It’s time for Cryptonite - our monthly roundup of all things crypto - with Dr. Tejaswi Nadahalli.

You can follow Tejaswi on twitter @nadahalli and he blogs at tejaswin.com

AI summary (via summarize.tech):

00:00:00 In this section, Dr. Tejaswi provides a compressed overview of three negative events in the crypto world during 2022. These events include the collapse of Terra Luna, the closure of Three Arrows Capital, and the exchange run on FTX. Dr. Tejaswi explains that the individuals responsible for these events, such as Do Kwon, Su Zhu, and Sam Bankman-Fried, are now under the control of law enforcement. Do Kwon is currently in jail, Su Zhu has been caught by the Singaporean police, and Sam Bankman-Fried's case has started in the US. Moving on, Shyam discusses the blacklisting of addresses and mentions the Tornado Cash mixer. He reveals that Tornado Cash had a web front end and a token embedded in the protocol, which incentivized money laundering. Shyam argues that the idealistic take on free speech and decentralization doesn't hold up in this case, as the individuals behind Tornado Cash were actively encouraging its use and benefiting from it.

00:05:00 In this section, the speaker discusses the concept of a peer-to-peer network and its importance in maintaining access and functionality even if certain peers are blocked or taken down. They explain that in the case of Tornado Cash, the website was hosted on a machine that was not part of the peer-to-peer network. The speaker then compares this concept to BitTorrent, where the torrent file itself contains the data needed to connect to other peers and download the file, eliminating the need for specific websites. They also mention the challenge Bitcoin faces in finding peers to connect to, with early attempts using IRC-based peers and later using hardcoded DNS nodes in the Bitcoin software. The speaker acknowledges the difficulty in finding a good solution to this bootstrapping problem in peer-to-peer networks. Additionally, they mention the recent hack of FTX exchange and the hacker's attempt to move stolen funds through various networks, highlighting the reliance on middle actors in bridging transactions between different networks.

00:10:00 In this section, the speaker discusses the challenges of bridging assets between different cryptocurrencies, particularly Bitcoin and Ethereum. While Ethereum has powerful smart contracts that allow for easy bridging, the process is more complicated when going back from Ethereum to Bitcoin, requiring trust and sign-off from certain decentralized bridges. The speaker also mentions the creeping centralization that occurs in these protocols, as well as the limitations of smart contracts and the complexities involved. The conversation then turns to Michael Lewis's book on SBF (Sam Bankman-Fried), in which the speaker notes that Lewis, who spent time with SBF, is said to defend SBF's actions rather than highlighting the rise and fall of the person. The speaker criticizes Lewis for not rewriting the book to reflect the unfolding events and for potentially doubling down on his own ignorance. They express skepticism towards the book, mentioning that they haven't heard any positive reviews of it.

00:15:00 In this section, the speaker discusses the criticism surrounding Michael Lewis's book and compares it to Walter Isaacson's biographies. They mention that Isaacson's new book on Elon Musk is regarded as better because it presents both the good and bad sides of Musk, unlike Lewis's portrayal of FTX founder SBF. The speaker also mentions the Mixin Network hack, explaining that it was a popular bridge for transferring assets between different chains. However, the hack occurred due to a single database holding the private keys, which were accessed by hackers, resulting in the loss of $200 million in assets. They speculate that the Chinese government may have been involved in the hack.

00:20:00 In this section, the speaker discusses the challenges with using bridges to transfer assets and presents an interesting solution. Instead of depositing assets in a bridge, the idea is to prove ownership of the assets on one chain while keeping them in one's own control. By continuously proving ownership through cryptographic proofs, the assets can be used as collateral on another chain without the need for traditional bridging. This approach eliminates the risk of hacks associated with bridges and relies on cryptography and mathematical assumptions. The speaker is optimistic about the potential of this method and highlights the importance of evolving and building safeguards in the crypto space.

00:25:00 In this section, the conversation revolves around the potential impact of advanced cryptographic technology on governments and their control over economic activities. The speaker points out that the current system allows governments to track and regulate financial transactions, but this new technology could enable tax avoidance and illicit activities. However, the speaker also notes that governments often prioritize monitoring everything rather than targeting specific actors, potentially infringing on privacy. They further discuss how regulation in the banking industry helps maintain trust and prevent societal collapse, emphasizing that governments are more focused on banks than individual cryptocurrency traders. The conversation then shifts to the regulator in Switzerland and their attempts to regulate the crypto industry, specifically mentioning staking as an example.

