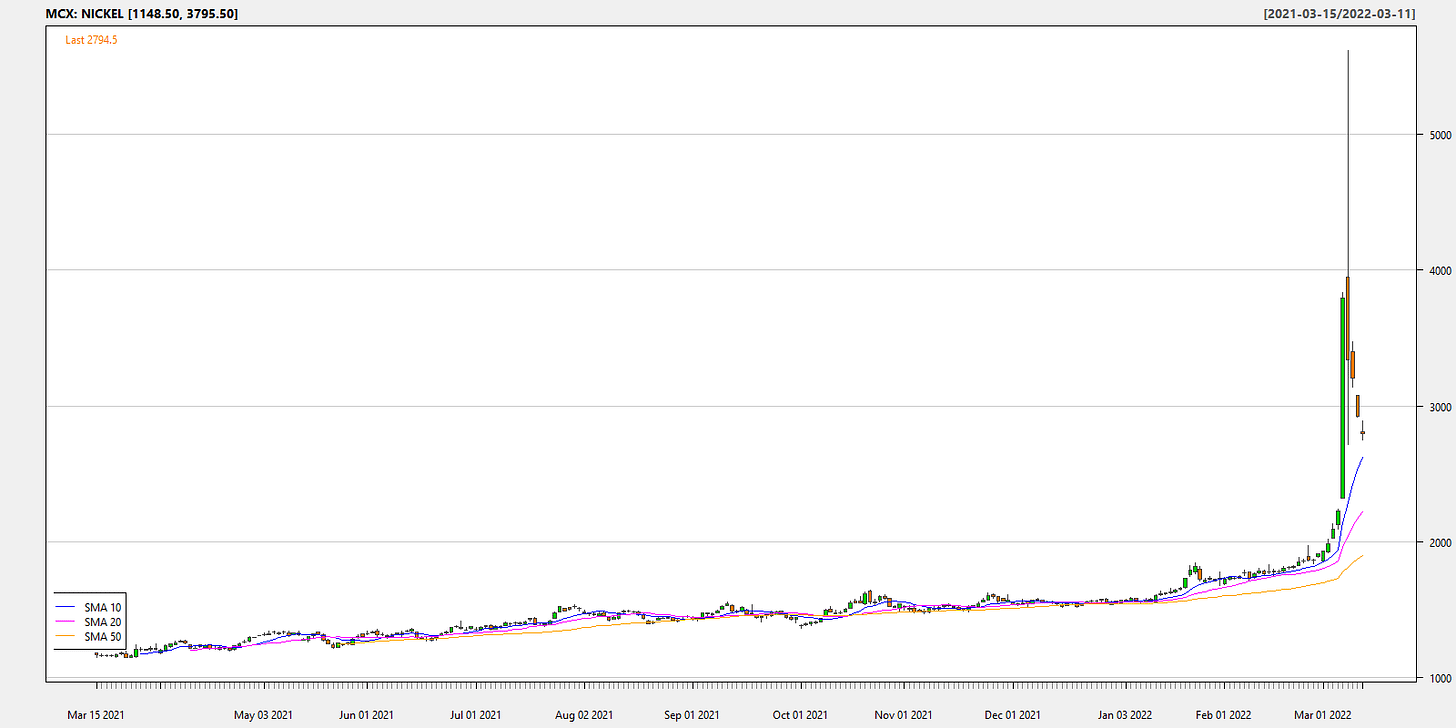

Putin’s war shows no sign of abating. The longer it drags out, the worse it is for everybody. Right now, we are experiencing a commodity price shock with crude almost doubling, aluminum mooning, nickel rocketing and the rupee tanking.

The price action in nickel was enough to threaten the bankruptcy of a Chinese tycoon so much so that the London Metal Exchange (owned by the HKEX which is owned by the Hong Kong Government which in turn is run by the CCP) threw all pretense of fair-play to the wind and cancelled the trades and suspended trading (thread). It was not some fat-finger trade what was a genuine mistake. It was an exchange bailing out an arrogant idiot.

