Cryptonite April 2023

I JUST BURNED A MILLION TO TELL YOU THEY'RE PRINTING TRILLIONS

It’s time for Cryptonite - our monthly roundup of all things crypto - with Dr. Tejaswi Nadahalli.

You can follow Tejaswi on twitter @nadahalli and he blogs at tejaswin.com

Video Summarized by Kagi:

- Balaji Srinivasan bet that Bitcoin would hit $1 million by May 2023, but it did not pan out.

- Srinivasan's argument was that the US banking system is on the edge of collapse, and when it does collapse, the Fed will cut interest rates drastically, causing money supply to seek hard assets like gold and Bitcoin.

- Srinivasan paid out $1.5 million instead of $1 million for the bet.

- James Medlock's articles before winning the bet were about wealth inequality and how taxes are not high enough.

- Medlock changed his tune after winning the bet, advocating for higher taxes and redistribution of wealth.

- The 2008 bank failures were not really bank failures, but rather broker failures.

- There are actual classic bank runs happening, with people withdrawing money from smaller banks and putting it in bigger banks.

- Insiders know about bank runs before the public, allowing them to pull out their money first.

- There is a lot of money writing new programming languages, but most of them are not commercial enterprises.

- Bhutanese government has been buying ASICs and mining Bitcoin since 2020.

Show Notes & Links

Balaji Srinivasan said his $1 million bet on bitcoin (BTC) has been closed out ahead of time, and he has donated $1.5 million ($500,000 more than required) to three different entities as settlement. (coindesk)

US regional banks are a train-wreck ($KRE). TBTF banks ($XLF) are holding up fine.

Coinbase filed suit against the SEC asking that the regulator be forced to publicly share its answer to a months-old petition on whether it would allow the crypto industry to be regulated using existing SEC frameworks. (cnbc)

Bhutan has secretly mined Bitcoin in the Himalayas for years - and it did it sustainably. (euronews)

Pepe coin has emerged as the latest addition to the growing popularity of meme coins.

New Layer 1 blockchains: Sui and Aptos

Crypto adoption tends to be higher in countries with capital restrictions, financial instability, and political instability. (reuters)

