It’s time for Cryptonite - our monthly roundup of all things crypto - with Dr. Tejaswi Nadahalli.

You can follow Tejaswi on twitter @nadahalli and he blogs at tejaswin.com

via summarize.tech:

00:00:00 In this section of Cryptonite, the hosts discuss the legal implications of cryptocurrency use, specifically focusing on the Tornado Cash case and Craig Wright's ongoing claims to be Satoshi. The Tornado Cash case involves three developers who deployed open-source code on the Ethereum blockchain for coin mixing, with one of them currently serving jail time in the Netherlands. The code, which facilitates anonymous transactions, has raised questions about free speech and the role of the developers in the laundering activities that occurred. Craig Wright, who has long claimed to be Satoshi Nakamoto but lacks proof, has sued several individuals in the crypto community who have disputed his claims. The Tornado Cash case and Wright's legal battles highlight the complex legal landscape surrounding cryptocurrencies and the challenges of balancing free speech, open-source code, and financial regulations.

00:05:00 In this section, Tejaswi discusses the legal case against Craig Wright, who claimed to be Satoshi Nakamoto, the creator of Bitcoin. The case, brought by an alliance called Copa, took place in England and lasted for six months. Wright was found to have lied and misrepresented himself, resulting in damages that he had to pay. The case had significant repercussions in the Bitcoin community, with Bitcoin.org taking down the white paper and several developers stopping their contributions due to Wright's copyright claims. Tejaswi expresses relief that the legal trouble is past and notes the involvement of Jack Dorsey and others in funding the lawsuit. The conversation then shifts to the topic of meme coins, which have exploded in the crypto market, with a market capitalization of over 60 billion. Meme coins, such as Dogecoin and Shiba Inu, have no real purpose other than to exist as part of a meme and are trusted by buyers based on their faith in the creator. Tejaswi finds the situation to be "crazy" and mentions various meme coins, some of which they are not even familiar with.

00:10:00 In this section, Tejaswi compares the situation of GameStop and AMC stocks, which have inflated prices due to speculation on social media, to meme coins in the crypto world. Shyam argues that while there is economic value tied to traditional equities, meme coins do not have any rational economic value and are purely speculative. Buyers and sellers of meme coins openly discuss the possibility of rug pulls and have no expectation of creating value. Shyam also mentions that the creator of a meme coin does not promise any economic value, and there is no misrepresentation since people are aware they are taking a risk. Shyam notes that $60 billion has been pumped into meme coins, indicating the availability of liquidity in the system looking for opportunities to invest in irrational things. Tejaswi mentions that even meme coins like Dogecoin, which started as a joke, have the potential to gain value if someone with influence decides to use it for a specific purpose.

00:15:00 In this section, Tejaswi discusses the concept of meme coins like Jeo Boden and Trump/MAGA, which has been associated with upcoming U.S. elections. Biden and Trump have no affiliation with these coins, but some believe it will pump when election results are announced. Tejaswi notes that there is no actual tie between the two events and that humans have a tendency to bet on random things. The creators of the coin could potentially do something valuable with it, but from what he knows, they will likely market it more or run away with the funds. Tejaswi also mentions the possibility of meme coin professionals making a quick profit by investing in these coins. The conversation then shifts to Ethereum ETFs, with Shyam questioning if they make sense due to the staking problem. Ethereum allows users to stake ether and earn yield, but if an ETF holds ether, it's unclear what they will do with it. Tejaswi notes that the SEC has only looked at ETFs where staking is not done, but the future is uncertain.

00:20:00 In this section, Tejaswi discusses the upcoming approval of an Ethereum ETF in the US, and how Grayscale's history with closed-end Bitcoin products may indicate the possibility of ETFs for other crypto assets in the future. Tejaswi also touches on the regulatory challenges facing the crypto industry, specifically the issue of banks' ability to custody crypto for their customers in the US. Tejaswi expresses confusion over why the political establishment would want to prevent banks from custodying crypto, suggesting it may be due to concerns over risk and contagion effects. Shyam speculates that the Fed may be the regulator driving this policy, and that banks may eventually be allowed to offer custody services for crypto assets as long as they are considered similar to safe deposit lockers, with customers assuming the risk and paying a fee for the service.

