It’s time for Cryptonite - our monthly roundup of all things crypto - with Dr. Tejaswi Nadahalli.

You can follow Tejaswi on twitter @nadahalli and he blogs at tejaswin.com

We discuss various aspects of the cryptocurrency market, including the impact of Bitcoin ETF approval in the US, the regulatory environment in India, and the debates surrounding Ethereum and NFTs. Following the approval of ten Bitcoin ETFs, including those from major players like Bitwise, VanEck, WisdomTree, and Fidelity, purchasing Bitcoin through an ETF could be cheaper than buying it directly due to lower fees.

However, we express concerns around the potential shutdown of ETFs if public interest wanes and the US influence on global cryptocurrency regulations.

We also explore the challenges and complexities of investing in cryptocurrencies from regions like India, highlighting the regulatory environment and potential risks involved.

We delve into Jevon's Paradox, the philosophy that increasing efficiency can lead to increased demand and ineffectiveness, which raises questions about the efficiency of cryptocurrencies like Ethereum and the potential implications for its long-term compatibility as a financial asset.

We also touch upon the role of technology in cryptocurrencies, pointing out the challenges Ethereum faces in achieving efficient transaction processing due to its decentralized nature.

A significant portion of the crypto market is influenced by hype, narratives, and memes rather than underlying technology, leading to potential misinformation and frustration with the lack of substance in some projects. Ultimately, we express hope that a balanced regulatory approach will be found to support growth and innovation in the crypto space while minimizing potential risks.

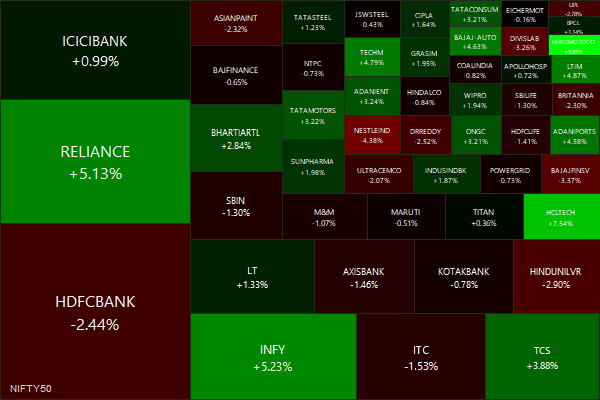

Markets this Week

Indian tech services providers had a week!

US data was constructive.

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

The Social Totality Hidden in the Code: Bitcoin, Cryptogenesis and Virtuality (SSRN)

Bitcoin and the wider cryptocurrency emergence is best understood as a dynamic in virtuality, encapsulating a specific sociality.

The Seasonality of Bitcoin (SSRN)

We examine the distribution of the daily returns, proposing a simple seasonality strategy based on holding BTC only for two hours per day.

Bitcoin Blocksize, Custodial Security, and Price (SSRN)

We predict that as the block size approaches this limit, the fullness of the block functions as a deterrent to nefarious actors that are attempting a cryptoexchange security breach or cryptoexchange fraud.

Bitcoin’s Achilles Heel - Transition from Block Rewards to Transaction Fees (SSRN)

The scheduled reductions in block rewards, known as halvings, lead to a decrease in Bitcoin's supply expansion rate. This shift means that miners' income will eventually rely solely on transaction fees. The analysis suggests that unless there is a significant increase in on-chain activity, these fees will not be enough to maintain current security levels.

Bubbles in Bitcoin and Ethereum: The Role of Halving in the Formation of Super Cycles (SSRN)

Halving had a significant impact on the formation of Bitcoin's supercycle bubbles in 2013, 2017, and especially in 2021. This impact had a contagious effect on altcoins, including Ethereum.

Crypto

Spot Bitcoin ETFs Are Here. Should You Invest? (morningstar)

What Is the Total Cost of Owning an ETF? (morningstar)

Spot BTC ETF Seed Misconceptions (linkedin)

Are flatcoins a good idea? (jpkoning)

UST and LUNA deemed securities in court (courtlistener)

SEC wants to leverage partial Terraform court victory in cases against Coinbase, Binance (theblock)

The cryptocurrency industry has made it much easier for criminals to defraud unwitting investors and launder the proceeds of their crimes. The combination of unregulated stablecoins and lax financial controls at exchanges enables the perpetrators of these schemes to bypass key protections in the mainstream financial system.

People are swindled for all kinds of reasons and with varying levels of sophistication. Greed and the promise of free money are powerful motivators, and these scams work on the perception that they are bringing smart people into the inside of something exclusive that other smart people know about. It’s a club, and now you can be part of it.

But the club is not what it seems. It may seem like there’s others going in there with you. But in all likelihood, it’s just some bot.

Economy & Investing

The 80/20 Rule for U.S. Venture? Not Exactly. (David Coats)

India

India's Nov industrial output growth slows to 2.4% y/y (reuters)

India's retail inflation rises to four-month high in December (reuters)

NASDAQ talks to India about overseas listings for local companies (reuters)

RoW

UK aircraft carriers can’t be sent to Red Sea because of Navy staffing crisis (telegraph)

Britain is a developing country (sambowman)

As long as the US is willing to run huge trade deficits to accommodate the domestic demand deficiencies of its trading partners, it has no choice but to give foreigners claims on US assets. These US assets can be in the form of farmland, factories, equity, apartments in New York, shopping malls in Wisconsin, corporate bonds, US government bonds, etc., but as long as the US is willing to run large current account deficits, it must give up ownership of these assets. Americans must pay for imports, either with exports or with assets, and so preventing foreigners from acquiring one kind of US asset just means having them acquire another kind.

China's policy dilemma: is boosting credit deflationary? (reuters)

Record one-third of Japan's unmarried adults under 50 have never dated (japantimes)

Odds & Ends

Sperm caught breaking Newton's third law of motion (newscientist)

Bottled water contains 100 times more plastic nanoparticles than previously thought (euronews, abcnews)

Which proteins contain the most microplastics? (washingtonpost)