It’s time for Cryptonite - our monthly roundup of all things crypto - with Dr. Tejaswi Nadahalli.

You can follow Tejaswi on twitter @nadahalli and he blogs at tejaswin.com

AI summary (via summarize.tech):

00:00:00 In this section of the YouTube video titled "Cryptonite, November 2023", the speaker discusses the recent Bitcoin rally and an upcoming event called Halving. The rally was triggered by the US Securities and Exchange Commission (SEC) allowing for the filing of spot Bitcoin ETFs. The demand for Bitcoin is increasing, as asset managers like Blackrock, Grayscale, and VanEck are launching Bitcoin ETFs. The supply of new Bitcoin coins will decrease due to a mechanism called Halving, which is built into the Bitcoin code. This decrease in supply will lead to a potential increase in the price of Bitcoin. However, whether the upcoming Halving event will be priced into the market is not certain. The speaker also notes that the demand for new Bitcoin coins is the only variable, while the supply is already circulating.

00:05:00 This section discusses the concept of cryptocurrency investment vehicles, specifically spot Bitcoin ETFs. This author highlights the former ETF issue, Grayscale Bitcoin Trust, which charged higher fees than holding spot Bitcoin but was very popular with people who only had access to such instruments through their brokerage accounts. The fees were so high that it enabled individuals to make an arbitrage trade with the Trust. However, now as more ETF applications are coming into play, there is a possibility that actual Bitcoin will be available in brokerage accounts, leading to an end to the premium that the Trust provided.

00:10:00 In this section, the speaker discusses the hack of the centralized exchange Poloniex, which was based in Singapore and started by Justin Sun. The exchange was hacked for $120 million worth of assets, including Bitcoin, Ethereum, and other coins. The speaker also mentions the use of Tether, a stablecoin, which is settled on the Tron blockchain, which has the most monthly active users among all blockchains. The speaker then talks about the Rand crypto exchange attack, which seems to have been caused by older wallet implementations. Famous crypto cases such as the DAO hack and the Ethereum DAO hack have had funds returned to users, but the extent of the reversal is questionable. Lastly, the speaker discusses the case of SBF (Sam Bankman Friedman) and how he is now in jail. The speaker also talks about the case of FTX, which had a lot of assets and owes a lot of money. The speaker discusses how the estate will unwind the whole thing, but it is uncertain how they will do it.

00:15:00 In this section, the speaker discusses the emergence of secondary deals and potential revival of the FTX exchange code. They mention that the intellectual property for launching a new exchange has been obtained and that the FTX exchange code can be taken as is, with necessary changes. The speaker also talks about the Solana Breakpoint conference, where another exchange, Backpack, was announced. Backpack has a connection to the FTX exchange, as the co-founder of Backpack is from the legal team at FTX. The speaker emphasizes the importance of liquidity for a new exchange, and notes that there is already a crowded space with established exchanges such as Coinbase, Kraken, and OKX. They also mention the concept of cross-margining and perpetual futures as areas for potential improvement in the exchange space. While the speaker acknowledges that there is a need for new exchanges, they also note that user volume is uncertain and cannot be guaranteed. They suggest that the crypto boom will likely happen soon, and that users will forget the negative aspects of the past two years. While new users may bring in liquidity, stability in the market may not come until after a second boom.

