Leading Indicators

- are they worth it?

Wrote a note about using the OECD CLI series to time the NIFTY here: Macro: Timing the NIFTY 50. It looks like there is a tiny effect that could go away if the composition of our index shifts away from cyclical industries. Its an interesting effect, nonetheless.

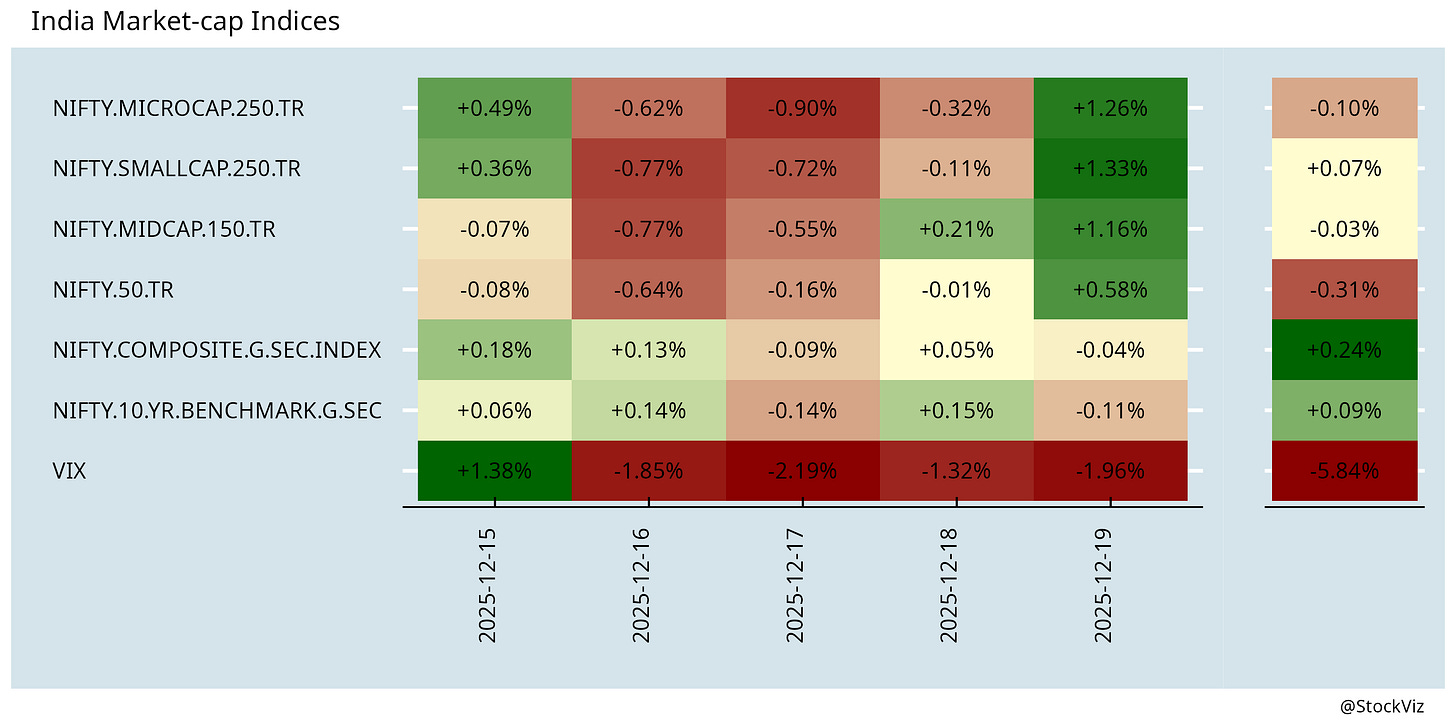

