It’s time for Cryptonite - our monthly roundup of all things crypto - with Dr. Tejaswi Nadahalli.

You can follow Tejaswi on twitter @nadahalli and he blogs at tejaswin.com

We did a brief exploration of quoted volume and spreads on hyperliquid: The Hyperliquid DEX. Stay tuned for more!

Summarized using krisp.ai:

Bitcoin Price Trends

- The discussion begins with an overview of Bitcoin's price movements, particularly following a rally attributed to political events in late November and early December.

- Currently, Bitcoin has been fluctuating between $94,000 and $100,000, a pattern reminiscent of previous price behaviors where it stabilizes after reaching an all-time high.

- The phenomenon of Bitcoin reaching a peak and then trading sideways is not uncommon, with historical references made to the '58,000 gang' meme from Twitter, which illustrates a similar behavior at a different price point.

- The conversation highlights the 'altcoin thesis,' which posits that when Bitcoin stabilizes, retail investors often shift their focus to altcoins, believing they may offer better opportunities for gains.

- Unit bias is discussed, where investors are drawn to lower-priced altcoins like Ripple or Solana due to their more accessible price points compared to Bitcoin.

- The historical context indicates that after Bitcoin maxes out, there tends to be increased activity in altcoins, as observed in past market cycles.

- Investors are encouraged to explore altcoin trading in the short term, particularly when Bitcoin's price stabilizes, as this may lead to favorable conditions for altcoin performance.

Emergence of AI Meme Coins

- The conversation shifts to the rise of AI meme coins, with examples such as FART coin and GOAT coin, which are gaining traction within the crypto space.

- These coins are characterized as being linked to AI themes, with various projects aiming to capitalize on the current interest in artificial intelligence.

- The listing of these coins on major exchanges like Binance is identified as a significant driver of their popularity and price increases.

- The mechanics of launching coins on exchanges are discussed, emphasizing the importance of market makers and the strategic accumulation of tokens prior to public listings.

- The potential for AI meme coins to generate substantial returns is acknowledged, yet there is a cautionary note about the speculative nature of such investments.

- The broader trend indicates a growing interest in AI-related projects within the cryptocurrency market, with many investors looking for opportunities in this emerging sector.

Market Dynamics and MicroStrategy

- The discussion transitions to MicroStrategy and its CEO Michael Saylor, who has significantly invested in Bitcoin, raising questions about the implications of such concentrated ownership.

- Saylor's strategy is viewed as both bold and potentially risky, with comparisons made to historical attempts to corner markets, such as the Hunt Brothers with silver.

- Clarifications are provided regarding the actual percentage of Bitcoin owned by MicroStrategy, which is estimated to be around 1 to 2 percent of the total supply.

- The role of ETFs in Bitcoin ownership is examined, noting that significant amounts of Bitcoin are held by various financial institutions, which could influence market dynamics.

- Concerns are raised about the implications of centralized ownership on Bitcoin's market behavior and the potential for price manipulation.

- The conversation concludes with a reflection on the nature of Bitcoin as a social construct, emphasizing its volatility and the influence of key players in shaping market perceptions.

What is Michael Saylor Doing? (theirrelevantinvestor)

MicroStrategy’s secret sauce is volatility, not bitcoin (ft)

Ponzi or Pioneer? Evaluating the Viability of MicroStrategy's Bitcoin-Focused Model (SSRN)

Quantum Computing and Its Implications

- The topic of quantum computing is introduced, with skepticism expressed regarding its potential to disrupt current cryptographic standards, including those used by Bitcoin.

- The discussion highlights the historical context of quantum computing, noting that while significant research has been conducted, practical applications remain elusive.

- Concerns are raised about the incentives behind quantum computing advancements, questioning who would benefit from breaking public key cryptography.

- The conversation emphasizes that transitioning Bitcoin to post-quantum cryptography is feasible, though the implications of Satoshi's holdings remain a philosophical quandary.

- The analogy is made between current quantum computing efforts and past technological revolutions, suggesting that significant breakthroughs may still be decades away.

- The overall sentiment is one of caution regarding the hype surrounding quantum computing and its real-world impact on cryptocurrencies.

Quantum Computing — or How I Learned to Stop Worrying and Ignore the Bomb (medium)

Decentralized Science and Capital Formation

- The conversation shifts to decentralized science (DeSci), which aims to democratize scientific research funding and reduce gatekeeping in academia.

- DeSci proposes that scientific research can be funded through cryptocurrency, allowing anyone to propose projects and seek backing from the community.

- Examples of successful DeSci projects illustrate how tokens can be used to fund research and provide a mechanism for accountability and community engagement.

- The potential for DeSci to disrupt traditional funding models is recognized, although challenges related to enforcement and accountability remain.