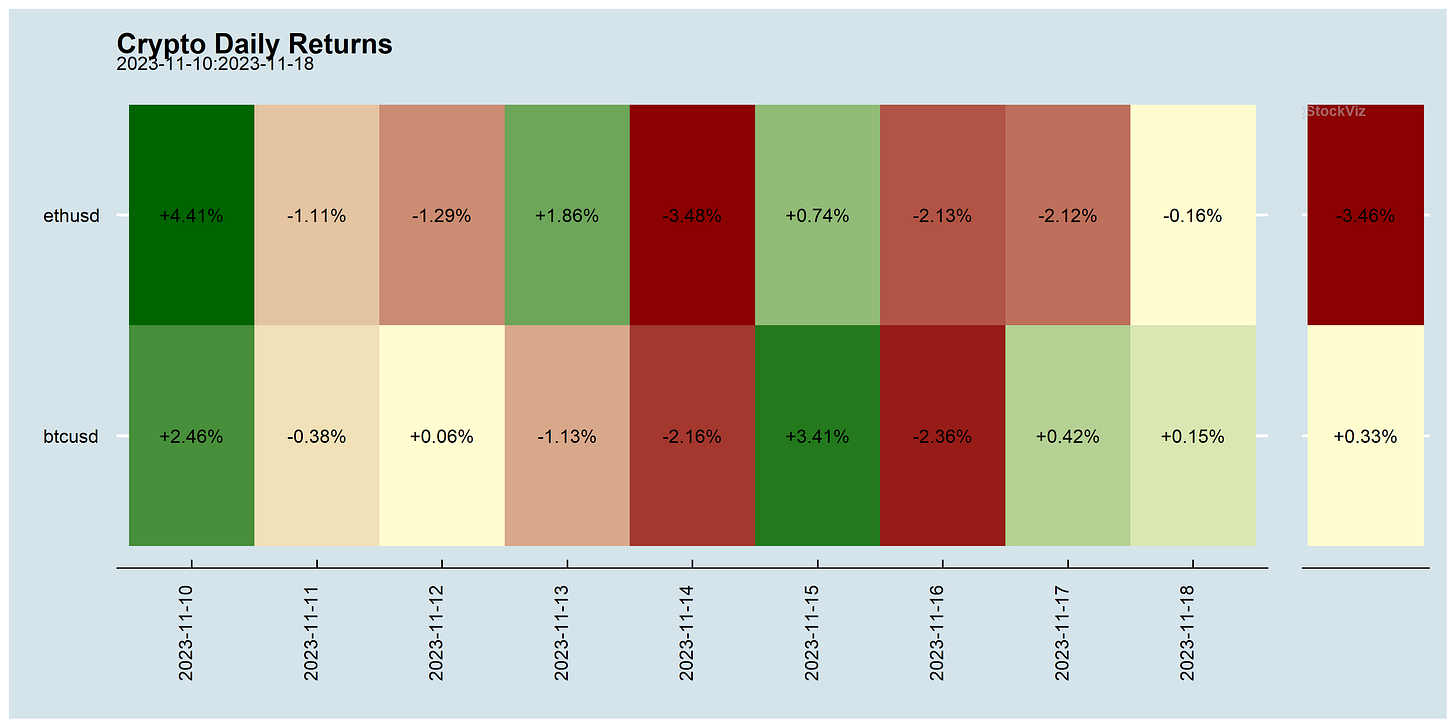

00:20:00 In this section, the speaker discusses the recent surge in participation in options trading and the positive returns experienced in the cryptocurrency market during 2023. This, despite the traditional stock markets lagging behind and being yet to attain their all-time highs, seems to be a clear evidence of the decoupling of cryptocurrencies from traditional equity markets, a perception not shared by everyone. The speaker attributes this ripple effect in the cryptocurrency market mainly to a shift in sentiment that followed the conclusion of the SBF saga and the Bitcoin ETF news, which despite having not hit their all-time highs, have substantially improved the market. It is suggested that this could be a relief rally, with the expectation that an innovative, groundbreaking project may not come out of the cryptocurrency market in the imminent future, but may happen at some point in the future. The NFT protocol on the Bitcoin blockchain joins the NFT race, getting an interesting volume, with bitcoin reportedly exceeding NFT volume on Ethereum, despite the latter being the preferred blockchain for this type of transaction.

00:25:00 In this section, the speaker discusses the knowledge gap between those who own crypto and trade it and their financial knowledge. He mentions that a survey has shown that most crypto owners are young, tech-savvy males with no financial background or knowledge. The speaker then goes on to mention the young tech-savvy investors who own other stocks like MicroStrategy and their Bitcoin holdings. He criticizes MicroStrategy for their lack of financial knowledge and their focus on leveraging their Bitcoin holdings, which he believes will ultimately lead to their downfall. The speaker concludes by noting that the next big blowup in the crypto market will likely be MicroStrategy, and that the launch of ETFs will lead to a dip in the market that will take out MicroStrategy. He also emphasizes the importance of the custody of cryptocurrencies, specifically Bitcoin, which he notes is one of the vulnerabilities of the crypto market. The speaker concludes by warning investors to be cautious and not to rely solely on the private holdings of individuals or entities in the crypto market.

