This week was more about what Powell said rather than what he did. Everybody expected a 75bps hike but the tone of his speech was that of a dad grounding his errant teen daughter who came home drunk after curfew.

No one knows whether this process will lead to a recession or if so, how significant that recession would be,” the Fed chief told reporters after the central bank delivered its third straight 75-basis point hike. “The chances of a soft landing are likely to diminish to the extent that policy needs to be more restrictive, or restrictive for longer. Nonetheless, we’re committed to getting inflation back down to 2%.

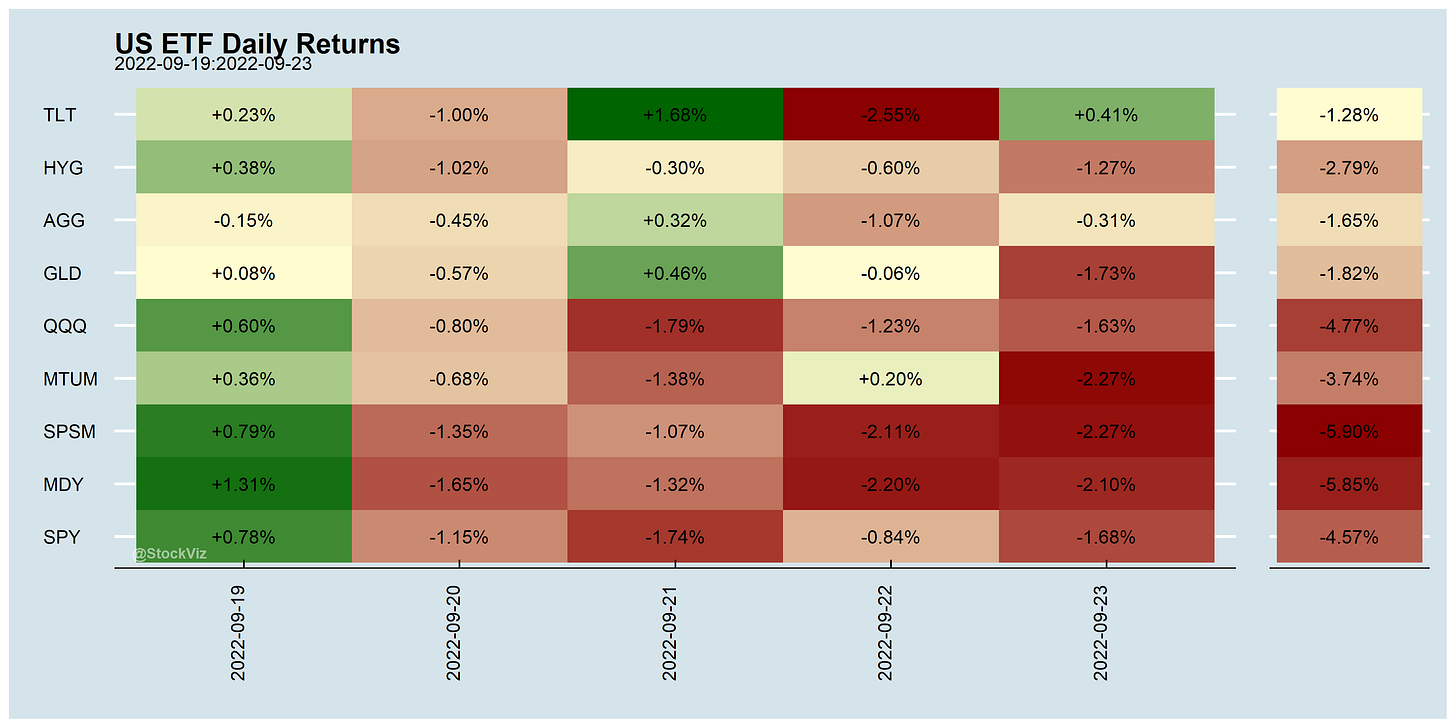

As financial conditions tighten, risk assets take a beating. As much as you might hate holding cash in a negative real interest rate environment, holding anything else is going to be worse.

The problem, as it has always been, is figuring out how much and for how long?

Bear markets don’t walk a straight line down, turn around and start a gradual ascent. Bear markets tend to be vicious roller-coaster rides.

The NIFTY has gyrated between ~18000 and ~16000 about a dozen times since the beginning of 2021 — a terrible time both for bulls and bears, and especially for momentum investors and trend-followers.

