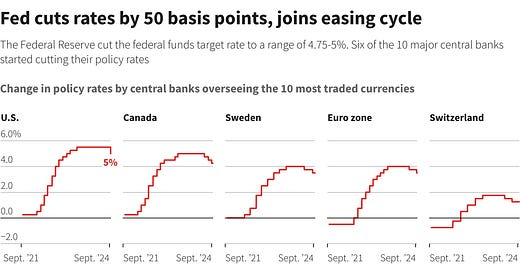

The US Federal Reserve met last week and cut the Fed Fund rate by 50bps. They have now joined the chorus of world central banks cutting their benchmark rates.

We explored if there were a systematic way to trade Indian equity markets on the “Fed Day” on Varsity: US Fed Rate Cut: How it affects traders and investors?

While the post explored NIFTY 50 for the sake of brevity, the impact on BANK NIFTY is similar (charts and code are up on github).

tl;dr: trade vega.

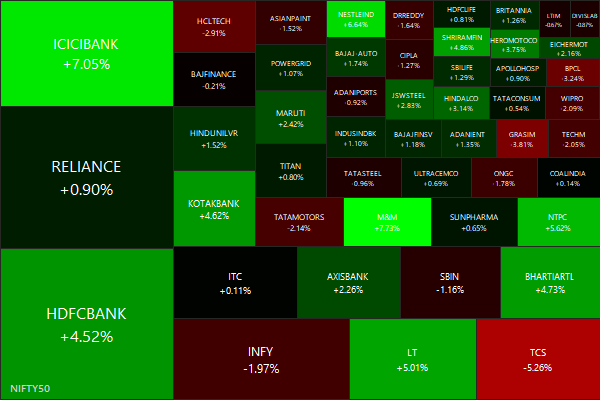

Markets this Week

0 to 6 in three years and back again?

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

The labor market impacts of ridesharing on American Cities (sciencedirect)

I estimate that Uber’s arrival to a city resulted in decline in the unemployment rate by between a fifth and a half of a percentage point. This suggests that Uber allowed many workers to supplement their earnings during periods of unemployment, framing the ridesharing service as a complement to, rather than a substitute for, traditional employment. I also find some evidence that Uber had a very small positive effect on wages at the lower end of the wage distribution, suggesting that Uber may have altered worker search behavior or affected bargaining power.

Infants use wealth to guide social behavior and evaluation (psycnet, berkeley)

Our biases favoring the rich over the poor may take root earlier than was previously believed — perhaps when we are very young toddlers.

The Wealth of Working Nations (nber)

Due to aging populations, the gap between GDP growth per capita and GDP growth per working-age adult (or per hour worked) has widened in many advanced economies. Countries like Japan, which have shown lackluster GDP growth per capita, have performed surprisingly well in terms of GDP growth per working-age adult (or per hour worked). Many advanced economies are also following similar balanced growth paths per working-age adult despite significant differences in the levels of GDP per working-age adult.

Intrinsic Value: A Solution to the Declining Performance of Value Strategies (ssrn)

The paper proposes to use intrinsic value as an alternative measure of fundamentals in predicting stock returns. We construct intrinsic value as the sum of the book value of equity and the present value of future economic profits. The CAPM alpha of a long-short portfolio of large stocks based on the intrinsic-value-to-market ratio is 56 bps per month between 1999 and 2023 when the book-to-market ratio and similarly constructed price multiples fail to predict returns. Given the low turnover of the strategy, accounting for transaction costs has a marginal impact on its net alpha. We argue that the underperformance of strategies based on traditional valuation multiples stems from their failure to model future economic profits, which matter the most in low discount rate environments.

Stealthy Shorts: Informed Liquidity Supply (ssrn)

Short sellers are widely known to be informed, which would typically suggest that they demand liquidity. We obtain comprehensive transaction-level data to decompose daily short volume into liquidity-demanding and liquidity-supplying components. Contrary to conventional wisdom, we show that the most informed short sellers are actually liquidity suppliers, not liquidity demanders.

Investing & Economy

India

India has implemented a series of measures to facilitate the exports of certain farm goods and limit imports of vegetable oils ahead of local elections in two states where farmers form an influential voting bloc. (reuters)

India's real estate sector attracted $3.5 billion from foreign institutional investors during the first half of 2024, making it the third most preferred global destination for land and development site investments (livemint)

Driven by high festive demand and a reduction in import duty, India’s gold imports jumped 221.41% in a month, reaching $10.06 billion in August (livemint)

RoW

US: the two factors that have driven up stock prices from an earnings perspective so much in the last four and a half years—low interest rates and low taxes—both seem to be going away. (cornell-capital)

LA’s streaming gold rush is over. Film and TV workers have been left in the dust. (sherwood)

From steel to kimchi, South Korean exporters face flood of Chinese rivals (ft)

China created a professional class in record time. Now, just as swiftly, many of their dreams are being crushed. (bloomberg)

Three Mile Island nuclear plant will reopen to power Microsoft data centers (npr)

AWS hiring for data center 'principal nuclear engineer' to evaluate SMRs and nuclear fuel strategy roadmaps (datacenterdynamics)