A lot of froth that was built up in the market is getting cleared out and its painful to watch. Do you know the last time this happened? It was two years ago.

2023-now:

2020-2022:

Back then, FIIs started selling in November 2021 and continued to do so for almost a year. Midcaps drewdown 21% and Smallcaps 27%. Flows came back only in August 2022. This time, FII flows turned negative in November last year. Midcaps are down 18% and Smallcaps 22%. When will it turaround?

The timing of these events is anyone’s guess. Market bottoms are a process and it might take a few more months before we can definitely say that the worst is behind us. But the point is that FIIs did come back. Markets did recover and go on to make multiple all-time-highs. The cycle did turn.

All this to say, market corrections and recoveries are part of life. This too shall pass.

This week, we turned our sights on Binance and looked at the liquidity of various coins listed there: Binance Liquidity

Markets this Week

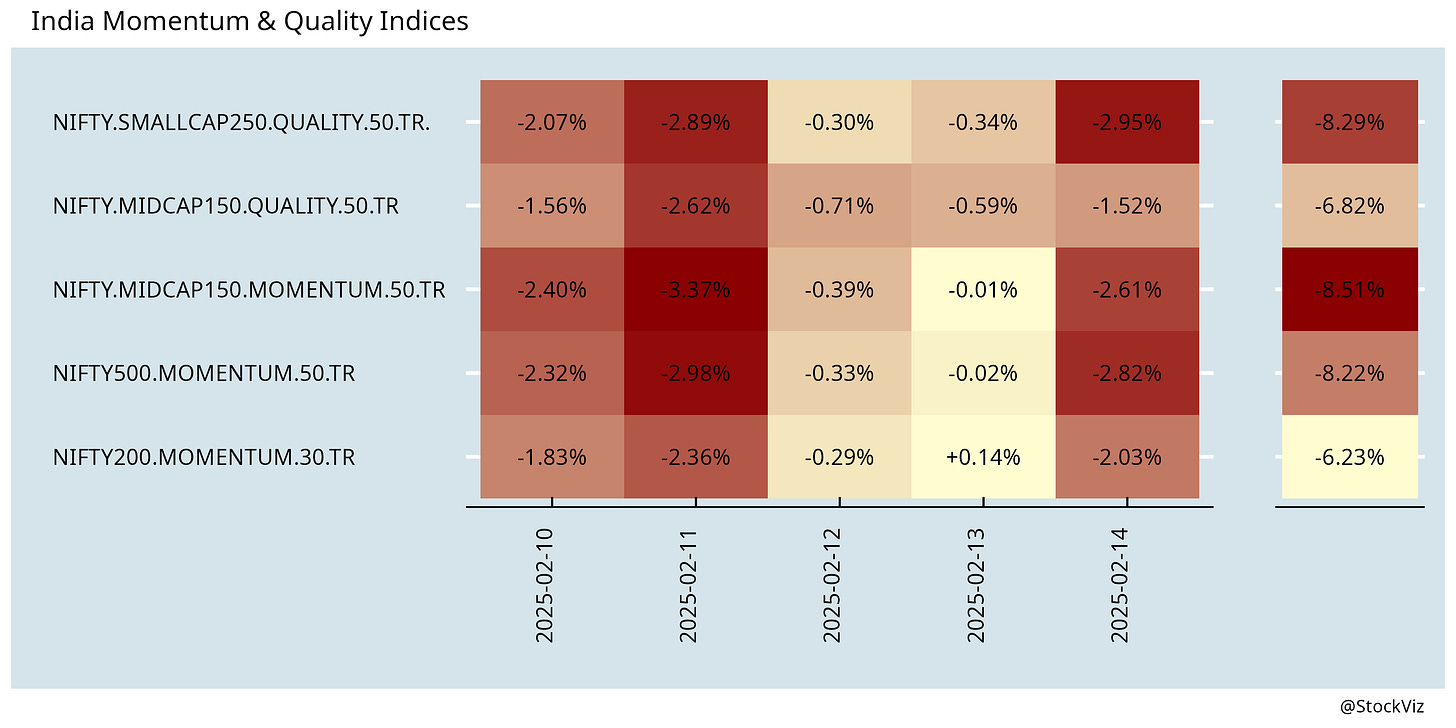

Roses are red and so were the markets…

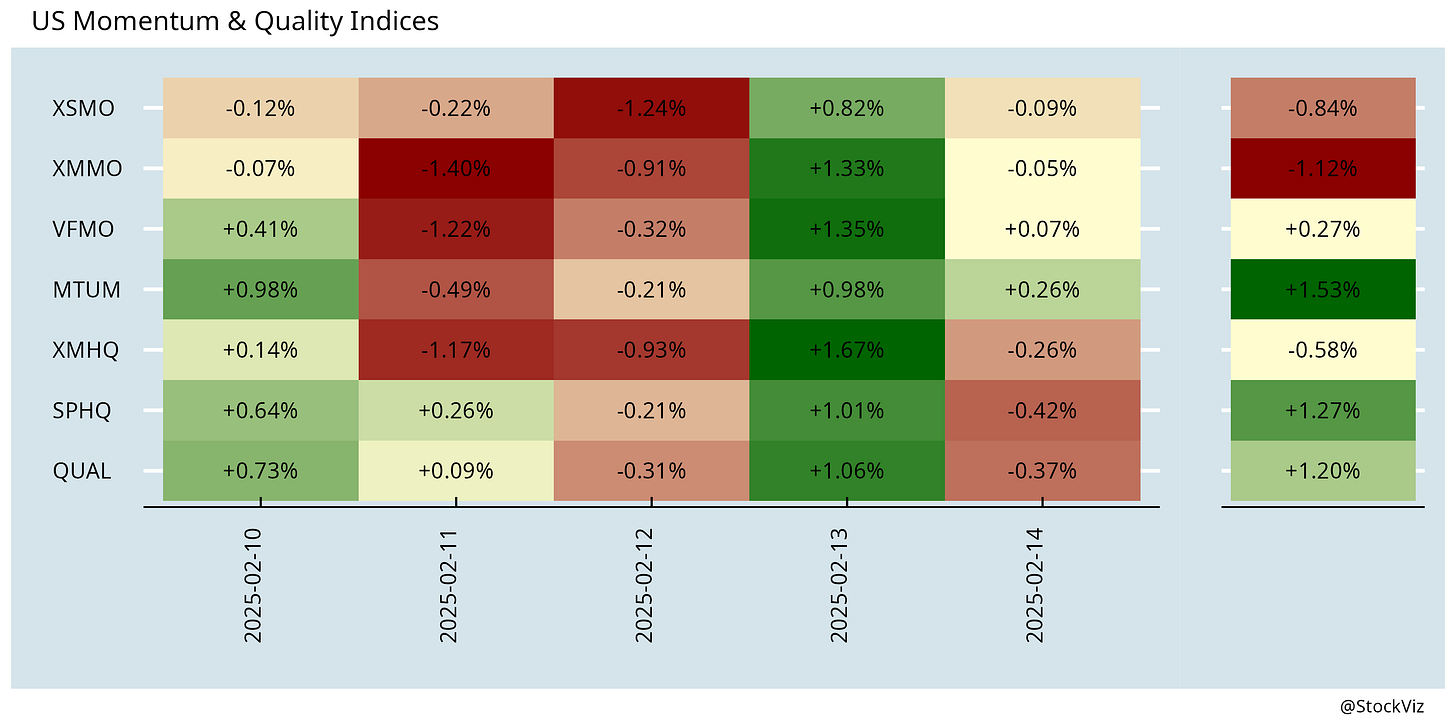

… tech to the rescue!

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

The Unintended Consequences of Rebalancing (SSRN)

Institutional investors engage in trillions of dollars of regular portfolio rebalancing, often based on calendar schedules or deviations from allocation targets. We document that such rebalancing has a market impact and generates predictable price patterns. We estimate that current rebalancing practices cost investors about $16 billion annually. Moreover, the predictability of these trades enables certain market participants to profit by front-running the orders of large institutional funds.

The Ability to NAV Time Interval Funds (alphaarchitect)

Highly illiquid assets trade infrequently making it difficult to know their true market value. To address this issue, funds that invest in illiquid assets create fair valuation estimates at periodic intervals. These valuation estimates determine the share values at which interval and tender offer funds issue and redeem their shares. Because the true value is uncertain, wealth transfers can be created between buy-and-hold investors and those entering and leaving the fund to the extent that the fair valuation estimate is different from the true value.

