Took the last week off for travel — proof that this newsletter is not written by an A.I.

The theoretical price of an option calculated by the Black-Scholes-Merton (BSM) model takes volatility as an input. However, you can turn it around and plugin the market price of the option and get the market implied volatility as an output. This implied volatility (IV) is what the market is willing to pay for future volatility. So, theoretically, if you overlay the lagged IV vs. historical volatility, they should come close?

This is what we discussed: Historical vs. Implied Volatility

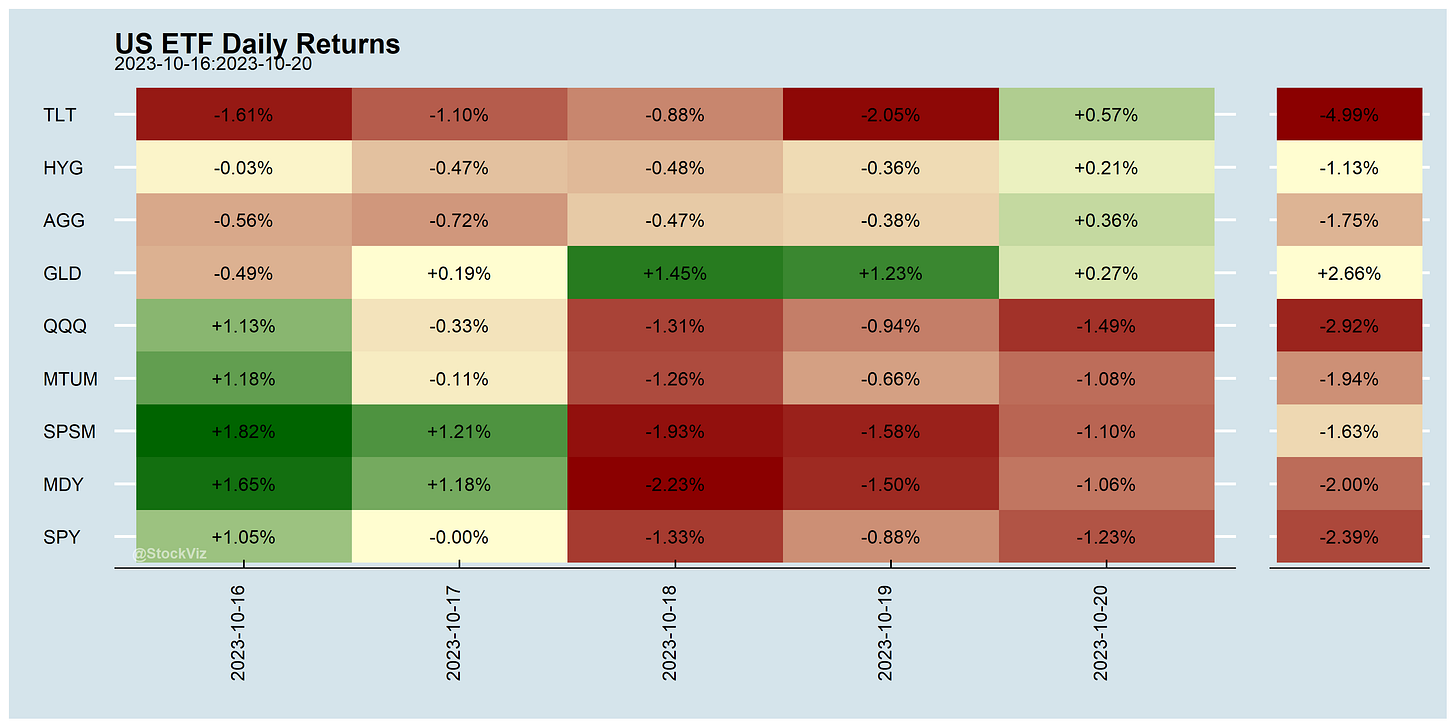

Markets this Week

Indian shitcaps got canned on Friday…

… all eyes on the MANGA earnings season.

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

Momentum: what do we know 30 years after Jegadeesh and Titman’s seminal paper? (alphaarchitect)

Anchoring and Global Underreaction to Firm-Specific News

Investors tend to hold on to their initial beliefs about a stock despite new information. Analysts react to firm-specific news but are less likely to change their recommendation if the stock price is near the 52-week high.

Passive Investing and Market Quality

We show that an increase in passive exchange-traded fund (ETF) ownership leads to stronger and more persistent return reversals. Exploiting exogenous changes due to index reconstitutions, we further show that more passive ownership causes higher bid-ask spreads, more exposure to aggregate liquidity shocks, more idiosyncratic volatility, and higher tail risk. We examine potential drivers of these results and show that higher passive ETF ownership reduces the importance of firm-specific information for returns but increases the importance of transitory noise and a firm's exposure to market-wide sentiment shocks.

Greenwashing: Do Investors, Markets and Boards Really Care? Yes. (SSRN)

Economy

Behind Bajaj Auto’s Q2 surge lies a tale of India's failed urban transport (livemint)

China Bet It All on Real Estate. Now Its Economy Is Paying the Price. (NYT)

United States domestic oil production hit an all-time high last week (apnews)

Teens Are Developing ‘Severe Gambling Problems’ as Online Betting Surges (vice)

How big is the role of luck in career success? (economist)

Investing Red Flags (sapientcapital)