00:25:00 In this section, Shyam discusses the differences between traditional assets like gold and crypto, and the role of governments and banks in regulating them. Shyam explains that banks may not be liable for crypto losses and that the US administration views crypto as a threat to the existing financial system. Shyam also mentions the correlation between crypto and other assets like NASDAQ and the shift of speculators from crypto to other areas like sports betting as possible reasons for the decline of crypto as an investment option. Overall, Shyam suggests that crypto exists within the US dollar system and is subject to the same rules and regulations, making it a purely speculative asset.

00:30:00 In this section, Tejaswi discusses the gambling nature of the crypto universe and the possibility of using cryptocurrencies like Bitcoin as a hedge against US debt and potential dollar debasement. Tejaswi notes that while some crypto coins may be used purely for gambling, such as sports betting, others like Bitcoin have a universal appeal and have survived despite calls for its demise for over a decade. Tejaswi also mentions attending conferences in Berlin, the hub of crypto innovation in Europe, and the presence of startups, protocols, and researchers working on blockchain technology.

00:35:00 In this section, Tejaswi discusses their experience at the ETHBerlin hackathon, which had around 300 teams competing, in comparison to ETHIndia with approximately 700 teams. The event focused on privacy, encryption, and anonymity, but was not investor-friendly due to the nature of these types of projects. The side events of the conference were more diverse, with themes including Solana, modularity, and chain abstraction. Chain abstraction refers to the trend in crypto of unbundling and bundling, with the current landscape having many layer one blockchains, and the need for managing assets across them leading to chain abstraction as a solution. Tejaswi also mentions the continued interest in crypto AI, data anonymization, and bundling and unbundling in the crypto industry.

00:40:00 In this section, Tejaswi discusses the theme of bundling and unbundling in the crypto market. In 2020, assets were bundled together to create collateral pools for lending markets. However, the risk associated with these bundles has led to a new protocol called Morpho, which is unbundling the market once again. Tejaswi notes that determining the actual value of the crypto market is difficult due to the circulation of money and off-chain transactions. Tejaswi also mentions Paradigm, a VC fund that has raised an impressive amount of money to invest in crypto companies, and the trend of Asian, European, American, and Indian VCs being active in the crypto space. An example given is an Indian exchange that operates with Indian rupees and uses Bitcoin futures for settlement, allowing for compliance with local regulations. Tejaswi expresses their thoughts on India's approach to crypto, noting that while they have banned crypto due to perceived lack of economic value, they have a thriving options market.

00:45:00 In this section, Shyam discusses the addictive nature of expiry day trading in the options market in India. He notes that high-frequency trading firms capture most of the money in this market, while retail traders are drawn to the potential for making a fortune. Shyam expresses concern that during the upcoming budget, regulators may introduce taxes to disincentivize gambling on options exchanges. He also mentions that equity options in India are physically settled, leading to a spike in trading activity and penalties for those unable to buy the full lot size before expiry. Shyam notes that this has resulted in a significant drop in single stock options volume.

00:50:00 In this section, Tejaswi discusses the ongoing interest in crypto markets, specifically in India, where speculative exchange products have emerged despite previous assumptions that the market was dead. The speaker also mentions the trend of Indian entrepreneurs relocating to avoid being in India in person and the development of new tools and protocols in the crypto space. The speaker concludes by encouraging viewers to keep an eye on interesting products and startups in the crypto world and wraps up the month's episode of Cryptonite. The speaker also mentions the upcoming US election as a potential event to watch but emphasizes that Bitcoin will continue to follow its own course.

