The difference between courage and stupidity is measured by success and survival.

Evan C. Currie, The Heart of Matter

The biggest mistake an investor can make is to bucket themselves into a style. Value/Growth/Momentum/Large-caps/Small-caps etc. exist only in publications that try and rank active managers. As an investor, why would you voluntarily tie one hand behind your back before entering the boxing ring?

The problem with being a “style” investor is that the market doesn't care about styles. Even something mundane like the small-cap premium is not a given. Take large/mid/small -caps, for example.

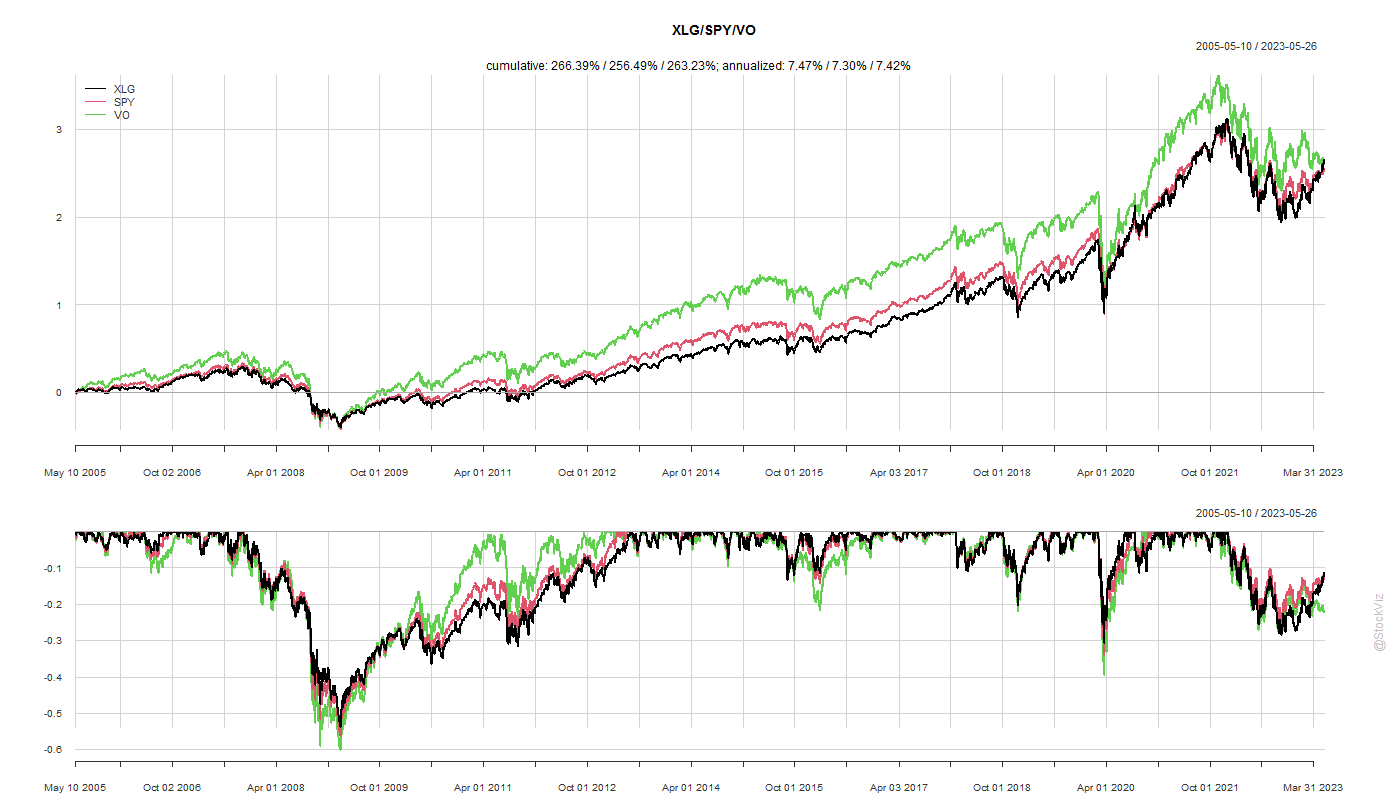

XLG 0.00%↑ - the S&P500 Top 50 ETF - US Mega-caps has outperformed VO 0.00%↑ - Mid-cap ETF over an 18 year period.

Was this always the case? No.

Till 2014, Mid-caps outperformed large-caps.

And then, something snapped - markets discovered that tech-monopolies had an insurmountable moat and started bidding them up.