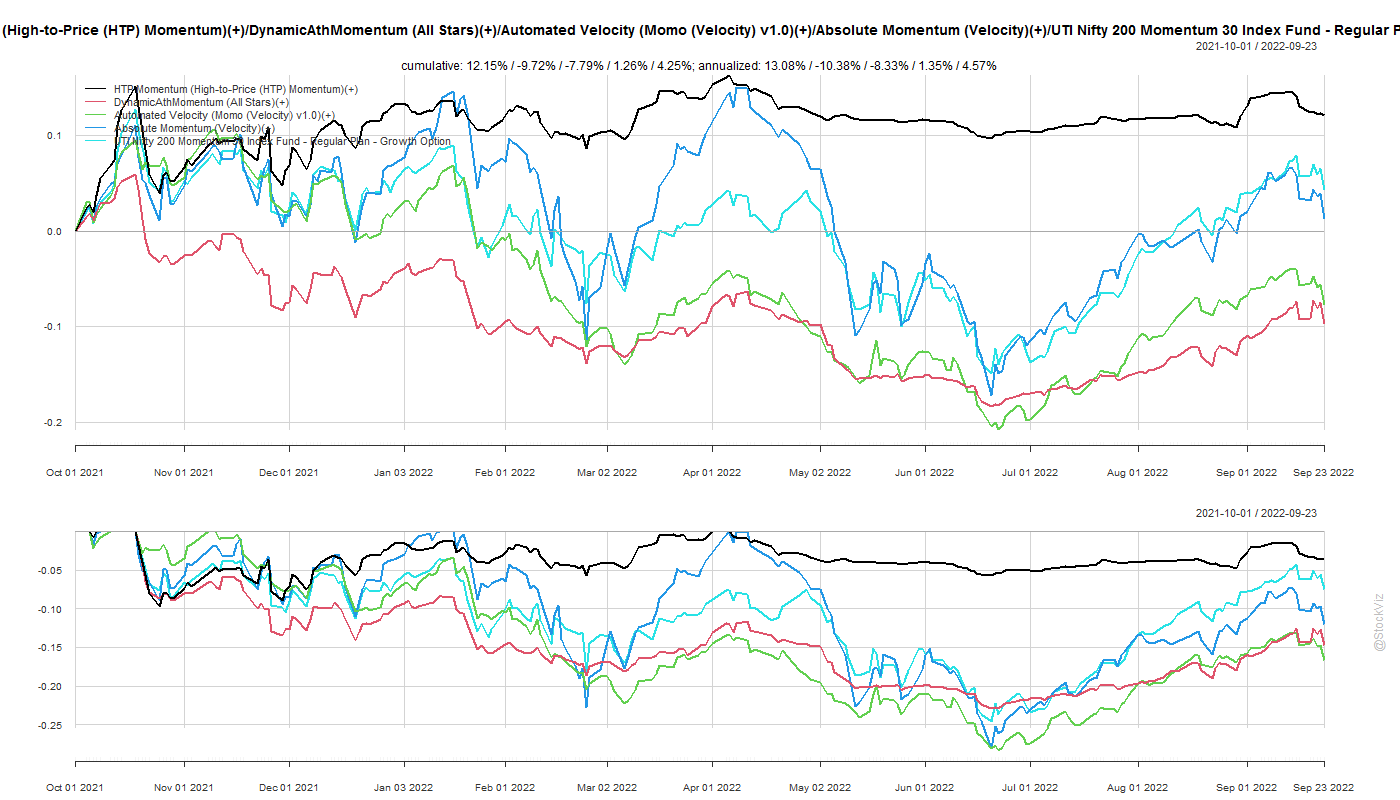

During times like these, super-conservative strategies outshine their aggressive peers. For e.g., our HTP strategy spent most of its time in cash and outperformed its momo peer.

HTP’s high cash-levels paid off in a roller-coaster market. It did, occasionally, take small bets but was stopped out when the markets turned.

In a market like this, static (monthly) rebalanced versions outperform their momo versions — a frustrating grind where investors see their transaction costs mount as their portfolio gets beaten up.

The risk with HTP is that it might stay in cash for too long after the market bottoms — a problem that momos will not have.

There is a risk vs. returns vs. costs tradeoffs here that is worth contemplating:

A “fast” strategy, like Momo Velocity, will react strongly to market downturns and switch to cash at the slightest sign of risk. This increases costs but saves your skin if the market continues to tank. It also allows you to invest in riskier stocks (midcaps, for instance) and reach for higher returns.

A “slow” strategy, like All Stars (ATH), will switch out to cash only after it takes the first downdraft in the markets squarely on the chin. Also, it is unlikely to get back into the market during the initial stages of a recovery. It will, however, avoid long bear markets, preserving capital. The tradeoff here is that costs are low if you stay committed over multiple market cycles.

HTP, with its large cash allocation and slow formation cycles, looks like it is sort of in-between the two. Any strategy that is largely in cash during market drawdowns but is able to ramp back in before durable uptrends is bound to out-perform both high-cost momos and low-speed ATH.

If our markets continue to gyrate, HTP will be “risk-off” and end up outperforming other momentum strategies. If the market does a sudden U-turn and rockets up, then momos will outperform.

