Every time markets drop more than 2%, CNBC brings out the “Markets in Turmoil” news special. The show is basically a reading out of Zerohedge headlines by doomer guests. It is so bad that it is a good contra signal.

Unfortunately, Markets in Turmoil is not alone. Most market news is useless. At the minimum, they should tell you about velocity (speed x direction) but more often than not, they leave one of them out because it is not “interesting,” i.e., will not make most headline skimmers click.

Case in point: market streaks.

These types of articles are so prevalent that we decided to put up a Varsity article on how useless these are as a PSA: How can traders use streaks?

Personally, I have not watched a single news show in over a decade and have gone from reading market news every day to reading it once a week.

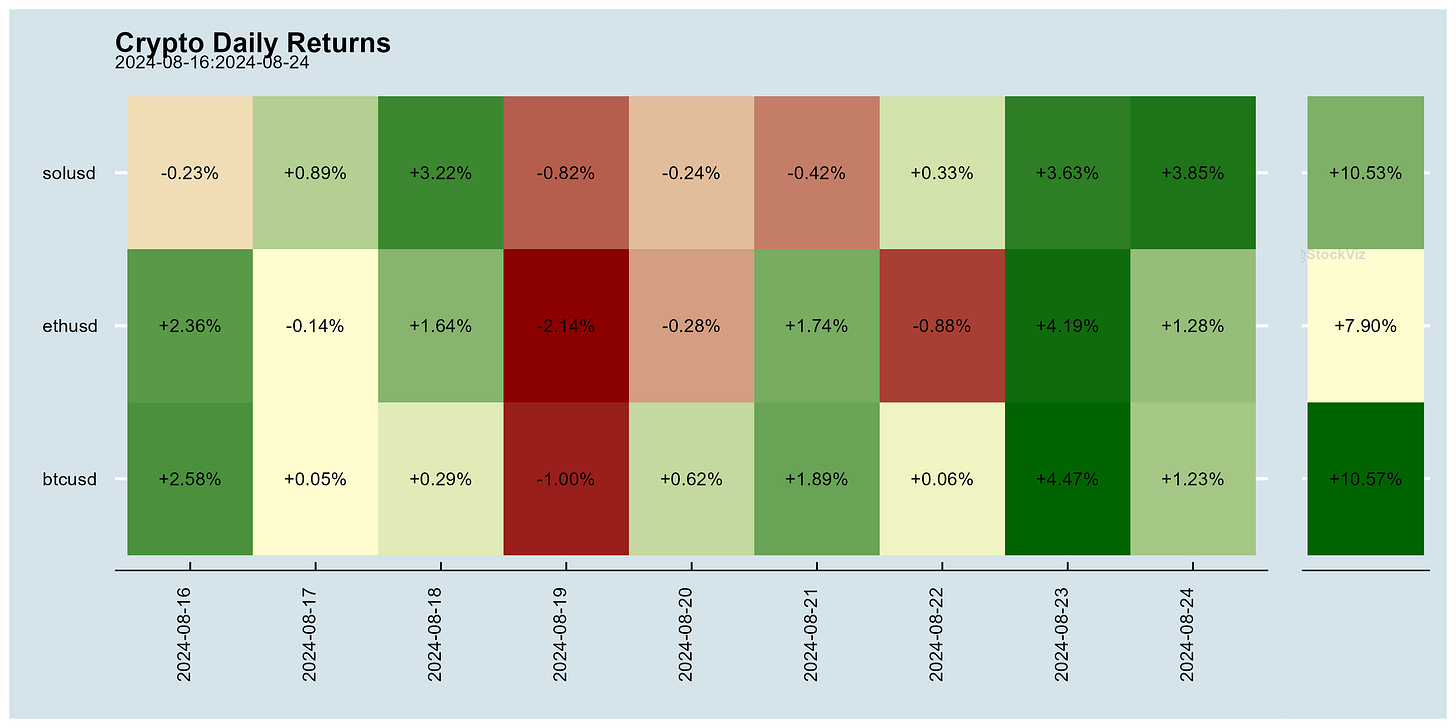

Markets this Week

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

Looks and Gaming (NBER)

We show that adults who are better-looking have more close friends. Arguably, gaming is costlier for them, and they thus engage in less of it. Physically attractive teens are less likely to engage in gaming at all, whereas unattractive teens who do game spend more time each week on it than other gamers. Attractive adults are also less likely than others to spend any time gaming; and if they do, they spend less time on it than less attractive adults. Good looks decrease gaming time.

Corporate Culture and Stock Return Comovement (SSRN)

We find that a positive (negative) and significant relationship exists between firms’ external (internal) culture and stock return comovement.

