MADness

A good idea violently executed...

What happens if you create a portfolio by rank ordering stocks by their moving average distances?

You get a beautiful backtest: MAD – Moving Average Distance

But will it survive post-publication crowding? Only time will tell.

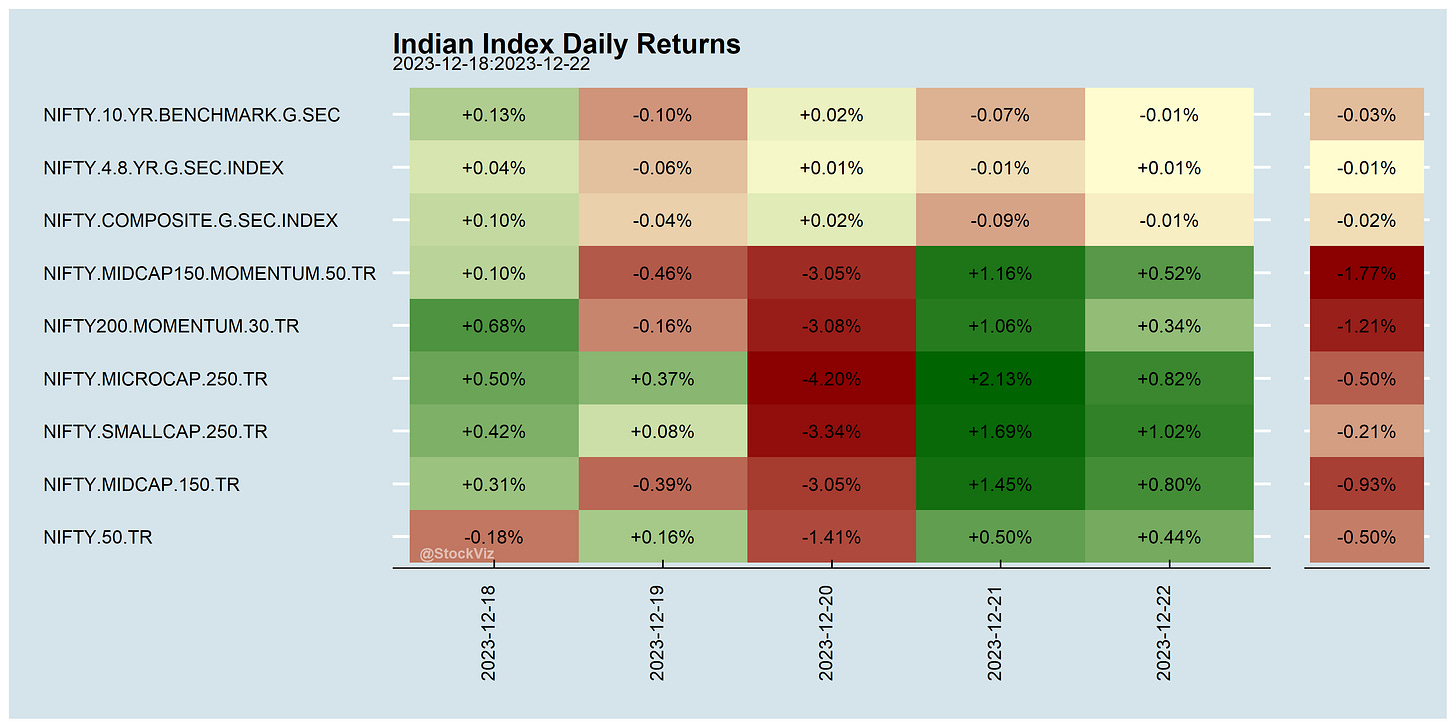

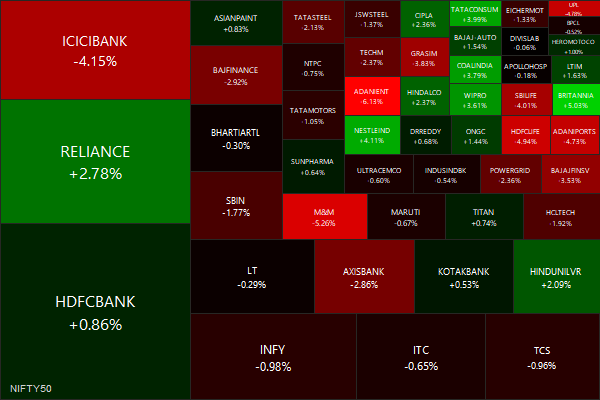

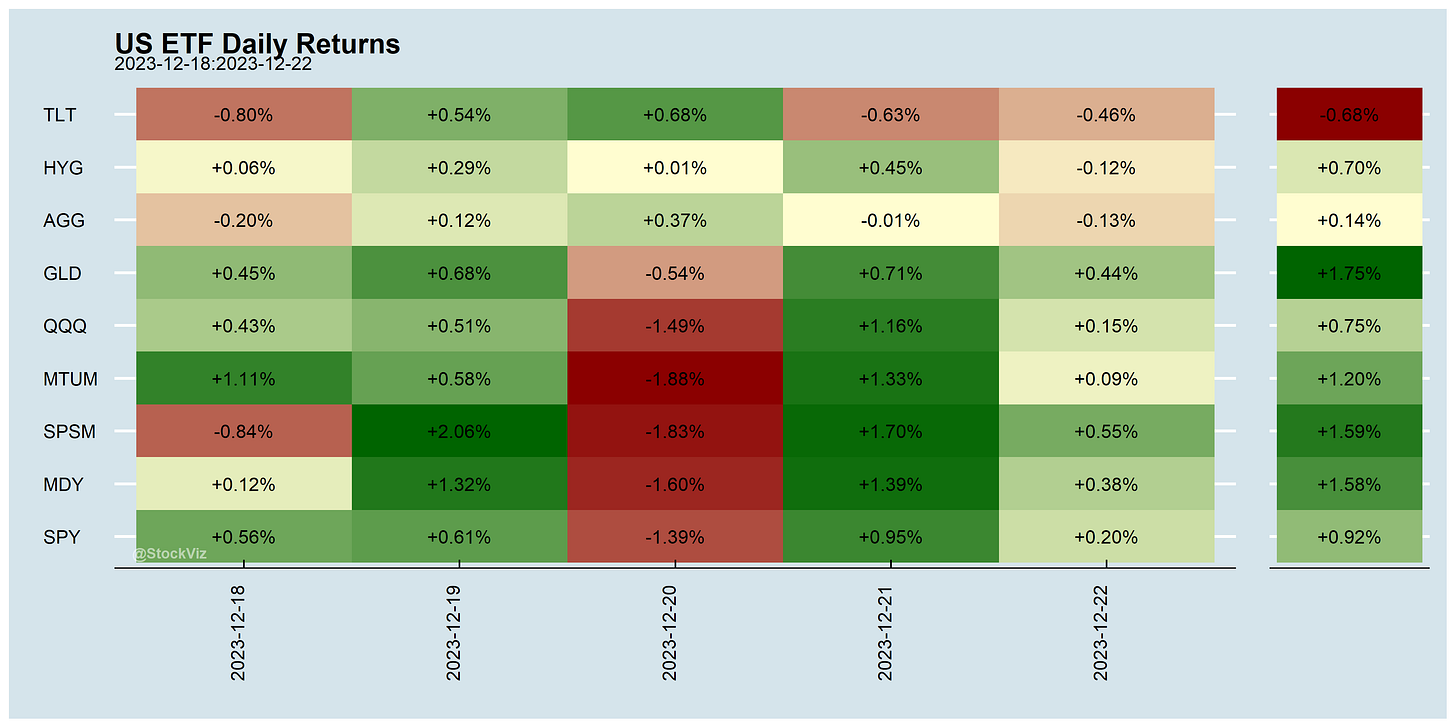

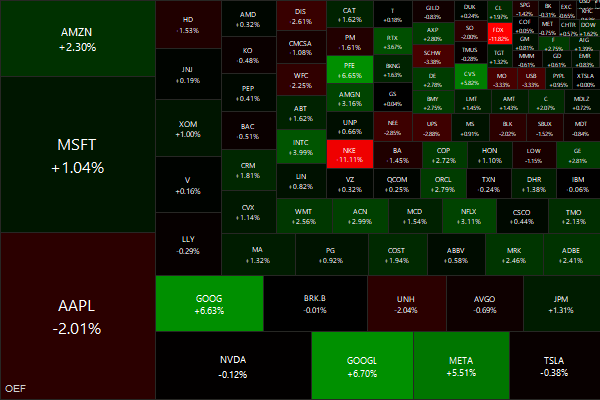

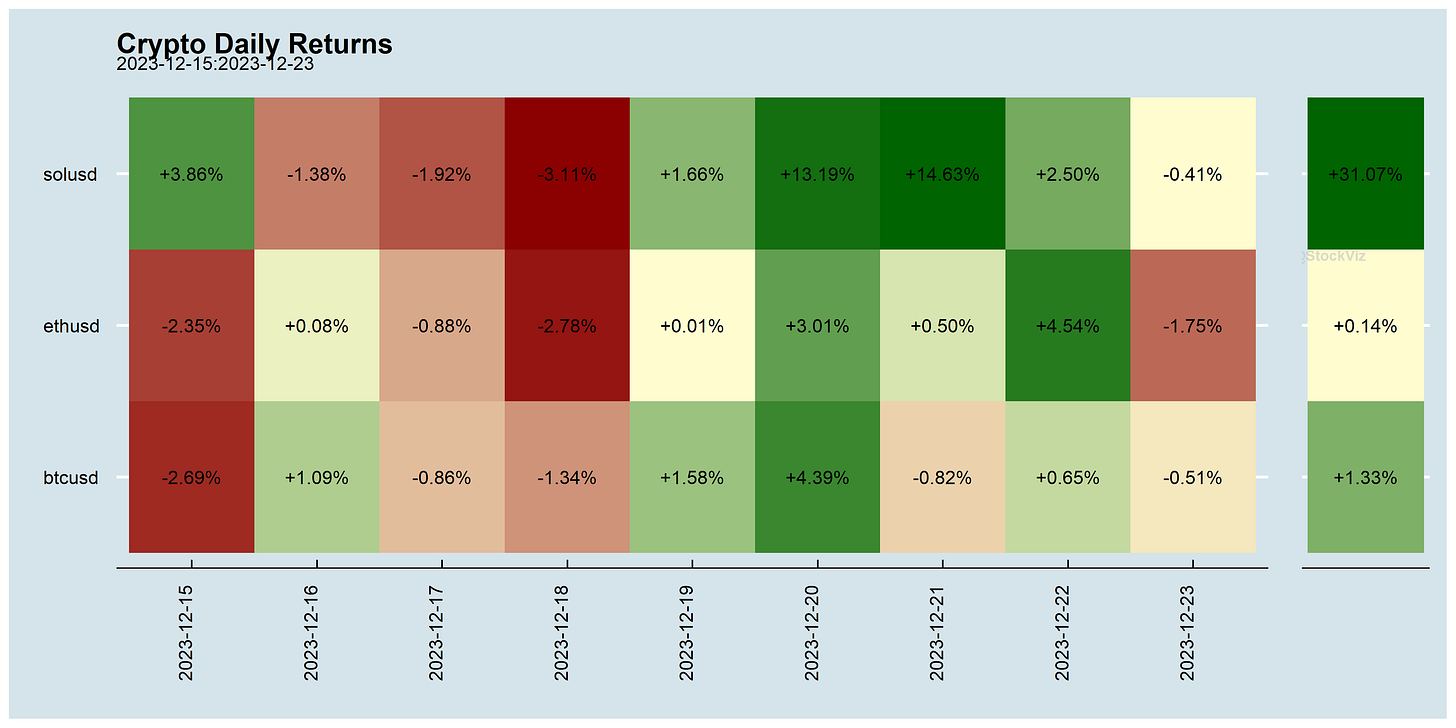

Markets this Week

What happened on Wednesday?!

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

Momentum: Evidence and Insights 30 Years Later (SSRN)

Since Jegadeesh and Titman (1993) documented the momentum effect in the US 30 years back, the literature has grown substantially. This paper evaluates various explanations for the phenomenon and reviews more recent literature.

Momentum and Illiquidity Premium in Indian Stock Market (SSRN)

Illiquid winners outperform liquid winners by an average 2.7% per month. The performance of momentum strategy could be enhanced by conditioning on past illiquidity. This remains robust after adjusting for size and value effect.

The Temptation of Factor Timing (alphaarchitect)

Rather than trying to predict the unpredictable, investors can be better served integrating multiple premiums and staying disciplined to reap the potential long-term rewards in the ever-changing market.

The Rise of Passive Investing and Active Mutual Fund Skill (SSRN)

As passive investment rises, investors identify the skill of active managers faster, leading unskilled managers to exit the active mutual fund industry. Because unskilled active managers increase noise in stock prices, greater passive investing improves market efficiency as unskilled managers exit.

Central Bank Digital Currency: Assessing the Risks and Dispelling the Myths (SSRN)

From expanding financial surveillance to destabilizing the financial system, CBDCs could impose enormous costs on citizens.