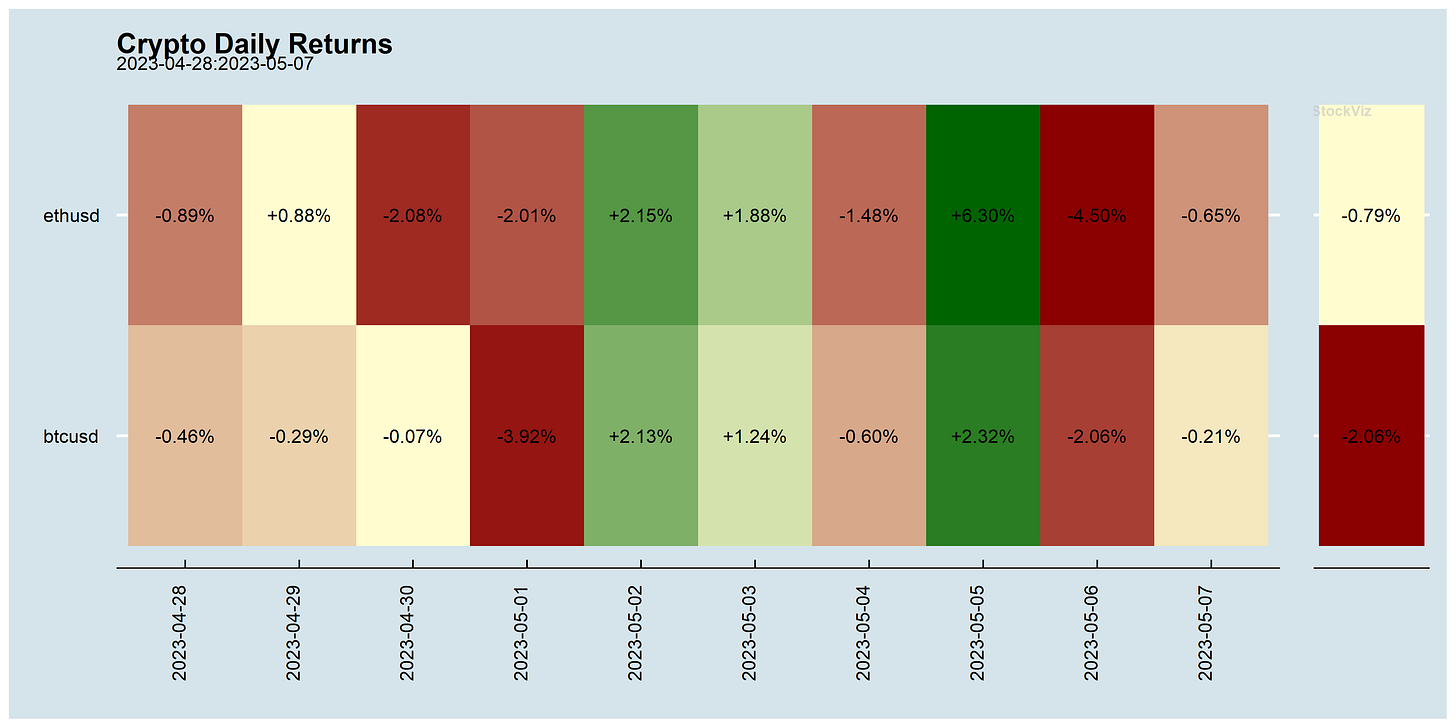

Markets this Week

More here: country ETFs, fixed income, currencies and commodities.

Links

Markets

After taking down Adani, Hindenburg Research goes after Carl Icahn.

Icahn Enterprises (IEP) is an ~$18 billion market cap holding company run by corporate raider and activist investor Carl Icahn, who, along with his son Brett, own approximately 85% of the company.

We found $IEP units to be inflated by 75%+

IEP trades at a 218% premium to NAV, vastly higher than comps

we've uncovered clear evidence of inflated marks for IEP's less liquid assets

IEP has suffered additional losses YTD following its last disclosure

Icahn Enterprises: The Corporate Raider Throwing Stones From His Own Glass House

Some $12bn was bet on horse races in the US in 2021. The most powerful figures in horse betting are what are collectively known as computer-assisted wagerers, or CAWs. These sophisticated bettors use horseracing data to the extreme, employing algorithms, research staff and sweetheart deals to enrich themselves. In recent years, they have increased their capital and their wagering to unprecedented heights, accounting for as much as one-third of the money bet nationwide.

India

Several shipments have been stuck at Indian ports due to glitches in the customs IT system, leading to importers paying heavy demurrage charges to the tune of around Rs 500-700 crore. According to trade reports, shipments worth Rs 3,000-5,000 crore are stuck pan India.

India's Go First airline files for bankruptcy, blames Pratt & Whitney engines (reuters)

India's April services activity hits near 13-year high, inflation accelerates. (reuters)

The Supreme Court allowed the Serious Fraud Investigation Office (SFIO) to resume criminal proceedings against former auditors of IL&FS Financial Services for their alleged role in financial irregularities at the firm. The bench said auditors were answerable for account statements signed by them even if they resigned later.

Research

There has been a large rise in savings by Americans in the top 1% of the income or wealth distribution over the past 35 years, which we call the saving glut of the rich. The saving glut of the rich has been almost as large as the global saving glut, and it has not been associated with an increase in investment. Instead, this rise in savings has been associated with substantial dissaving by the non-rich and dissaving by the government. A process by which the financial sector is unveiled reveals that rich households have accumulated substantial financial assets that are direct claims on household and government debt. Analysis using variation across states shows that the rise in top income shares has been important in generating the saving glut of the rich.

The jobs that are most exposed to AI are the ones that require the most education, are the most creative & earn the most. This is a population that never faced a major automation threat before.

A study of the effects of minimum wages increases on poverty reduction finds a 10% increase in the minimum wage is associated with a statistically insignificant 0.17% increase in long-term poverty.

Macro

In designing a banking system you can choose 2:

tightly regulated

fragmented

profitable enough to make credit broadly accessible

It's hard to do all 3, because tightly regulated commodity type businesses trend towards scale and hyper concentration to sustain profits

China’s party-state, long steeped in secrecy, is creating a black box around information on the world’s second-largest economy, alarming global businesses and investors. Authorities in recent months have restricted or outright cut off overseas access to various databases involving corporate-registration information, patents, procurement documents, academic journals and official statistical yearbooks.

Don’t Bother Investing in China Unless You’re Chinese (bloomberg)

Meme of the Week

The video is hilarious.