Investor Search and Asset Prices (SSRN)

We introduce a novel peer momentum by linking firms that are co-searched by investors on the SEC EDGAR server. A trading strategy based on this peer momentum generates an annualized return alpha of 17%.

Narrative Momentum (SSRN)

Investors underreact to economic narratives. Narrative-mimicking portfolios of recently rising narrative intensities outperform those of declining intensities by about 8% annually, controlling for standard risk factors. Neither stock nor factor price momentum explains narrative momentum, which is stronger for slowly trending narratives. Furthermore, analysts tend to underreact to narrative-sensitive stocks.

Local-Thinking Bias (SSRN)

Tests examining multiple analysts forecasting on the same firm at the same time show that each analyst indeed overreacts to their idiosyncratic local information. Analysts also simultaneously underreact to news from economically linked firms that are not within their individual portfolios, again consistent with local-thinking bias. Market prices track the analyst overreactions, leading to predictable and economically significant return reversal patterns. A trading strategy that incorporates the overreaction effect earns meaningful abnormal returns.

Economy & Investing

Stop Paying Attention (behaviouralinvestment)

15 Ways to Lose Money in the Markets (awealthofcommonsense)

India

SEBI chief earned revenue in potential rules violation (reuters).

India Inc records worst quarter since Covid-19 pandemic, profits shrink 3.1% (economictimes).

Nearly 12% of Indian-tested spices fail FSSAI quality and safety standards (livemint).

India's peer-to-peer (P2P) lenders are staring at an existential crisis, after the banking regulator halted many of the practices that made the industry what it is today (livemint).

India's commerce minister accused Amazon and other e-commerce companies of predatory pricing practices and said the sector's rapid rise should not disrupt millions of brick-and-mortar stores operating in the country (reuters).

RoW

Whereas in the United States and other similar economies, monetary expansion seems to feed directly or indirectly into boosting the consumption side of the economy, China’s financial system today and Japan’s then have been structured in ways such that monetary expansion results mainly in credit expansion that, for well-understood institutional reasons, is directed mainly into the supply side of the economy. The result is that credit expansion supports supply more than it supports demand.

Is Inflation a Monetary Phenomenon in China? (carnegieendowment)

The humble lump of iron ore benefited the most from the Chinese economic boom of the last 25 years. From the late 1990s to earlier this year, iron ore prices jumped nearly tenfold, more than any other major commodity; traded volume tripled. And now, it’s over (bloomberg).

Beijing shows signs of frustration as megaprojects in Pakistan, including Gwadar port and CPEC, face growing security risks (scmp).

A predistributional approach to economic policy making, as opposed to a redistributional one, asks not what can be done to compensate those who suffer from low or falling incomes, but what can be done to affect the operation of the market, without material harm to efficiency, such that incomes and opportunities for those at the bottom and lower ranks are maximized.

Toward a More Prosperous, Less Polarized, Worker-Friendly Economy (cfr)

ECB policymakers' views converging on Sept rate cut (reuters).

Fed's Powell, in policy shift, says 'time has come' to cut rates (reuters).

China, now by far the world’s largest sovereign lender, has played a leading role in saddling many countries with levels of debt, often through nontransparent arrangements, that are comparable with those seen in the 1980s. The situation is becoming perilous (nytimes).

Most Western experts, and some of their Chinese colleagues, have long believed that the only acceptable substitute for domestic investment is increased consumption. According to World Bank figures, household consumption in 2022 accounted for only 37 percent of China’s GDP compared with 68 percent in the United States, and the economist Michael Pettis has estimated that China would have to reallocate as much as ten to 15 percent of its GDP toward consumption to sustain healthy growth. But China will not take that tack, because shifting a substantial portion of the country’s wealth into the hands of ordinary citizens would empower them at the CCP’s expense.

Stopping the Next China Shock (foreignaffairs)

Low resale values for electric cars have pushed the leasing firms that drive Europe's auto market to double prices over the last three years and some are threatening to quit the business altogether if regulators force them to go electric too fast (reuters).

There have been cases historically in which tariffs have positively affected growth and other cases in which they have negatively affected growth. It would be much more helpful to work through the range of conditions in which tariffs are likely to boost growth, and the conditions in which they are likely to suppress growth, and then see which set of conditions more closely applies. @michaelxpettis

Hackers may have stolen the Social Security numbers of every American. The data was purportedly stolen from National Public Data, a company that performs background checks. (latimes, asisonline).

China-linked cyber-spies infect Russian govt, IT sector (theregister).

The global fertility crisis is worse than you think (spectator).

Think you are sick? It may be the nocebo effect (washingtonpost).