tl;dr: Trump took a giant swing. The bond market puked and the dollar tanked. With 30-year yields approaching 5%, Trump blinked and hit pause.

The bond market’s going good. It had a little moment, but I solved that problem very quickly.

-Trump

Trump started with 54% tariffs against China and ended the week with 145%. China retaliated with 125%. This is now effectively a trade embargo, and once the existing inventory is flushed, Americans are in for a moment of reckoning (bloomberg).

Let’s not forget that 25% tariffs stand on Mexico and Canada + 10% on everyone else. The United States had a goods trade surplus of $2.8 billion with Singapore last year but they still got hit with a 10% tariff.

I’m telling you, these countries are calling us up, kissing my ass. They are dying to make a deal. ‘Please, please, Sir, make a deal. I’ll do anything. I’ll do anything, sir.

-Trump (yahoo)

Countries say White House hasn’t responded on tariff talks (politico). Just as well because nobody knows exactly what concessions the US is seeking that could pave the way for a negotiated solution. In the meantime, Trump is waiting for a call from Xi:

The Chinese were also told that Chinese President Xi Jinping should request a call with US President Donald Trump. Instead, US officials woke up to news of increased Chinese tariffs and no request for a leader level call.

Trump is waiting for Xi to call (cnn)

Markets found their footing once Trump seemed to back off a bit. Now we have Fed officials saying that they will do what it takes to maintain bond-market stability (ft). However, markets are a long way off from where they were before Liberation Day.

Total chaos. Nobody knows what comes next.