- The conversation concludes with a positive note on the evolving landscape of cryptocurrency, highlighting the emergence of meaningful use cases beyond speculative investments.

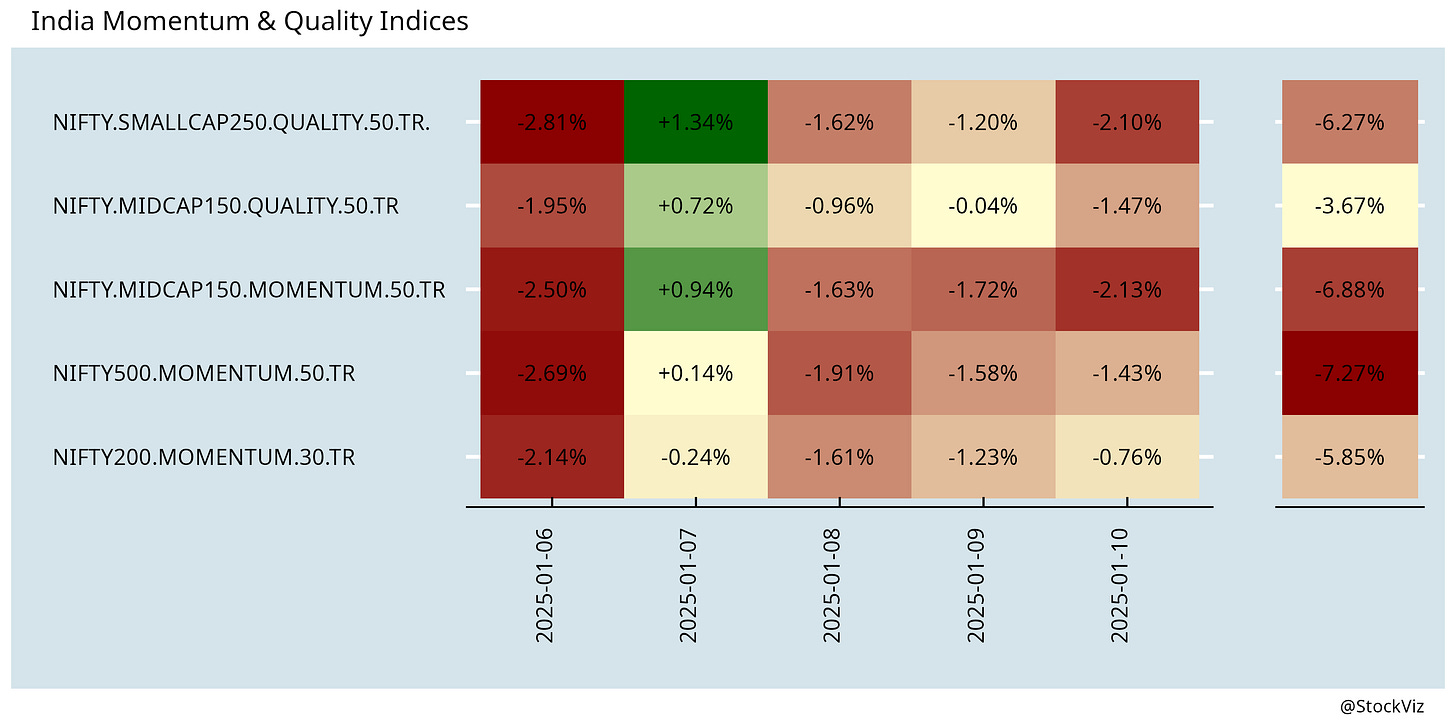

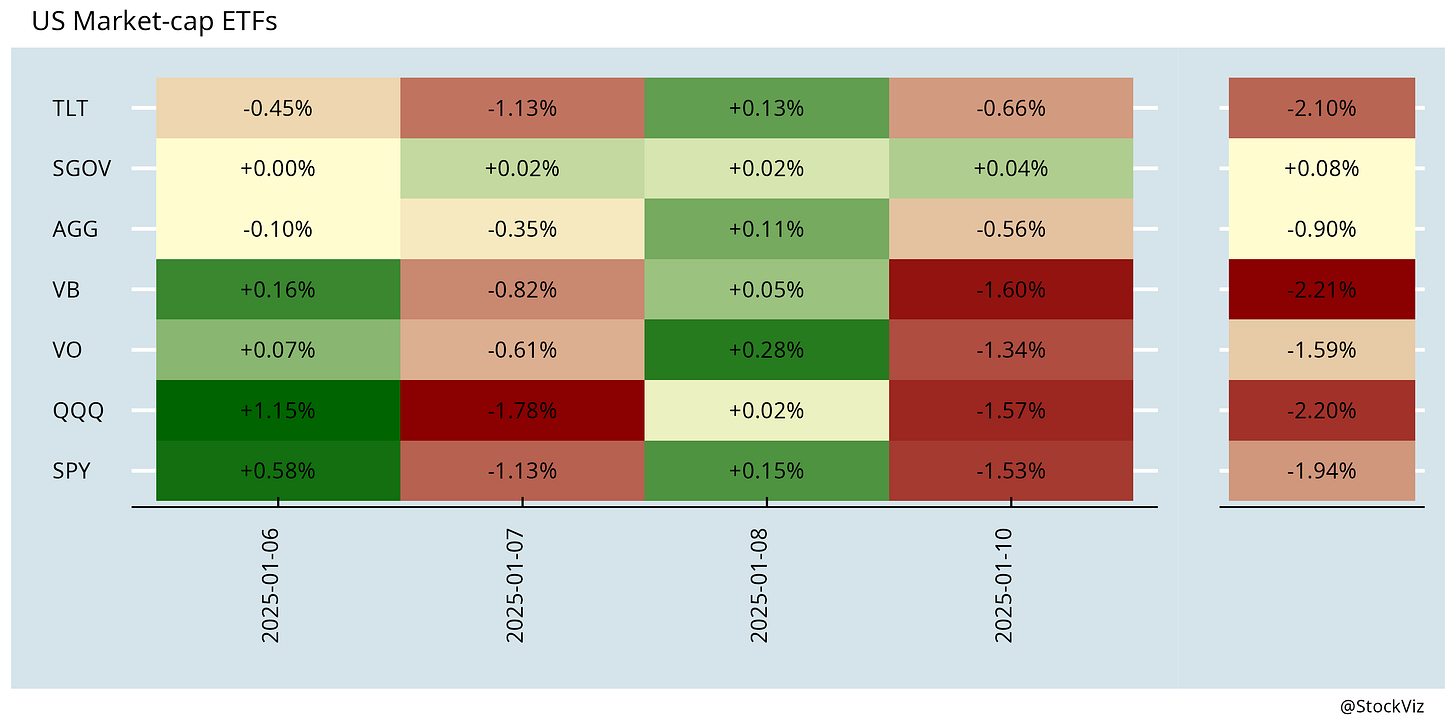

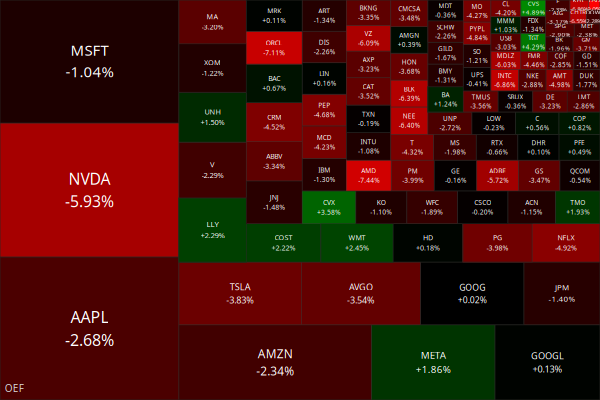

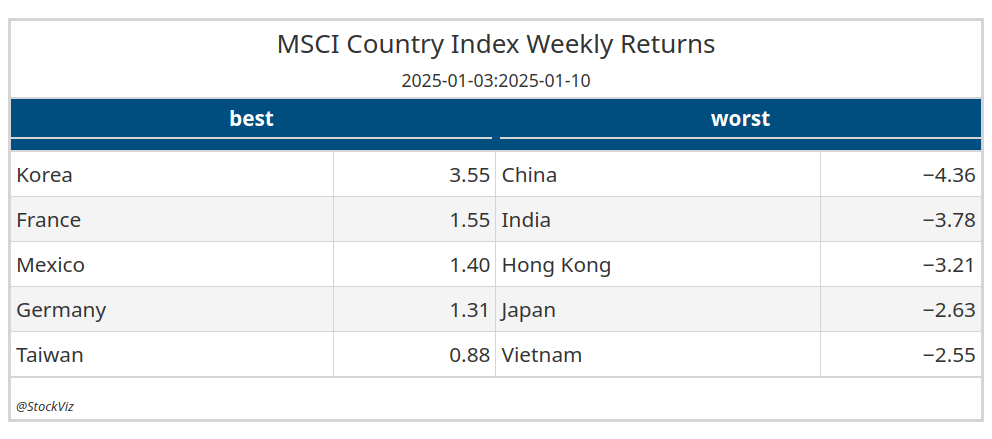

Markets this Week

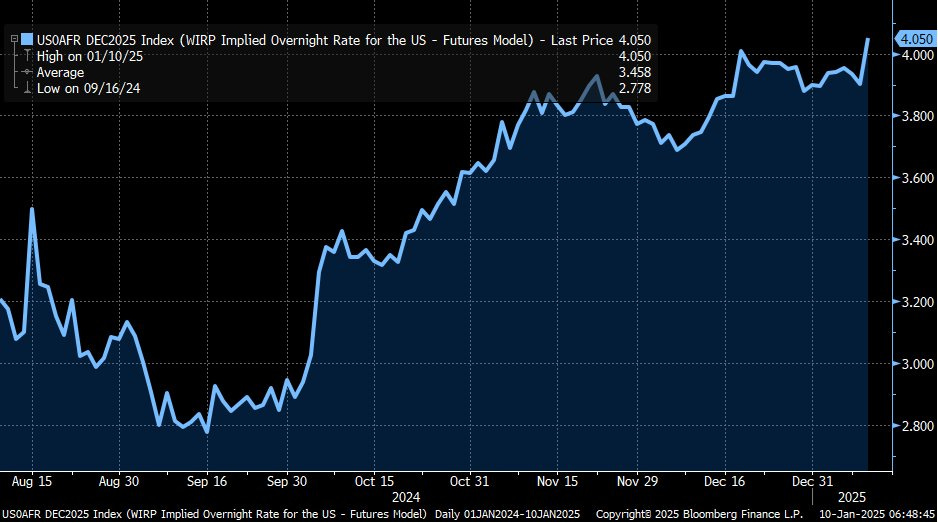

FIIs continued their selling spree…

… and apparently the US economy is doing too well so the stock market tanked.

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

Housing and Fertility (SSRN)

This paper examines the impact of access to housing on fertility rates using random variation from housing credit lotteries in Brazil. We find that obtaining housing increases the average probability of having a child by 3.8% and the number of children by 3.2%. For 20-25-year-olds, the corresponding effects are 32% and 33%. The lifetime fertility increase for a 20-year old is twice as large from obtaining housing immediately relative to obtaining it at age 30. These results suggest that alleviating housing credit and physical space constraints can significantly increase fertility.

The impact of social media influencers on the financial market performance of firms (wiley)

