It’s time for Cryptonite - our monthly roundup of all things crypto - with Tejaswi Nadahalli.

You can follow Tejaswi on twitter @nadahalli and he blogs at tejaswin.com

Ever since FTX/Alameda went down, SBF has been on an aggressive whitewashing tour. While Tejaswi thinks it’s unfair and wants SBF behind bars, I, for one, want him to get away with it.

Sure, it was fraud in the fiat space, but everybody who stayed in crypto this year knew that the whole space was a grift. But they remained thinking that they will be the rug puller and not the victim (rug pullee?). So, why does this come as any surprise? And is fraud in the metaverse fraud in the meatverse?

The polycule in which SBF, Caroline and his buddies lived in is a metaphor for the entire crypto ecosystem:

When Sam says, "he poorly risk-managed" it means, "I, FTX's CEO Sam, should not have allowed Alameda Sam to use pretend Sam-money as collateral to take real-$$ from Sam's customers."

(Thread)

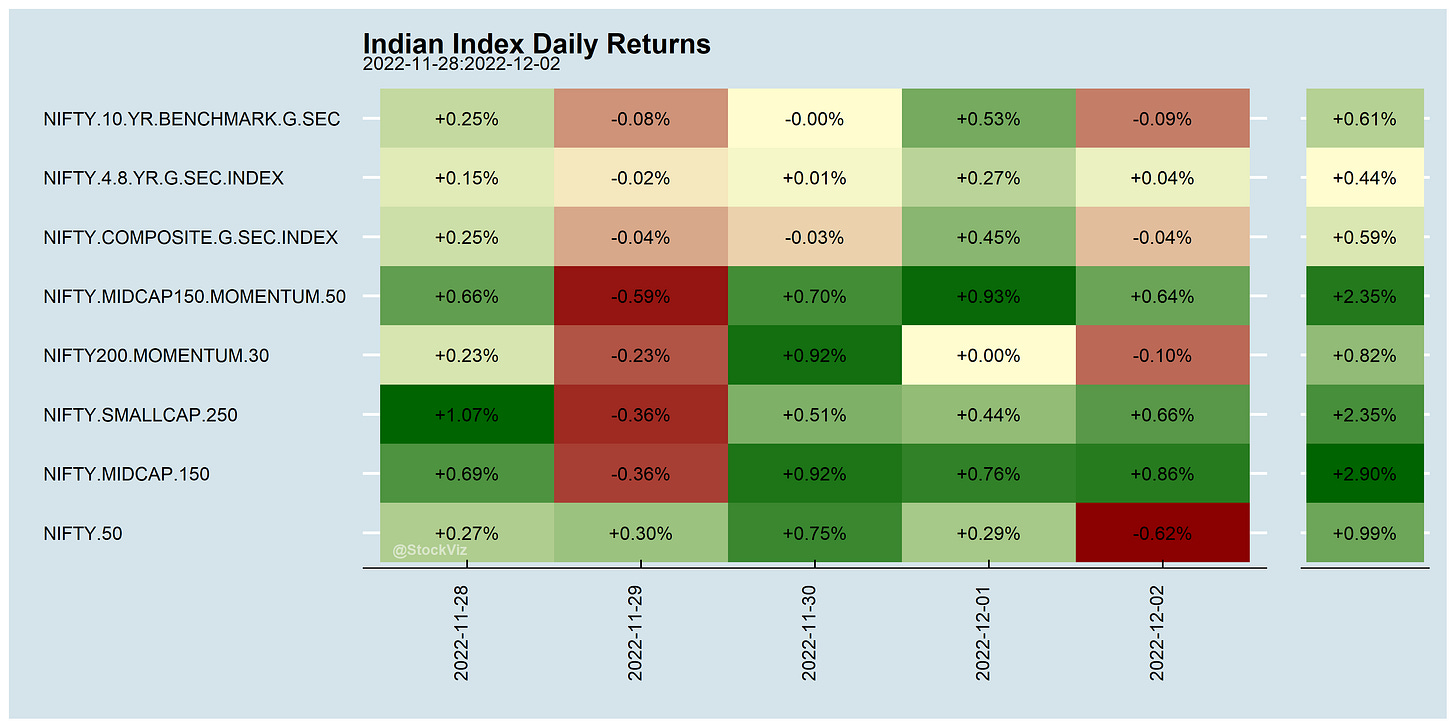

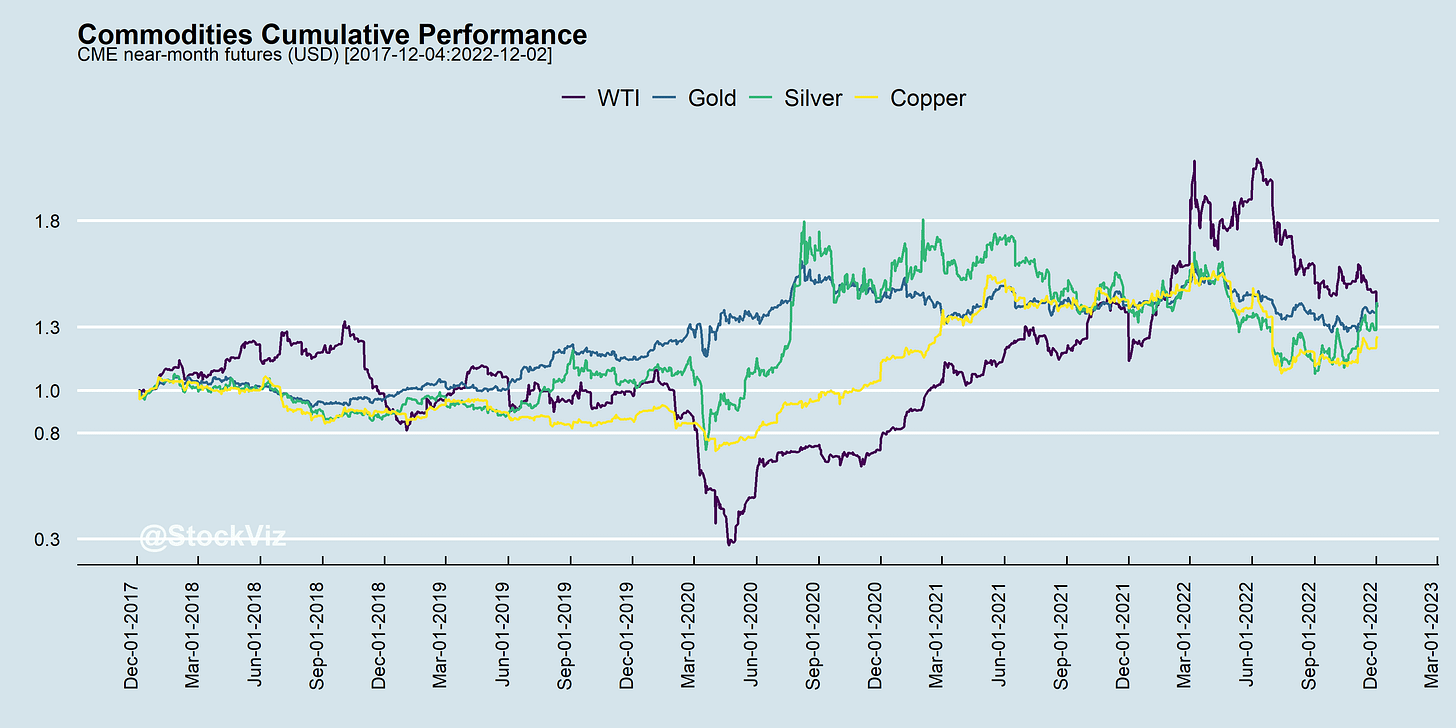

Markets this Week

Links

Make rug pulls great again!

Former FTX Executive Brett Harrison in Talks With Investors for New Crypto Startup. (theinformation)

The VCs try not to commit the securities fraud themselves. Their business model here is to incentivise it. (davidgerard)

~

If legit, then super-dumb.

The often unobserved “cost” of spectacular gains is the spectacular risks that were undertaken to achieve the gains. A famous Buffett quote: "Over the years, a number of very smart people have learned the hard way that a long stream of impressive numbers multiplied by a single zero always equals zero."

(Thread)

Every major decision they have made is related to acquiring more leverage - via deceptive fundraises, financial engineering, and ultimately, outright fraud.

(Thread)

~

Ultimately, the anti-establishment MLM/Ponzis opened the door through with the establishment is going to walk through.

Credibility is more important than tech. (washingtonpost)

~

It is bitcoin. Not bitcoin.

Money is, first and foremost, a generally recognized medium of exchange. (alt-m)

~

The ECB has some thoughts

Since Bitcoin appears to be neither suitable as a payment system nor as a form of investment, it should be treated as neither in regulatory terms and thus should not be legitimised. Similarly, the financial industry should be wary of the long-term damage of promoting Bitcoin investments…

