Farming vs. Hunting

risk premia harvesting vs. arbitrage

Almost all strategies discussed publicly can be filed under the “risk premia harvesting”, aka farming, category. Factor investing, trend-following, value investing, swing-trading, 9:20 option selling, are all different ways of harvesting market beta. But before you harvest, you must first warehouse. Whatever profit you make is compensation for warehousing risk.

True arbitrage is very rarely made public, at least as long as it is profitable. It involves the simultaneous buying & selling of offsetting risks and pocketing a spread. You either profit from information inefficiencies (keeping prices across multiple venues in-line) or you get paid to keep spreads narrow (market-making.)

If you are a retail investor, chances are pretty slim that you’ll ever get pitched a true arbitrage. For example, the smirk exists because of the skew. Selling this skew is only an “arbitrage” if hedging costs less. Selling OTM puts naked is not some grand arbitrage strategy - there are cheaper and less risky ways to harvest the positive drift of markets.

Always be skeptical of strategies that appear to be “risk-free”. It is more likely that you haven’t thought of all the risks.

Markets this Week

Indian earnings season got off to a relatively good start…

… while tech rallied.

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

Physical attractiveness and intergenerational social mobility

Physical attractiveness matters both for males’ and females’ intergenerational social mobility outcomes, but it is more important for males. Across three measures of social mobility—education, occupation, and income—physically attractive males are more likely to be socially mobile than males of average attractiveness. Physical attractiveness is an independent predictor of intergenerational social mobility outcomes regarding individuals’ educational, occupational, and income attainment.

Convergent Evolution Toward the Joint-Stock Company

The origin of the modern publicly-held joint-stock company is typically traced to large-scale maritime trading companies in England and the Netherlands in the early 17th century. Highlighting medieval cases in southern Europe, we claim that the joint-stock company likely emerged in several times and places, in response to a similar set of needs and requirements for coordinating large-scale enterprises.

A Critical Assessment of Lifecycle Investment Advice

We challenge two central tenets of lifecycle investing: (i) investors should diversify across stocks and bonds and (ii) the young should hold more stocks than the old. An even mix of 50% domestic stocks and 50% international stocks held throughout one’s lifetime vastly outperforms age-based, stock-bond strategies in building wealth, supporting retirement consumption, preserving capital, and generating bequests.

Forecast the Sharpe Ratio, Invest with Optimism

We show that a measure of market optimism from a representative agent asset pricing model under ambiguity, theoretically and empirically predicts the market Sharpe ratio, outperforming 25 of 27 equity premium predictors in-sample and out-of-sample. The measure negatively predicts the equity premium and positively predicts volatility, amplifying its Sharpe ratio predictability.

Protestants and Pensions

Religion matters for financial economic outcomes.

Investing

Competitive Advantage & Capital Allocation (dorseyasset)

Competitive advantage drives the duration of excess ROIC, which increases long-term business value.

Capital allocation links shareholder value and business value, amplifying or reducing equity returns.

Superb capital allocation can compensate for a lack of competitive advantage.

A massive moat can compensate for poor capital allocation.

Economy

The Old Pension Scheme (OPS) wildfire must be stopped before it’s too late (livemint). Apart from the issue of inter-generational equity, with future generations burdened with higher taxes to service the debt incurred for pension payouts, if the OPS becomes the norm, governments will soon have no money for anything other than paying salaries, pensions and interest on past borrowings (livemint). However, the switchover to NPS has been unfair to newer government recruits. A way out could be to raise the salaries of those under NPS for parity with those under OPS (livemint).

India has signed a whole bunch of Migration and Mobility Partnership Agreements with different countries (icwa). Most recently, with Taiwan and Israel.

For the first time since the bubonic plague in the fourteenth century, the world’s human population is about to shrink. (thefp)

The last commodities supercycle was a bubble for the ages, and investors – particularly junior mining investors – were badly burned when it popped in 2012. Politicians can talk about the critical minerals crisis all they want, but until private capital is willing to touch the sector again, all the warnings about China’s dominance amount to little more than screaming into the wind.

How Canada squandered the chance to finance the critical minerals revolution (theglobeandmail)

Britain says makers, not car owners liable for self-driving crashes (reuters)

The global medical spa market was valued at $16.4 billion last year. In 2021, more than 5.4 million injectable procedures, including Botox and dermal fillers, were performed in the US and Canada. That’s more than double the number of procedures carried out in 2019. An increasing number of clients are women in their 20s and 30s. Some start even younger, as early as age 14. Many of them want to look ageless and symmetrical, with a visage that is plump in the right spots and chiselled in the rest. Such a face can rarely be accomplished by biology alone. But that is not a problem. New tech, and a rapidly vanishing stigma, have created a vast market for cosmetic work that is often more extensive, more visible and far more focused on younger clientele. The new mantra: if you don’t like something about your face, you can change it.

