Instead of More, try Less

Essentialism vs. the maximalism/minimalism dichotomy

Its become fashionable to brag about the number of data points being used to drive one’s quantitative models. However, when it comes to financial markets, more isn’t necessarily better. This week, we started looking at how removing information from a dataset can provide more clarity. Do read our opening salvo: Direction vs. Magnitude.

ML system designers will recognize it as a form of feature engineering. Our motivation for doing this is to apply a whole different class of algorithms that cannot be applied on financial timeseries.

Let’s see where this goes. If you have any useful links, do drop it on the comments below.

Markets this Week

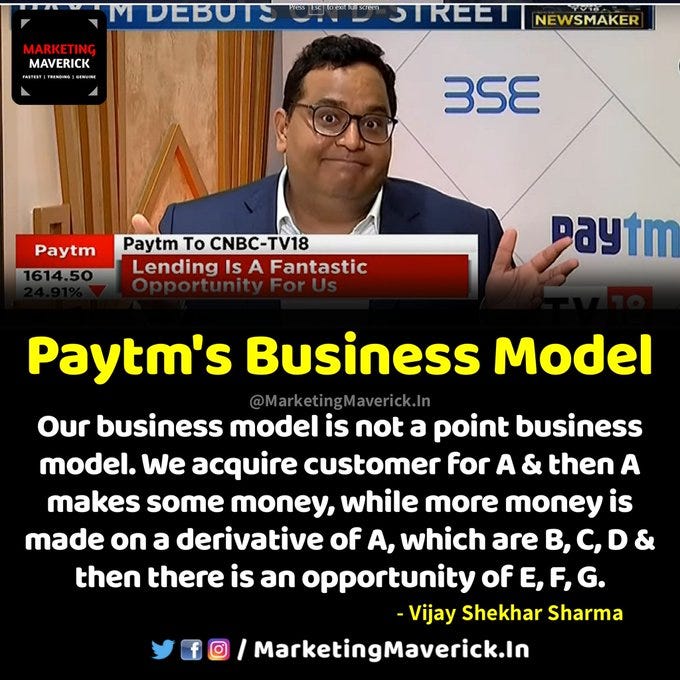

Markets took a bit of a shellacking this week. Paytm, India’s largest IPO in a decade, dropping 28% on debut did not help the mood.

Links

Why you Should Stop Predicting Prices if you want to Stand a Chance of Predicting Prices (Medium)

What Drives Gold Prices? (ChicagoFed)

Are Rising U.S. Interest Rates Destabilizing for Emerging Market Economies? (FEDS Notes)