Markets this Week

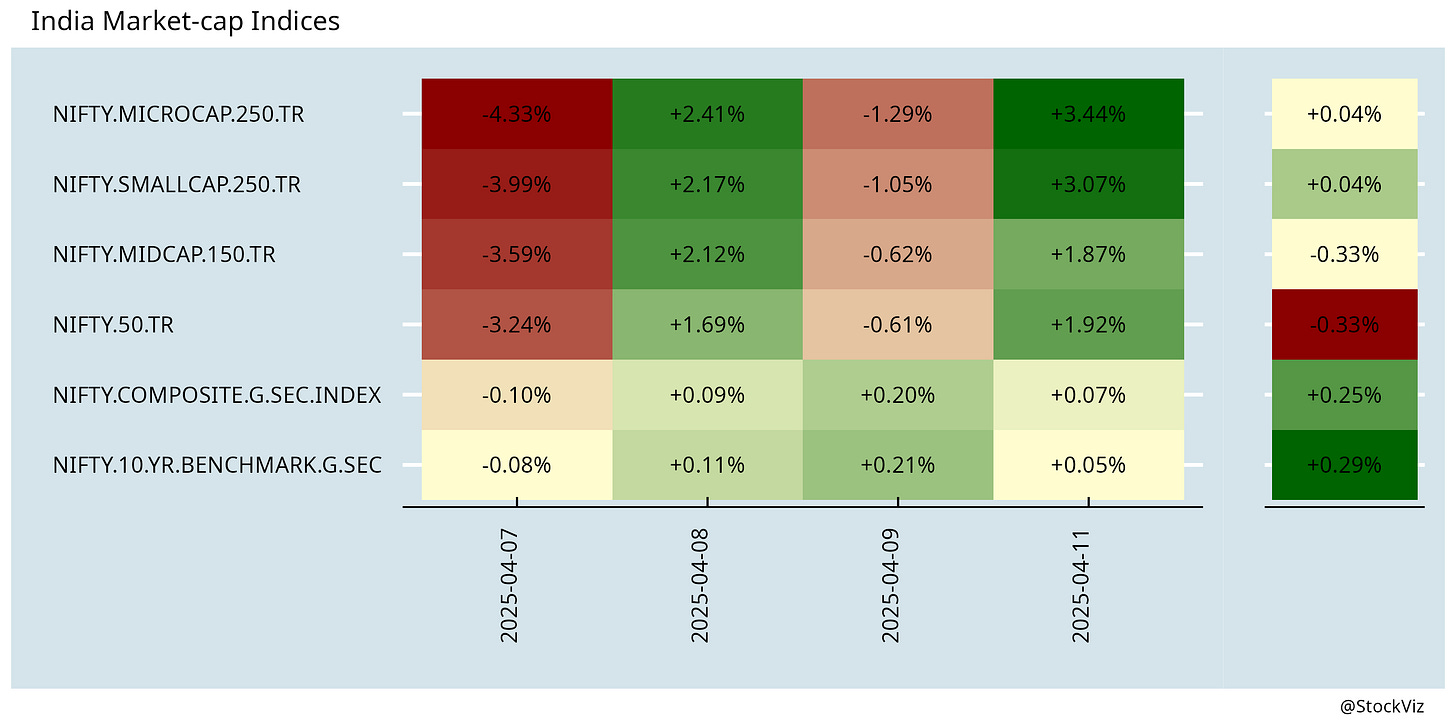

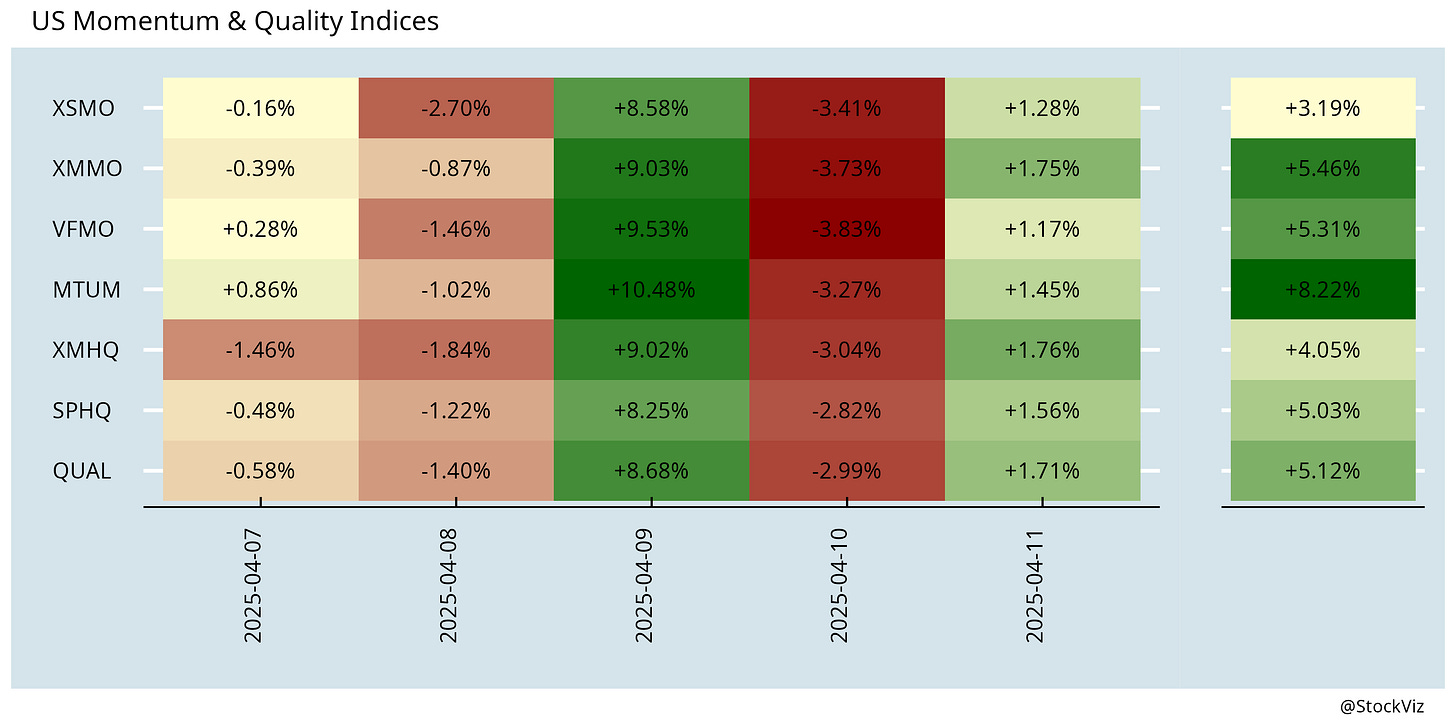

An uptick in flows reversed…

… with indices taking it pretty well…

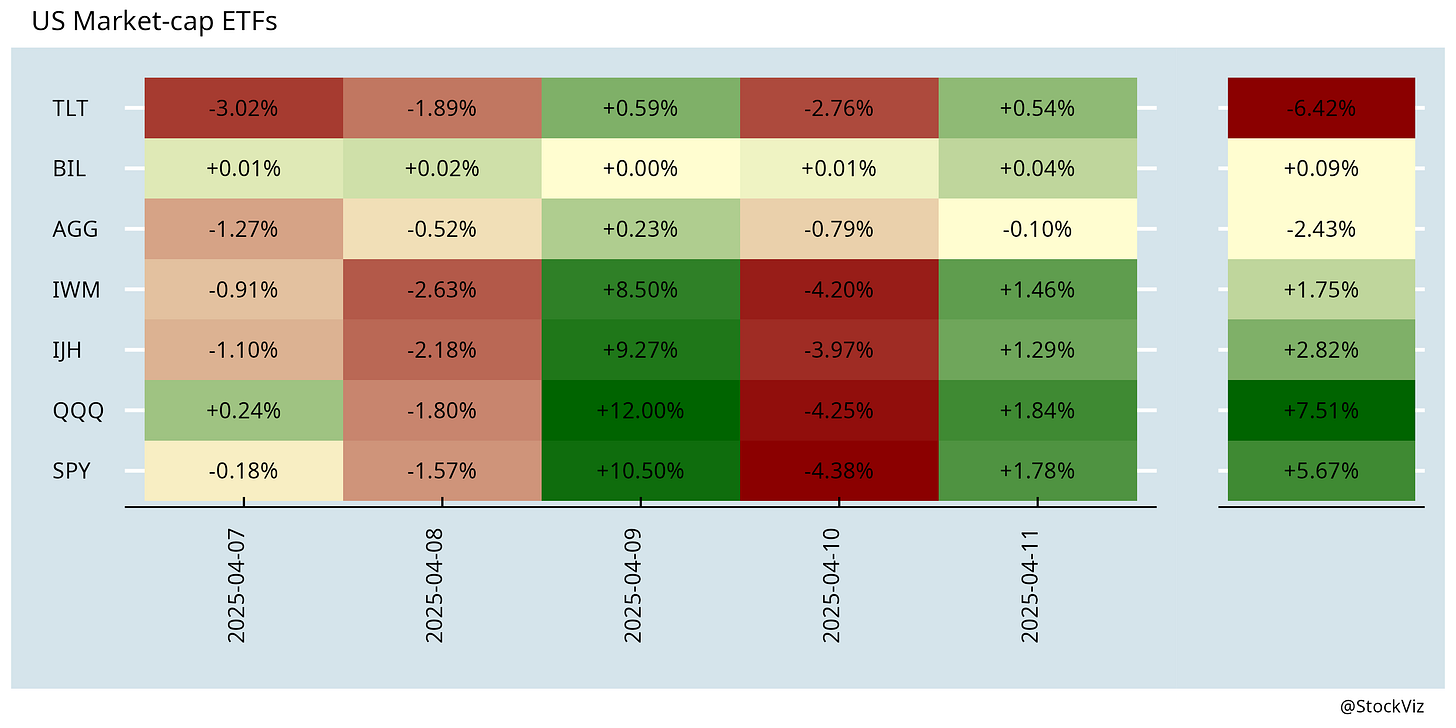

… US bonds took it on the chin…

Links

Tariffs

America’s financial system came close to the brink (economist).

Donald Trump’s ego melts the global economy (newyorker).

Applying exceptionally high tariffs to many developing economies that produce products with no competing US domestic industry, the tariffs will only impose costs on already poor countries that are reeling from cuts to US development assistance (piie).

Trump’s Wanton Tariffs Will Shatter the World Economy (foreignpolicy).

Even if the United States retreats from the broad-based, substantial tariffs that Trump has announced, the damage has been done to business and investor confidence. Washington has cast a pall on business investment and consumption demand, which could tip the softening U.S. economy into a recession—and drag the rest of the world economy down with it (foreignaffairs).

Investors’ unwillingness to believe that Trump would overturn the global trading order has to be seen as a willful blindness to who he is and what matters to him. In general, Trump is uninterested in policy, but trade is the one exception, and always has been. His attitude toward trade—namely, that trade deficits are horrible and tariffs are great—has been strikingly consistent for almost 40 years. The way he talks about trade has stayed the same, and his position on tariffs has stayed the same (theatlantic).

Apple airlifts 600 tons of iPhones from India 'to beat' Trump tariffs (reuters).

EU, China will look into setting minimum prices on electric vehicles (reuters).

Trump's tariff pause only stokes more uncertainty for CEOs (reuters).

Trump says he'll 'take a look' at exempting some larger US companies hit especially hard by tariffs "instinctively" (foxnews).

Trump administration backs off Nvidia's 'H20' chip crackdown after a million dollar Mar-a-Lago dinner (npr).

