Suppose you own a gold mine. What exactly is the impact of the price of gold on your equity? It is not very straightforward.

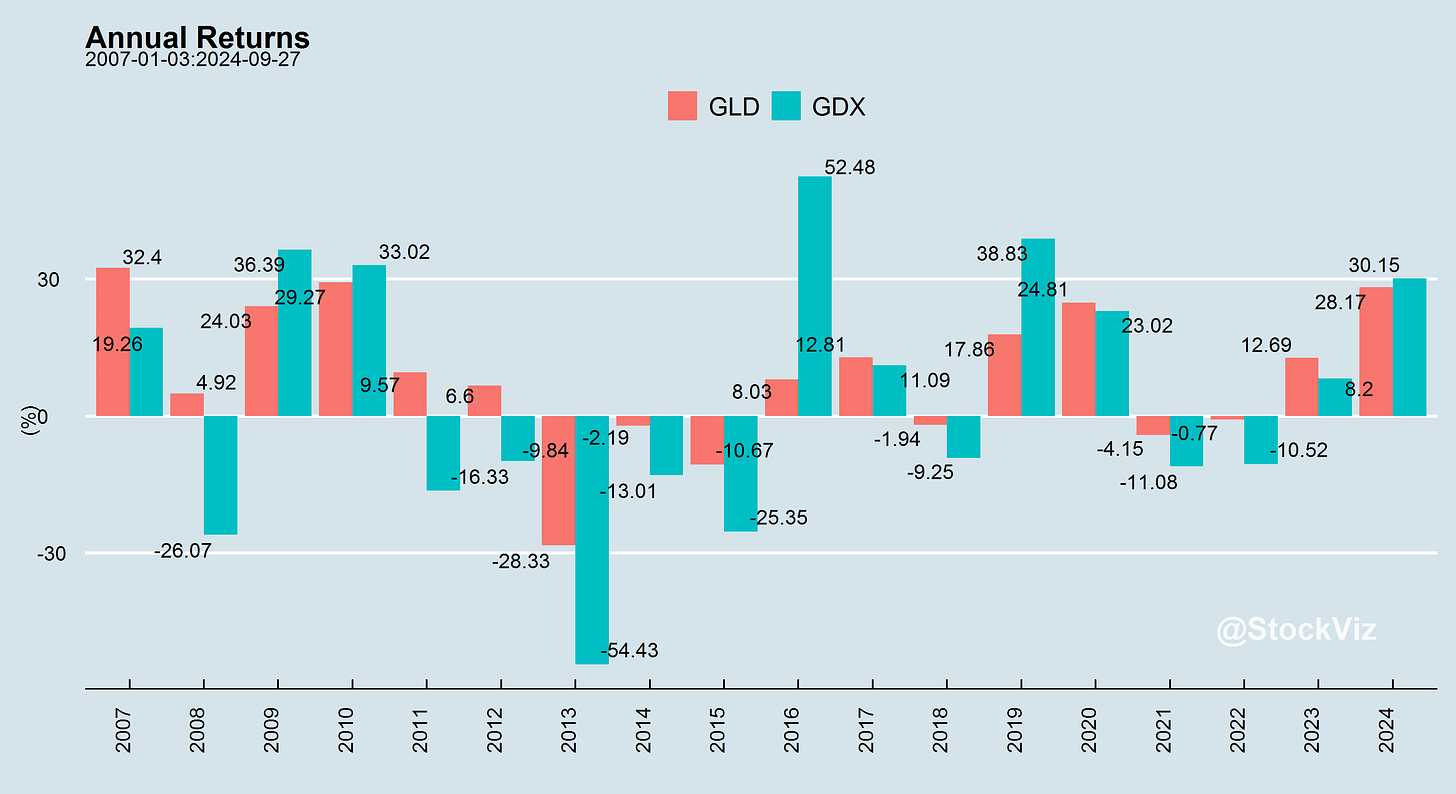

If you compare GLD (the gold ETF) with GDX (the gold miner’s ETF), holding the metal outright over equities made sense.

On any given year, one could outperform the other but over the long term, the miners have been largely flat while the metal itself has annualized at 8%.

Do commodities always win over commodity stocks? Not always and it depends on the economics with which the commodity firm operates.

Aluminum vs. NALCO is a case we highlight here: Commodities vs. Commodity Stocks.

You need to model commodities and commodity stocks separately. The twain may never meet.

Markets this Week

The post-COVID performance of Chinese markets have been a disaster…

… however, investors are cheering on their latest stimulus.

