Inside Edge

beta for thee, lamborghini for me

A lot of controversy, finger-wagging and hashtags this week on the alleged front-running by a bunch of guys (why it always men?) working for Axis Mutual Fund. The tip-off was the head-trader driving around in a Lamborghini and a Rolls Royce.

Apparently, Axis knew about it since February but chose to let the accused continue with business-as-usual until their hand was tipped by media reports. You can read all about it in moneylife and livemint.

The last time that employees of a big mutual fund company were involved in something like this was HDFC’s, about a decade ago.

Unfortunately for investors, there is no asset management company in the world that can guarantee that none of its employees will front-run or insider-trade to their detriment. To catch this sort of behavior, institutions rely on large-scale surveillance and data-mining systems. But, at the end of the day, these systems are back-ward looking and human ingenuity will always remain one step ahead.

Punishing bad actors that do get caught is the bare minimum. Because the whole financial services industry is filled with perverse incentives.

Media is incentivized to dramatize everything to chase eyeballs and clicks. Their only crime is to be boring.

Brokers are incentivized to drive transactions. Their only crime is asking you to buy-and-hold.

Paying a percentage of assets? They are incentivized to gather assets. Their only crime is being sub-scale.

Paying carry? They are incentivized towards max-risk. Their only crime is being conservative.

Paying a per-visit flat fee? They are incentivized to atomize. Their only crime is being comprehensive.

A successful asset management business involves most, if not all, of the above activities. Regulators try to balance these incentives against the value provided by the business but can never really get rid of them. As far I know, only Warren Buffett’s Berkshire Hathaway and Jack Bogle’s Vanguard have even attempted to overcome these temptations. And they have done this by adopting unique corporate structures.

I guess it is my way of saying, don’t be naïve. Nobody is Caesar's wife. Nobody is going to pass the agni pariksha in this industry.

Markets this Week

There is no more alpha. There is just beta you understand and beta you don’t understand, and beta you are positioned to buy vs. beta you are already exposed to and should sell.

John H. Cochrane (pdf)

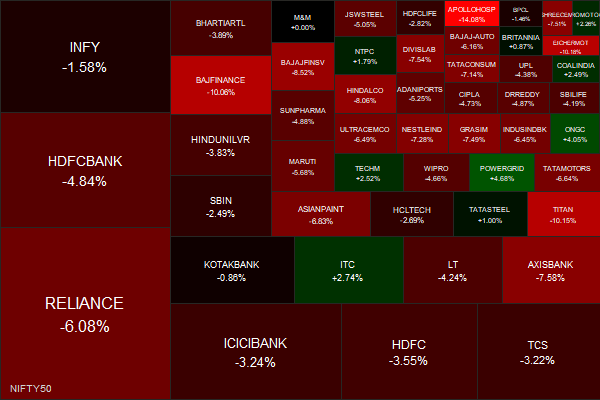

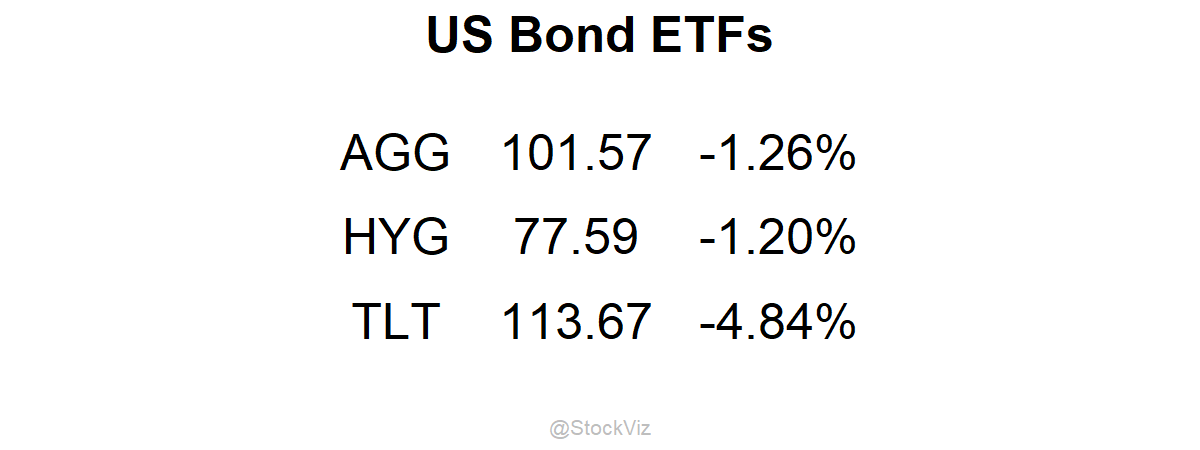

This week was all about central banks hiking rates. We got +40bps and the Americans got +50bps. CNBC ran “Markets in Turmoil” after Nasdaq dropped 5% on Thursday.

All said and done, Indian equities have held up better than most. INDA, the Indian ETF, has fallen less than both EEM and SPY.

Links

A new study suggests that companies with relatively high trademark filings earn higher future profits (WSJ)

'Buy now, pay later' is sending the TikTok generation spiraling into debt (sfgate)

More than 4.7 million people in India - nearly 10 times higher than official records suggest - are thought to have died because of Covid-19, according to a new World Health Organization (WHO) report. India's government has rejected the figure, saying the methodology is flawed. (BBC)

owning myspace equity doesn't make you facebook rich

@mgnr_io

Nice to see Indian retail investors keeping the faith!

On Monday morning, with volumes thinned by the UK’s bank holiday, Citigroup briefly crashed the European market. (FT)