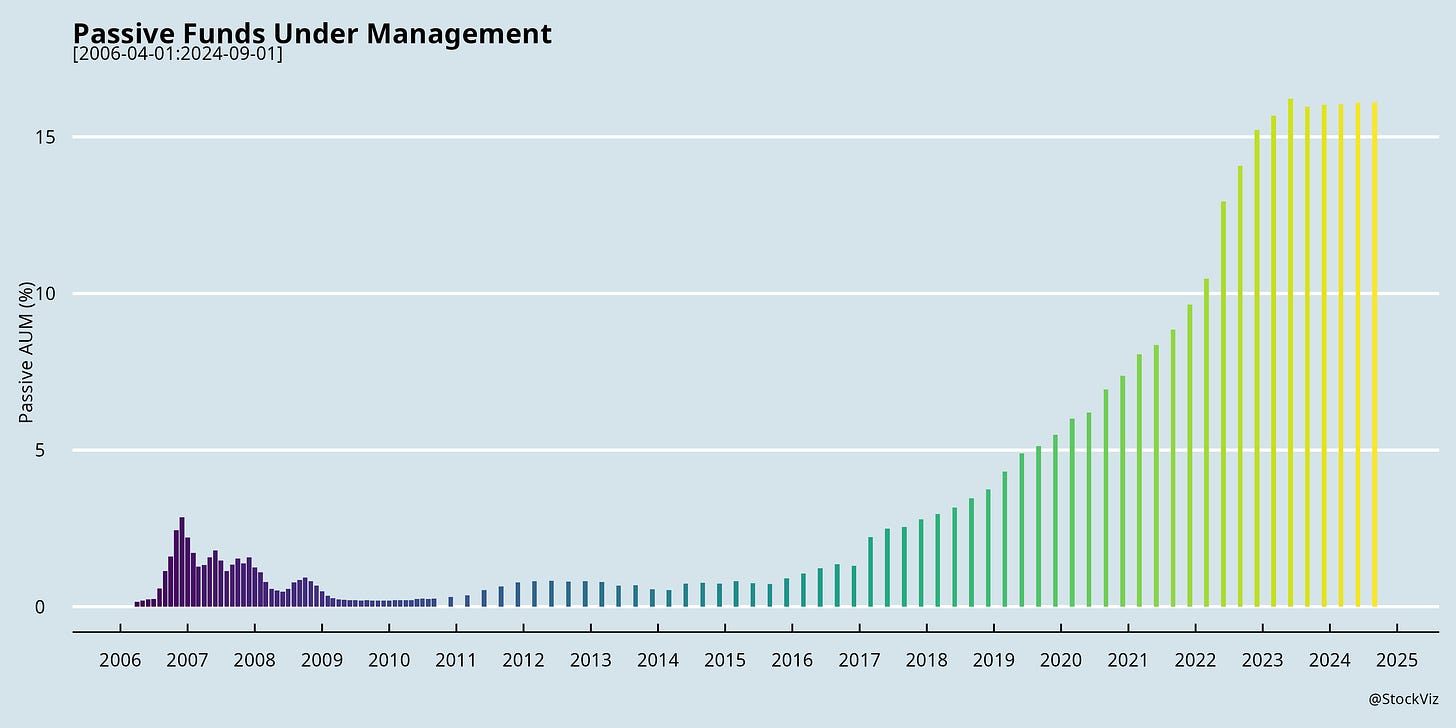

We use index funds and ETFs for a number of our strategies and we believe that the long arch of time bends towards passive strategies. There is also a general consensus that active managers under-perform their benchmarks in India. However, while there has been growth in the total AUM of index funds and ETFs…

… market-share has been stagnating.

However, this hasn’t stopped NSE and fund houses from launching a slew of indices and index funds. At last count, there were more than 100 total return equity indices on NSE’s website.

Purists would question the need for more than 4 indices. Shouldn’t one each for large/mid/small/micro be enough?

