The biggest criticism of momentum strategies is the large drawdowns they experience when the tide turns. For example, the midcap momentum index, NIFTY MIDCAP150 MOMENTUM 50, is down 24% and simple momentum strategies are down around 30% right now. The problem is that any attempt to “fix” this incurs costs - costs that eat into returns when the markets are booming. A case in point is our Tactical Momentum strategy vs. its simple Momentum cousin.

The Tactical strategy uses a moving average on the simple Momentum strategy to exit when the equity curve dips. It underperformed for almost six months, getting whipsawed by the election and budget dramas in the market. It finally delivered on its original intent in the recent turmoil in the markets - a drawdown of 13% while outperforming the simple Momentum strategy.

Risk Management is Not Free (Part I, Part II, Part III)

You will not be able to duck all the bullets, but as long as you escape the bazooka, you will be alright.

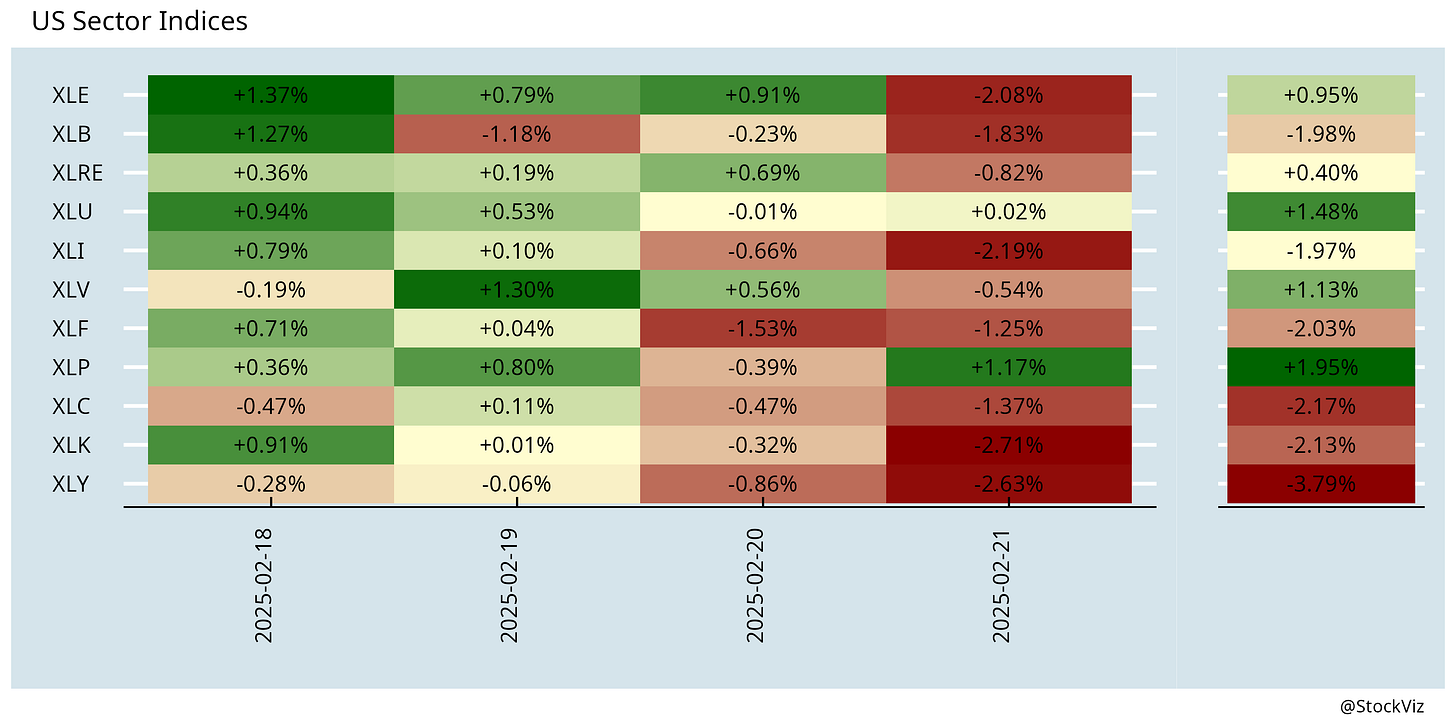

Markets this Week

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

The Labor Market Impact of Digital Technologies (NBER)

We find significant negative effects on high-skill and female workers, particularly those in non-IT services. In IT services, although high-skill employment declined, vacancy postings for high-skill workers increased, implying a shift in labor demand toward newer skill sets.