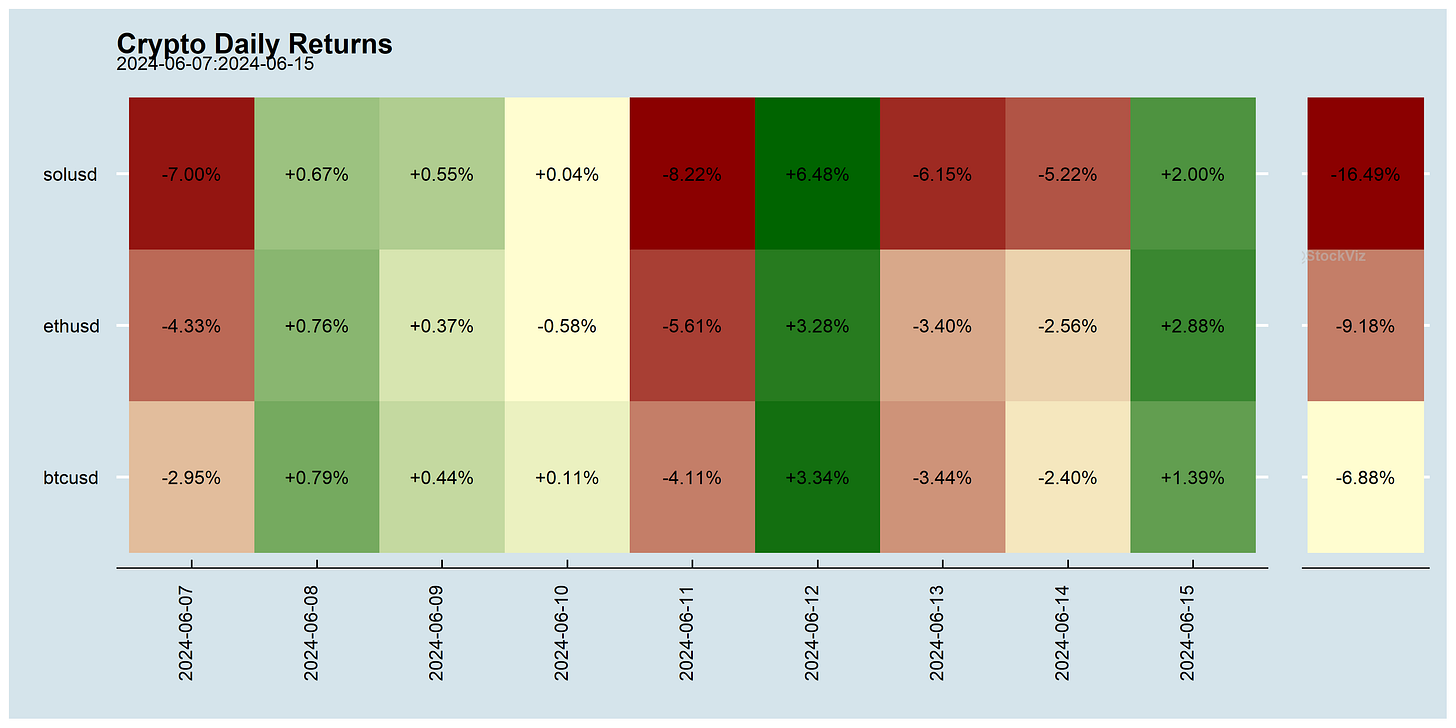

Markets this Week

Indian indices back to making all time highs…

… QQQ 🚀🚀🚀

More here: country ETFs, fixed income, currencies and commodities.

Links

Crypto trading should be regulated to curb harms caused by addiction (dailymail).

Tornado Cash Developer Alexey Pertsev Found Guilty, Sentenced to 64 Months in Prison by Dutch Court (coindesk).

Tornado Cash Is Not Free Speech. It’s a Golem (lawfaremedia).

"I didn't launder the cash, your honor. The robot did." (jpkoning)

Grayscale launches two new trusts investing in NEAR and STX (theblock).

BlackRock's IBIT ETF has become the world's largest fund for Bitcoin, overtaking Grayscale Bitcoin Trust (reuters).

Research

Cryptocurrency Volume-Weighted Time Series Momentum (SSRN)

Our findings suggest that trading volume may provide signals within cryptocurrency markets to create profitable strategies.

Unlocking Ethereum's Potential: The Rise of Spot ETFs in Cryptocurrency Investment (SSRN)

This article explores the advantages and risks of incorporating Ethereum spot ETFs into portfolios.

Geopolitical Risks and Cryptocurrency Returns (SSRN)

This study examines how global geopolitical risks, threats, and acts impact the daily returns of ten major cryptocurrencies. None of them offer a reliable hedge against geopolitical risks.

The Relationship between Bitcoin and Nasdaq, U.S. Dollar Index and Commodities (SSRN)

This paper investigates the long-run interaction between Bitcoin and Nasdaq, U.S. Dollar Index and commodities by applying weekly data from a January 1, 2017 until May 21, 2023. The results reveal a positive and significant relationship between Bitcoin and Nasdaq, as well as a similar positive association between Bitcoin and Oil prices.

Cryptocurrency Regulations: The Indian Scenario (SSRN)

This research aims to delve into the historical trajectory of cryptocurrencies, scrutinize the legal complexities they present, and analyse the imperative for comprehensive regulatory measures.