CNBC was all about the NIFTY hitting all time highs this week but there is little jubilation amongst the retail crowd. Most of them exited last year when NIFTY had made its previous ATH and they are now in the “should we/shouldn’t we” analysis-paralysis mode.

This must be the most hated ATHs ever.

Technically, in dollar-terms (a stand-in for inflation/macro adjusted price levels), NIFTY 50 and SMALLCAP 250 are yet to get back to their ATHs made last year. However, the party is in full swing in the MID and MICRO space.

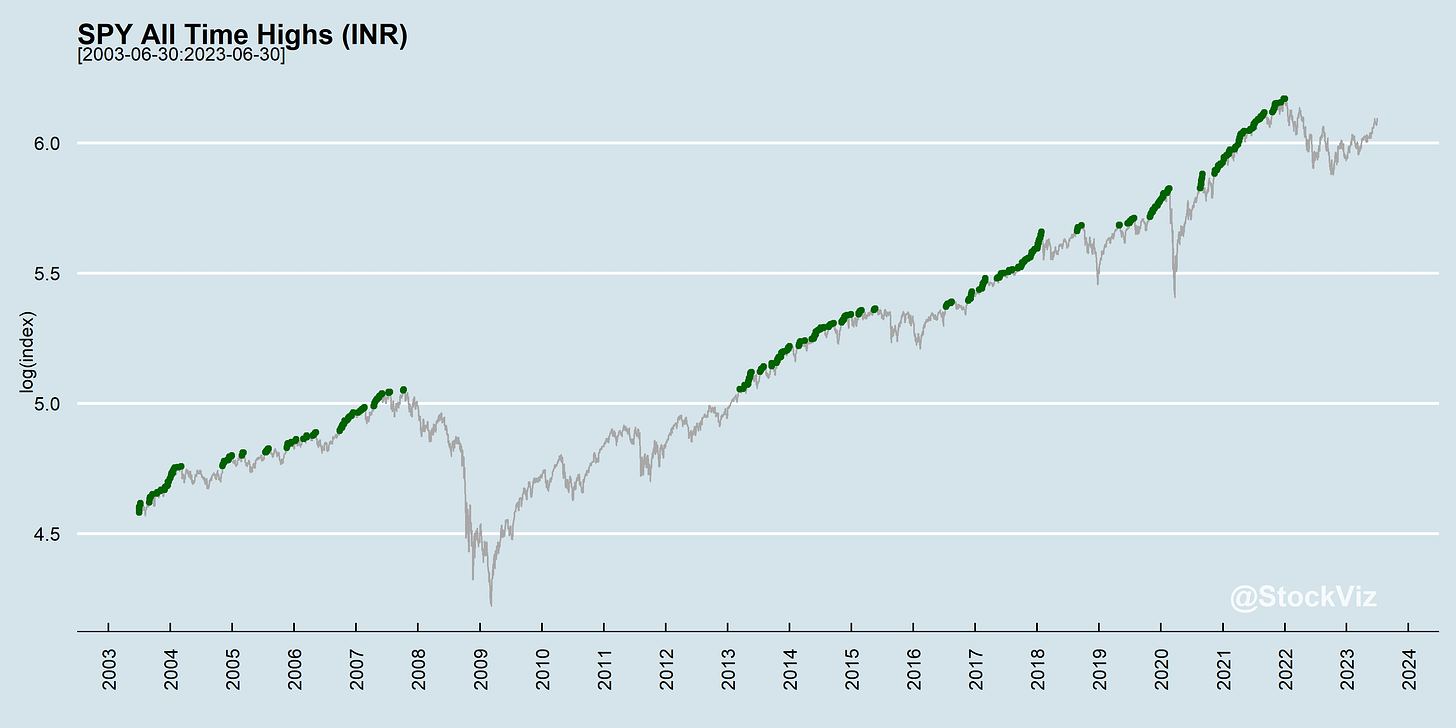

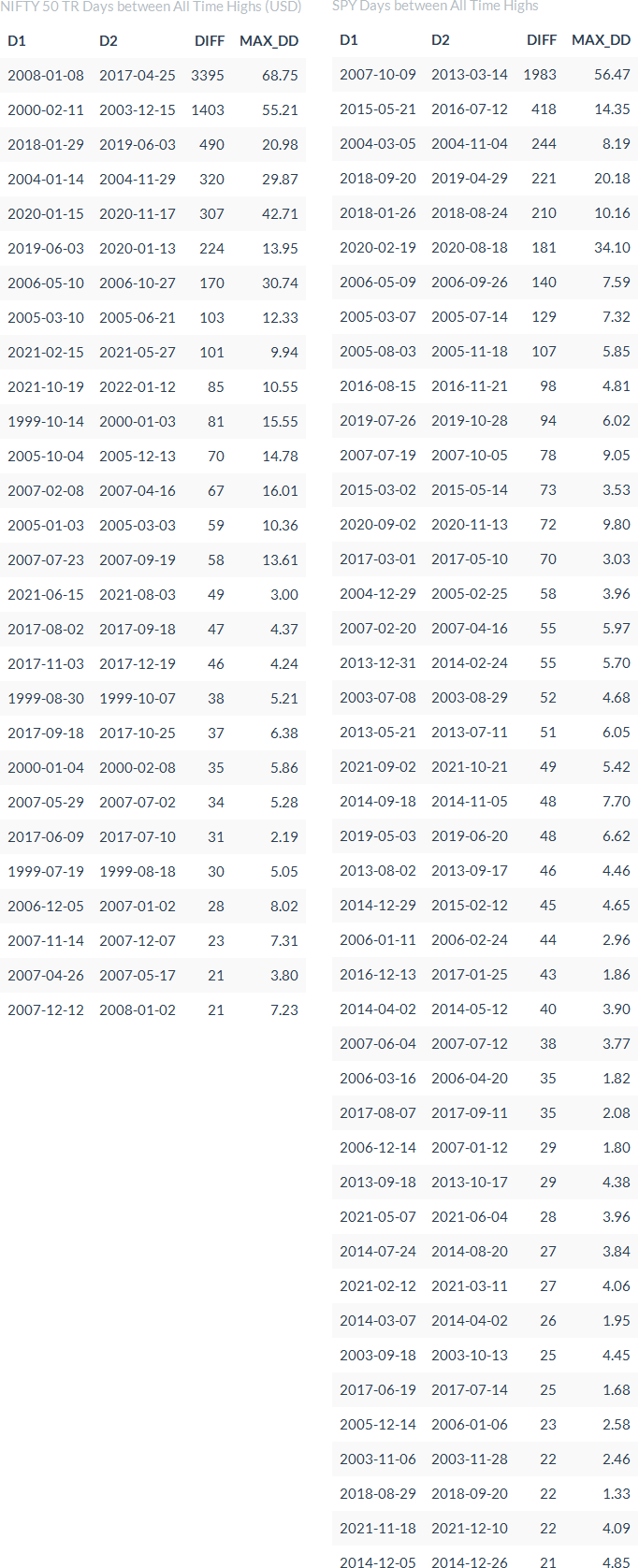

At least some of the tiredness can be attributed to how the US markets have been the last 20 years.

The last decade has bee just one long never-ending party with some time-off to digest, recover and rejoin. The differences in recovery times are stark.

All goes to say, best ignore these labels and treat them as just another milestone in the long random walk of stocks that are tied together in a positive drift.

