Most of the time in quant finance, linear regression is all you need. What you regress is more important than the fancy tool of the day. Whenever a buzzy new technology hits the market — A.I. now, Neural Networks and Machine Learning a few years ago — there’s a tendency to force-fit them to the world of investing and market them as a new way to peel a potato.

However, whenever you venture out of good ol’ linear regression, you end up with extremely over-fit and unexplainable models.

This is something we discussed with the example of using a very basic “A.I.” tool - an SVM - to model momentum. You can read it here: SVM for Momentum.

Caveat emptor.

Markets this Week

Budget jitters saw selloffs in momentum stocks…

… while tech stocks sold off in the US.

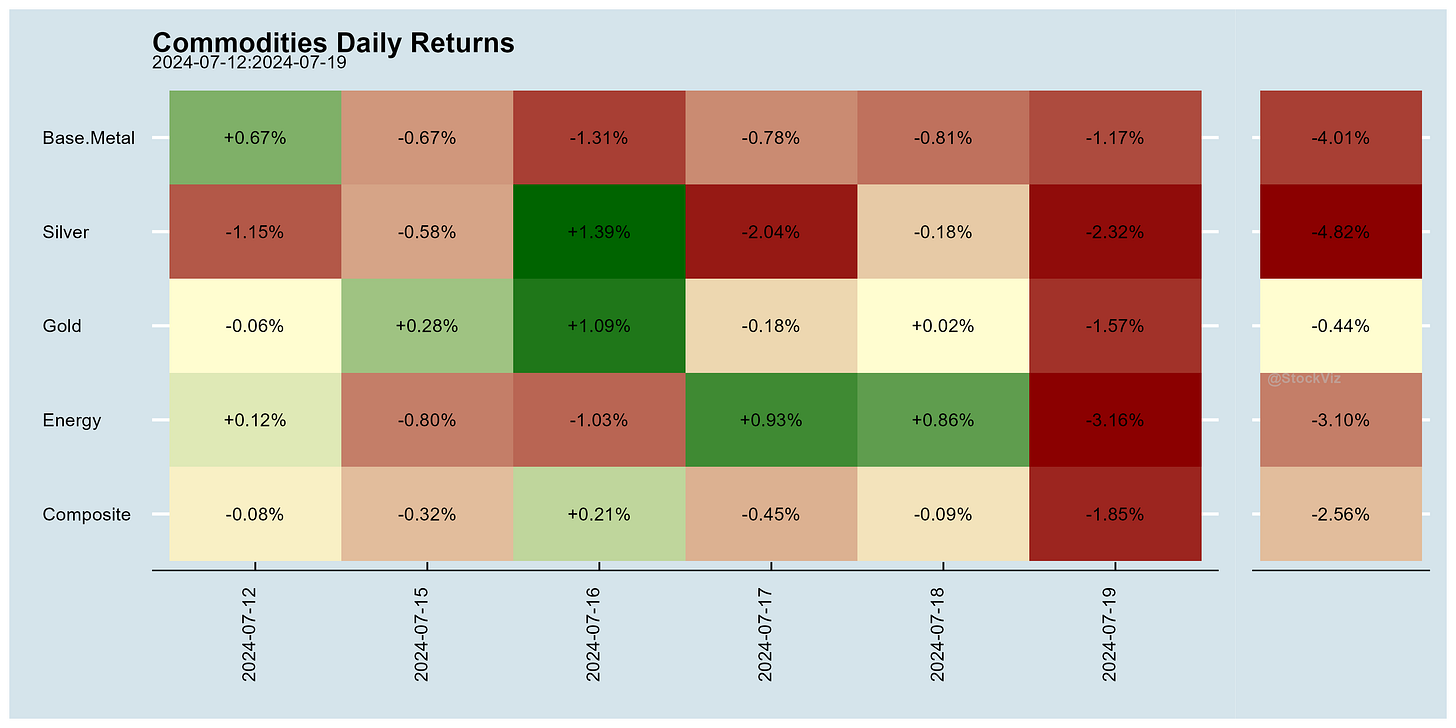

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

Visual Deception in Financial Market (SSRN)

The candlestick chart is the most widely used visual aid in the financial market. Like most charting tools, it has a default auto-scaling function that automatically adjusts the visual scale of stock price paths. This paper finds that the auto-scaling of candlestick charts deceives investors’ interpretation of stock returns and volatility, resulting in earnings misreaction and cross-sectional variation of risk compensation.

Global Fund Flows: What They Reveal About Global Factors (SSRN)

The Capital Asset Pricing Model (CAPM) emerges as the most influential in predicting global fund flows. The prevalent use of the CAPM leads to correlated demand, which positively predicts stock returns in the short term but reverses in the long term.

Rising Immigration Has Helped Cool an Overheated Labor Market (KCF)

The influx of immigrant workers appears to have helped alleviate the severe staffing shortages in certain industries that were pervasive during the pandemic’s volatile period.