The problem is that it simply takes time to get comfortable with indices outside of “lindy” market-caps. Some of NSE’s “strategy” indices are shown to clock very impressive returns. However, performance before the index launch date should always be taken with a high dose of scepticism. The incentives to overfit are large given the financial rewards at stake.

Besides, how is your average investor supposed to choose between NIFTY200 ALPHA 30 and NIFTY200 MOMENTUM 30 indices?

Also, running an index fund is no cakewalk. Some of the liquidity assumptions made during bull markets cannot be extrapolated indefinitely. And there have been cases where index rebalancing trades failed because they were stuck in circuit for days together.

Large tracking differences indicate problems on the implementation side of things.

Generally speaking, indices live three different lives:

Their lives before launch date is awesome. All sunshine and rainbows. The best that they will ever be.

The period after launch but before funds start referencing them is when they are the most vulnerable. This courtship phase is where they can sink without a trace.

NFOs are when things get real. Will excess returns survive funds being deployed? Tracking errors and differences begin to enter the picture.

Most Indian indices are still living their 1st and 2nd lives.

On the bright side, a few things are forcing the hand of the fund management business.

Thanks to SEBI, existing fund houses cannot launch any more actively managed funds and sales & marketing departments hate to sit idle. Blackrock - the world’s largest passive fund manager - is all set to launch in India.

So who knows? Ready or not, we might soon get a NIFTY ALPHA QUALITY VALUE LOW-VOLATILITY 30 Index fund!