Bitcoin’s last stand (ecb)

~

Crypto is a metaverse where banking history is speed run in real-time. They should be allowed to take it to conclusion.

Crypto this year resembles free banking in the early 1800s. Banking was saved by introduction of a single national currency, lender of last resort, deposit insurance, comprehensive regulation. But I don't think that recipe works for crypto… Bank-like regulation would negate the efficiency, anonymity that supposedly makes crypto superior to fiat. U.S. needed banks, currency & thus had to find a regulatory solution to banking instability. It doesn't need crypto; fiat currency, regular banks are working just fine.

(Thread)

~

How is crypto different from online gambling?

For four of the past five years, British punters have lost more than £14 billion on online casino games, sports betting and other forms of gambling. Fully 60% of the industry’s profits come from only 5% of its customers.

Britain Opened the Door to Online Gambling. Now It’s Living With the Consequences (bloomberg)

~

Always been

~

Not the hero crypto needs but the hero it deserves

Sam Bankman-Fried is a con man and fraudster of historic proportions. (coindesk)

Despite the picture his coordinated PR campaign is trying to paint, Sam is not a boy genius who flew too close to the sun. He's a low brow criminal who fraudulently and knowingly stole billions from millions of people.

(Thread)

So to recap, the CEO and control owner of a firm, allegedly:

✅ Took $10B of customer deposits

✅ Moved them to a company he owns 100%

✅ Further moved them to himself

✅ Made special software to hide the transfers from others

(Thread)

~

Contagion making its way through the system:

BlockFi’s Rise and Fall: A Timeline (coindesk)

Crypto broker Genesis owes Winklevoss exchange’s customers $900mn (FT)

If this is really the end for Genesis, this could be more impactful than FTX. (Thread)

Grayscale's Bitcoin Trust, which passively invests in bitcoin, holds over 633,000 of the coins, which at today's prices equals nearly $11 billion and represents 3.3% of all coins mined… Questions swirl around the health of Grayscale's parent, Digital Currency Group. DCG is the largest holder of GBTC shares with almost 10%

(theblock)

~

A very underrated take: