Housekeeping

retiring tired models...

More often than not, models published in academic journals don’t work out during forward testing. This is partly because academic models skip Indian markets entirely, partly because of signal decay and implementation differences. This week, we got rid of some of those models that sounded good on paper but failed to put in the numbers.

High-to-Price (HTP) Momentum

We had high hopes for this (Momentum without the Crash) but in an environment that was great for momentum strategies, the model lagged indices.

Fractional Momentum

Turns out, full momentum is better than fractional momentum :/

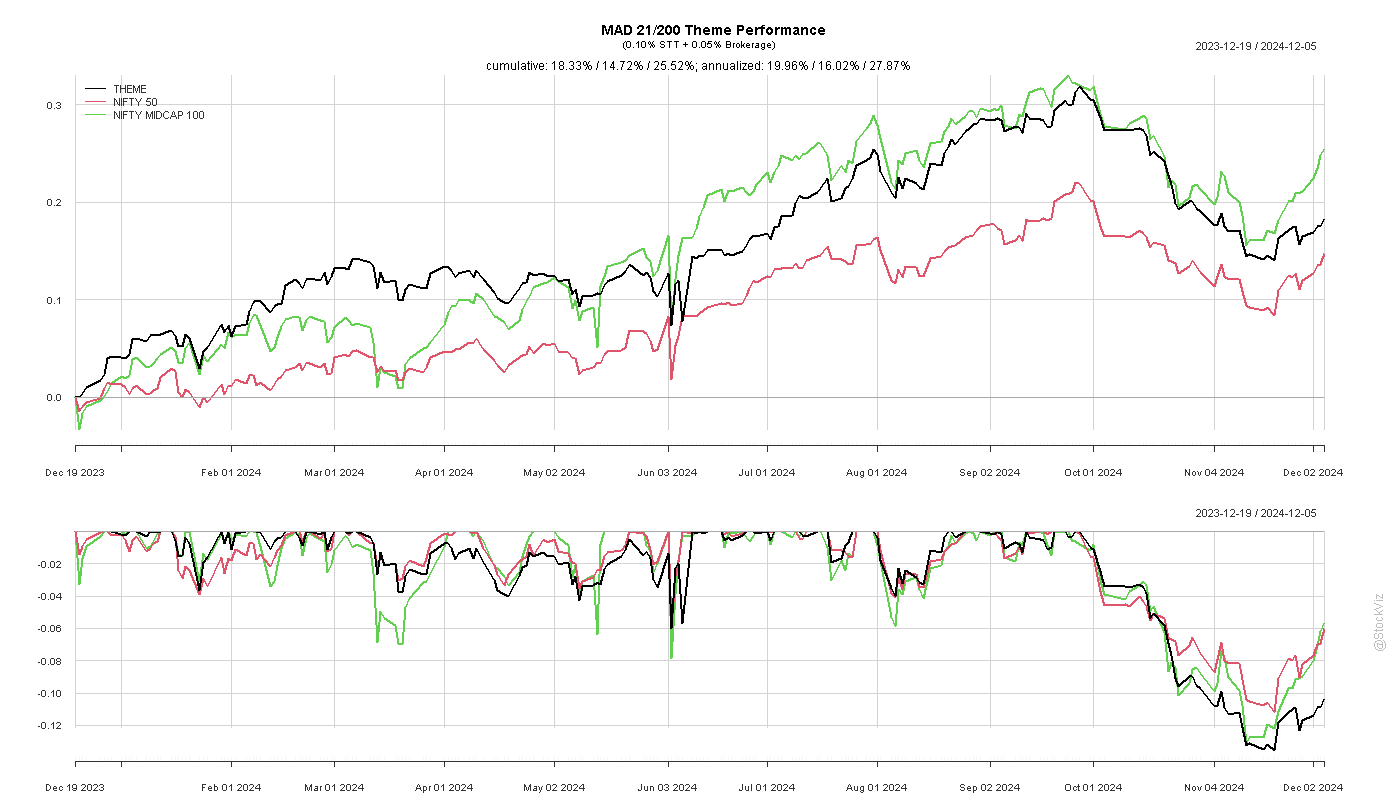

Moving Average Distance

Great backtest but poor performance with real data. Cannot have momentum strategies that trail indices during bull markets. That sort of behavior is for value strategies. Another one bites the dust.

Soaring Phoenix

What happens if you go bottom fishing using valuation metrics?

We combined companies with strong return on capital & profitability metrics and added trailing stop-losses to stocks rebounding from their deepest draw-downs to create a portfolio of "value in action" stocks.

Value strategies take time to work but we gave it eight years. Turns out, there’s only garbage in the garbage bin, not diamonds.

Cheap Bot

The worst part about value investing is that drawdowns tend to be deep and during bull markets you end up filling the portfolio with utter trash that nobody wants to buy even during the best of times. Value without a quality filter turns out to be a disaster.

We gave this eight years as well.

Momo Residual Momentum

Another one from an academic paper that under-performed benchmark indices.

Residual returns are what is left after fitting a Fama-French Three Factor model through a stock's return series.

This Theme consists of a portfolio of equally weighted stocks that have high residual returns.

This strategy took a lot of effort to set up. A reminder that effort is the input, not the output.

Factor Momentum

Equity factors like Momentum, Quality, Low-volatility, Value and Small-cap exhibit momentum. Our research indicates that systematically buying whatever factor/style that out-performed recently result in enhanced results.

This strategy came highly recommended but failed in the real world. Not sure if we screwed up the implementation or it is an Indian markets thing. Disappointed.

We are keeping a version of this that uses our own models as the underlying (Model Momentum). We’ll give that another year.

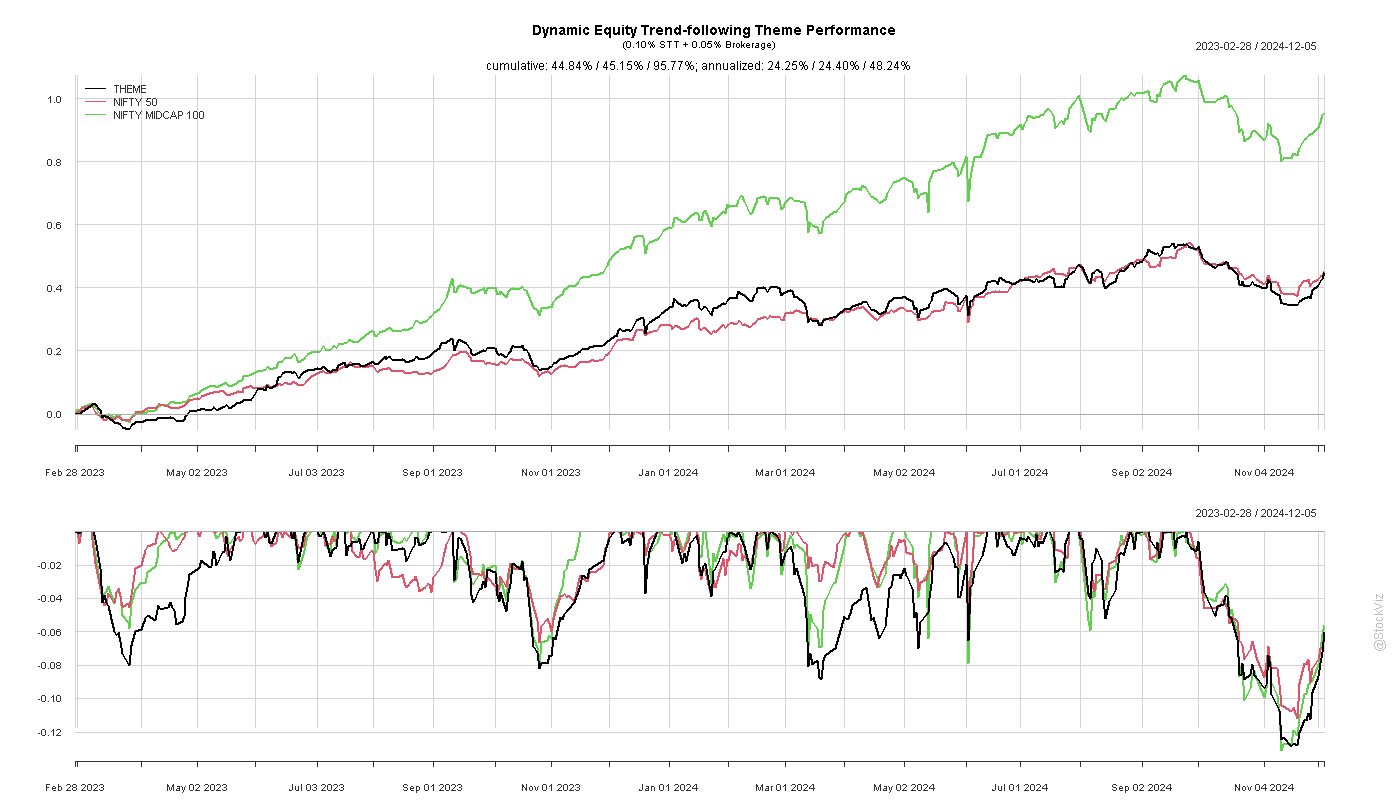

Dynamic Equity Trend-following

This one shouldn’t have worked and it didn’t. It basically tried to fit a bunch of trend following parameters to the most recent time-series of individual equities, ranked them and stacked them. There’s justice in this world after all.

Along with these, we’ve removed a bunch of models that were setup based on specific client demands who have since moved on to other strategies.

Weeding out under-performing strategies makes space for those that work. For example, we have been testing a Quantitative Value strategy: Pricing Power (GPM) that filters for stocks that have stable gross profit margins over 5-years. Looks promising, has decent literature backing it up, but will it survive the next 3 years? Stay tuned!

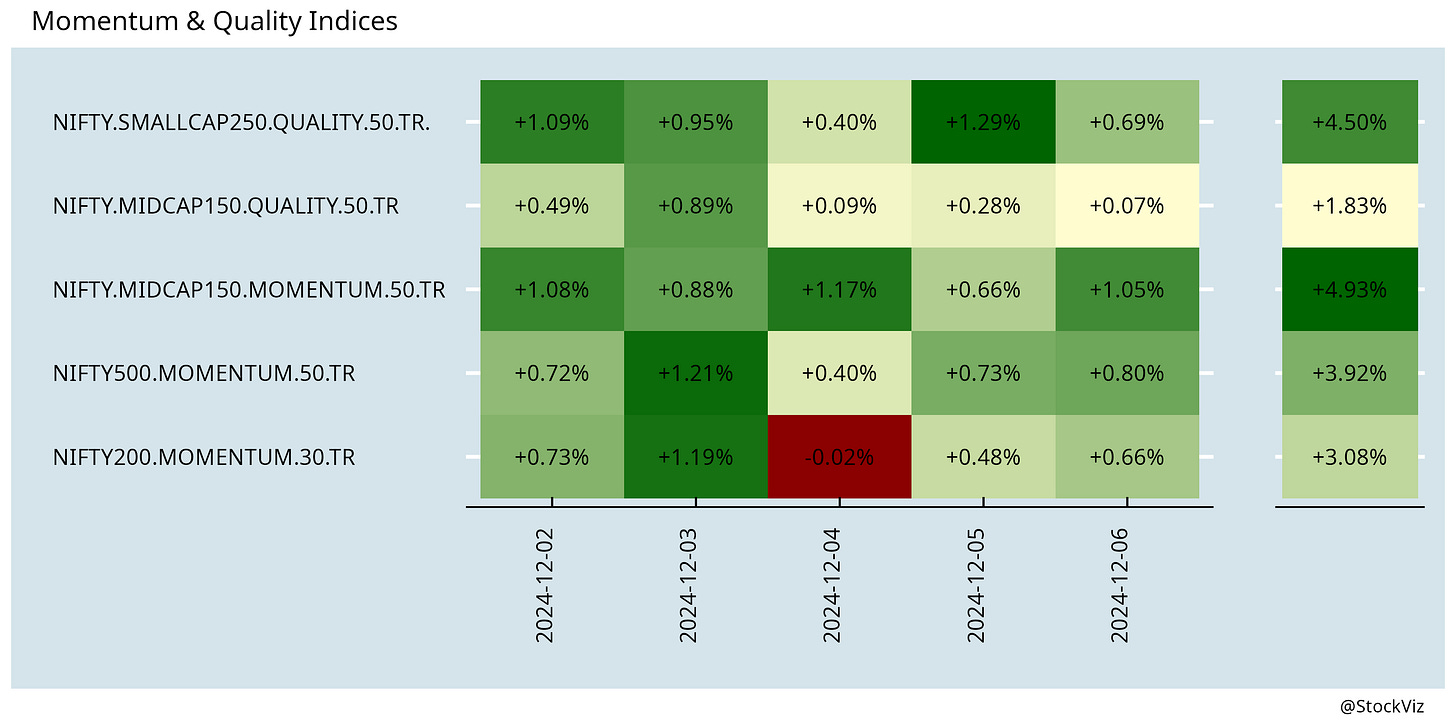

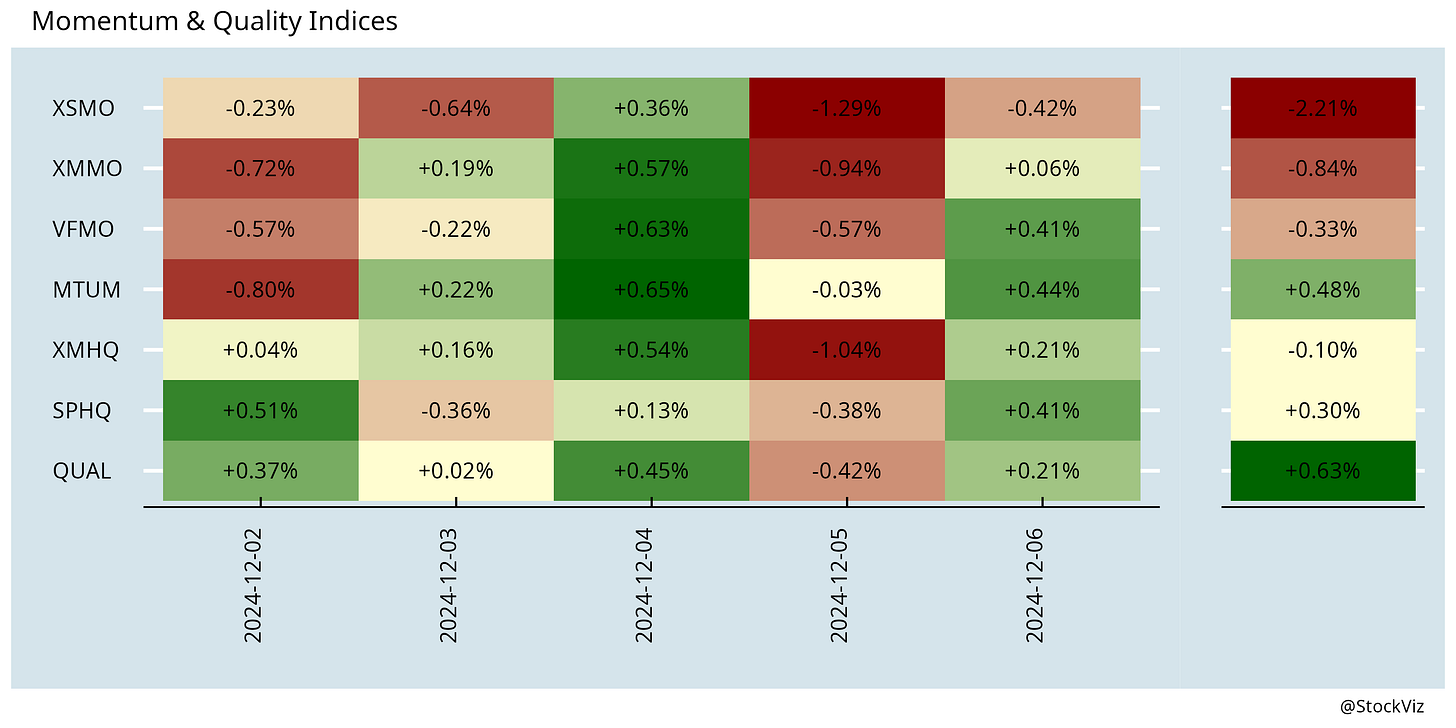

Markets this Week

FII’s re-enter and everything rallies…

A.I. drives tech…

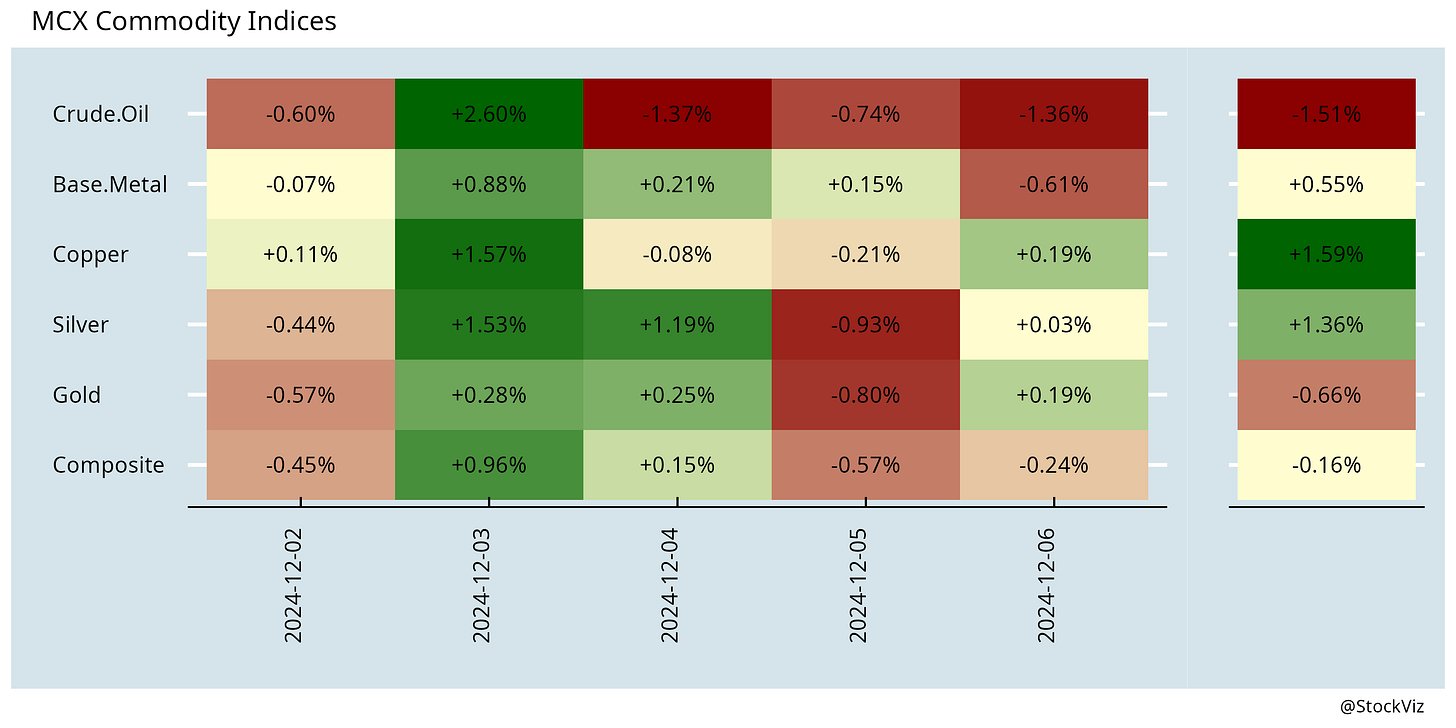

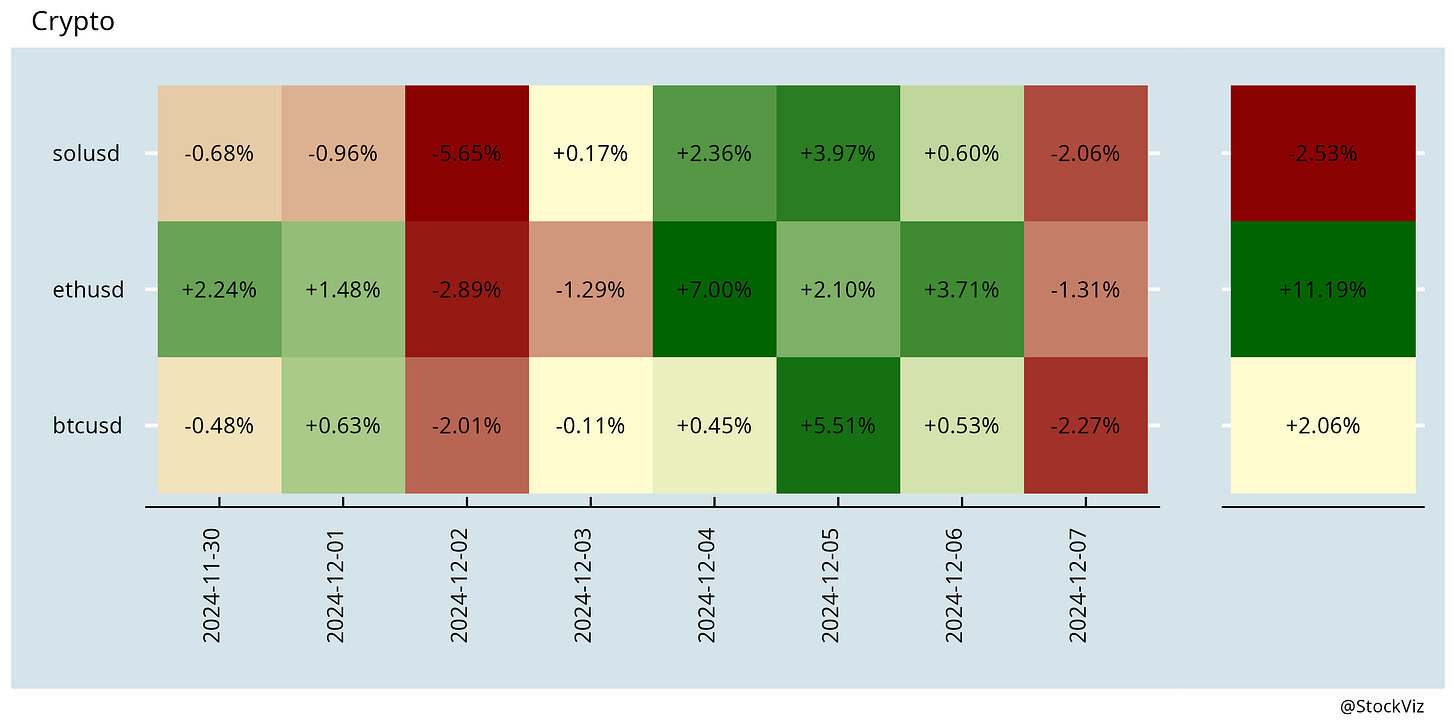

More here: country ETFs, fixed income, currencies and commodities.

A decent week for equity markets around the world…

Links

Research

Examining Revealed Preferences Using Fund Inflows and Outflows (SSRN)

I study the revealed preferences of retail investors in equity mutual funds to examine the horizon of past performance that matters for buying and selling decisions separately. Current inflows are influenced by performance