00:30:00 In this section, the speaker discusses the new regulation in Switzerland that requires staking service providers to obtain banking licenses. Staking involves depositing cryptocurrency and validating transactions on the blockchain. Typically, users deposit their cryptocurrency with staking service providers who validate transactions on their behalf and take a small cut of the yield. However, the regulator now considers these service providers to be acting like banks, as they hold deposits and provide yields that are not immediately liquid. This regulation poses a challenge for many staking service providers, as they would need to meet capital requirements similar to traditional banks. The blockchain industry is lobbying against this regulation, but it is expected to be implemented soon. Many people in the industry are concerned about the future of their operations and may consider relocation. The speaker also mentions that banks themselves might enter the staking market once the regulation is in place, offering staking services and the option to receive funds in Swiss francs.

00:35:00 In this section, the speaker discusses the current bear market in the cryptocurrency space and the need to build infrastructure to support the future bull market. They mention buzzwords such as smart contracts, rollups, app chains, and L1s, which are all part of the technology being developed to address scalability issues. The speaker highlights the trend of moving application logic away from smart contracts and into off-chain servers or higher layers to improve performance. They also talk about the emergence of new blockchains like Solana, Sui, Aptos, and Monad, which aim to achieve higher transactions per second without compromising security guarantees. These blockchains, born out of Facebook's abandoned Libra project, are gaining attention, although the speaker expresses reservations about the need for additional blockchains when Ethereum and Bitcoin already exist.

00:40:00 In this section, the speaker discusses the concept of rollups in the context of scaling Ethereum. A rollup is essentially an off-chain component where transactions are executed on a web2 server running application logic. After a certain period of time, the server batches up the transactions into a more compact representation and commits it to the blockchain. The advantage is that the smart contract associated with the rollup is open and can be verified by users. This allows for settlement on the public blockchain while keeping the actual transactions private. Several rollups have emerged, such as Coinbase's Base, Optimism, Arbitrum, ZK Sync, and StarkEx, and they are capable of processing tens of thousands of transactions per second. The implementation of rollups on Ethereum raises the question of why new blockchains like Solana or Polkadot are necessary when rollups can achieve high scalability.

00:45:00 In this section, the speaker explains that when deploying a smart contract, the control shifts to the smart contract itself, making the user no longer liable for its actions. The friend.tech smart contract is deployed on Coinbase's layer, and Coinbase operates as a front end for the smart contract. Coinbase periodically commits the entire blockchain state to Ethereum, and the smart contract on Ethereum verifies the state transition. Friend.tech utilizes the blockchain as a database, but Coinbase compresses the state into a single blob and submits it periodically. Users can verify that the state is committed properly, holding Coinbase accountable. This verification option provides transparency and accountability, unlike traditional platforms where users have to trust the platform's code implementation. Additionally, the speaker mentions app chains, which are similar to rollups and provide a way to scale applications.

00:50:00 In this section, the speaker discusses the difference between a Base Layer and an App Chain. A Base Layer, such as low rollup, allows you to write any smart contract on it. On the other hand, an App Chain is a rollup that exposes only one specific logic, like derivatives trading. The speaker uses the example of dydx, a derivatives exchange running as a full blockchain on top of another platform. The entire purpose of the dydx blockchain is to support derivatives trading, making it an app-specific chain. The speaker also speculates that app chains may be created out of regulatory concerns, as operating as an unregistered exchange can be risky. Additionally, the conversation briefly touches on the metaverse and Mark Zuckerberg's interest in VR/AR technology, as well as Sam Altman's collaboration with Jonathan Ive on a new project.

00:55:00 In this section, the speaker discusses the collaboration between Sam Alman and Johnny Ive in designing a phone and creating a whole ecosystem, mentioning that building a large language model is probably easier than designing a phone. They also express frustration with spam calls and mention the Google pixel's automatic call rejection feature, which is highly effective at filtering out spam calls. The speaker supports this AI work and looks forward to future discussions on the topic.

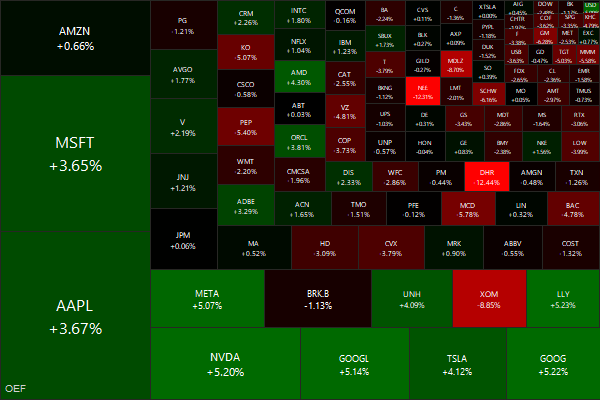

Markets this Week

The RBI threw a googly at the bond-market on Friday saying that it might consider OMOs to mop up excess liquidity from the system (indianexpress). Bonds puked.

US long-bonds continued to get hammered as the curve continued to steepen.

Bond ETF returns since 2010 are now negative:

More here: country ETFs, fixed income, currencies and commodities.