It’s time for Cryptonite - our monthly roundup of all things crypto - with Dr. Tejaswi Nadahalli.

You can follow Tejaswi on twitter @nadahalli and he blogs at tejaswin.com

A detailed summary can be found here.

Concise Summary (via recall):

Dr. Tejaswi's disillusionment with the crypto industry

Dr. Tejaswi has been involved in the crypto industry for most of the decade and has a PhD in crypto, but has become disillusioned with the industry's focus on financialization and lack of real-world applications.

The Trump meme coin triggered a realization that US regulators had been arbitrarily enforcing guidelines, and the crypto industry's response was to create more meme coins with no real utility.

Dr. Tejaswi has decided to leave the non-Bitcoin part of the crypto industry, citing the lack of interesting work and the dominance of financialization, and is now focused on other areas such as cryptography and distributed systems.

Ripple's win against the SEC

The crypto industry was happy about Ripple winning against the SEC, despite not liking Ripple as a company, because they wanted the SEC to lose due to its harsh approach to regulating crypto companies.

Starkware's struggle for product-market fit

Starware, a blockchain, has been trying to find product-market fit for years and has been sustaining itself with raised funding, but its token is not being used, and the founder is trying to find ways to get users.

The fact that technology doesn't matter at a high level in crypto, and that tokens are not rewarded for their technological advancements, is a key takeaway, with Bitcoin being the only one that has held its value despite lacking innovation.

The Bit hack and its aftermath

The ByBit hack, which was the biggest crypto hack ever, involved North Korean state-sponsored attackers who stole $1.6 billion in Ethereum and laundered it through Bitcoin.

The hack was made possible by a malicious JavaScript code that targeted the ByBit wallet and was pushed to a web 2 UI called Safe.Global, which was used to orchestrate on-chain signatures.

The regulatory environment and market trends in crypto

The regulatory environment in the US has become more attractive for crypto, with the SEC dropping cases against several exchanges and protocols, and the US government announcing a Strategic Bitcoin Reserve.

Despite the bullish regulatory environment, crypto markets have been bearish, with Bitcoin testing the $80,000 barrier, and no new crypto narrative or idea has emerged to drive growth.

Challenges and pitfalls in the crypto market

Many people got into crypto, specifically meme coins, without doing their research and ended up losing money, similar to what happens in equity markets.

The lack of control over supply in crypto is a significant issue, with many coins and tokens being launched without any real value or use case.

On-chain transparency is a unique aspect of crypto, providing a wealth of information about transactions and allowing for more informed decision-making.

However, this transparency also creates a premium on knowing what's happening in the market, making it essential for investors to do their homework before trading.

The ease of launching new tokens and the lack of regulation in crypto have led to the creation of many low-quality or even fraudulent tokens.

The use of bot farms and copy trading can also manipulate the market, making it difficult for retail investors to make informed decisions.

Trading challenges and opportunities in high-speed systems

The biggest problem with trading in systems like HyperLiquid is latency, which can lead to significant losses for those with slower compute speeds.

There are opportunities for trading in such systems, but leverage can be a scary part due to the potential for 30% drawdowns, making it difficult to survive.

Wrapped Bitcoin and regulatory hurdles

The concept of wrapped Bitcoin (wBTC) is interesting, but its current management by a consortium with a shady history raises concerns about its legitimacy.

Regulatory clarity and tax implications are significant hurdles for crypto trading, especially in regions like India, where the lack of clarity can lead to issues with income tax authorities.

Markets this Week

Red was the most popular color this holi…

… with IndusInd bank making everything else look good.

Gold & silver on a tear.

