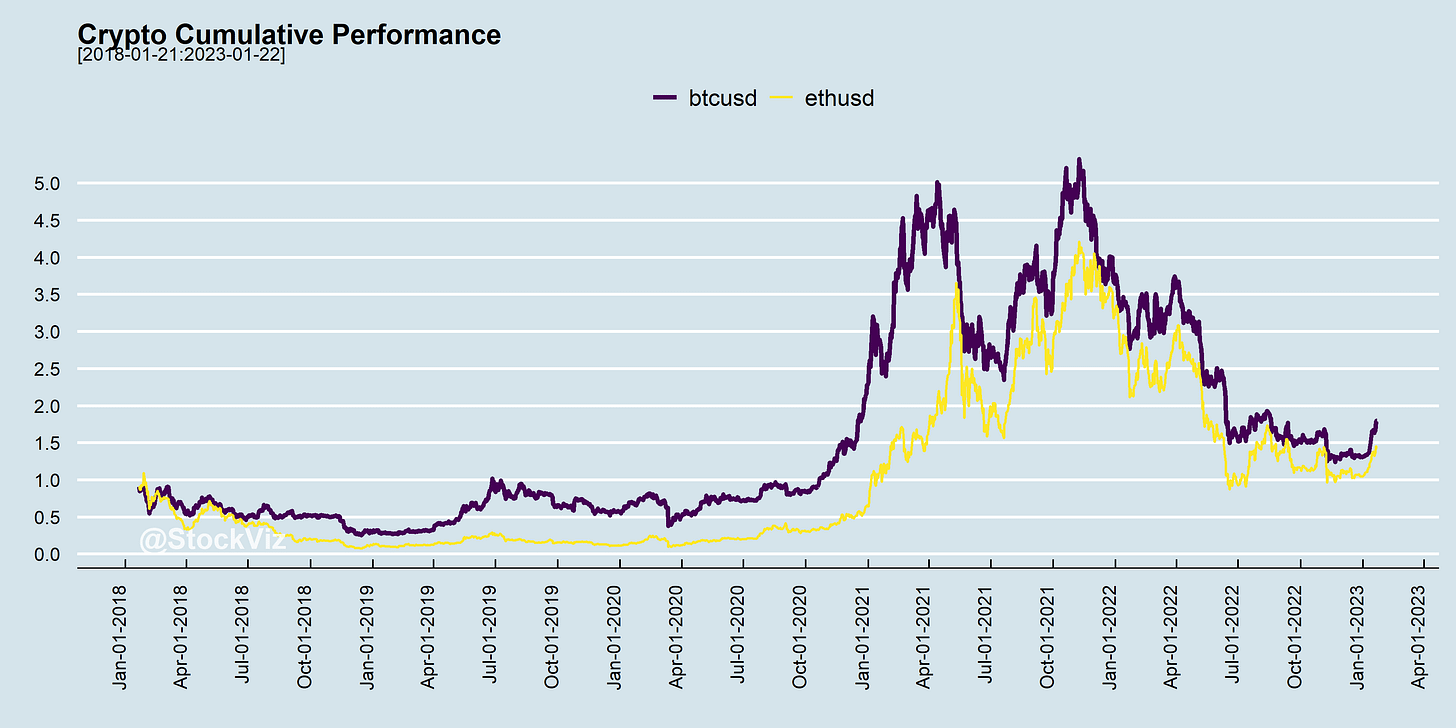

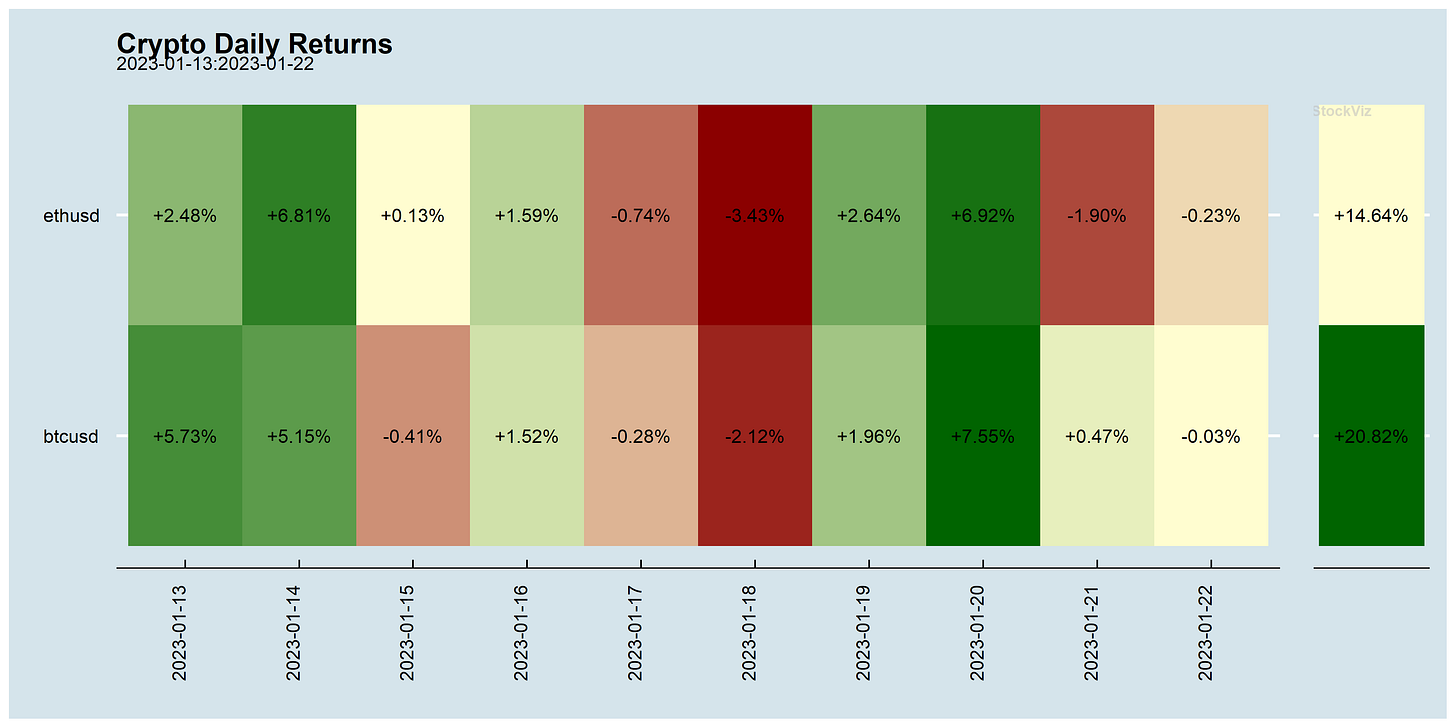

Markets this Week

More here: fixed income, currencies and commodities.

The best performing country ETF so far this year: ARGT (Argentina).

Links

Costs matter.

~

Cashflows matter.

~

Where are the jobs?

The rising unemployment in India belies other indicators suggesting the economy is undergoing a healthy rebound from the COVID-19 pandemic. Instead, the surge in people looking for work, many of them rural migrants, raises concerns about consumption and longer term growth prospects.

Despite India's economic growth, few jobs and meagre pay for urban youth (reuters)

~

It used to be called organized crime: the omnipotent empire known as Ticketmaster/Live Nation (thread)

~

After BREIT, it’s now the turn of SREIT and KREST to halt investor withdrawals.