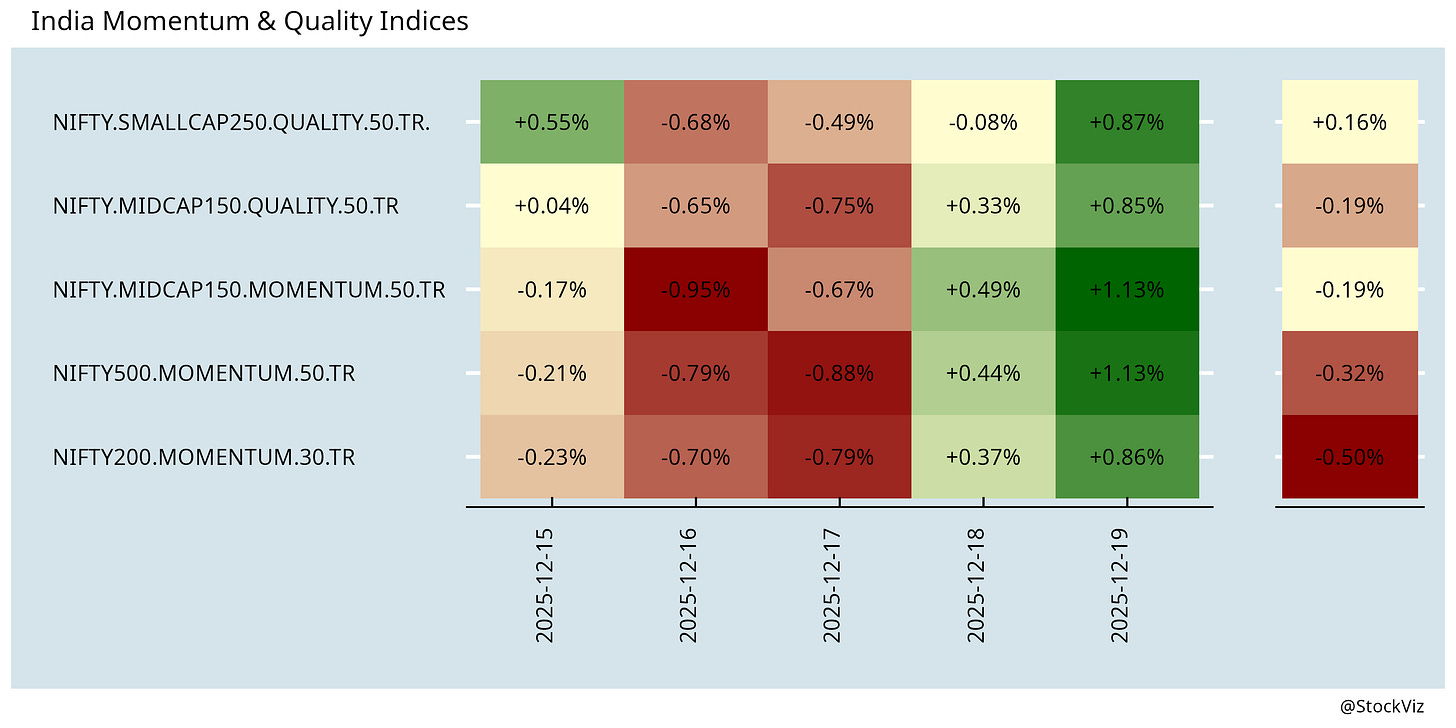

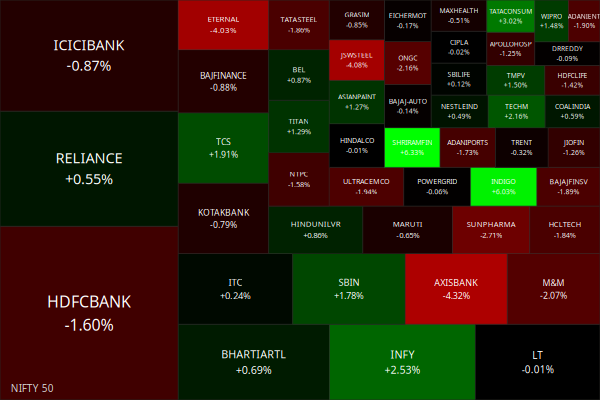

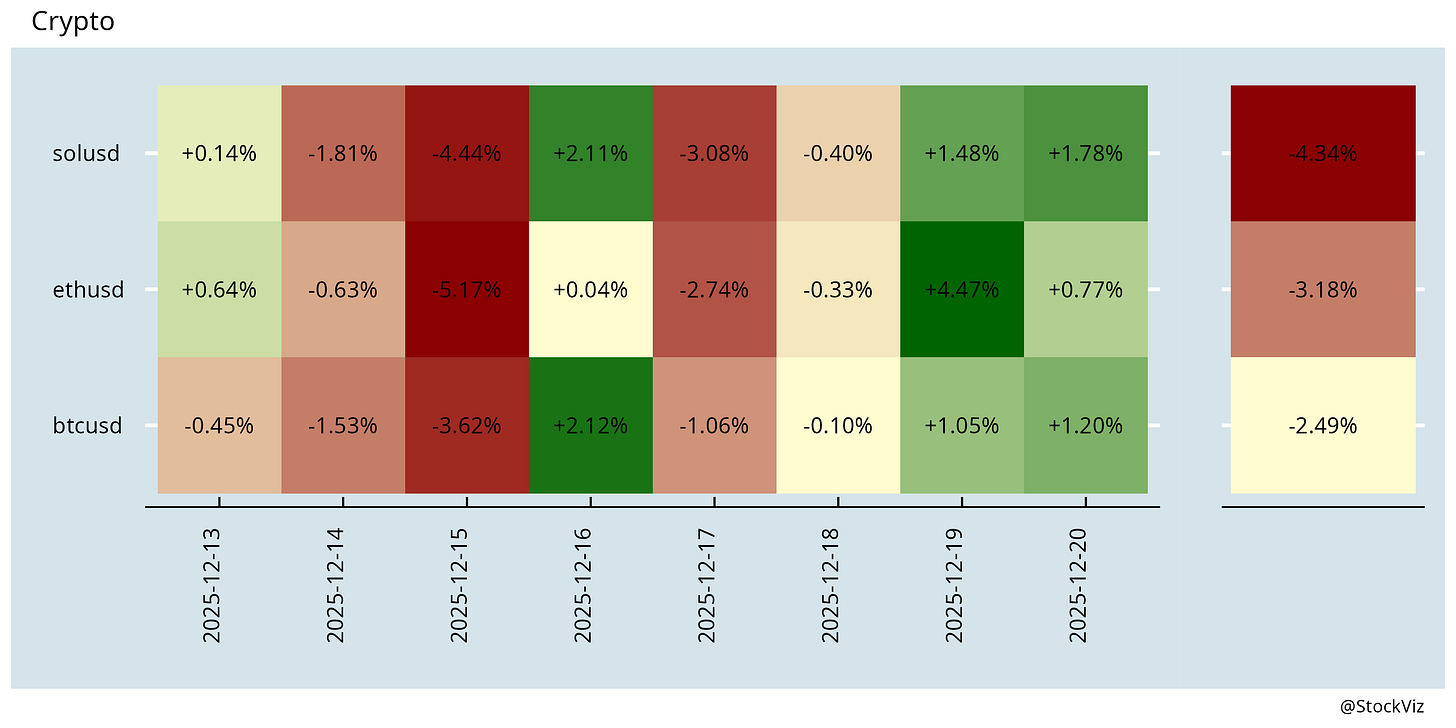

Markets this Week

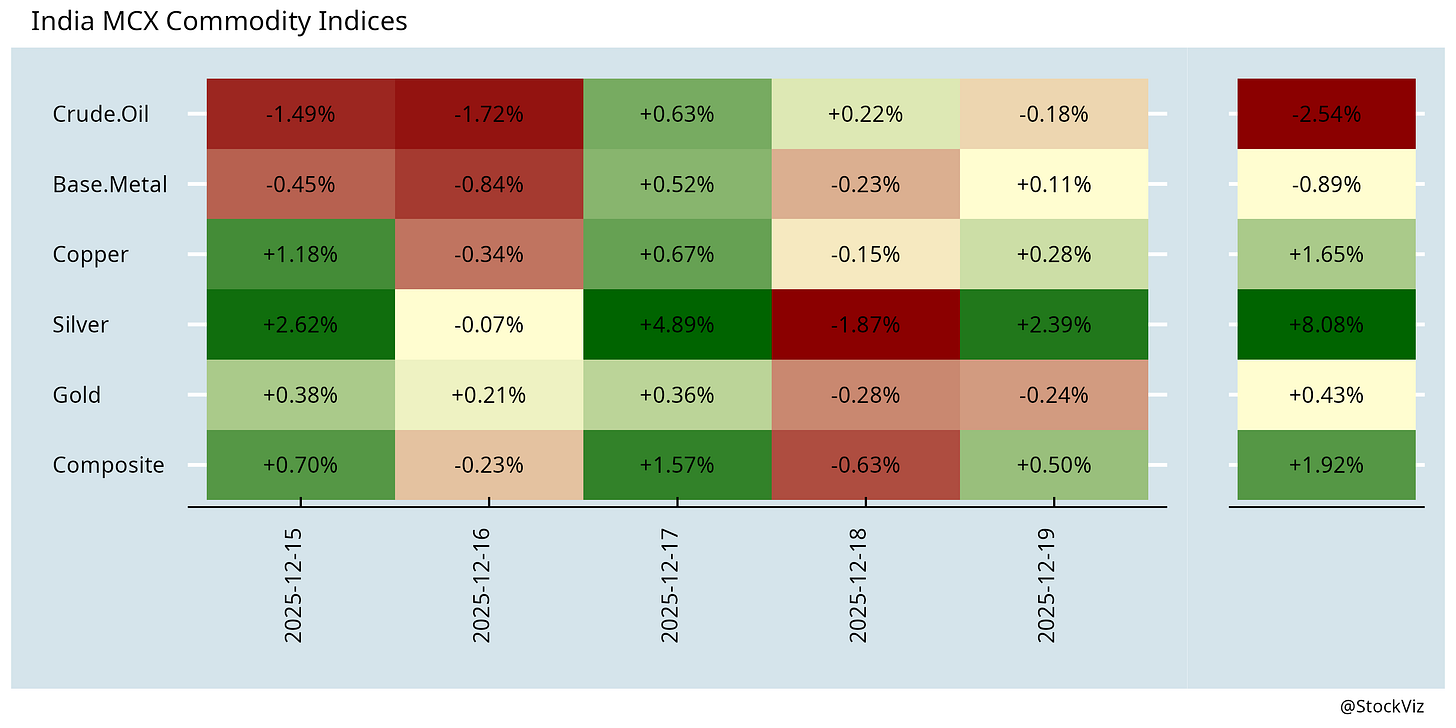

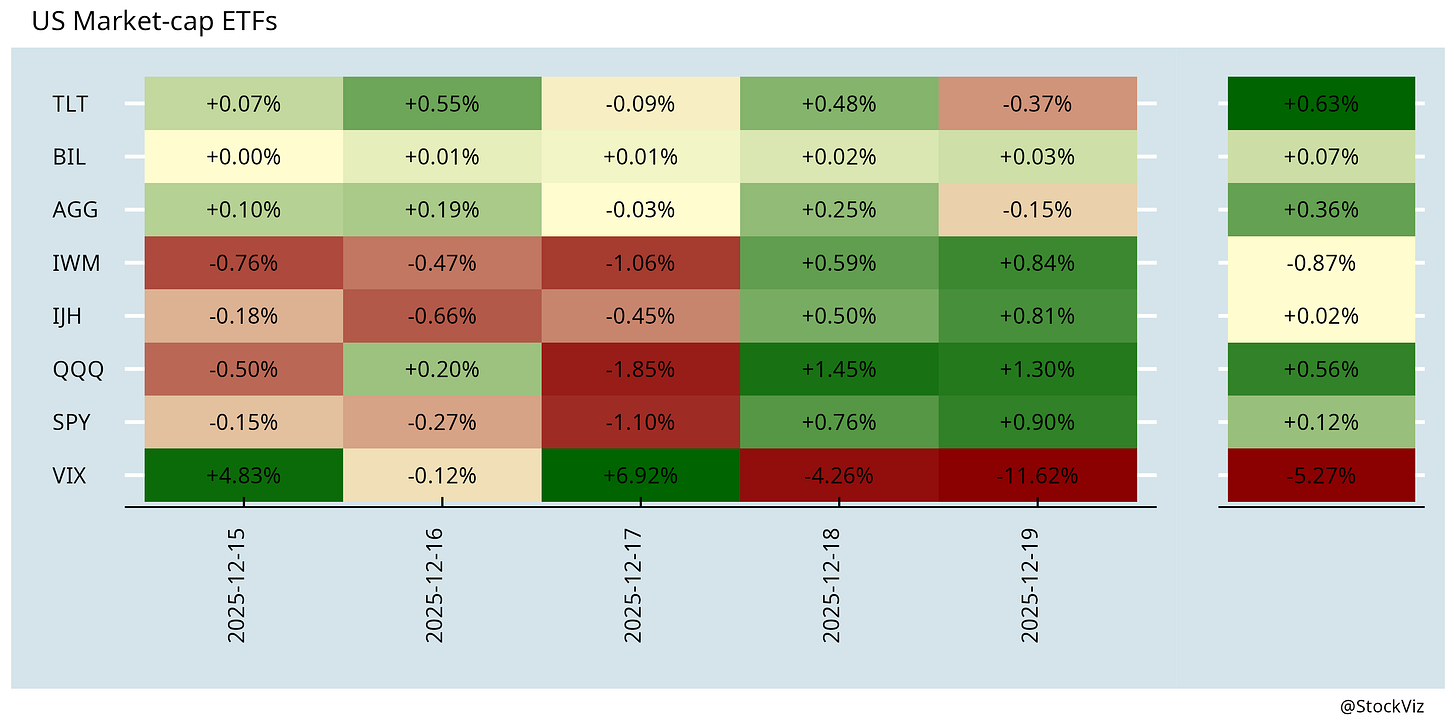

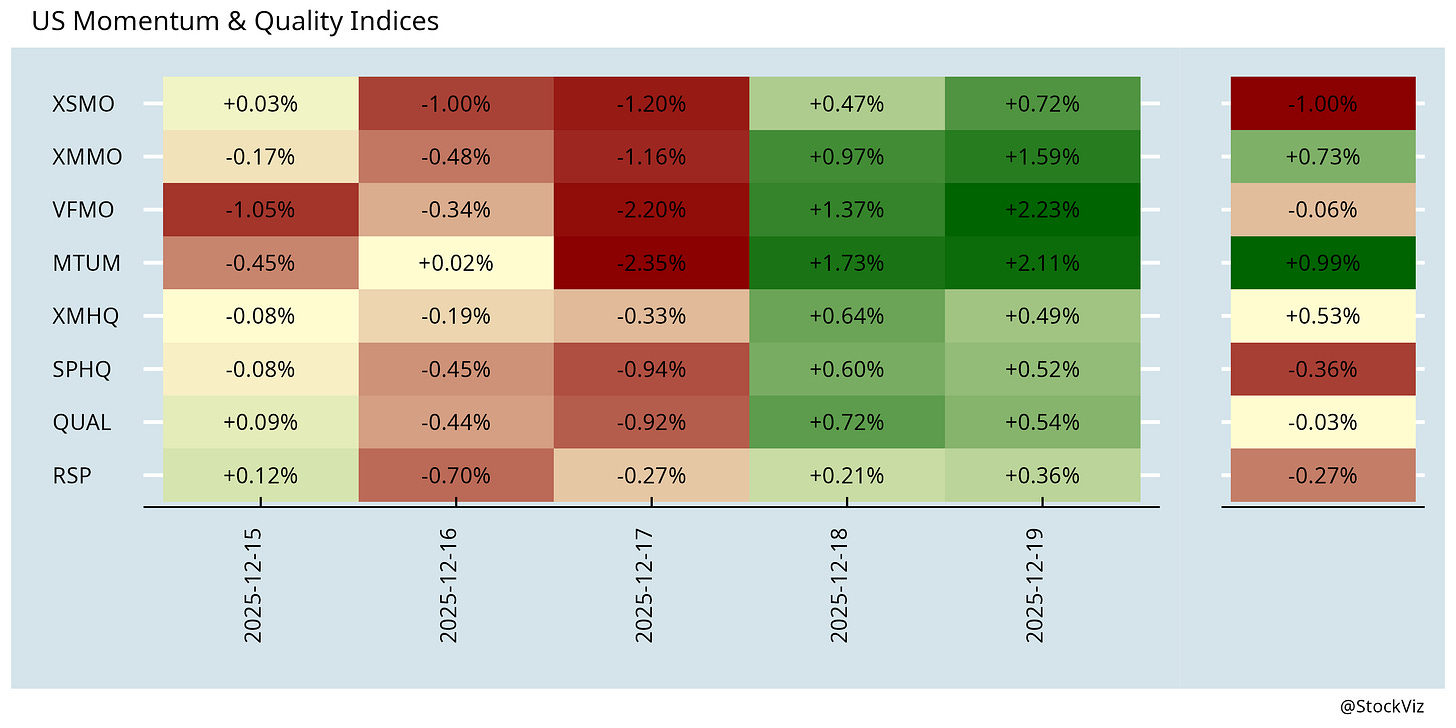

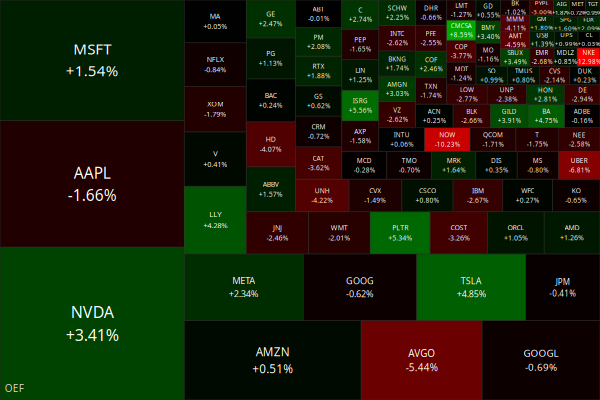

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

The Virtue of Complexity in Return Prediction (wiley)

Much of the extant literature predicts market returns with “simple” models that use only a few parameters. Contrary to conventional wisdom, we theoretically prove that simple models severely understate return predictability compared to “complex” models in which the number of parameters exceeds the number of observations. We empirically document the virtue of complexity in U.S. equity market return prediction. Our findings establish the rationale for modeling expected returns through machine learning.

Overnight Price Jumps and Short-Term Return Predictability (SSRN)

Cumulative overnight jump returns negatively predict short-term returns.

The Value of Stock Analysis in News (SSRN)

Financial journalism delivers material insights beyond regulatory disclosures, thereby enhancing price discovery in capital markets.

India

Infosys ADRs triggered two trading halts on the NYSE. They surged as much as 56%, touching a 52-week high of $30, before trading was paused (msn).