The New Face (torontolife)

Odds & Ends

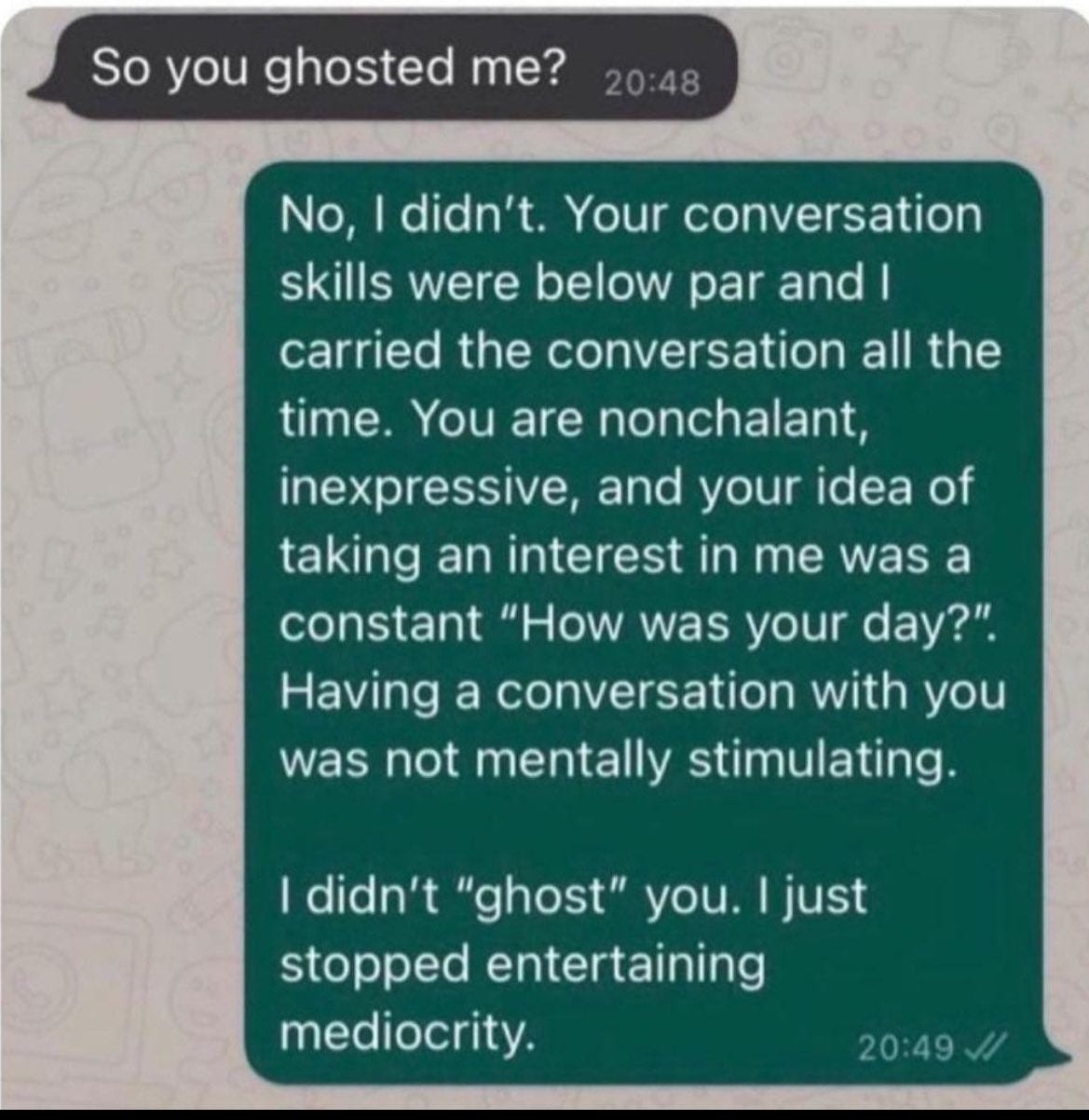

OnlyFans: Anonymous workers ghostwrite messages and build intimate relationships with fans. (vice)

What will you do if your Airbnb tenant refuses to move out? (latimes)