In my younger days, I used to take the night bus between Bangalore and Mangalore while visiting my folks there. The toughest part of the 6-hour journey was crossing the “ghats” - a dozen vertical hairpin bends in the middle of the night with oncoming traffic.

The bus operators typically run the route with two drivers. One of them is the ghats specialist and the other one handles the rest. Driving the ghats is all about intense focus for a couple of hours - think of it as a sprint. The rest of the stretch requires someone who can manage traffic for 4-5 hours - a marathon, if you will.

Investment management is a bit like the Bangalore-Mangalore road trip. You spend most of your time on straight highways - bull markets where stocks drift higher. But for a short period of time, you’ll have hair-raising hairpin bends - bear markets where stocks go crazy.

Since markets spend most of their time in bull markets, most managers are experts at highway driving. When it comes to navigating a bear, the best they can do is hang onto their jobs. i.e., not crash.

As an investor, it is important to know what you are paying for. Managers who outperform everybody in a bull are unlikely to survive a bear. Its just not in their DNA. Similarly, those who come out on top of a bear rarely go on to outperform when the market turns.

The most glaring example is Wood vs. Buffett.

Wood’s probably not going to survive this bear but Buffett is never going to “ride the next wave.”

Investors should know what they are getting into before they pick active fund managers. It is a three way bet on the driver, the bus and the road.

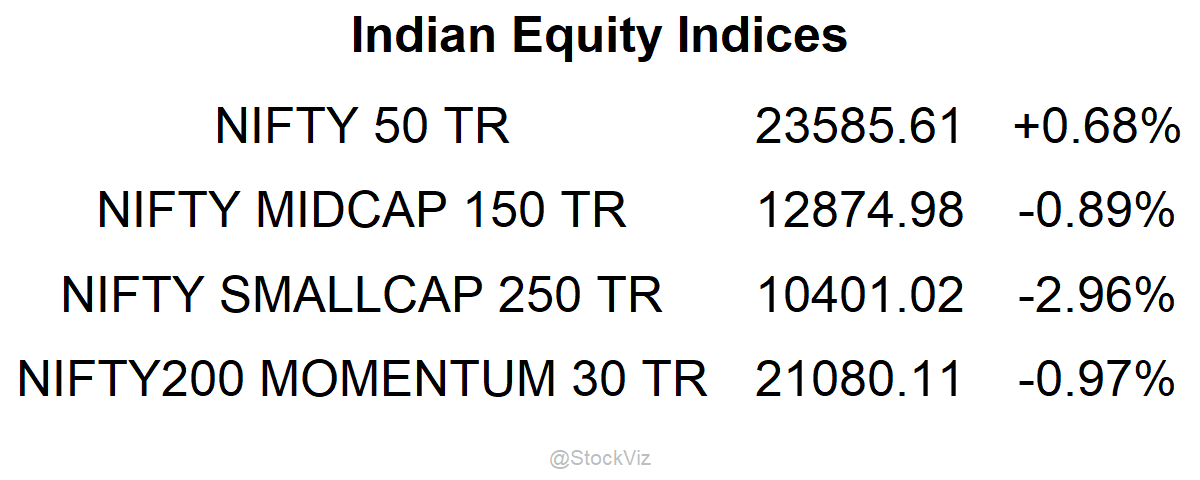

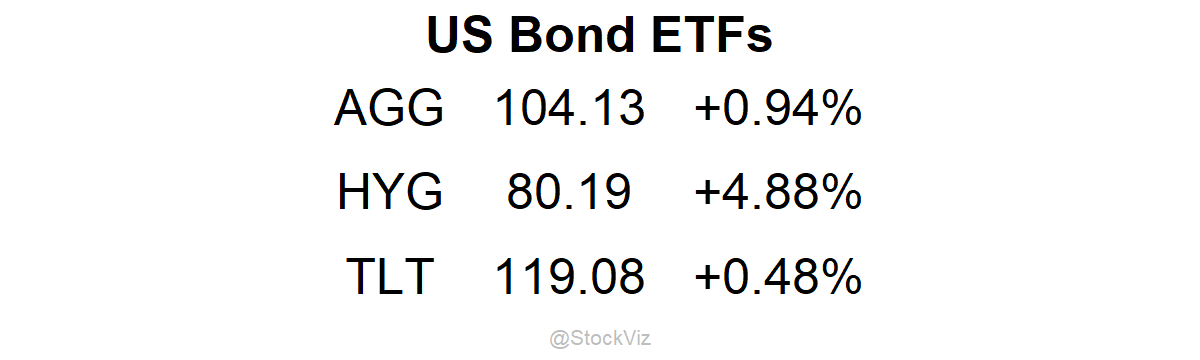

Markets this Week

It looks like the flavor of the season are export bans and windfall taxes. India banned the export of wheat, restricted the export of sugar and rice is probably next. Oil producers, who were staring at the abyss of negative oil just two years ago, are now the new villians who are making obscene profits at the expense of the common man and should be taxed.

This madness will continue until something breaks.

Links

Covers of The Economist and Time Magazine that point in a direction for a particular asset class are contrarian. They work as contrary indicators in both directions. (mbrentdonnelly)

The Delhi smog was caused by farmers burning stubble. (indianexpress)

After the plague, comes famine. (wapo)