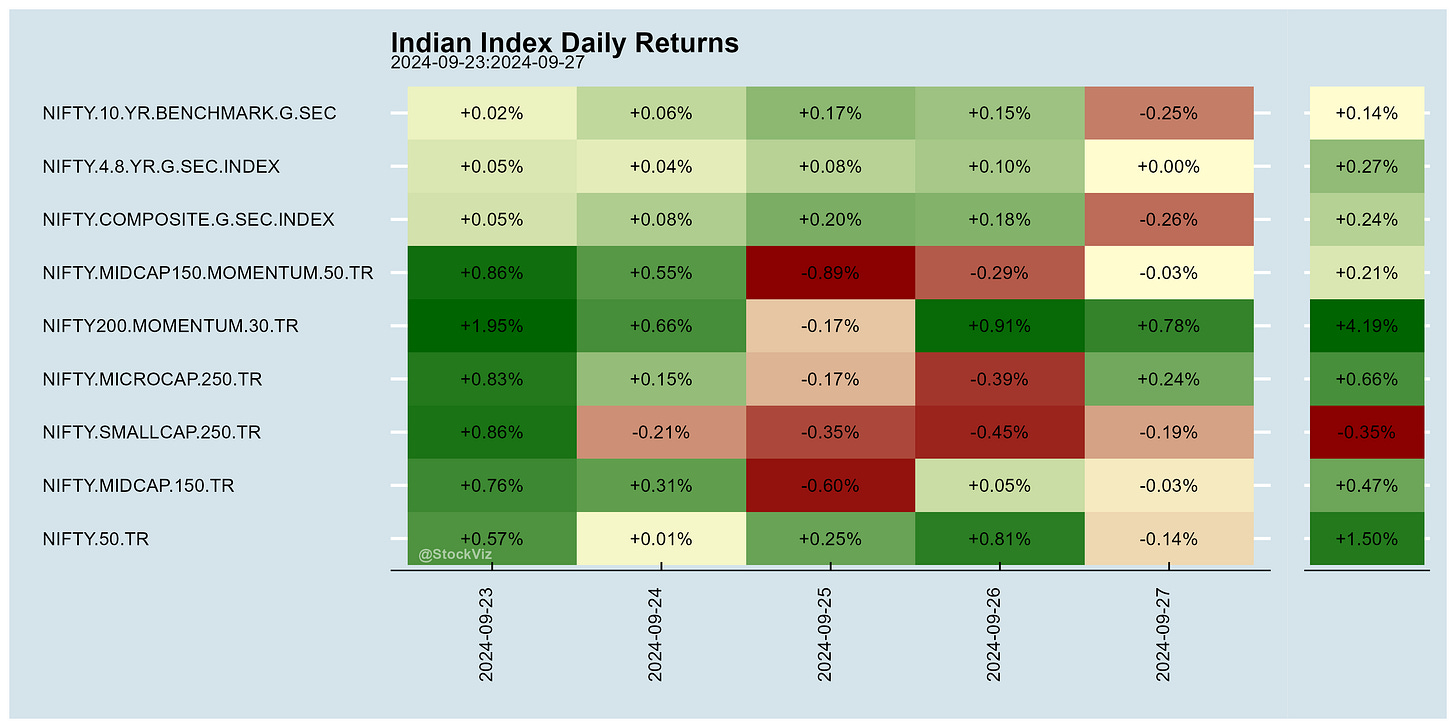

Indian markets continued to chop around…

… with commodities and autos outperforming.

US indices remained flattish…

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

A Unified Framework for Value and Momentum (SSRN)

Expected returns can be estimated via valuation ratios adjusted for expected future cash flow growth and momentum is a reasonable proxy for earnings growth. Using cash flow growth proxies helps improve value’s forecast for expected returns, and importantly, drowns out momentum’s contribution to expected returns.

Entry Costs Rise with Growth (NBER)

Over time and across states in the U.S., the number of firms is more closely tied to overall employment than to output per worker. These facts imply that the costs of creating a new firm increase sharply with productivity growth.

Limits to Diversification: Passive Investing and Market Risk (SSRN)

We show that the rise of passive investing leads to higher correlations among stocks and increased market volatility, thereby limiting the benefit of diversification. The extent to which a stock is held by passive funds (index mutual funds and ETFs) positively predicts its beta, correlation, and covariance with other stocks, but not its idiosyncratic volatility. During crisis periods, stocks with high passive holdings contribute more to market risk compared to before the crisis. Correlated trading by passive funds explains these results, which are further amplified by implicit indexing due to performance benchmarking.

Is 24/7 Trading Better? (SSRN)

We show that even short market closures can significantly improve liquidity. Anticipating these closures, traders engage in aggressive trading, which concentrates and coordinates liquidity. A market structure with a daily closure improves allocative efficiency relative to a continuously open market, even though traders cannot trade during the closure itself. Our findings suggest moving to a longer trading day could be beneficial, but moving to 24/7 trading would harm welfare.