We find that mega influencers affect investors' attention, volatility and trading volume but not stock returns. It takes top influencers with extreme sentiment posts to affect returns and, even here, the effect is short-lived.

Bitcoin and Global Equity Markets: Linked Over the Long Term (SSRN)

This study analyzes the long-term relationship between Bitcoin and the MSCI World index from 2018 to 2024. The results reveal the existence of a cointegrating relationship, establishing that Bitcoin is significantly influenced in the long term by equity markets dynamics.

Investing

India

India forecasts 2024/25 economic growth of 6.4%, slowest in four years (reuters)

How taxes and fees add 7-12% to your property purchase cost (livemint)

India’s historic gold import number in November cut sharply, Jan-Nov corrected from 796 tonnes to 664 tonnes. The downward revision in gold imports alone is likely to also shrink the nation's trade gap by at least $11.7 billion. (reuters)

Apple Inc. supplier Foxconn Technology Group and Dixon Technologies India Ltd. are asking India to pay them billions of rupees in subsidies they think they are entitled to under the government’s production incentives program. (bloomberg)

Chinese staff are unable to travel to Foxconn’s iPhone factories in India, and workers already stationed in India are being recalled. Shipments of specialized equipment to India have been held up in China. (restofworld)

row

$1.2–$1.3 trillion in $100 bills are held outside the U.S., or 70% of all $100s. (federalreserve)

When tariffs are moderate and used to complement a domestic investment agenda, they need not do much harm; they can even be useful. When they are indiscriminate and are not supported by purposeful domestic policies, they do considerable damage – most of it at home. (project-syndicate)

AI Wants More Data. More Chips. More Real Estate. More Power. More Water. More Everything (bloomberg)

China plans to build ‘Three Gorges dam in space’ to harness solar power (scmp)

Storm brewing in China’s solar-panel sector threatens to spiral out of control (scmp)

In 2024, the number of Chinese asylum seekers since Xi Jinping took power in 2012 broke the one million mark. (safeguarddefenders)

Odds & Ends

LA is burning:

How Well-Intentioned Policies Fueled L.A.’s Fires (theatlantic)

Learn smart lessons from the L.A. fires, not stupid lessons (noahpinion)

Thousands of Los Angeles homeowners were dropped by their insurers before the Palisades Fire (cbsnews)

Study Confirms Antarctica Hasn’t Warmed In Past 70 Years (principia-scientific)

Americans are now spending more time alone than ever. It’s changing our personalities, our politics, and even our relationship to reality. (theatlantic)

OnlyFans origins (reuters)