Why Do Poor People Commit More Crime? (marginalrevolution)

Investing & Economics

King Coal (iea)

The Big Cloud Exit FAQ (hey)

World economy on brink of ‘cold war two’, Gita Gopinath (theguardian)

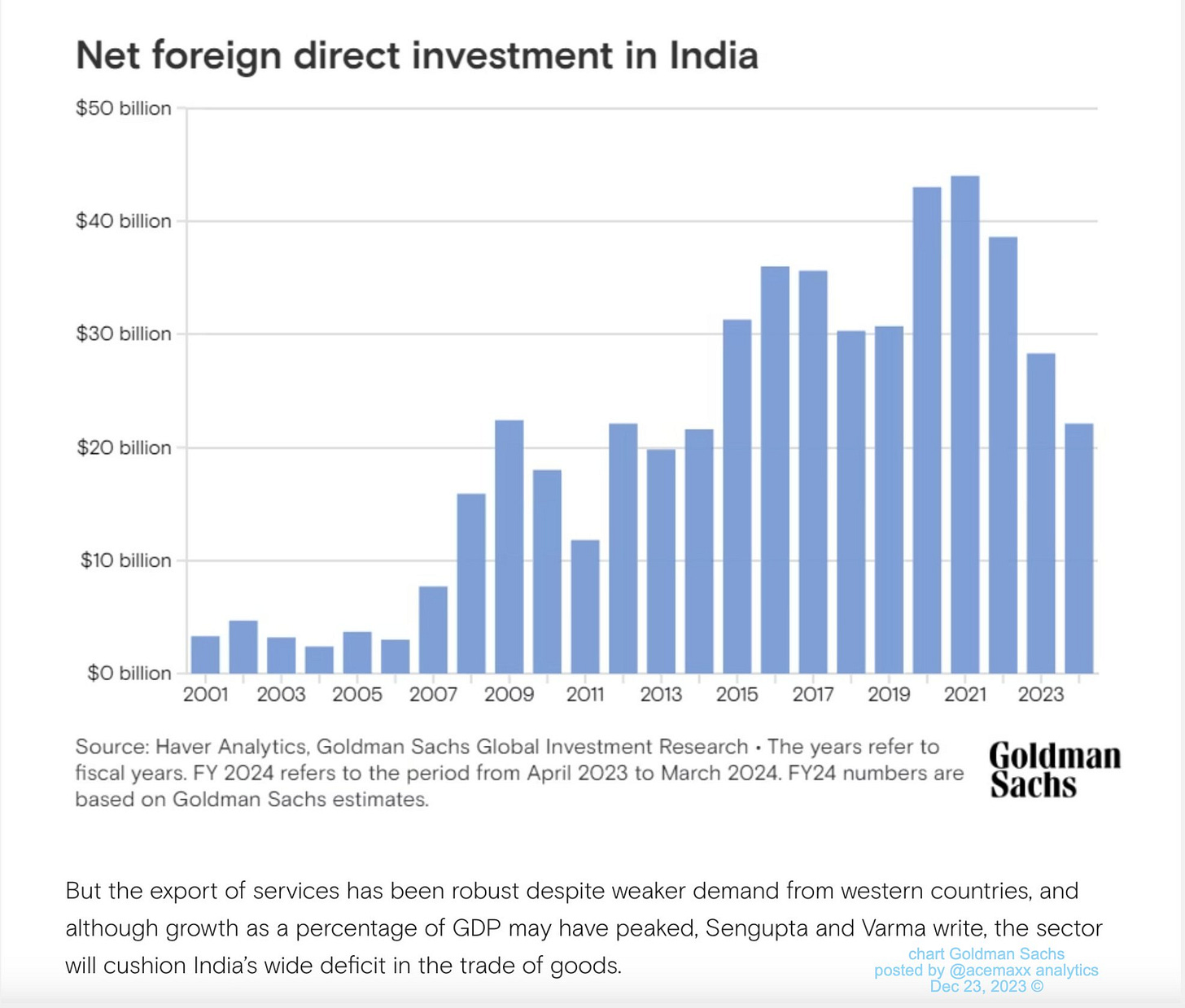

India

New telecom bill set to approve administrative allocation for satellite broadband services (livemint, livemint)

The RBI barred entities regulated by it, including banks and non-banking finance companies (NBFCs), from investing in alternate investment funds (AIFs) that have investments in existing and recent borrowers. (reuters)

The RBI’s new rule barring banks and non-banks from investing in alternative investment funds (AIFs) having downstream investments in debtor funds is impractical (livemint)

SEBI is getting serious about T+0 settlement (reuters)

RoW

China’s students once attended graduate school in droves. Today, they have other plans (scmp)

A New Wave of Chinese Middle-Class Migrants Is Coming to the US. They are part of a growing group from China who are crossing the US border illegally, seeking asylum and a better life (bloomberg)

