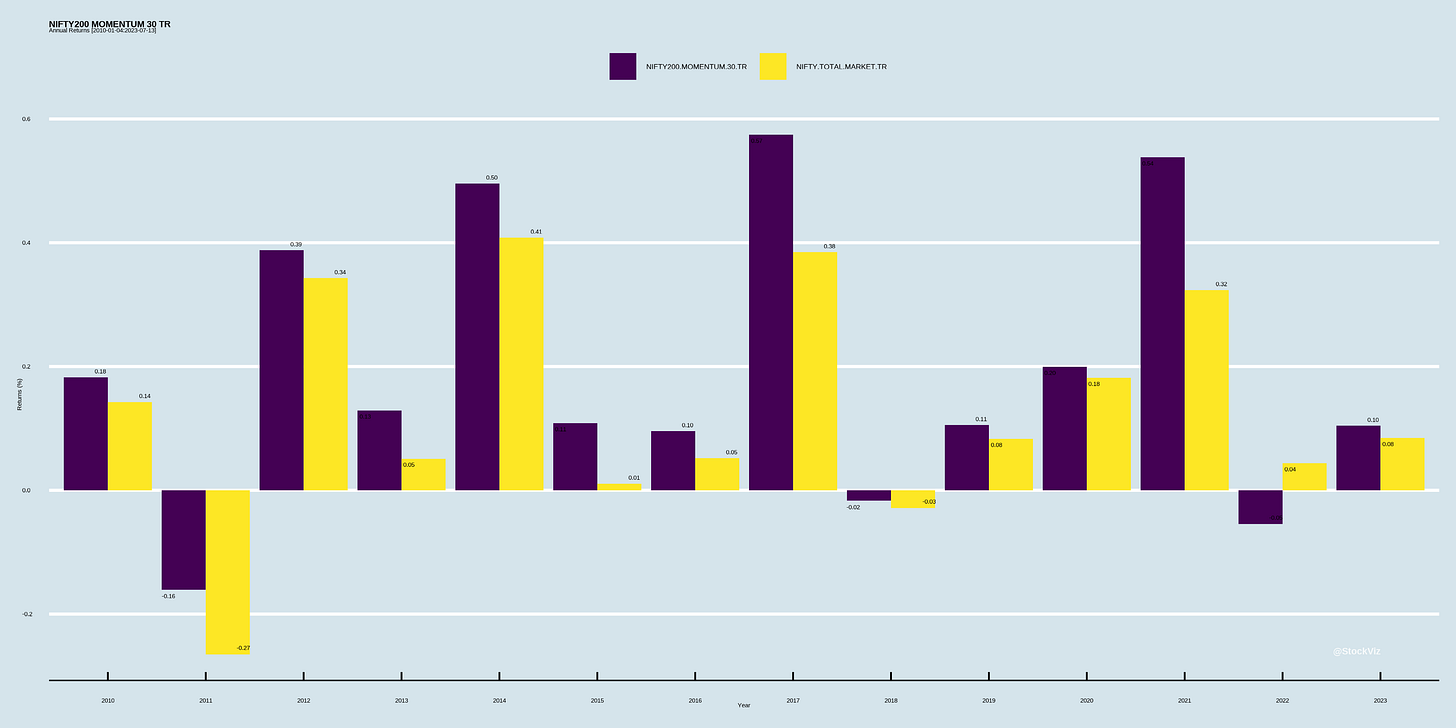

Momentum strategies have delivered outsized returns in India. Over the last few years, NSE launched momentum indices that have been embraced by fund houses and investors alike.

The large-cap NIFTY200 MOMENTUM 30 TR index…

… and the mid-cap NIFTY MIDCAP150 MOMENTUM 50 TR index…

have the market beat.

While investors are more gung-ho about large-cap momentum funds, the siren song of excess returns in the midcap space will be hard to ignore.

Besides, the mutual fund wrapper has a tax advantage that direct-equity strategies do not have when it comes to churn. And momentum strategies churn a lot.

In the most recent rebalance, more than half the large-cap fund churned out…

… and midcaps were only slightly better.

The only drawback of these indices is that they are rebalanced every 6-months - they are the slow-moving beasts of the momentum world. If the market permanently shifts to a faster rhythm, then these funds will start to lag behind.

Meanwhile, as the sizes of these funds increase, it should provide a lot of front-running opportunities.

If your direct-equity momentum strategy is not exceptionally better than these index funds, then it makes sense to join the indexers on this one.

Markets this Week

The inflation scenario in the US seems to be getting better and hopes are up on a “soft-landing.” Equities everywhere are on a bull run.

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

A survey of literature on machine learning in the study of financial markets. (SSRN)

If you found a tree that prints money, would you tell anybody about it? Take this one with a pinch of salt:

With approximately 900 million observations we conduct, to our knowledge, the largest study ever of intraday stock return predictability using machine learning techniques finding consistent out-of-sample predictability across market, sector, and individual stock returns at various time horizons. While linear models have the strongest statistical predictive power, nonlinear models economically dominate them and machine learning intraday long-short portfolios based on their forecasts attain Sharpe ratios of 4 after transaction costs. Predictability is short-lived, highest in the middle of the day, and more pronounced for less liquid firms, which indicates that slow-moving capital is an economic source of mispricing.

Sell-side analysts are not useless after all.

Sell-side analysts' forecasts of future stock returns are highly biased and the aggregated consensus forecast is a poor predictor of future returns. In sharp contrast, we show that the information revealed through the implicit ranking of return forecasts conducted individually by each analyst is highly informative of subsequent returns. Long-short portfolios sorted on these rankings result in large and highly significant excess returns that cannot be explained by previous anomaly characteristics or information extracted from consensus forecasts.

Are factor returns seasonal?

We study factor return seasonalities in international markets. We document a pervasive cross-sectional pattern: anomalies with a high average same-calendar month return outperform those with low average returns. The effect originates from price seasonalities, which transmit to factor portfolios, engendering seasonality in their returns.

Inverted yield curves foretell recessions. It is known.

We provide evidence on the effect of the slope of the yield curve on economic activity through bank lending. We show that a steeper yield curve associated with higher term premiums boosts bank profits and the supply of bank loans. Intuitively, a higher term premium represents greater expected profits on maturity transformation, which is at the core of banks’ business model, and therefore incentivizes bank lending.

Dan Ariely, one of the fathers of behavioral economics, faked his data. (science)

Economy

Inflation is 'history' for the U.S. (cnbc)

Meet the Wall Street scaremongers who were totally wrong about an 'imminent recession'. (businessinsider)

Things are fine. So gold prices are bleh. (economist)

The Jones Act’s requirement that vessels used in domestic trade be constructed in U.S. shipyards fails to pass even the faintest whiff of a cost‐benefit analysis. Among its harms include higher costs for those that must rely on these ships, added stress on infrastructure and congestion as transport is shifted to less expensive modes, irritated relations with U.S. trading partners and allies, and a smaller and older U.S. fleet than would otherwise be the case. (cato)

60% of workers today are employed in occupations that did not exist in 1940.

Odds & Ends

Our oceans are boiling. Short beach-houses. (cbsnews)

The socialist Spanish minister uses a private jet to attend a climate conference. 100 metres before the venue she gets out off the limo and takes a bicycle. The security cars follow her. (tweet)