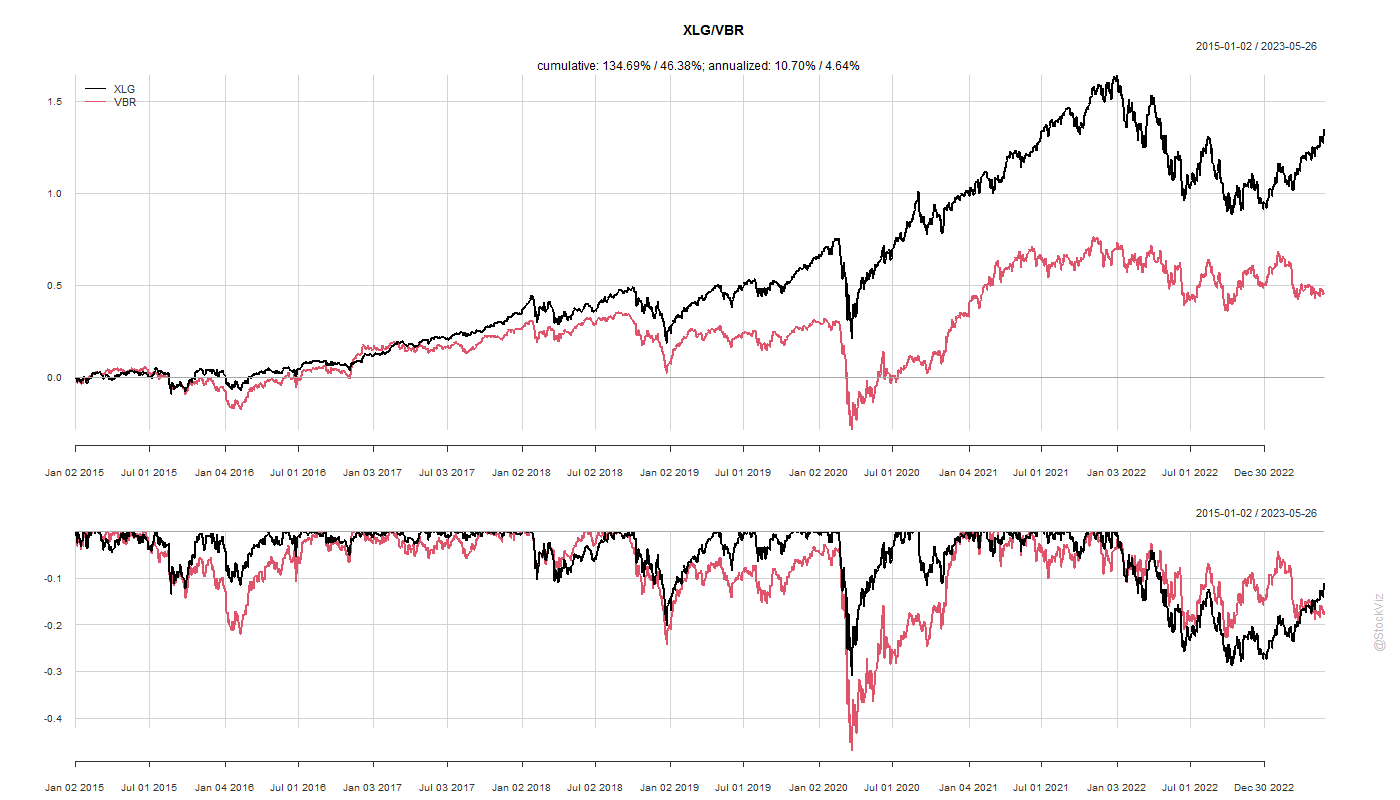

Since 2015, Mega-caps have outperformed Mid-caps by over 4% CAGR.

Worse, as an investor, if you had bucketed yourself as “small-cap value”, then you would’ve got your ass handed to you.

Here’s the eternal dilemma that faces investors: when should you change your mind?

Change it too often, then you will be chasing whatever style outperformed recently only to see it mean-revert. Never change and become Hussman.

This is why there are very few legends in investing who have made it past 30 years in the profession without blowing themselves up.

