It’s time for Cryptonite - our monthly roundup of all things crypto - with Tejaswi Nadahalli.

You can follow Tejaswi on twitter @nadahalli and he blogs at tejaswin.com

Once the tide of easy money started turning, we are finding out who was swimming naked the whole time.

One of the problems is that lobbyists are paid much better than regulators.

And the media couldn’t say “no” to their advertising dollars.

So, we had the Fed at 0% forcing savers to reach for yield, VCs who were willing participants in Ponzis, regulators who were asleep at the wheel and the media cheerleading these crooks.

And now, the blame game begins. Better late than never, I guess.

In a complaint filed on Thursday, the attorney-general’s office claimed Mashinsky acted as a “modern-day Robin Hood”, promising customers returns of up to 17 per cent via its Earn programme — which paid interest on cryptocurrency deposits — and urged users to stay invested even as the hole in the platform’s balance sheet grew larger. “Alex Mashinsky promised to lead investors to financial freedom but led them down a path of financial ruin,” New York attorney-general Letitia James said in a statement. “The law is clear that making false and unsubstantiated promises and misleading investors is illegal.”

Celsius founder Mashinsky sued for fraud by New York attorney-general (FT)

If “making false and unsubstantiated promises and misleading investors” is a crime, then pretty much all of the defi/NFT complex should be in jail.

Also, the fact that crypto “depositors” will not be first-in-line during a bankruptcy process was flagged years ago. Yet, people continued to pour money into these schemes.

The collapse of so many crypto exchanges and platforms has allowed us to see up close for the first time the utter lawlessness that fuels crypto. Free from the burdensome yoke of regulation that the non-crypto world has to deal with, the likes of FTX have been free to do as they please, allegedly misappropriating billions of dollars of customers’ funds and committing fraud on a vast scale. (FT)

Unfortunately, we haven’t seen the last of this because people still believe.

While crypto was the mother of all scams, the scamming during the ZIRP era was not limited to crypto.

This one scammed JP Morgan with a made-up excel sheet of customer details and got caught when an employee observed that the list contained exactly 1,048,576 rows, the maximum permitted by Microsoft Excel. (courtlistener)

At least, JP Morgan will recover for this. @shl went after retail.

Large swaths of “private” equity is mostly an elaborate ruse to hide volatility and help institutional capital beat completely made-up benchmarks so that the bureaucrats in charge can make bonus.

The gap between private and public valuations is wide enough to sail Evergreen through. We wrote about BREIT last week.

SPACs were, thankfully, a fairly short-lived grift.

Elon remains the GOAT of cocking a snook at regulators. Milking the company dry while literally selling cars that kill people and trucks without airbags.

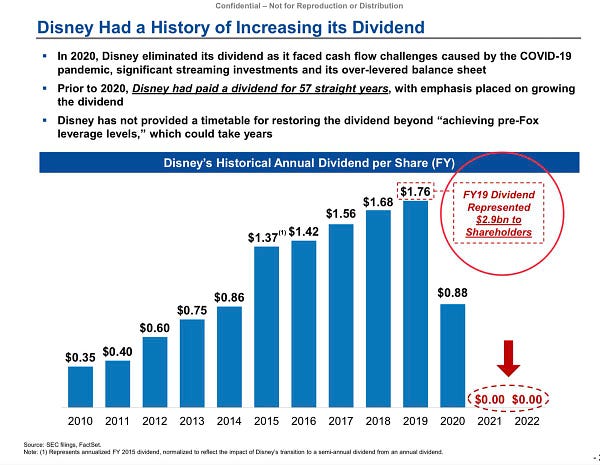

Collectively the brass at Tesla appear to have unloaded 126 million Tesla shares for more than $41 billion. Over the history of the company Tesla raised $32 billion in equity and earned cumulative profits of $9 billion. Cumulative cash flow from operations totals $32 billion. Book value foots to $41 billion. Insiders have sold shares worth more than equity capital raised, cumulative profit (regardless of how measured), or book value, which adds equity capital raised plus cumulative profit. The company has never paid a dividend. Who's winning here? (thread)

