Is buying today’s winners and holding them for a day a winning strategy? Not in Indian markets but turns out that because of the way Chinese retail investors behave, it could work out ok there (blog).

Momentum is universal but there’s no one config/specification that works everywhere. Just like how value is not just P/B, momentum is not just 12_1_1.

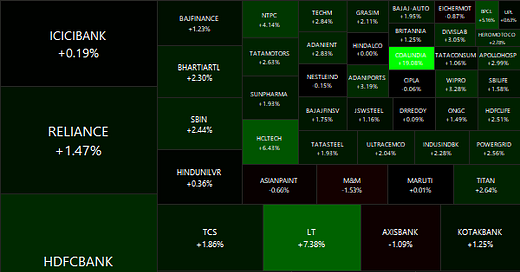

Markets this Week

Micro-/Small-/Mid- caps continue to be on fire. Momentum to the moon!

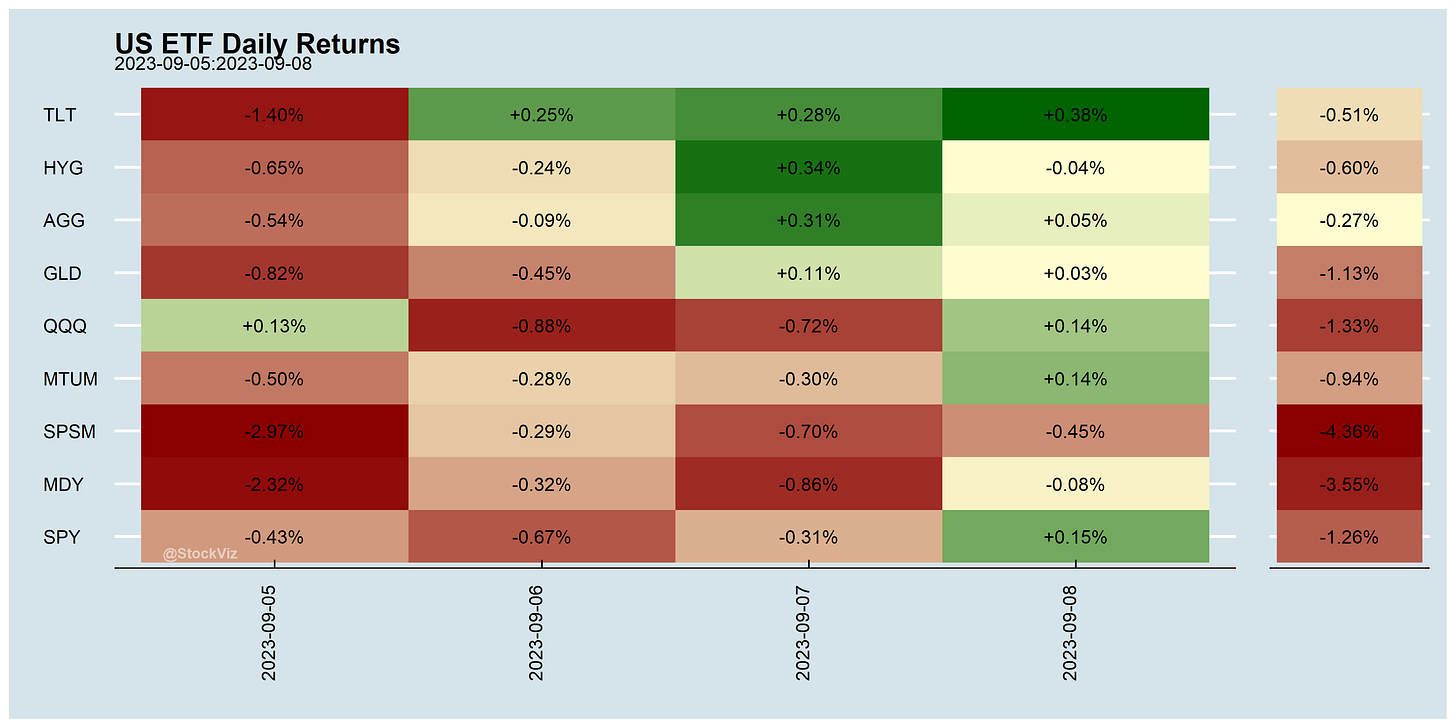

Apple got whacked by the Chinese and pulled down major indices.

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

Corporate Tax Cuts and the Decline of the Manufacturing Labor Share

Lower corporate tax rates reduce the labor share by raising the market share of capital-intensive firms. Corporate tax cuts explain a significant part of the decline in the manufacturing labor share since the 1950s. The shift away from traditionally large, labor-intensive production units raised the concentration of market shares and reduced the concentration of employment.

Economists should stop forecasting growth and inflation. (tweet) Also, data revisions are occasionally so big that they upend our shared understanding of what’s going on (wsj).

Judging Banks’ Risk by the Profits They Report

In competitive capital markets, risky debt claims that offer high yields in good times have high systematic risk exposure in bad times. We apply this idea to bank risk measurement. We find that banks with high accounting return on equity (ROE) prior to a crisis have higher systematic tail risk exposure during the crisis.

