We started a new series on trend following up at Zerodha Varsity: Could Trend-Following Be A Successful Trading Strategy? (Part I). Hopefully, you’ll find it inspiring to start your own journey.

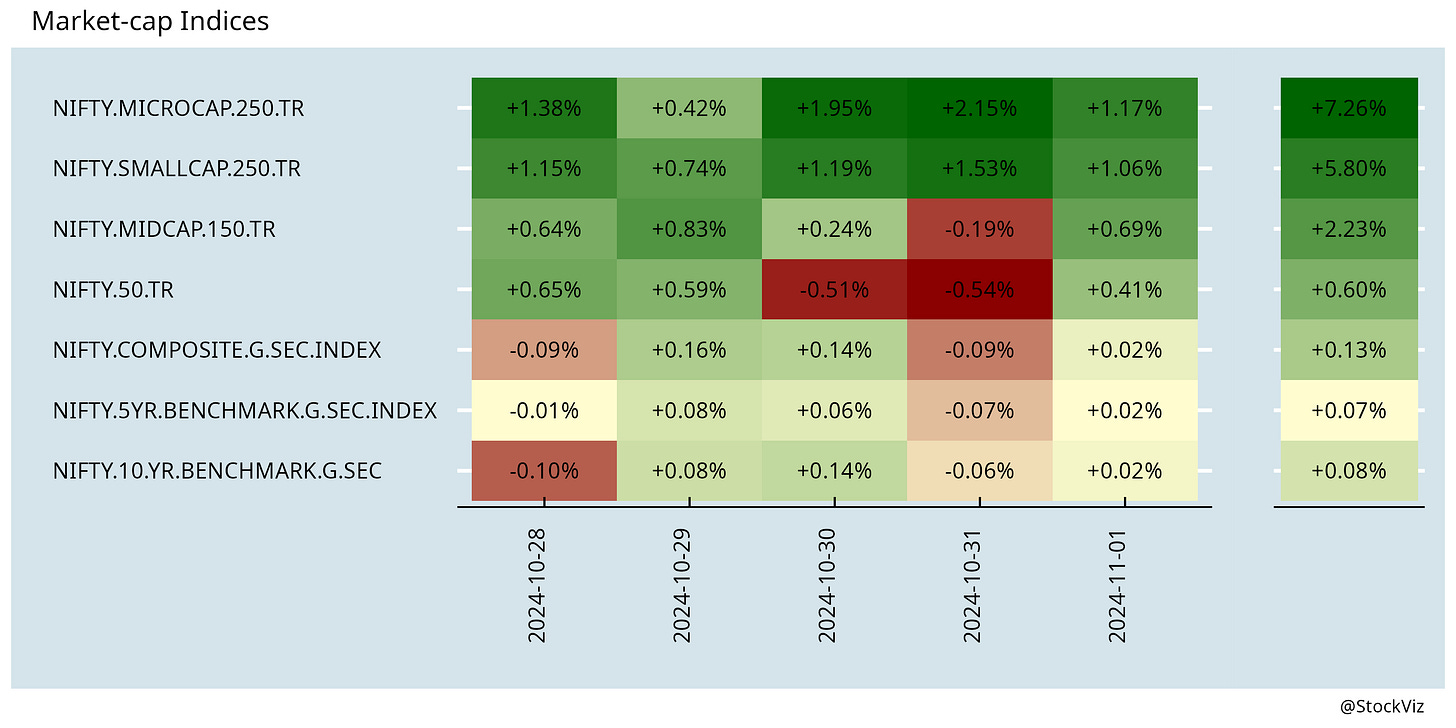

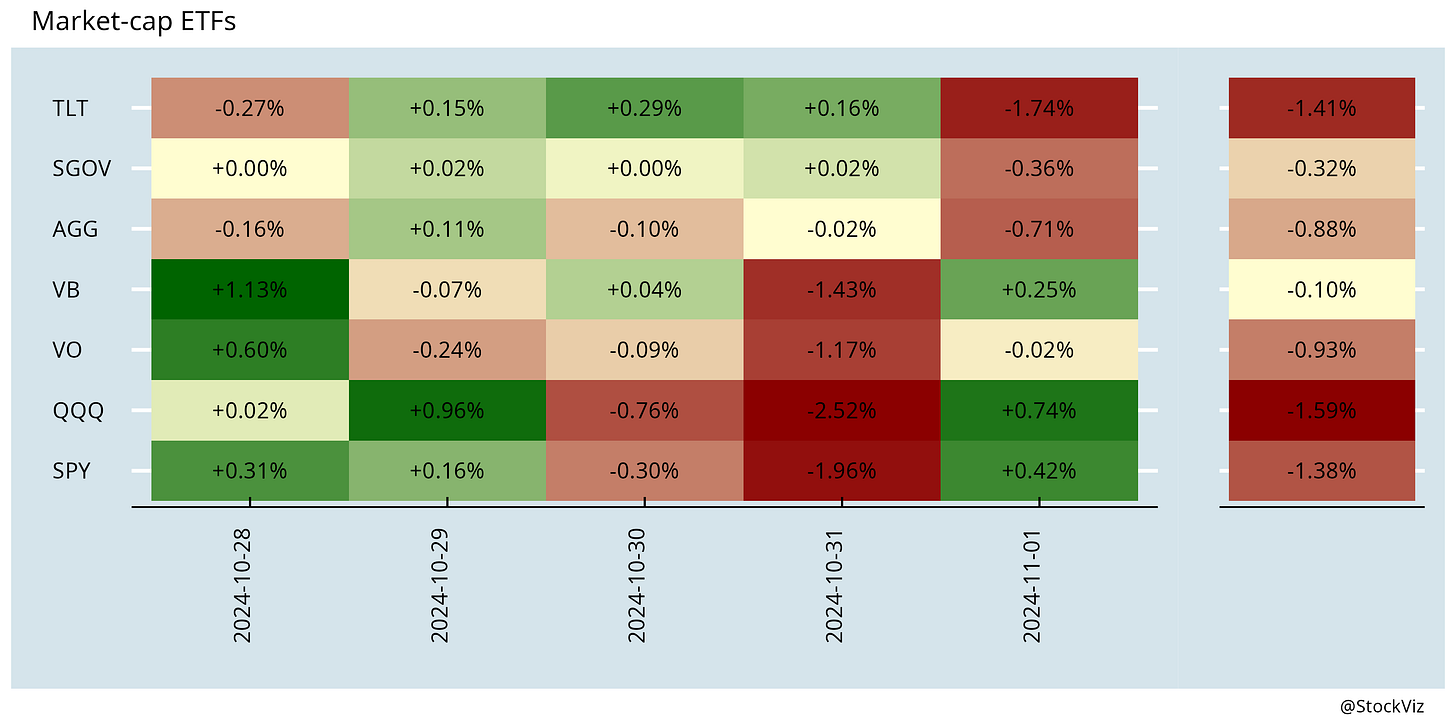

Markets this Week

More here: country ETFs, fixed income, currencies and commodities.

Research

Interday Cross-Sectional Momentum (SSRN)

We examine whether half-hour returns predict half-hour returns on subsequent days at the firm level. We show that interday cross-sectional momentum is most pronounced during the last half hour of a trading day.

Is 24/7 Trading Better? (SSRN)

Our findings suggest moving to a longer trading day could be beneficial, but moving to 24/7 trading would harm welfare.

Leveraging the Low-Volatility Effect (SSRN)

Low-volatility stocks tend to lag during prolonged bull market, a challenge that can be addressed using leverage. This paper outlines five use cases to leverage upon the low-volatility effect.

Links

Investing

Alpha sources are usually transient because they are inefficiencies which go away when people notice them, or at least when people start trading them. The most important signal that an anomaly is going away is when the product becomes more liquid and more volume trades. (hulltactical)

Assessing Corporate venture capital, Sovereign funds and Green Energy (aswathdamodaran)

India

India’s healthcare sector is undergoing large-scale ownership change in favour of PE funds. (fortuneindia)

