It’s time for Cryptonite - our monthly roundup of all things crypto - with Tejaswi Nadahalli.

You can follow Tejaswi on twitter @nadahalli and he blogs at tejaswin.com

We discussed a bunch of things, some highlights:

Looks like Silvergate, a crypto focused bank, is going under.

Silvergate reported a $1 billion loss for the fourth quarter in January (reuters). Depositors started panicking and withdrawing funds, raising doubts about its ability to continue as a “going concern” (reuters).

Crypto-related deposits plunged 68% in the fourth quarter. To satisfy the withdrawals, Silvergate liquidated debt it was holding on its balance sheet. The $718 million it lost selling the debt far exceeds the bank’s total profit since at least 2013 (wsj).

Silvergate vs. ARKK - looks like “innovation” is really out of favor.

Banks are supposed to be boring. Get out the minute it gets described as exciting or exceptional.

Adverse selection at work.

As usual, taxpayers will be left holding the bag.

Silvergate, received at least $3.6 billion in loans from FHLB (cointelegraph). Looks like that’s a write-off.

Another bank down bad: Credit Suisse. At least this one is getting bailed out by the Swiss.

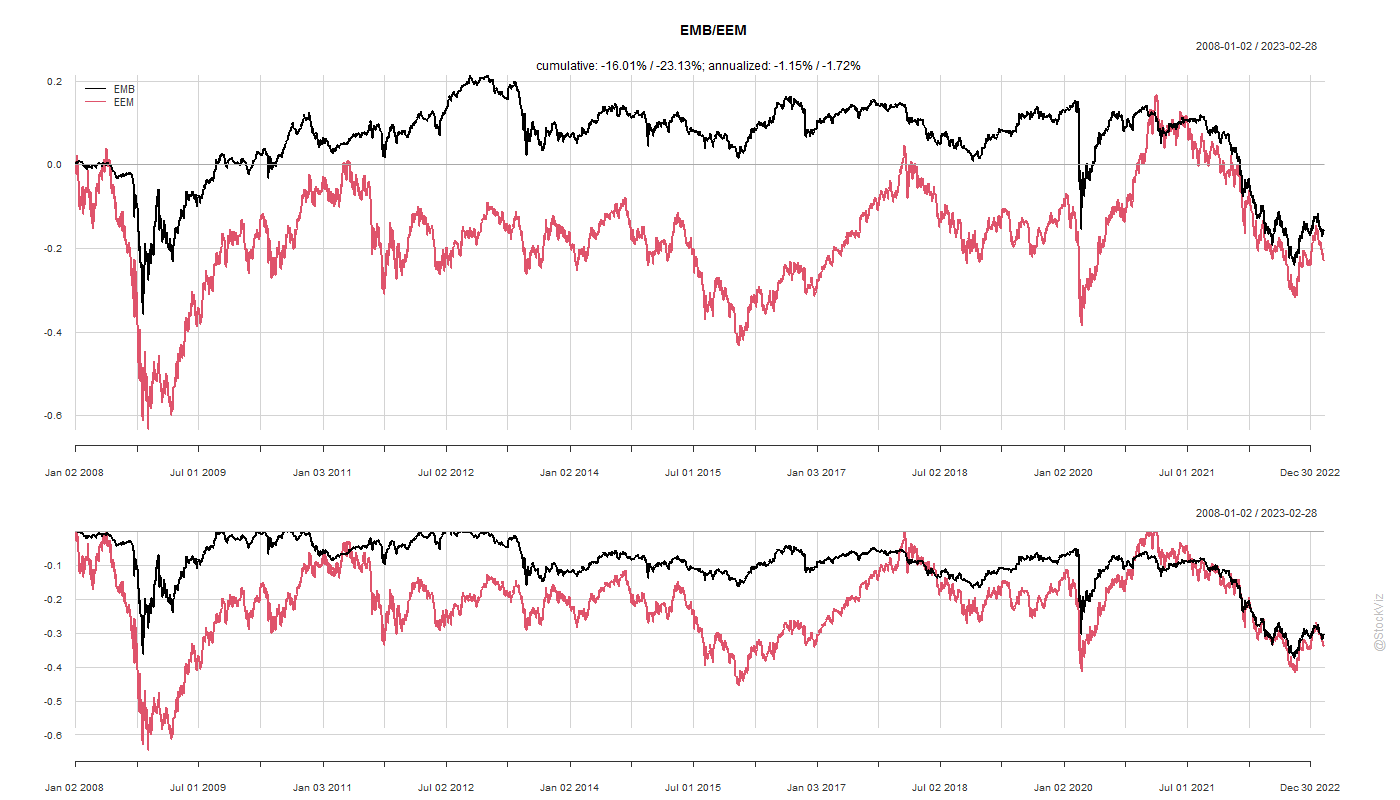

