The macro backdrop couldn’t be more bearish for Indian markets but here we are.

The US Dollar and treasury yields shooting up triggered cataclysms in emerging markets in earlier rounds. Anybody who studied past “macro” patterns and went short Indian equities would’ve gone bankrupt by now.

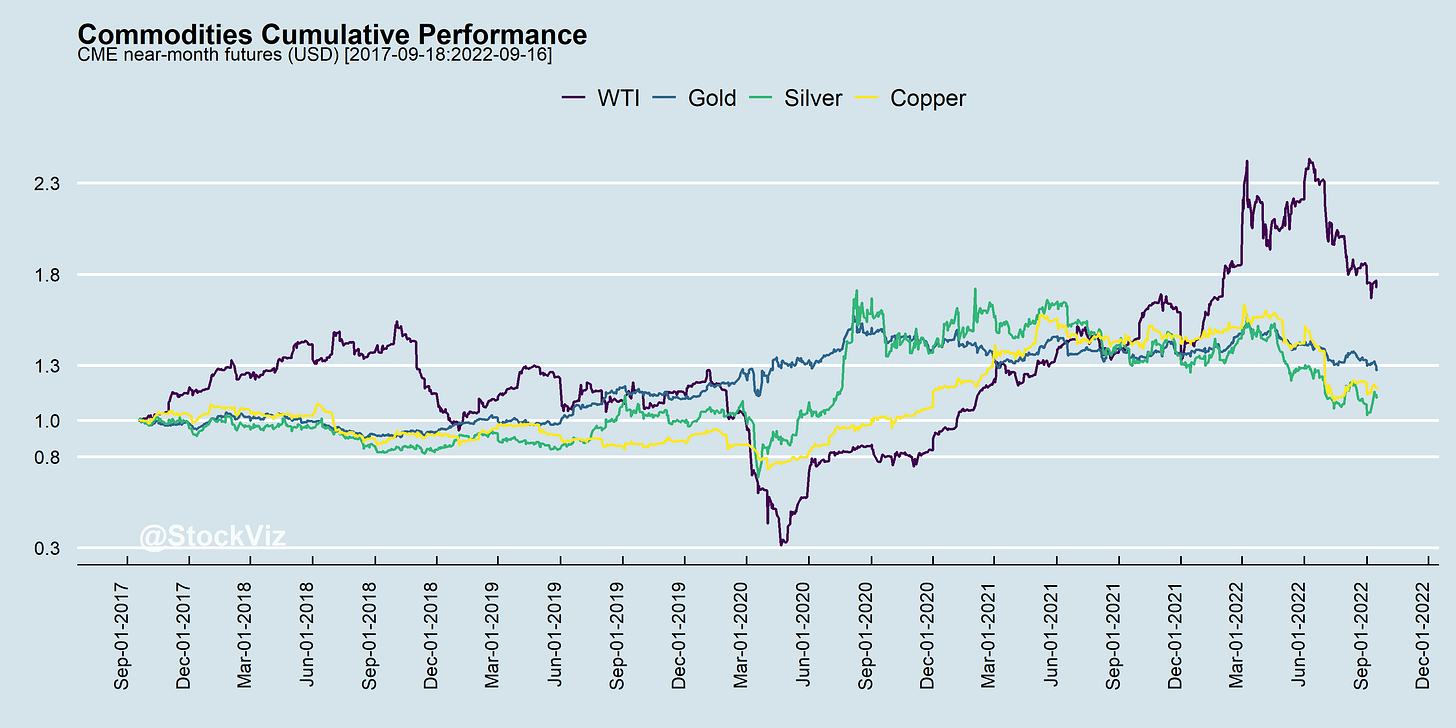

Gold, forever pitched as an inflation hedge, has been runover by the rising dollar. Always a bridesmaid, never the bride.

INDA out-performing SPY in this environment is baffling. Watching Indian markets rally back to all-time highs must be one of the most painful trades in quite a while.

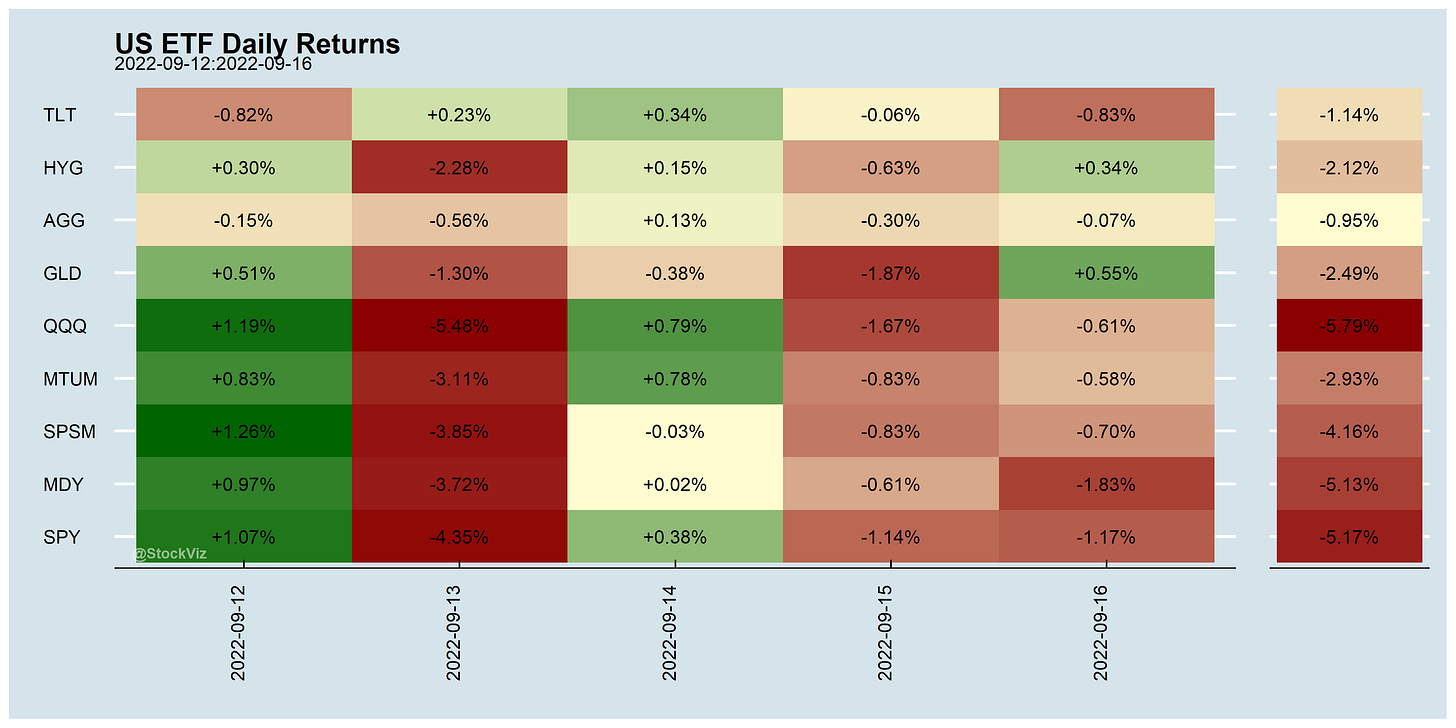

Markets this Week

Links

Energy

When Politicians Step into Heart of Pricing & Supply - watch out. (TRA)

EU physics denial has come home to roost. (boriquagato)

Germany – a country proactively shutting down nuclear power plants despite suffering a massive energy crisis – is back to burning wood for power on an enormous scale. (TRA)

Investing

Macro