Markets this Week

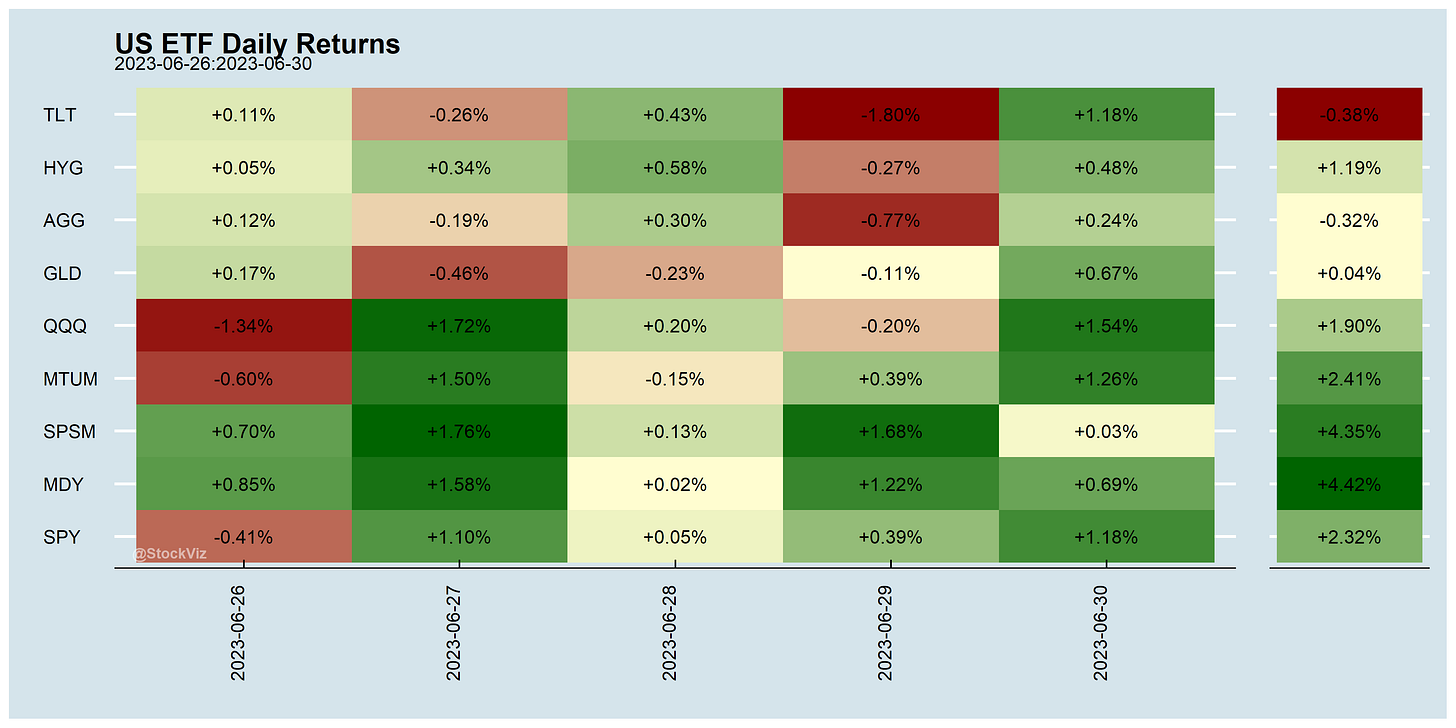

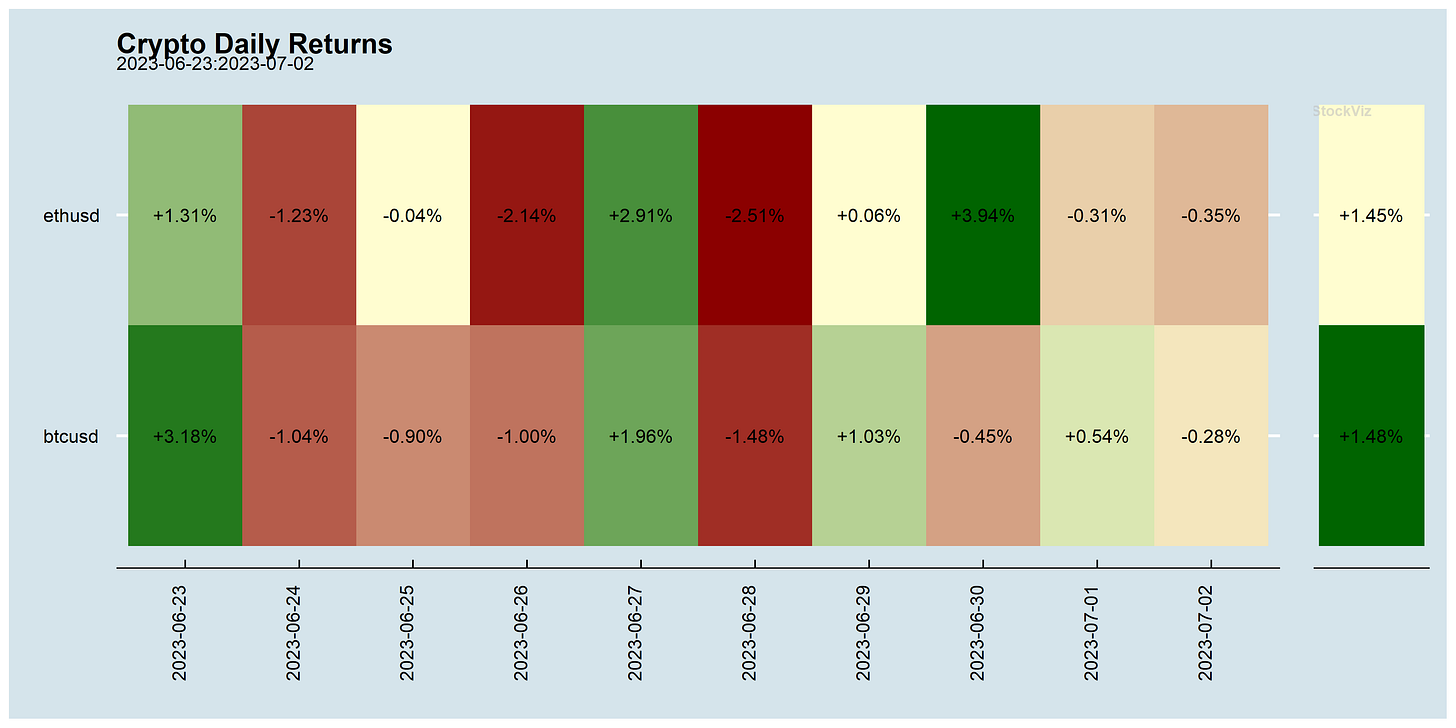

Everything green. Unbelievable.

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

If QE/ZIRP is truly over, then we’re in trouble.

I show that the decline in interest rates and corporate tax rates over the past three decades accounts for the majority of the period’s exceptional stock market performance. Lower interest expenses and corporate tax rates mechanically explain over 40 percent of the real growth in corporate profits from 1989 to 2019. In addition, the decline in risk-free rates alone accounts for all of the expansion in price-to-earnings multiples. I argue, however, that the boost to profits and valuations from ever-declining interest and corporate tax rates is unlikely to continue, indicating significantly lower profit growth and stock returns in the future.

Macro-economics is mostly useless for investing.

Instead of using prices to predict market trends, some trend-followers seek to identify trends in macroeconomic data as predictors of market moves. While reasonable at first glance, the simplicity of this approach is not well-suited to addressing the complexity and idiosyncracy of macroeconomic data and their impact on prices. Macroeconomic trend strategies have potential weaknesses, which may include ignoring more timely data, the conditional relationship between economic data and prices, and the impact of valuation information. All these arise from the tendency of macroeconomic trend strategies to mimic price-based trend-following, rather than leveraging the particulars of macroeconomic data and their relationships to prices.

Prices can change just because of a change in the level of prevailing emotions even in the absence of any new information becoming available. (SSRN, SSRN)

Finally, some respite for technical analysts.

Moving averages (MAs) of stock market indices act as psychological barriers. We reveal that market indices do not move continuously near their MAs, especially in markets dominated by unsophisticated investors. Using international data, we find that a stock market index’s MA exerts a significant impact on future index returns when it is crossed over.

Investing

The Indian market is big but not that big. (thread)

Economy