The nontraded REITs had strong performance in 2022 despite a sharp drop in comparable public REITs. The Starwood REIT returned 6.3%, the KKR REIT, 8.3%, and the Blackstone REIT, 8.4%. Apartment REITs had negative returns of about 30% in 2022, and the broad Vanguard Real Estate exchange-traded fund (VNQ) was down 26%, including dividends.

Starwood, KKR Retail Real Estate Funds Limit Investor Withdrawals (barrons)

~

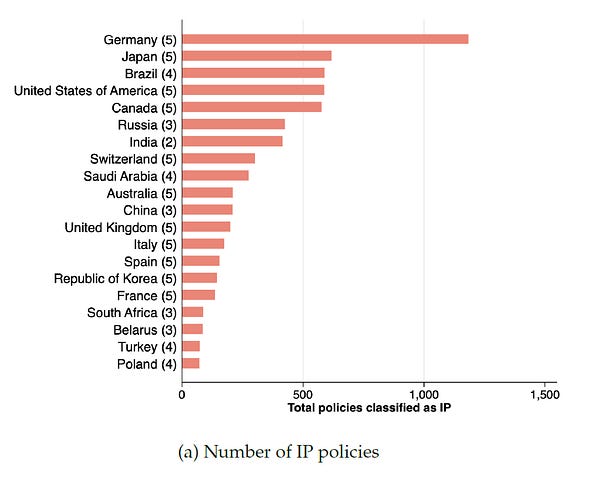

Free trade and industrial policy can co-exist. The problem is always the incentive structure.

The Economist: America turning protectionist is bad for the world.

Michael Pettis: U.S. policies to reduce its deficit actually enhance free trade.

~

Investing!

Bruce Greenwald’s lectures and talks in one place: thread.

The premium rate of returns generated by equities over the long term is a function of the elevated level of anxiety that equity owners must manage relative to bond investors.

The Equity Anxiety Premium (intrinsicinvesting)

~

All “Green Transition” roads lead to China.