Beliefs About the Economy are Excessively Sensitive to Household-Level Shocks (NBER)

We find that compared to actual inflation, people's inflation forecasts covary much more strongly (and negatively) with both recently realized household income changes and measures of expected future household income changes.

Does U.S. Academic Research Destroy the Predictability of Global Stock Returns? (SSRN)

We examine the out-of-sample and post-publication return predictability of 87 factors published in U.S. journals across global stock markets encompassing 38 countries, focusing on their capacity to explain cross-sectional stock returns. Our results underscore a pronounced impact of U.S. academic publications on global markets, with portfolio returns being 65% and 73% lower out-of-sample and post-publication, respectively. These diminishing returns are consistently observed across both developed and developing markets. This result implies that global studies and investors are increasingly integrating insights from U.S. academic publications to rectify potential mispricing.

India

India’s government is finalizing rules to cut down visa delays for Chinese technicians, responding to complaints from businesses who say the restrictions are hurting the country’s ability to become a manufacturing hub (bloomberg).

India is likely to do all it can to ensure the rupee keeps pace with the weakening Chinese yuan in order to protect its export competitiveness (bloomberg).

How India Checkmate China On Silver Trade (businessworld).

India is becoming more dependent on China economically. Indian corporates are publicly pushing the Modi government to make concessions to China. Even though the government argues that ties with China can’t be normal till the problems on the border are resolved, it is unable to prevent the deepening of economic relations.

Modi’s China Bind (foreignpolicy).

Taiwan firms shift supply chains to India from China (reuters).

SEBI proposes new asset class for high-risk investors (reuters).

An unrelenting deposit crunch has RBI worried that a wide credit-deposit gap could expose India’s banking system to structural liquidity issues (livemint).

Processed food has invaded Indian kitchens (livemint).

Just like a Ponzi scheme, so long as the money being brought in by new investors is more than what gets withdrawn by others, Indian stock prices will probably continue their upward trend. Talking of stretched equity valuations is pointless in such a scenario (livemint).

RoW

China needs more momentum in its economic recovery (chinadaily).

Communist China: A Long March to Collapse? (cepa)

The decision Americans must make about industrial policy is whether policies that drive the nature and direction of the U.S. economy should be designed at home or abroad by its trade partners. In a hyperglobalized world, trade and industrial policies in one country are transmitted through trade imbalances into their obverse among that country’s trade partners.

Which Country Should Design U.S. Industrial Policy? (carnegieendowment)

Thai economy faces upheaval due to factory closures and cheap Chinese imports (thejakartapost).

US central bankers are ready to cut interest rates in September amid growing confidence that price stability is within sight – while risks to the labor market have grown. They’ve laid the groundwork for the coming move in speeches over recent weeks, and Chair Jerome Powell will likely flag it more explicitly after a policy meeting on July 30-31 (bloomberg).

Raising Interest Rates Adds to Inflation

Stocks are Only Up Because of QE

Zero Interest Rate Policy (ZIRP) Causes a Speculative Mania

Three Bad Narratives That Are Dead (disciplinefunds).

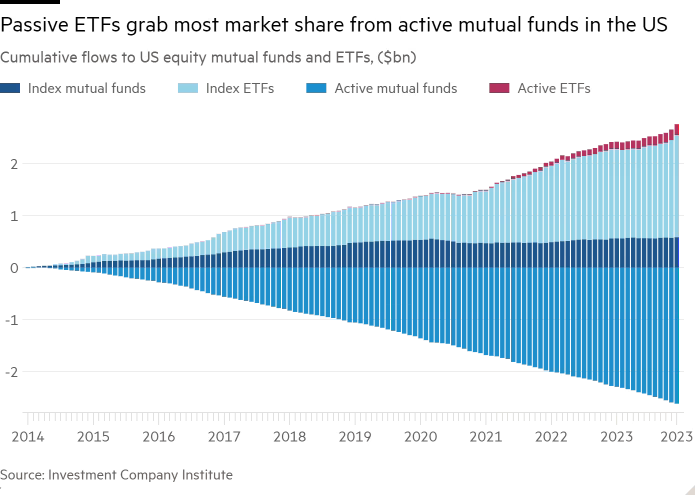

Actively managed funds of all kinds have been the epicentre of outflows in recent years as money has been redirected to cheaper passive funds, driving down average fees. In the past two years alone, passive funds have attracted more than $1.1tn in net new money while active funds shed almost $1.4tn (ft).

An obsession with growth has generated massive inequality, undermined global economic stability, and weakened faith in democracy. Reversing these trends requires reining in the power of financial capital and managing global trade flows. The global economy needs to be restructured away from the interests of globalized wealth to the interests of workers in the domestic economy.

What’s “Growth” Got to Do with It? (carnegieendowment)

Goldman's global head of equity research shares 2 fundamental issues with the AI craze (businessinsider, goldmansachs).

Complex Systems Won’t Survive the Competence Crisis (palladiummag)

CrowdStrike and Microsoft: What we know about global IT outage (bbc).