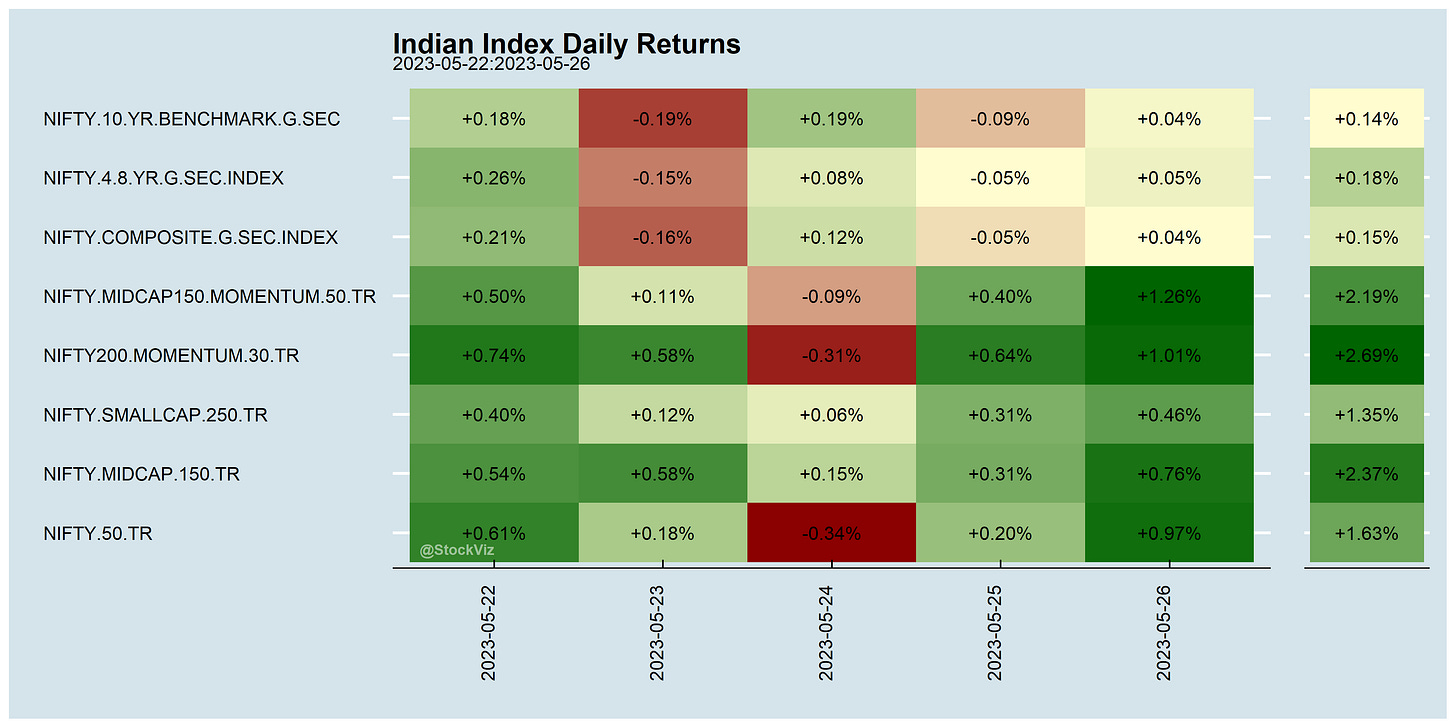

Markets this Week

Cathy Wood, who built an ARKK to invest in “innovation” and AI, stumbled when it came to NVDA 0.00%↑ - the biggest success story in the current AI pump.

ARKK Dumped Nvidia Stock Before $560 Billion Surge (bloomberg)

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

The Fundamental-to-Market Ratio and the Value Premium Decline

Recent evidence indicates the value premium declined over time. In this paper, we argue this decline happened because book equity, BE, is no longer a good proxy for fundamental equity, FE, defined as the equity value originating purely from cash flows.

An Examination of Number of Holdings and Universe Size in Momentum Strategies: Evidence from India

On a risk-adjusted basis, highly concentrated portfolios do not outperform. Our findings also illustrate that the choice of the investment universe and the number of holdings in the portfolio significantly affect performance momentum strategies.

Company earnings guidance is wrong about 70% of the time

Managers are miscalibrated: on average, they indicate a 78% likelihood they will report results within their guidance range even though historical estimates for these firms suggest this occurs only 31% of the time.

Noise is a secret destroyer of productivity

A 10db noise increase (from a dishwasher to a vacuum) lowers productivity by 5%. Noise really hurts detailed work. With a little noise software engineers find fewer bugs, productivity drops, & many tasks are disrupted.

Investing

Stocks with the highest estimated growth rates almost always underperform those with the lowest estimates.