Primary Capital Market Transactions and Index Funds (SSRN)

We document the effects of mechanical buying by CRSP-index-tracking funds on post-IPO returns and IPO deal structure. Leveraging a difference-indifferences style design built on a 2017 CRSP rule change, we find that expected index fund demand leads fast track IPOs to outperform non-fast track IPOs by 15 percentage points shortly after the IPO, although this outperformance largely reverts within six months. Further, fast track IPOs are priced higher and are more likely to be upsized, raising 7.7% more capital than similar non fast track IPOs, evidence that expected passive buying has real implications for firms raising capital in public markets.

Investing & Economy

India

India's total mutual fund assets jumped to an all-time high of 66.7 trillion rupees ($794.45 billion), as of August-end, adding about 16 trillion rupees in 2024. (reuters)

Stock Market Mania Takes Hold Deep in Hinterlands of India (bloomberg)

Action to recognise, avoid, overcome perils of middle income trap has to be made policy focus (economictimes)

RoW

President Xi Jinping has issued a rallying call in an unexpected Politburo meeting to help the private sector and mobilise officials across the nation to prioritise reviving the economy. (scmp)

China's central bank unveils most aggressive stimulus since pandemic (reuters)

A number of quantitative hedge funds in China were hit severely on Friday as the nation’s equities staged their biggest rally in years. (bloomberg)

David Tepper is buying more of “everything” related to China after Beijing rolled out sweeping stimulus measures that exceeded expectations. (bloomberg)

The Biden administration announced a sweeping initiative to ban Chinese-developed software from internet-connected cars in the United States, justifying the move on national security grounds. The action is intended to prevent Chinese intelligence agencies from monitoring the movements of Americans or using the vehicles’ electronics as a pathway into the U.S. electric grid or other critical infrastructure. (nytimes, reuters)

EU seeks to put brakes on China's fast fashion online retailers Shein, Temu (yahoo)

After the U.S. government on Monday announced it wanted to ban Chinese tech linking cars to the internet from American roads, European officials have echoed Washington's concerns about the spying, surveillance and sabotage risks posed by what EU digital czar Margrethe Vestager described as “computers on wheels.” (politico)

Determined to thwart the automating of their jobs, about 45,000 dockworkers along the U.S. East and Gulf Coasts are threatening to strike. The Union is demanding significantly higher wages and a total ban on the automation of cranes, gates and container movements that are used in the loading or loading of freight at 36 U.S. ports. (apnews)

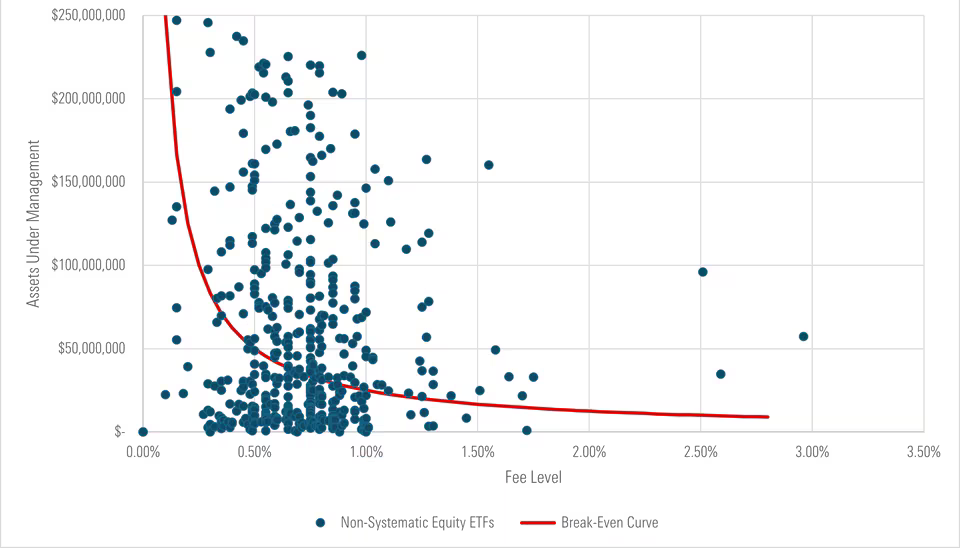

Most Active Equity ETFs Are Struggling (morningstar)

California sues ExxonMobil over alleged role in plastic pollution crisis (theguardian)

Odds & Ends

Major breakthrough could extend EV range to over 3,000 miles on a single charge (msn)

Automatic takeoffs are coming for passenger jets and they’re going to redraw the map of the sky (cnn)

How Covid destroyed our lives, from newborns to pensioners (telegraph)

Good one! Many ways to stalk you ...I liked the cow ai meme.