Finfluencers

Tweet-level data from a social media platform reveals low average accuracy and high dispersion in the quality of advice by financial influencers, or “finfluencers”: 28% of finfluencers are skilled, generating 2.6% monthly abnormal returns, 16% are unskilled, and 56% have negative skill (“antiskill”) generating -2.3% monthly abnormal returns. Consistent with homophily shaping finfluencers’ social networks, antiskilled finfluencers have more followers and more influence on retail trading than skilled finfluencers. The advice by antiskilled finfluencers creates overly optimistic beliefs most times and persistent swings in followers’ beliefs. Consequently, finfluencers cause excessive trading and inefficient prices such that a contrarian strategy yields 1.2% monthly out-of-sample performance.

Economics

The China Model Is Dead (msn)

China’s chronic trade surplus reflect the fact that its economy is geared to produce more than it consumes. This had the benefit of turbocharging investment and development. But it requires the rest of the world to consume more than it produces. (thread)

If you’re not the owner of a company that gets a lot of its profits from Chinese sales, the direct impacts of a Chinese slowdown on the U.S. economy are pretty modest… A lot of Southeast Asia and East Asia is tightly connected to China. A big part of that connection, though, is producing components that go into the Chinese export machines… The commodity exporters typically have the largest direct exposure to internal Chinese demand. And so there could be more spillovers there. (nymag)

China’s demand dilemma could spell trouble for the world (ft)

China's exports and imports extended declines in August as the twin pressures of sagging overseas demand and weak consumer spending at home squeezed businesses. (reuters)

When the purpose of exports is mainly to pay for imports, both sides can benefit by specializing in each side's comparative advantage. But when the purpose of exports is to externalize weak domestic demand, the world is worse off, not better off. (@michaelxpettis)

Overseas demand for inexpensive vehicles made in China, mostly gasoline-powered models that Chinese consumers now shun in favor of electric cars, is so great that the biggest obstacle to selling more abroad is a lack of specialized ships to carry them. (nytimes, @michaelxpettis)

Instead of prioritizing free-market reforms in developing nations, Biden’s team is now more interested in them partnering with Western governments and financial institutions on projects that will address climate change and create new supply chains outside of China — or both. The old conditions of neoliberalism — privatization and austerity — are giving way to new conditions under Biden’s new economic order — namely, climate action, pandemic resilience and a turn away from Chinese-style autocracy. (politico)

China's demand for petrol is likely to peak as early as next year as electric vehicle sales soar. This will push Chinese refiners to ramp up exports of the motor fuel to Asia and spur them to make more naphtha, diesel and jet fuel, crimping refining margins in the region. (reuters)

When we apply the BEA method to Indian data, the most recent growth rate falls from the headline 7.8% to 4.5% (project-syndicate)

India is working on a proposal that could introduce a condition that finished IT hardware such as laptops, personal computers and servers can only be imported from “trusted geographies”, a move aimed at curbing imports from China amid a deepening rift between New Delhi and Beijing. (indianexpress)

Where does India fit?

Diamond demand is falling so fast—courtesy lab-grown stones—De Beers is cutting some prices by more than 40% (fortune)

Investing

Qualcomm To Lose Up To 60 million Chipset Orders in 2024 Thanks To Huawei’s Kirin 9000S, Potential Profit Loss in the Billions (wccftech)

This short report on PDD 0.00%↑ is worth a read. (grizzlyreports)

Instant settlement of Indian stock-market trades to come in by October 2024 (reuters)

Reliance, Tata cos sign AI partnerships with Nvidia (livemint). Wonder what the financing looks like - NVIDIA is no stranger to the alchemy of finance (reuters)

Investing is what you control - primarily spending for your own production. Saving is what you can't control - allocations to secondary markets. Focus on what you can control. (@cullenroche)

Odds & Ends

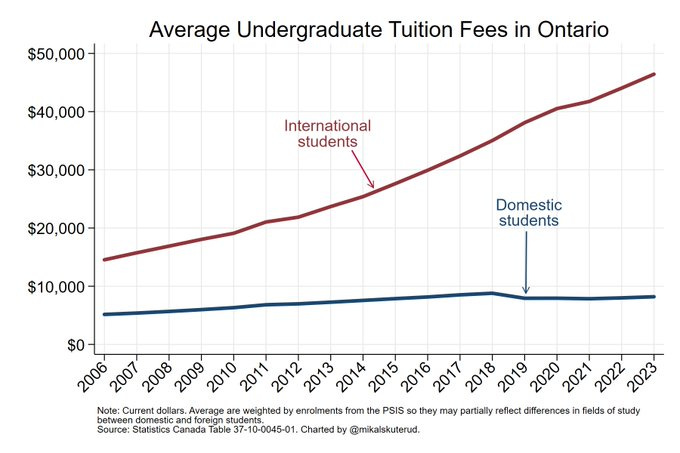

In 2006, international students in Ontario's universities paid 2.8 times more in tuition fees than their domestic counterparts (on average). This year they are paying 5.7 times more. (@mikalskuterud)