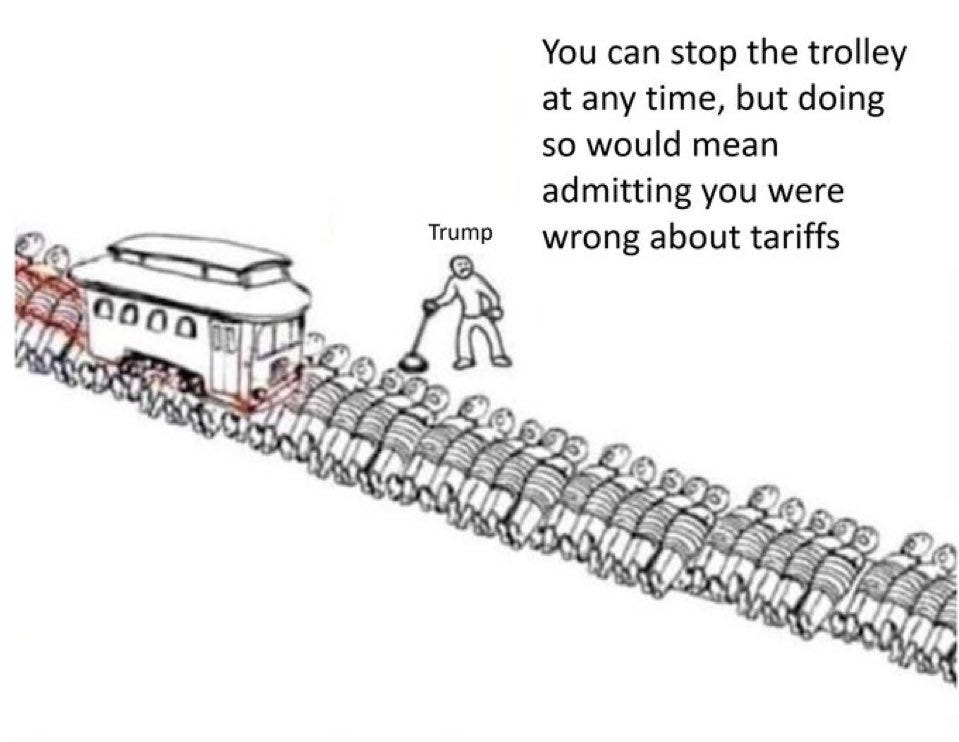

Monday: Tariff on. Friday: Tariff off.

More here: country ETFs, fixed income, currencies and commodities.

Links

Investing

India

Selloff in Indian stocks burns retail investors, fans economic risks (reuters).

IndusInd Bank flags lapses worth ₹1,530 cr in derivatives portfolio (livemint)

Ola Electric Mobility, India’s largest EV company, struggles to maintain its edge as legacy players tap into customer trust and brand loyalty (restofworld).

if China wants to stay much more powerful than India, it has an incentive to make sure that economic development is not evenly distributed — that the new wave of globalization skips India entirely.

China’s leaders probably envision a new global economy in which high-value manufacturing activity resides in China, lower-value assembly work lives in other countries, and India remains a service-dependent backwater.

China is trying to kneecap Indian manufacturing (noahpinion)

Airbus and Boeing Resist India’s Push for Local Final Assembly Lines After China Experience (idrw)

row

A crypto reserve would be a ready-made vehicle for corruption, creating colossal conflicts of interest over corporate regulation and government policy (theatlantic).

Trump's economic shock therapy (axios).

Europe will find itself increasingly squeezed, with the United States unwilling to absorb what it produces and China competing against it in Europe and in whatever smaller countries remain that are still open to exports (nytimes).

Heavy Industry Is Europe’s Trump Card (foreignpolicy).

There are several problems with Trump’s hope that imposing tariffs will create factory jobs. For any given industry, tariffs do act as a subsidy, but they subsidize domestic production, not employment. Today, manufacturing production is increasingly intensive in inputs such as machines, robots, and other technology, not human labor. A new semiconductor factory, for example, may cost $20 billion to construct but ultimately operates using few workers, aside from highly trained engineers. Tariffs may thus bring new plants, but not necessarily the jobs that might have once come with them (foreignaffairs).

Art lenders issue margin calls as painting prices fall (ft)

Germany's leading political parties have announced a historic deal on a spending programme to unlock hundreds of billions of euros for defence and infrastructure (euronews).

Britain ‘no longer a rich country’ after living standards plunge (yahoo).

How the British Broke Their Own Economy (theatlantic).

While it is easy to blame market uncertainty on Trump, tariffs and trade wars for the moment, the truth is that the forces that have led us here have been building for years, both in our political and economic arenas. In short, even if the tariffs cease to be front page news, and the fears of an immediate trade war ease, the underlying forces of anti-globalization that gave rise to them will continue to play out in global commerce and markets.

In some small corners of the US market, Korean retail investors are major players. In leveraged ETFs on stocks and crypto, they often own more than 20% of shares outstanding. Among their top-50 U.S. holdings are eight leveraged ETFs, including a 2X single-stock ETF where they own 40%. (acadian-asset).

Chinese vehicle exports to Russia last year hit seven times the level of 2022. Russia bought up more than 1mn Chinese vehicles last year, soaking up about 30 per cent of its neighbour’s petrol car exports. The surge handed Chinese brands 63 per cent of the Russian market (ft).

China now eclipses every other country in the world in the green technologies of the future (washingtonpost).

Roomba maker iRobot flags going concern risk (reuters).

Odds & Ends

The Long Road to Humanoid Robotics (edgeofautomation)

China knew 10 years ago that these robots would be a force and doubled down again in 2023. This is not a question of ifs: China knows what comes next if they are first to unlock these robots, they will iterate faster than the US, they will subsidize the industry to an unprecedented extent, they will achieve massive economies of scale and oversupply all global markets, and the general purpose robotics boom will be nothing but a bad dream for the US if nothing changes.

Netflix’s movies don’t have to abide by any of the norms established over the history of cinema: they don’t have to be profitable, pretty, sexy, intelligent, funny, well-made, or anything else that pulls audiences into theater seats. On the platform, you didn’t need to make a hit to succeed. You didn’t even need your film to be remembered. You just needed “enough of everything to attract anyone.” (nplusonemag)

Especially more than 1 meme, perfect.

All in the family post. Lol