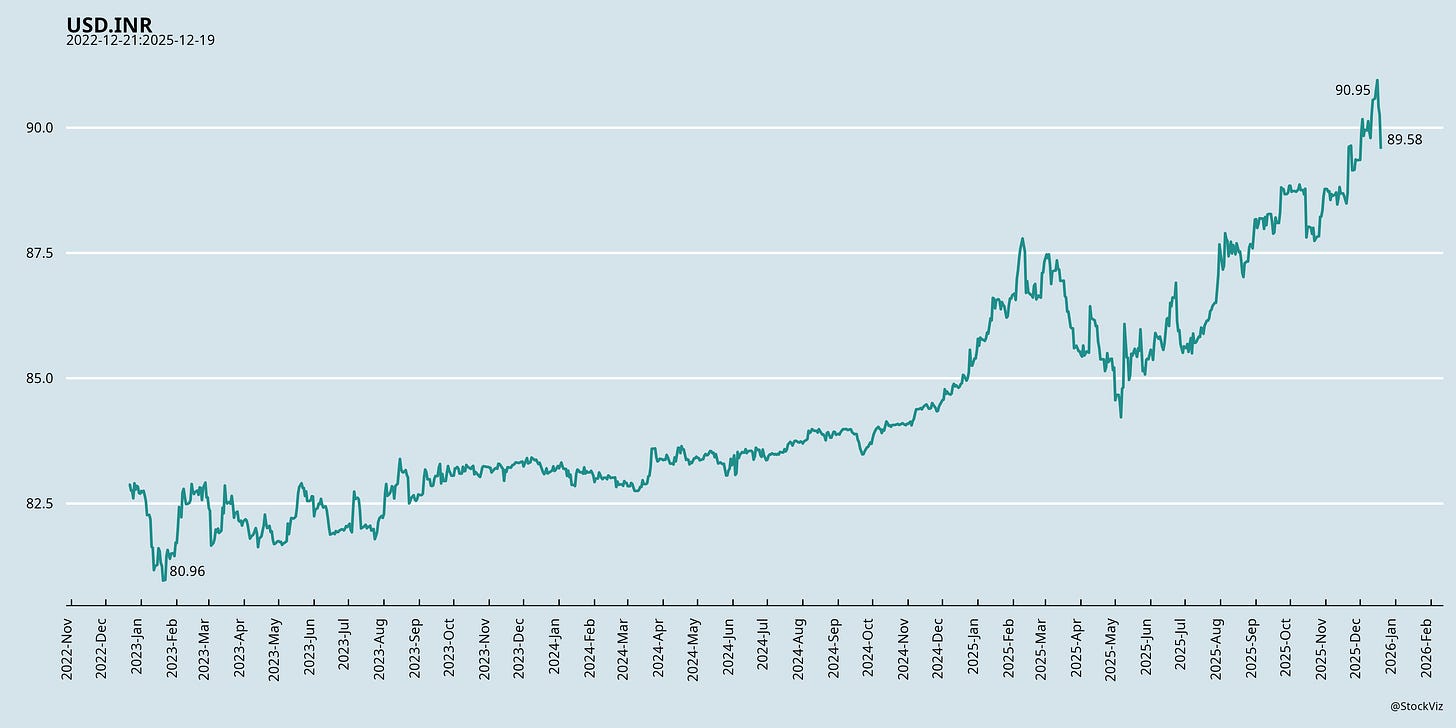

If India wants the rupee to reflect its domestic strength, it must urgently address the structural imbalance in its trade account. The long-term solution is a strategic national commitment to becoming a net exporter of both goods and services (livemint).

SHANTI: a landmark atomic energy bill that allows private and foreign companies to enter the nuclear power sector (thehindu, ndtv).

The Insurance Bill marks the industry’s biggest reform in decades (livemint)

India’s poorest households just lived through a decade of historic upgrade (pdf).

India recorded a 12% decline in foreign tourist arrivals in the first nine months of the year (January-September), compared to the previous year (livemint).

Adani, the JSW Group and Reliance Industries Ltd have disclosed their intent to manufacture turbines. For Suzlon Energy Ltd, India’s largest wind turbine maker and one of the few global survivors in a brutally cyclical industry, the timing is unsettling (livemint).

An unambitious elite and a working class held back by inadequate education and inequities of caste and gender are stymying the emergence of a global middle class in India (bloomberg).

row

America’s collapsing consumption is the world’s disenshittification opportunity (pluralistic).

Nasdaq plans to roll out round-the-clock trading of stocks (reuters).

Lessons from Roomba: sometimes being first mover sucks. iRobot’s sales took five years to double to $1.4bn by 2020, but just three years to halve from their 2021 $1.6bn peak (ft).

Tesla is the most unreliable used car brand in America, even behind Jeep and Chrysler (techspot).

China’s massive regreening effort has altered the country’s hydrology, shifting more precipitation to some areas while drying out others (popularmechanics).