@lhamtil

~

~

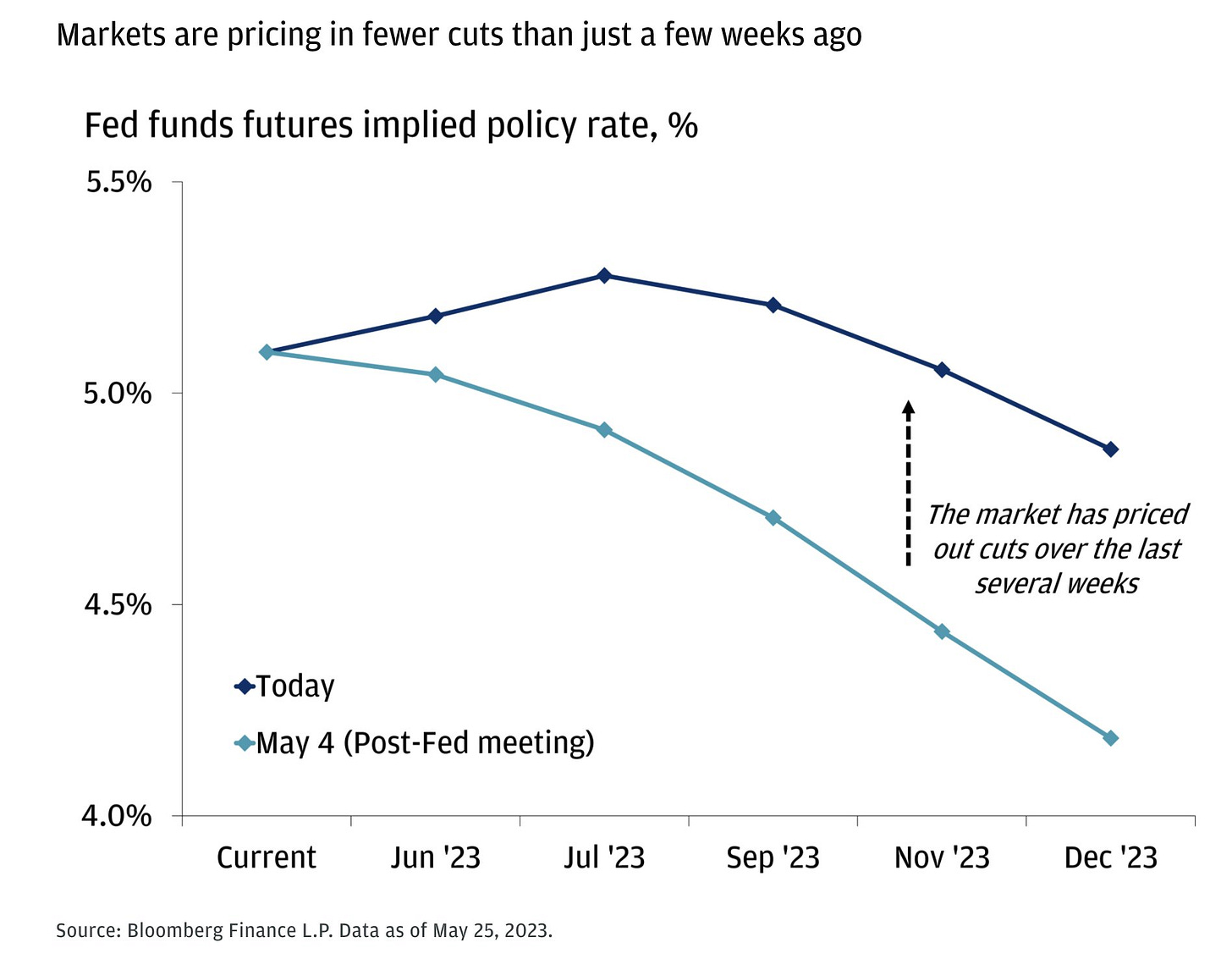

No rate-cuts this year?

Economy

The State of the Indian Economy Today: What do the Numbers Actually Say? (theindiaforum)

~

New, productivity-enhancing technology doesn't cause unemployment. What causes unemployment is if the benefits of this new technology are concentrated in the hands of the few. In that case new technology can increase supply without increasing demand commensurately, and the economy must adjust in the form of fewer jobs or more debt.

~

A deflationary shock is building in global manufacturing. Delivery times - very stretched post-COVID - are down across advanced economies (black), while input (red) and output (blue) prices are also normalizing fast. A wave of goods price deflation is coming.

Odds & Ends

In this lawsuit, a real-life, supposedly professional highly paid attorney relied on—wait for it—AI, namely, ChatGPT, to help him write his brief. ChatGPT hallucinated a bunch of non-existent legal citations—and the judge noticed. Now that lawyer is facing sanctions.

Meme of the Week

Watch the video here.