Generative AI at Work (oup)

We study the staggered introduction of a generative AI–based conversational assistant using data from 5,172 customer-support agents. Access to AI assistance increases worker productivity, as measured by issues resolved per hour, by 15% on average. Less experienced and lower-skilled workers improve both the speed and quality of their output, while the most experienced and highest-skilled workers see small gains in speed and small declines in quality. Gains from AI adoption are largest for moderately rare problems, where human agents have less baseline experience but the system still has adequate training data.

The US as the Global Equity Safe Haven (SSRN)

We systematically document a flight-to-US phenomenon in the global equity market when global volatility soars. A fund would on average rebalance to a US stock by 2% of this position relative to a non-US stock contemporaneously under one unit increase of the log VIX index. The rebalance to US is mostly offset by withdraw from the emerging markets. When volatility rises, mutual funds rebalance to US to lower their potential fire sale cost, thanks to the better balance sheet capacity of US liquidity providers leading to a lower haircut for US stocks.

The Passive Investing Impact (SSRN)

High-indexed stocks highly outperform their low-indexed counterparts, primarily due to the influx of passive capital flows rather than fundamental value. The recent underperformance of value and small-cap stocks is intrinsically related to the secular passive shift.

The Profitability Factor, Its Extensions, and Evidence from China (SSRN)

Using data from the Chinese stock market, the study evaluates various profitability measures, including ROE, ROA, ROTC, ROIC, and RNOA, and their ability to predict returns.

Investing

Harsh Lessons I Learned About Pairs Trading (entropychase)

The average dollar that investors put to work in daily leveraged stock and bond ETFs earned only 5 percentage points more than could have been earned by conventional ETFs or the individual stocks concerned, while enduring much greater volatility along the way (morningstar).

India

Indian insurers are considering making New Delhi residents pay 10% to 15% more for new health policies after an extraordinary spike in claims related to air pollution in 2024 in India's capital (reuters).

The nearly five-month-long slide in Indian equities could continue since the slowdown in corporate earnings growth and the exodus of foreign investors will persist as the world's fifth-largest economy sputters (reuters).

India’s gold jewellery demand has fallen for three consecutive years while gold ETFs, which track gold prices without involving physical ownership, have seen a surge in popularity (cnbctv18).