How to sneak billions of dollars out of China (economist)

Greedflation: corporate profiteering ‘significantly’ boosted global prices, study shows (theguardian)

Will we see a repeat of the past decade of U.S. equity returns? (aqr)

Americans Over 70 Hold More Than 30% of the Country’s Wealth (bloomberg)

ProShares to launch S&P 500 ETF with zero-day call options (reuters)

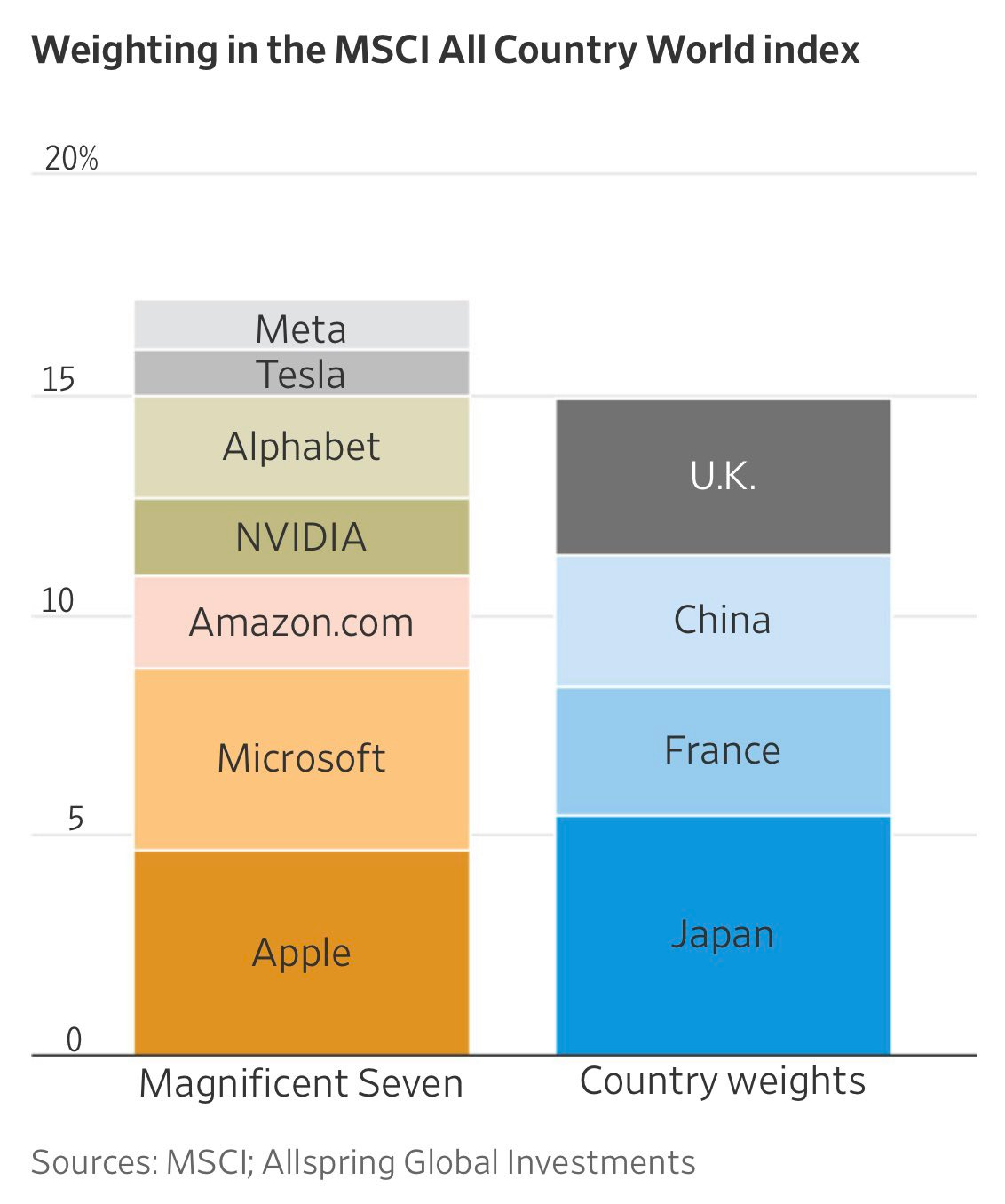

US equity market is dominated by the Mag7.

A.I.

A Chinese professor used AI to write a science fiction novel. Then it was a winner in a national competition (scmp)

You can make great music, whether you're a shower singer or a charting artist. No instrument needed, just imagination. (suno.ai, tweet)

AI is a danger to the financial system (CNN)