00:30:00 in this section, the speaker discusses the challenges associated with institutional custody in the world of Bitcoin and other digital assets. They explain that because traditional SEs don't have identity proofs for custodians dealing with digital assets, in the case of an error or mistake by the custodian, there is no way to get the assets back except to sell them on the open market. In contrast, in the case of digital asset custodians, if an error or mistake occurs, there may be no way to recover the assets, making them permanently gone. The speaker also discusses the issue of decentralization versus high performance, suggesting that centralizing as much as possible to achieve high performance is not ideal, as decentralization comes at the cost of low performance. However, they claim that by launching their own layer one blockchain, decentralized players may still achieve high performance while also maintaining decentralization.

00:35:00 In this section, the speaker discusses the potential regulatory challenges facing smart contracts. They note that many smart contracts are currently controlled by a single company, which raises concerns about manipulation and lack of transparency. The speaker argues that, in order to protect themselves from regulation, smart contract companies are turning to blockchain technology to make their networks more decentralized. They cite DyDx as an example of a company that has launched its own blockchain in an attempt to gain regulatory protection. The speaker notes that this process requires significant engineering effort, and that there are long-term projects involved in creating a new blockchain. In summary, the speaker suggests that the use of blockchain technology is becoming a vital strategy for smart contract companies seeking to navigate regulatory environments.

00:40:00 In this section of the transcript, the speaker discusses the UI and settlement aspects of the cryptocurrency industry. They mention that eventually, the UI can be managed by any compliant company. However, the underlying settlement can still be open for people to find out how to do it. The speaker also discusses an incident last month where the WSJ claimed that 10000 million plus worth of cryptocurrency donations were made to known Hamas addresses. The speaker notes that the crypto community went crazy about this, claiming that it was not true

00:45:00 In this section, the speaker discusses the regulatory challenges faced by cryptocurrencies and other blockchain-based technologies. They argue that governments and financial institutions are attempting to control the use of these technologies, particularly in areas where they could pose a threat to the established financial system, such as creating a parallel financial infrastructure or enabling unregulated gambling. The speaker emphasizes that the desire for profit and control drive both the development and regulation of these technologies, leading to boom-bust cycles and potential legal issues for those who use or invest in them. While the speaker expresses a concern for their own safety, they ultimately suggest that the demand for these technologies will continue to grow, as they offer endless possibilities for innovation and financial engineering.

00:50:00 In this section, the speaker discusses the concept of fraud and how it is defined. They argue that while AIG may have written credit default swaps, it was not an "out and out fraud" as it was underwritten with the expectation that they would be paid back. The speaker goes on to discuss the issue of "mark to market" and how it has not been applied correctly in Blackstone REIT, which holds commercial office buildings and has not corrected the prices of its assets. The speaker also raises the question of liquidity, stating that it is difficult to find someone to sell these assets to. They further argue that the boost in Blackstone REIT's prices during the boom times was due to the fact that it could only be bought at a higher price, and that it would be fine to continue investing in real estate as long as people "hold right."

00:55:00 In this section, the speaker discusses the concept of the estate cycle in real estate investing. They emphasize the importance of complying with government regulations and obtaining their blessings before proceeding. The speaker also mentions the influence of social media and the potential danger of crossing a line that could result in banishment. They suggest that the regulatory framework for real finance works in the form of the government and regulators drawing the line, and that investors should play the game rather than hitting their opponents. The speaker thanks their audience for tuning in and promises to see them again next month.

