We built on our liquidity discussion from last month here: Market-cap Deciles and Illiquidity.

During bull markets, there is always a pattern of traders screening for low float stocks and pumping them on social media. Investors, seeing the prices go up, pile into them. And for a while, all is well. However, when the cycle inevitably turns, the very illiquid nature of these stocks that ramped the prices up will throw them over a cliff.

The liquidity that you find during bull markets can make you complacent. Don’t let your guard down!

Markets this Week

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

A voting machine or a weighing machine? (outcastbeta)

Valuation changes account for 96.9% (yearly horizon) to 72.6% (40-year horizon) of the variance in real total returns. Valuation changes are so dominant that a clairvoyant capable of foreseeing real fundamental returns for the next 10-year period essentially struggles to predict real total returns.

Causal Peer Effects on Household Spending, Beliefs and Happiness (nber)

Individuals with exogenously higher perceived relative income become more opposed to redistribution. Also, believing that one earns more than peers causally leads to large positive effects on happiness.

The Impact of the Great Recession on Mortality and Welfare (nber)

An increase in the unemployment rate of the magnitude of the Great Recession reduces the average, annual age-adjusted mortality rate by 2.3 percent, with effects persisting for at least 10 years. Mortality reductions appear across causes of death and are concentrated in the half of the population with a high school degree or less.

India

Investors dig into India's stock market as China flounders, discount risks (reuters)

The NRI share in annual home sales, which was sub-10% before 2020, increased to 15% in 2023, and will touch 20% by 2025. (livemint)

Multiple data sources suggest a decline or at best a deceleration in the income earned by working Indians in the last five years. (livemint)

For the first time in 2023, consumption gaps between urban and rural markets are narrowing. (reuters)

RoW

Morningstar Calls Cathie Wood The Worst 'Wealth Destroyer' (investors)

Can Anyone Challenge the Economic Dominance of the United States? (awealthofcommonsense)

US bank in trouble because of commercial real estate exposure. (reuters)

US Commercial Real Estate Contagion Is Now Moving to Europe (bloomberg)

The Hole In Boeing’s Inspection Program (levernews)

US Solar Boom Opens $2 Billion Indian Door to Banned Products From China (bloomberg)

Renewable energy sector leaders in India have listed Chinese vendors as major suppliers in the PLI scheme. (livemint)

China spent 20 years destroying emerging-market competitors in the manufacturing space, or at least squeezing them out of global markets. Now it’s threatening to do the same to advanced economies’ manufacturers. (ft)

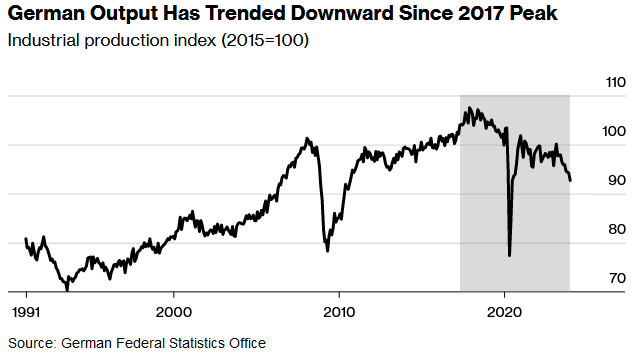

Germany’s Days as an Industrial Superpower Are Coming to an End (bloomberg)

A.I.

Finance worker pays out $25 million after video call with deepfake ‘chief financial officer’ (cnn)

OpenAI CEO Sam Altman seeks as much as $7 trillion for new AI chip project (cnbc)