Speaking of things that are down bad, will emerging markets ever make money? Both bonds and equities are negative over the last 15 years. Maybe it’s the ETFs but what in God’s name is going on?

~

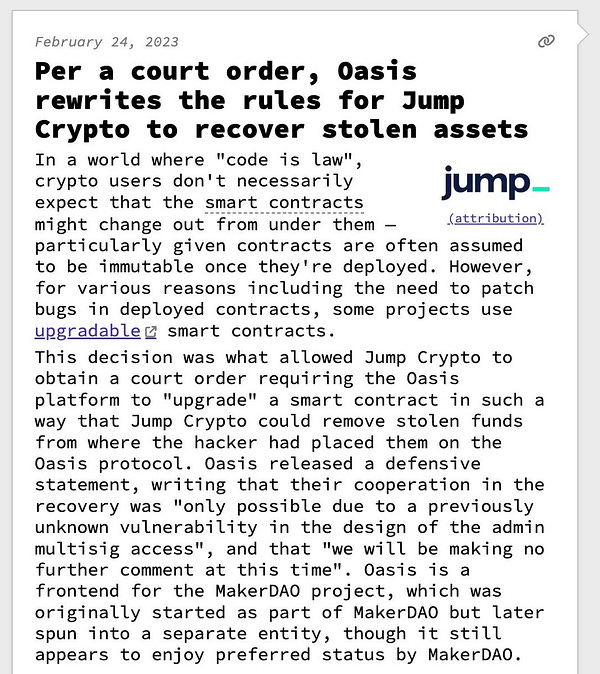

DeFi was supposed to be censorship-resistant decentralized finance. Well.

The Ethereum hard-fork back in 2016 was the original sin. I don’t think anybody believes DeFi is really “de-fi” any more.

~

Looks like everybody was stealing customer funds…

Binance used customer funds for its own purposes in a move similar to FTX scandal. (businessinsider)

… and regulators have some thoughts…

… and are after stablecoin issuers and staking services.

The SEC and the NYDFS have been after Paxos, a firm that issues the 3rd largest stablecoin - the Binance USD (theverge, forbes, cnbc).

Tether and Bitfinex banked with fake documents and shell companies (wsj).

Kraken got a $30 million wrap on the knuckles.

When a company or platform offers you these kinds of returns, whether they call their services 'lending,' 'earn,' 'rewards,' 'APY,' or 'staking' - that relationship should come with the protections of the federal securities laws.

Gary Gensler, SEC Chair. (reuters)

~

Fart noise reportedly sells for $280,000 in Bitcoin's own NFT mania. (web3isgoinggreat)

