The sales pitch for diversification goes something like this: put your money in different assets so that even if one goes down, you’ll still have the others. However, in the hyper-financialized world that we live in, everything seems to be more correlated and moving faster.

In The Quants, Scott Patterson describes the incessant demand of quantitative traders to connect everything together so that their algorithms can keep trading faster and faster. This has resulted in events propagating through increasingly interlinked markets at ever greater speed. The time it takes for markets to react to an event has gone down from days to nanoseconds over the last few decades.

What might have looked as loosely coupled markets a decade ago could very well be joined at the hip now.

If you suppose that markets are driven by people and their behavior are molded by culture, then financial market participants the world over think more-or-less along the same lines. Its a sort of mono-culture on speed where being fast beats being right.

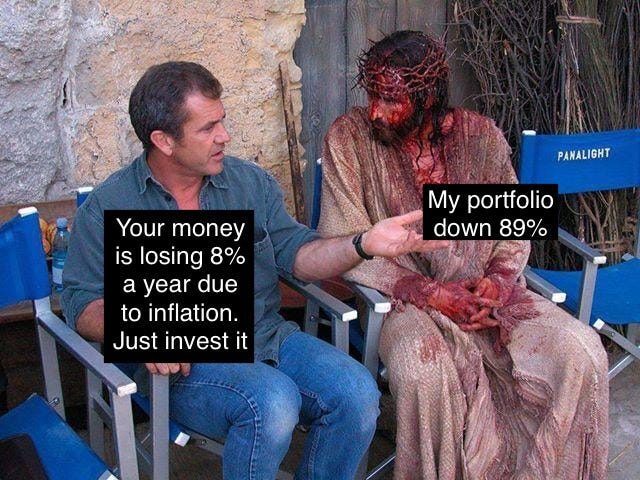

So, what does a lowly “retail” investor to do? The path of least damage is to do nothing and accept volatility in financial assets. Everything else that is tempting to try, be it hedging, stop-losses, market-timing systems or tactical strategies come with associated costs that have to be paid upfront for future results that are not guaranteed in any shape or form.

Diversify and chill.

The more you follow financial market news, the more you look at prices, the more you try to “take over the reins”, the more likely it is that you will end up doing something stupid. Just accept the punishment… and chill.

Further Reading:

Risk Management is Not Free, Part II

Risk Management is Not Free, Part III: Hedging

Markets this Week

Markets don’t move in straight lines. Even if the market ultimately bottoms after making a 30% drawdown, the path it takes is anybody’s guess. Bear markets are brutal not just for the bulls, but for the bears as well. Notice how the NIFTY 50 seesawed between “all clear” and “eject! eject! eject!” during the 2015-2016 drawdown (black, bottom chart).

While the markets generally ended green this week, don’t forget that the MPC meets Monday through Wednesday to figure out how to continue to tighten financial conditions by tweaking numbers on the croutons floating on an alphabet soup of a dozen acronyms. Expect more swings.

Links

There’s been a steady shrinking in the number of small manufacturers since the pandemic started. The number of small consumer goods makers exiting business rose as rural consumption slows and higher input costs curtail their ability to increase prices. (bqprime)

Soaring inflation leads emerging markets into stagflation. (iif)

Stagflation: the risk is back, but not 1970s style. (swissre)

The Rise and Fall of Wall Street’s Most Controversial Investor. (nymag)

Generating alpha is what active fund managers are paid to do. The problem is, when a manager succeeds, more people are persuaded to invest. And the larger the assets under management, the harder it becomes to continue generating alpha. (evidenceinvestor)

Restaurant’s ‘Virtual Cashier’ Is Actually Someone Working From Nicaragua For $3.75 (techthelead)

Agricultural land use has peaked. While agricultural land use has fallen, the amount of food we produce has continued to increase. (tra)