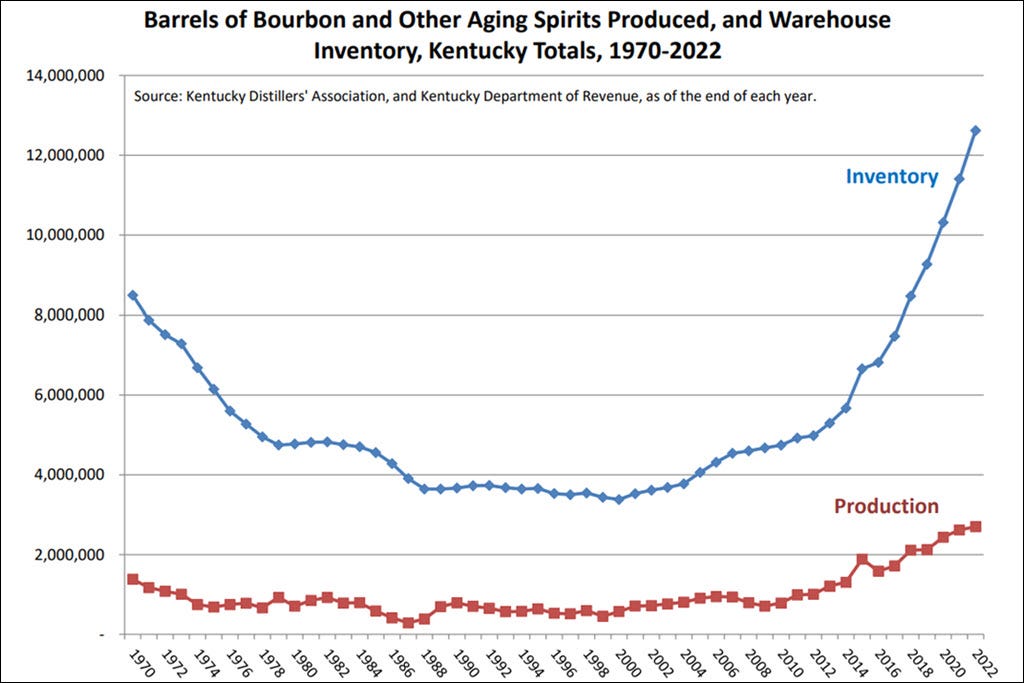

India has slashed import duty on bourbon whiskey to 50% from 150% earlier (indianexpress). Just in time to save American distillers’ asses.

row

Argentinian president Javier Milei promotes memecoin that then crashes 95% in apparent $100 million+ rug pull (web3isgoinggreat, fortune).

Crypto exchange Bybit said it was hacked, resulting in what analysts estimate was the loss of almost $1.5 billion worth of tokens in the biggest theft ever committed in the industry. Researchers believe North Korean hackers were likely responsible (bloomberg). Bybit hack was similar to WazirX incident (thestreet).

There are a record 1,200 venture-backed unicorns that have yet to go public or get acquired. Fewer than 30% of the unicorns from 2021 have raised financing in the past three years. Of those, almost half have done down rounds (bloomberg).

New coronavirus that can cause a pandemic discovered in China (dailymail)

Homegrown AI and other cutting-edge technology is boosting internal surveillance by the ruling Chinese Communist Party and expanding its overseas influence and infiltration operations, and is already in use far beyond its borders (rfa).

BYD, the world’s largest electric vehicle maker, is making advanced driver assistance systems a standard feature across most of its line-up — at no additional cost. Tesla, for example, charges $8,000 for its driver assistance software. Now, automakers will find it increasingly difficult to justify charging for software in markets where BYD is offering it as standard (ft).

After decades of dominating China’s market for high-performance cars with precision engineering, German automakers are losing out to Chinese rivals. Among the hardest hit has been Porsche, which reported last month that its deliveries in China plunged 28 percent in 2024. (nytimes)

China now dominates global manufacturing, and its trade surplus dwarfs the biggest run by Germany and Japan during their eras of postwar export supremacy. Countries around the world get cheap Chinese products, but they can’t sell nearly as many of their own to China. Mr. Xi is making China’s trade partners and competitors pay for the government’s misplaced bet on real estate and its longer-term failure to strengthen the spending of Chinese households (nytimes).

As the West throws up barriers to Chinese goods, they are flowing to emerging markets instead. In the past three years, the value of Chinese exports to the Association of South-East Asian Nations (ASEAN) has risen by 24%. Imports flowing the other way have not grown. As a result, China’s trade surplus with ASEAN has doubled (economist).

Chinese authorities in recent months have made it more difficult for some engineers and equipment to leave the country, proposed new export controls to retain key battery technologies, and moved to restrict technologies for processing critical minerals (ft).

Odds & Ends

Generative AI is a financial, ecological and social time bomb, and I believe that it's fundamentally damaging the relationship between the tech industry and society, while also shining a glaring, blinding light on the disconnection between the powerful and regular people. The fact that Sam Altman can ship such mediocre software and get more coverage and attention than every meaningful scientific breakthrough of the last five years combined is a sign that our society is sick, our media is broken, and that the tech industry thinks we're all fucking morons (wheresyoured).