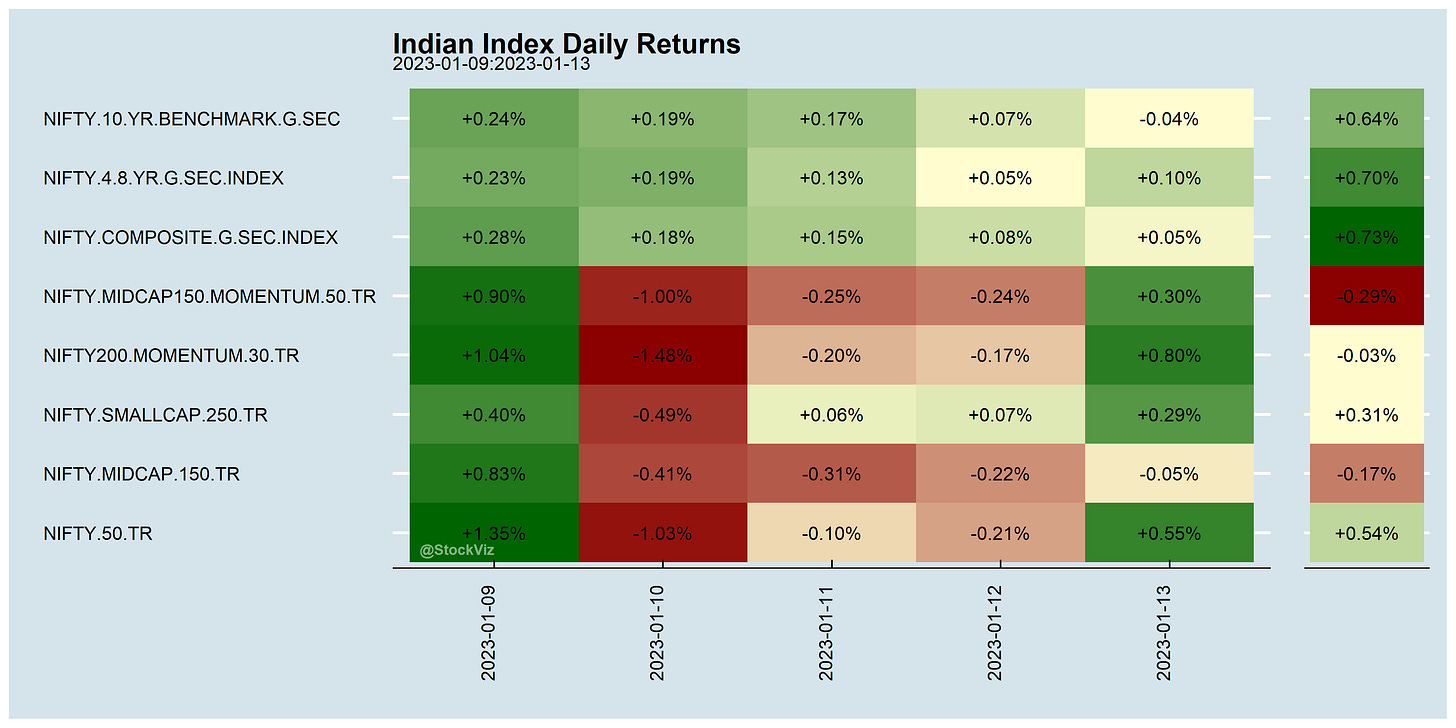

Markets this Week

More here: fixed income, currencies and commodities.

Links

When are you right, when are you wrong and when are you a genius?

~

If you think index investing is taking hold in your market, then it makes sense to be the first to jump ship.

~

If a company cannot generate free cashflow that accrues to equity, what good is its moat/growth/IP?

~

I don’t get it. It is incredibly difficult to setup free health-care infrastructure. The British then went about destroying theirs. Why?

~

While you are driving through potholed Bangalore roads, know that the Romans had it figured out centuries ago and weep.