While the world is focused on oligarchs’ yachts, a silent crisis is brewing in emerging markets: food inflation.

High food prices have sparked revolutions in the past and some EMs are more vulnerable than others (Egypt, Middle East, China).

Rate traders are pricing-in an imminent recession.

What we have here is a commodity supply shock that is going to stoke inflation. But persistently high commodity prices are deflationary. So, India (and EMs that import energy & commodities), are staring at a stagflationary future. Honestly, nobody knows.

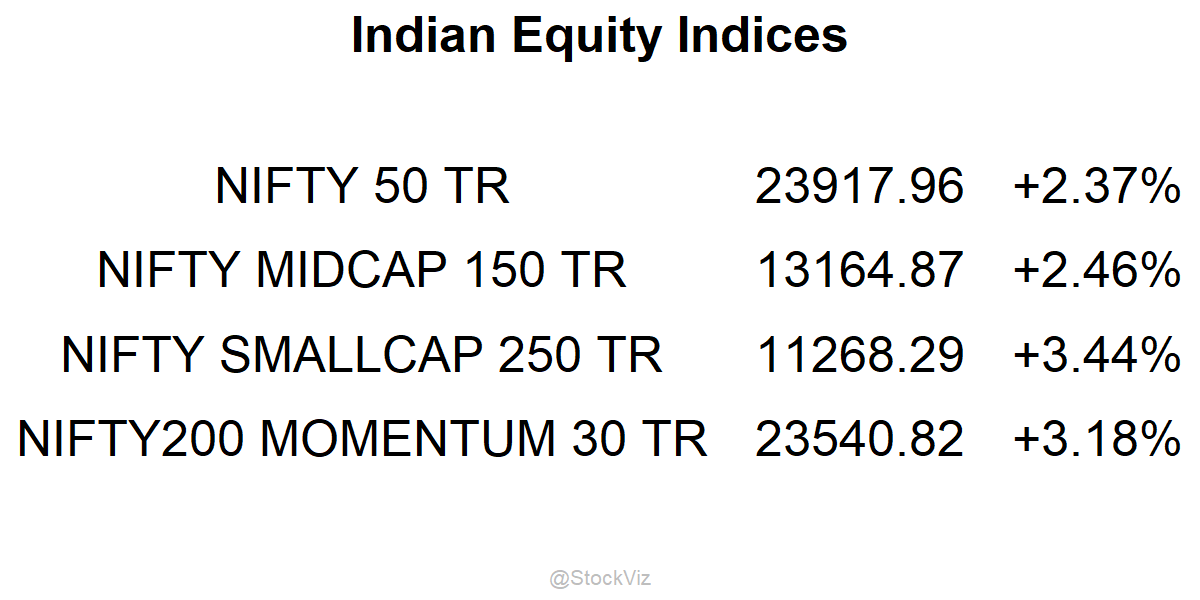

Markets this Week

The US Fed is widely expected to raise rates by 25bps this week.

Gold

Gold prices spiked on macro uncertainties and investors are once again interested in it.

We have always advised a prudent allocation to gold through Sovereign Gold Bonds (SGBs). It is a great “hold till maturity” instrument: both its coupon (2.5%) and price appreciation are tax free.

However, SGBs are poorly traded in the secondary market because they are non-standard. Each issue has a different face value derived from the price of gold (and the coupon is paid on face, so your cashflow stream differs from issue-to-issue). It has an embedded put option that activates after the 5-year mark but if you exercise it (window open twice a year), you’ll have to pay LTCG. So, each issue is “different” and, naturally, they trade poorly.

Alternately, there are gold funds and ETFs (GOLDBEES) for cash-an-carry investors and futures on the MCX and NSE for specs.

LRS

For a while, the option of investing in US equities through Indian fund houses was available. But it looks like the RBI closed that window by refusing to raise the $7 billion limit on international holdings in January. Some MFs are accepting existing SIP inflows but all lumpsums have been blocked. (ValueResearch, ET, PPFAS)

Read: Funding Your Dollar Dreams, Indians Investing Abroad