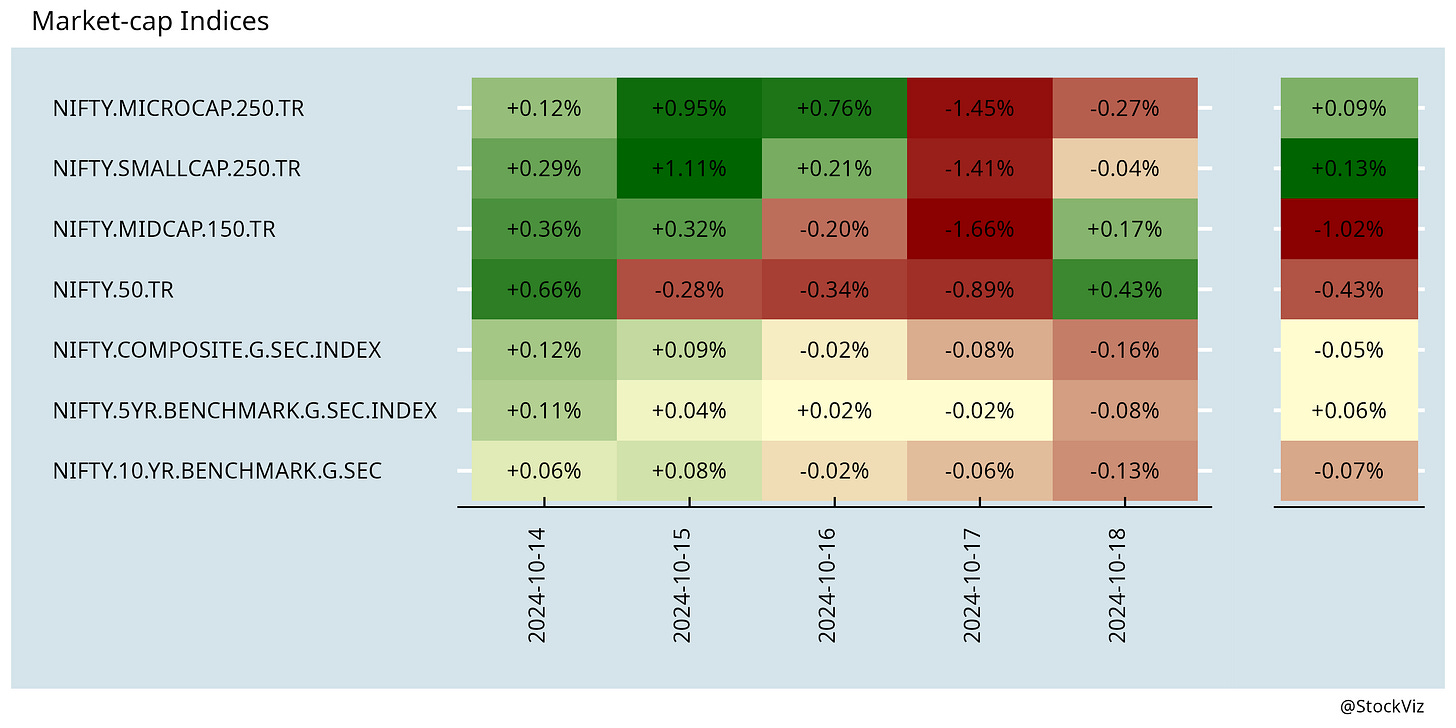

Markets this Week

A friendly reminder to stop listening to stock-tips no matter what the source: A month ago, Rajiv Bajaj, Managing Director of Bajaj Auto, said that the company's stock could reach ₹20000. Second quarter results and outlook were so bad that the stock crashed 12% in one day and ended the week at ₹10000.

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

Anomaly Time (SSRN)

We examine the timing of returns around the publication of anomaly trading signals. We show that anomaly returns are concentrated in the first month after information release dates, and these returns decay soon thereafter. Many anomalies do predict returns if portfolios are formed immediately after information releases.

On the Nature of Entrepreneurship (NBER)

Self-employed individuals have significantly higher average income and steeper, more persistent income growth profiles than paid- employed peers with similar characteristics. We find a much smaller role for non-pecuniary motives in driving entrepreneurial choice and little evidence for inordinately high risk factors or startup costs impeding entry. Linking individual and business filings, we find that business founders have sufficient resources in the initial years of operation to ensure positive individual income despite the fact that most claim a loss on the business.

Regret in Global Equity Markets (SSRN)

This paper investigates the relation between investment regret and the cross-section of equity returns in an international context. We measure the regret from investing in a stock as the negative of the difference between the stock's return and the maximum return that could have been achieved by a stock either in the same industry or with a similar market capitalization or book-to-market ratio. Next, we calculate one-month-ahead returns to a portfolio that is long (short) in high-regret (low-regret) stocks. First, the positive relation between regret and future returns is stronger for equal-weighted portfolios suggesting that it is more acute for small stocks. Second, the regret effect is stronger in emerging markets compared to developed markets.

Investing

India

India's CPI in September accelerated to its highest in nine months to 5.49%, due to higher food prices. It was 3.65% in August, and economists' had forecast 5.04%. (reuters)

Rising prices of edible oils and vegetables like onions and tomatoes have driven up grocery spending for Indian households ahead of the festival season, prompting some consumers to limit more expensive purchases like electronic items. (reuters)

With increased hiring and a package of over ₹20 lakh per annum to boot, Japan is emerging as the new promised land for Indian engineering students. (livemint)

How Akasa Air’s Vinay Dube is taking on the IndiGo-Air India duopoly (livemint)

Row

To accelerate the clean energy transition across the U.S., Google is signing the world’s first corporate agreement to purchase nuclear energy from multiple small modular reactors (SMR) to be developed by Kairos Power. (google)

Amazon investing in SMRs to deploy 5 GW by 2039 (ans)

It has been 13 years, and I can’t think of a good reason not to publish both Todd and Ted’s investment results. Why can’t we know how they’ve done over the past 13 years? (Todd Combs Retrospective?)

Odds & Ends

Scientists have designed a new form of insulin that can automatically switch itself on and off depending on glucose levels in the blood. In animals, this ‘smart’ insulin reduced high blood-sugar concentrations effectively while preventing levels from dropping too low. (nature)

Widespread physical distancing and masking practiced during the early days of COVID-19 appear to have pushed Influenza B/Yamagata into oblivion. This surprised many who study influenza, as it would be the first documented instance of a virus going extinct due to changes in human behavior. (npr)

Once lauded as a wonder of the age, cocaine soon became the object of profound anxieties. What happened? (aeon)