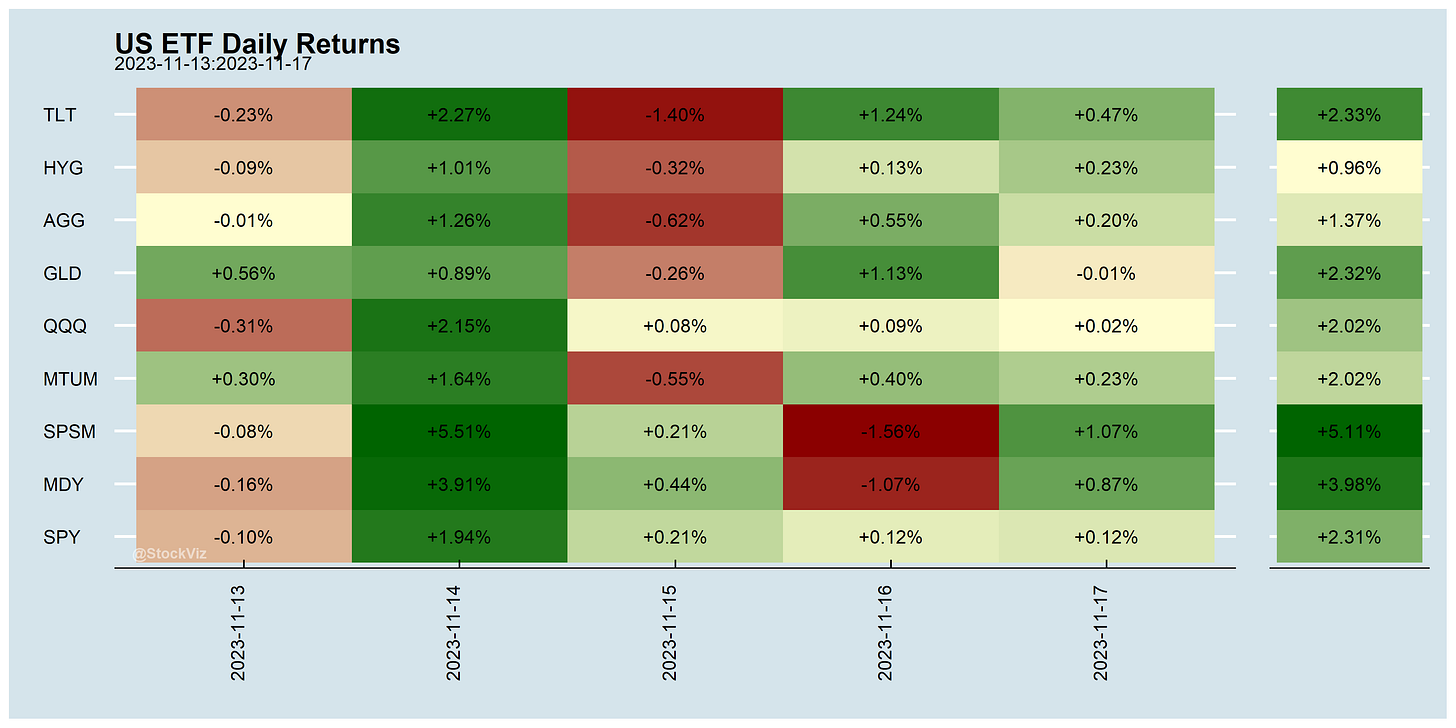

Markets this Week

🚀🚀🚀

More here: country ETFs, fixed income, currencies and commodities.

Links

Sam Bankman-Fried’s conviction on seven charges of fraud, conspiracy, and money laundering is only the first act in what promises to be a lengthy, expensive legal drama. (thenation)

Who Invests in Crypto? (NBER)

Bitcoin miners make money ahead of 'halving' (reuters)

If you created a bitcoin wallet before 2016, your money may be at risk (washingtonpost)

In future, cryptoassets to be included in international automatic exchange of information in tax matters (Swiss government)

the claims of superior risk-adjusted performance by the PE industry are exaggerated. Given their lack of liquidity, opaqueness, and greater use of leverage, it seems logical that investors should demand something like a 3-4% IRR premium. Yet, there is no evidence that the industry overall has been able to deliver that.

The Real Reason So Many Asset Managers Are Struggling in China (institutionalinvestor)

The augmented historical record reveals substantial variation in values central to financial analysis. Stock returns, bond returns, the correlation between them, their standard deviation, and the contribution of dividends have not been stationary. Measurement spanning even 100 years need not bring convergence.

The expanded historical record shows that stocks can perform poorly in absolute terms and underperform bonds, whether the holding period is 20, 30, 50, or 100 years.

the decision to avoid having children may amount to a kind of performance anxiety in the face of intense expectations and weak governmental and social support

Inside an OnlyFans empire (washingtonpost)