Coupang data breach: some 33.7 million customer accounts - more than half of South Korea's roughly-52 million population - were likely exposed (bbc).

A.I.

Why Huawei Can’t Catch Nvidia and U.S. Export Controls Should Remain (cfr)

AI will work its way up the legal hierarchy. First the gruntwork, then the drafting, the citation, the argumentation. Eventually the majority of legal jobs will be replaced (spectator).

Copywriters were one of the first to have their jobs targeted by AI firms. These are their stories, three years into the AI era (bloodinthemachine).

Odds & Ends

More than half of Parkinson’s research dollars in the past two decades have flowed toward genetics. But Parkinson’s rates in the US have doubled in the past 30 years. And studies suggest they will climb another 15 to 35 percent in each coming decade. This is not how an inherited genetic disease is supposed to behave (wired).

Hey, great read as always; your exploration of complex models for return prediction and machine learning, a fascinating read even for a Pilates enthusiast, is so insightful.

That China hydrology link is wild. They've planted billions of trees and it's literally redistributing rainfall patterns across the country. The thing about massive reforestation is that transpiration from all those new trees pulls moisture inland from coastal regions, which sounds great until you realize you're just shifting water problems around rather than solving them.

I saw similar effects in an Ethiopia reforestation project where increased tree cover boosted local precipitation by about 8% but reduced downstream flow to neighboring regions. When you're engineering climate at that scale, second-order effects start mattering alot. China's betting they can model this accurately enough, but hydrological modeling breaks down fast when your dealing with nonlinear feedback loops.