India

India's industrial output at 6-month low in February (reuters).

India central bank cuts rates, changes stance to 'accommodative' (reuters).

Flows into India's equity mutual funds moderated to 11-month low in March, falling sequentially for the third straight month (reuters).

India’s ship building ambitions take shape with the Indian PSUs set to form joint ventures with Japan’ Mitsui and South Korea’ Hyundai Heavy Industries and Hanwha for building ships (livemint).

row

U.S. democracy will likely break down during the second Trump administration, in the sense that it will cease to meet standard criteria for liberal democracy: full adult suffrage, free and fair elections, and broad protection of civil liberties (foreignaffairs).

The United States is not just abandoning its historical role as the world’s clean-governance policeman. It is changing sides and becoming a mob boss (foreignaffairs).

Fed independence could be at stake (nbcnews).

Elon Musk drastically drops DOGE’s savings goal from $2 trillion to $150 billion for the year (fortune).

The Internal Revenue Service's (IRS) internal estimates indicate that the Trump administration's Department of Government Efficiency (DOGE) has induced disruptions that will wipe out about $500 billion worth of tax revenues (economictimes).

Pentagon to end $5.1 billion in contracts with Accenture, Deloitte (reuters).

China possesses scale, and the United States does not—at least not by itself. Because its only viable path lies in coalition with others, Washington would be particularly unwise to go it alone in a complex global competition. By retreating to a sphere of influence in the Western hemisphere, the United States would cede the rest of the world to a globally engaged China (foreignaffairs).

How Hermès defied the luxury slump (economist).

Versace’s ‘Quiet Luxury’ Blunder Opened Door to Prada Takeover (bloomberg).

Odds & Ends

Salmon are swimming faster due to painkillers dumped into rivers (nypost).