A massive underground deposit of high-grade phosphate rock in Norway, pitched as the world’s largest, is big enough to satisfy world demand for fertilisers, solar panels and electric car batteries over the next 100 years, according to the company exploiting the resource. (euractiv)

Chinese manufacturing PMI inched up to 49.0 from 48.8 in May, staying below the 50-point mark that separates expansion from contraction. The non-manufacturing PMI fell to 53.2 from 54.50 in May, indicating a slowdown in service sector activity and construction. (reuters)

First, for China to upend the dominance of the US dollar and replace it, even partially, with the renminbi would require major – and probably disruptive – changes in China’s financial markets and monetary policies. Second, the end of US-dollar dominance would probably come about only after specific actions were taken by US policymakers to limit the ability of foreigners to use US financial markets as the absorber of last resort of global savings imbalances. And third, the US economy and financial system absorbs nearly half of the world’s savings imbalances. A global economy without the US dollar as the dominant currency would also likely be one without large, persistent trade and savings imbalances.

Canada just rolled out a red carpet for tech workers. (canada)

In India, if you want scam, scam hard and scram to Dubai. (zeebiz)

Odds & Ends

Processed food is killing us. (washingtonpost)

Some people taking Ozempic, a type 2 diabetes drug used for weight loss, report reduced cravings for alcohol, smoking, and other addictive habits. (healthnews) After being injected with Ozempic, a user could try to imagine a moist slab of black forest gateau, or a calorically-dense, half-pound Baconator bacon cheeseburger from Wendy’s, and their body physically revolts, with spasms of nausea and waves of ill feeling. It’s the chemical realization of a behavioral psychologist’s wildest dream; A Clockwork Orange for junk food, an eating disorder in an injection. (theguardian)

Earth’s spin is going off-kilter. Accelerated melting of the polar ice sheets and mountain glaciers has changed the way mass is distributed around the planet enough to influence its spin. Now, some of the same scientists have identified another factor that’s had the same kind of effect: colossal quantities of water pumped out of the ground for crops and households.