If only we had a crystal ball…

Markets this Week

Links

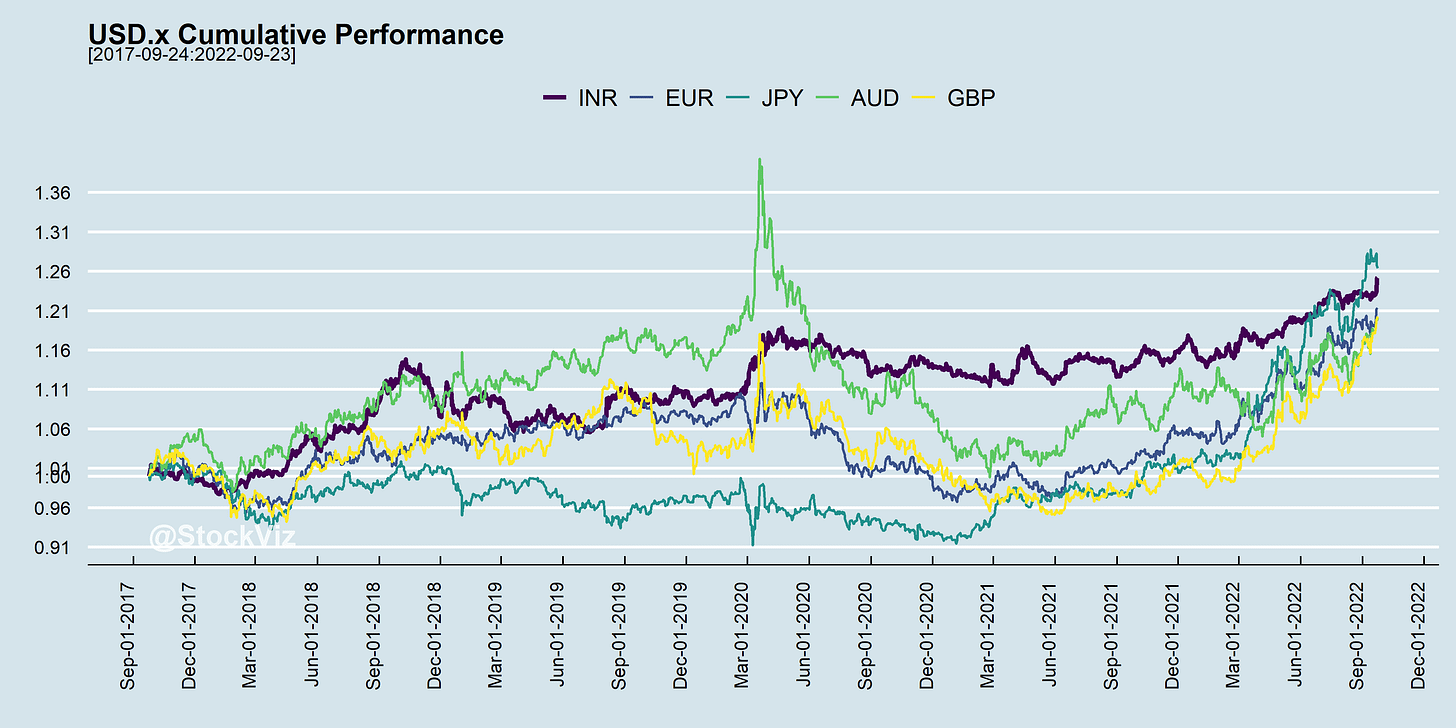

The UK Finance Minister presented a mini-budget that is being termed the “Kami-Kwasi”.

Investors dumped U.K. government bonds and the pound.

The pound, which has already fallen by nearly a fifth this year against the dollar, slid another 3% Friday to $1.09, hitting a fresh 37-year low. It is now within spitting distance of its all-time low of around $1.05 hit in 1985.

Markets Are Right to Be Shocked by Britain’s Version of Reaganomics (WSJ)

~

~

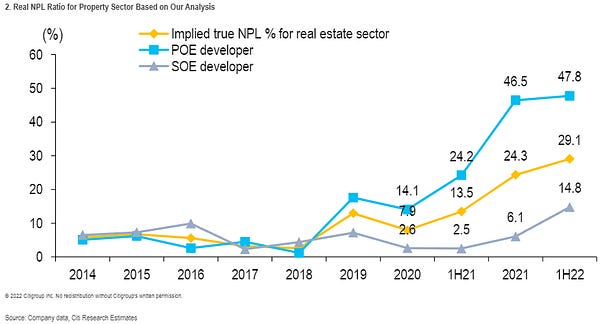

Real-estate getting crushed everywhere. Except in India… which has decoupled, apparently.

~

~

~

Wealth Should Trickle Up, Not Down (carnegieendowment)

~

VCs have their own version of the hot-hand fallacy.