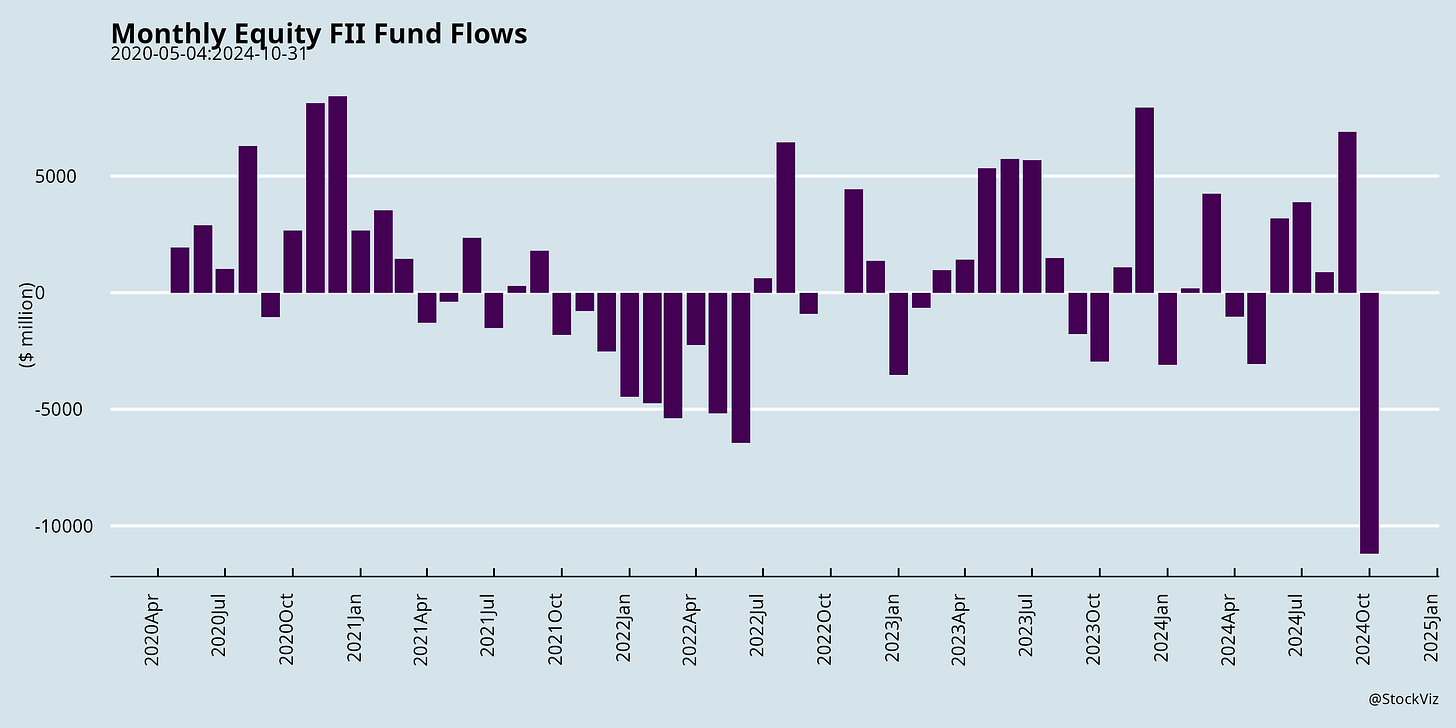

Foreign institutional investors (FIIs) have been on a selling spree in October. As of 30 September, the total equity assets under FII custody had stood at a little over $930 billion. Net sales of $10.2 billion in October works out to 1.1% of what these institutions already owned. (livemint)

Global fund managers increased their allocation to China at India's expense after Asia's largest economy unleashed a stimulus package. (reuters)

Apple's exports of India-made iPhones nearly reached $6 billion in six months by September 2024, a 30% increase from last year. (timesofindia)

The comfortable margins that fast-moving consumer goods companies once reaped are under stress. All players in this $200-bn market in India need to adjust to the changed field.(newindianexpress)

Indian lenders face rising defaults from over-leveraged retail borrowers. (reuters)

row

How private equity ‘gutted’ dozens of U.S. hospitals (washingtonpost)

US Efforts to Contain Xi’s Push for Tech Supremacy Are Faltering. The world outside the US is increasingly driving Chinese electric vehicles, scrolling the web on Chinese smartphones and powering their homes with Chinese solar panels. (bloomberg)

How Volkswagen Lost Its Way in China (nytimes)

Skydio, the US’s largest drone maker and a supplier to Ukraine’s military, faces a supply chain crisis after Beijing imposed sanctions on the company, including banning Chinese groups from providing it with critical components. (ft)

Profits at China's industrial enterprises plunged last month by the most this year, mainly because of persistently low factory gate prices, surging costs, and a high comparative base a year earlier. (yicaiglobal)

The next U.S. administration will face a China struggling with slowing economic growth, an uneasy middle class, and a leader who seems more committed to building a world-class military than a prosperous society. (foreignaffairs)

what we have seen in recent decades is countries adopting industrial policies that are designed not to raise their standard of living but to increase exports — in order both to accumulate assets abroad and to establish their advantage in leading edge industries. These are not the market forces of Smith and Ricardo. These are the beggar-thy-neighbour policies that were condemned early in the last century.

Donald Trump’s trade remedies reflect America’s troubled reality (ft)

AI takes abundance to infinity, and Meta is the purest play of all. (stratechery)

Odds & Ends

Sugar restrictions in utero and early childhood reduces risk of chronic disease (berkeley)

Happy Deepawali Duh