The Low-Vol Effect in Crypto (efalken)

Using data from January 2018, we can see that there has been a substantial low volatility return premium in crypto.

Childbirth and Firm Performance (NBER)

Using multiple administrative data sources from Norway, we examine how firm performance changes after entrepreneurs become parents. Female-owned businesses experience a substantial decline in profits, steadily decreasing to 30% below baseline ten years post-childbirth. In contrast, male-owned businesses show no decline, often growing in revenues and costs after childbirth. The profit decline for female-owned firms is most pronounced among highly capable entrepreneurs, women who are majority owners, and those with working spouses. Entrepreneurial effort is key to performance, and our findings suggest that time demands from childbirth and childcare are a significant determinant of the decline in firm profits.

Student Loan Forgiveness (NBER)

We find that student loan forgiveness led to increases in mortgage, auto, and credit card debt by 9 cents for every dollar forgiven. Borrowers’ monthly earnings and employment fell, at increasing rates for each month post forgiveness.

Investing

India

Nothing new in India’s new income tax bill except an erosion of citizen’s privacy. (reuters)

India's new central bank chief Sanjay Malhotra is likely to take a growth-supportive approach over the next few months, as he joins Prime Minister Narendra Modi's government in its efforts to pull the economy out of a slowdown. (reuters)

An economy cannot pursue an independent monetary policy, maintain a fixed exchange rate and have free flows of capital at the same time. It must sacrifice one of these three objectives. The Impossible Trinity. (livemint)

With just about 1% of Indians expected to fund about a third of the government’s gross tax revenue next fiscal year, India has a taxation problem. It is not about high rates, but about who actually pays. (livemint)

How an ERP system led to a $1.4 billion tax dispute in India (livemint)

row

Foreign students represent 22% of all enrolments at higher education institutions in the UK, 24% in Australia and 30% in Canada. The US hosts the largest number of international students at 1.1 million. (livemint)

The new economic philosophy that dominated during the Biden years emphasized demand over supply. It considered concerns over budget constraints overstated and placed its faith in predistribution as a way to change the trajectory of the macroeconomy. It promised policies that could simultaneously transform industries, prioritize marginalized groups in procurement and hiring practices, and serve broad social goals. Ultimately, this post-neoliberal ideology and its adherents did not take tradeoffs seriously enough, laboring under an illusion that previous policymakers were too beholden to economic orthodoxy to make real progress for people (foreignaffairs)

Trump’s tariff fixation is part of a global economic plan that is solid. He understands how raw economic power, not marginal productivity, decides who does what to whom — both domestically and internationally. (unherd)

The economic outlook on tariffs is not straightforward. The impact of tariffs on inflation and prices is influenced by a variety of factors, and their effects are not always as significant as they may initially seem. (deerpointmacro)

Thanks to climate change, soaring home prices in the United States may have peaked in the places most at risk, leaving the nation on the precipice of a generational decline. (nytimes)

Chinese producers, facing weak demand at home and harsher conditions in the United States, where they sell more than $400 billion worth of goods annually, have no choice but to rush to alternative export markets all at the same time. But no other country comes even close to U.S. consumption power, significantly limiting the production the rest of the world could absorb from its second-largest economy. (reuters)

Marriages in China plunged by a fifth to the lowest level on record last year, a setback to efforts by the government to reverse a demographic crisis threatening the world’s second-biggest economy. (bloomberg)

Hedge Funds Are Pocketing Much of Their Clients’ Gains (bloomberg)

Meta plans to work on its own humanoid robot hardware. Meta’s goal is to provide what Google’s Android operating system and Qualcomm Inc.’s chips did for the phone industry by building a foundation for the rest of the market. (bloomberg)

Waymo is taking dollars from Uber (earnestanalytics). 2025 is looking peak disruption for the human-centric rideshare model in the US (platformaeronaut).

Odds & Ends

Dating AIs - a survey (wired)

The commonly-held belief that attempting to suppress negative thoughts is bad for our mental health could be wrong (cam)

Between learning and forgetting, there is storage and retrieval that most probably follows Moores laws for human neurons