stretching back 52 months, while outflows react to past performance up to 37 months. However, performance information from such long horizons does not translate to superior fund selection compared to using a simple metric such as previous month’s net return. This indicates that fund investors’ dependence on long-term historical performance is sub-optimal.

Reaching for Beta (SSRN)

Using data on equity mutual fund portfolio allocations and transactions, we show that a rise in short-term interest rates via contractionary monetary policy leads fund managers to tilt their portfolios towards stocks with higher market exposure. This Reaching for Beta is persistent and increases the net buying pressure of high-beta stocks. Funds that actively reach for beta experience more inflows when monetary policy is restrictive, while they deliver higher raw returns but no significant alpha after controlling for market and other risk factors. Funds' demand for high beta stocks induces systematic price pressures, which take several months to dissipate. In contrast to reaching for yield, which associates low interest rates with risk-shifting, reaching for beta implies that tighter monetary policy increases risk-taking in the equity market.

Crowding and Downside Risk: International Evidence (SSRN)

A firm's future downside risk has a strong and robust positive association with the crowding of its trades. In particular, a one standard deviation increase in crowding raises a firm's negative conditional skewness by 22.65% and holds after controlling for other firm fundamentals and characteristics.

Investing & Economy

India

India’s economy slumped to a seven-quarter low of 5.4% in the July to September period, much lower than consensus estimates and below the Reserve Bank of India’s 7% projection. (bloomberg, reuters)

Boom in Unlisted Share Trading Creates Riches and Risks in India (bloomberg)

The RBI kept its key interest rate unchanged but cut the cash reserve ratio that banks are required to hold for the first time in over four years, effectively easing monetary conditions as economic growth slows. (reuters)

NRIs struggle to protect properties amid rising cases of illegal possession in India (cnbctv18)

India’s One Nation One Subscription initiative: 18 million students, researchers, and professors will have free access to approximately 13,000 articles, including those from difficult-to-access publications like Elsevier, Springer Nature, and Wiley. (edexlive)

In labour-intensive industries, the number of employees who work in the 100 largest factories, in absolute terms, has essentially remained unchanged between 2011 and 2022. (livemint)

row

Crony Capitalism Is Coming to America (nytimes)

U.S. Markets Are Swallowing the Rest of the World (awealthofcommonsense)

US sports betting: fewer than 5% withdrew more from their betting apps than they deposited. These few players—whose wagers apparently won—collectively earned more than $100 million. The next 80% of bettors made up for those operators’ losses. And the 3% of bettors who lost the most accounted for almost half of net revenue. (bloomberg)

UK uncovers vast crypto laundering scheme for gangsters and Russian spies (nzherald)

Tether Has Become a Massive Money Laundering Tool for Mexican Drug Traffickers, Feds Say (404media)

Odds & Ends

AI-generated influencers based on stolen images of real-life adult content creators are flooding social media. (wired)

Meme of the Week