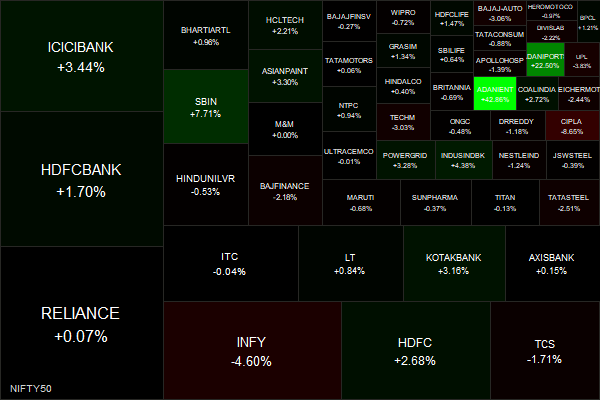

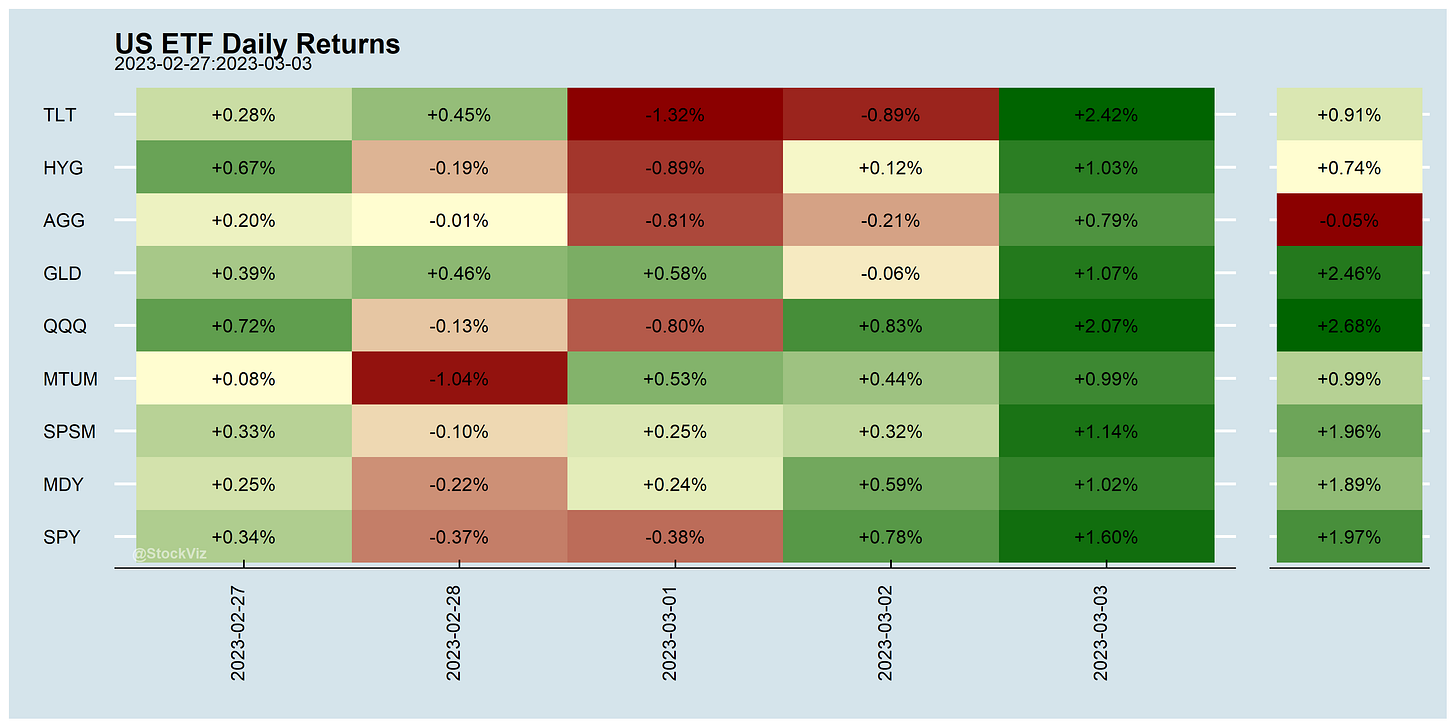

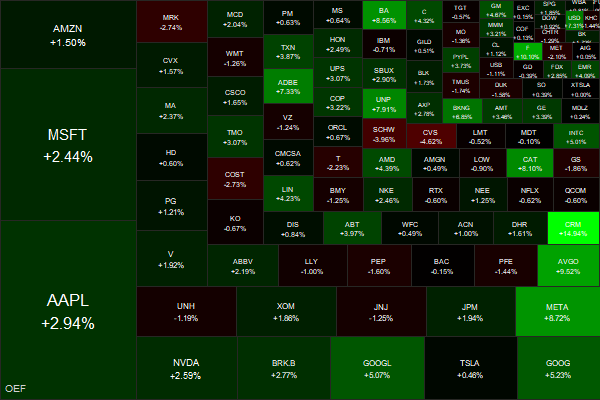

Markets this Week

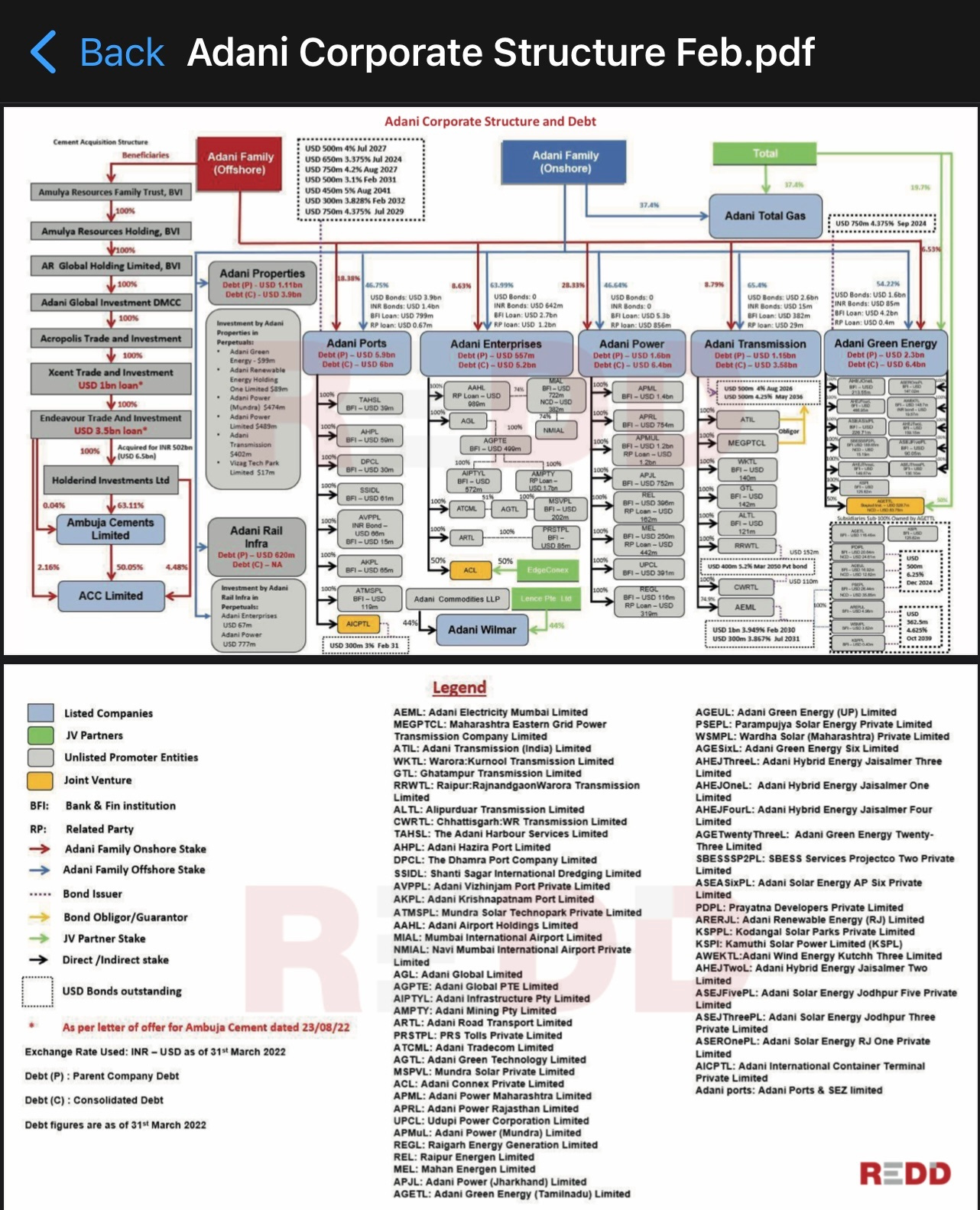

The Adanis got rescued by an American private equity fund (reuters).

I guess they had one look at this corporate structure and said “I want this now!”

More here: country ETFs, fixed income, currencies and commodities.