Back in the 70’s, there was alpha in knowing a bit of high-school geometry and having a subscription to chart books.

Unfortunately, some ideas from the 70’s fail to go away. Like technical analysis. Every few years into a bull market, we have a new crop of college students who rediscover these concepts and shoehorn it into the CAPM/Fama-French framework.

This week, we replicated an academic paper that constructs a portfolio based on a “trend factor”. You can read more here: Trend Factor. We were not really surprised that it was a disappointment.

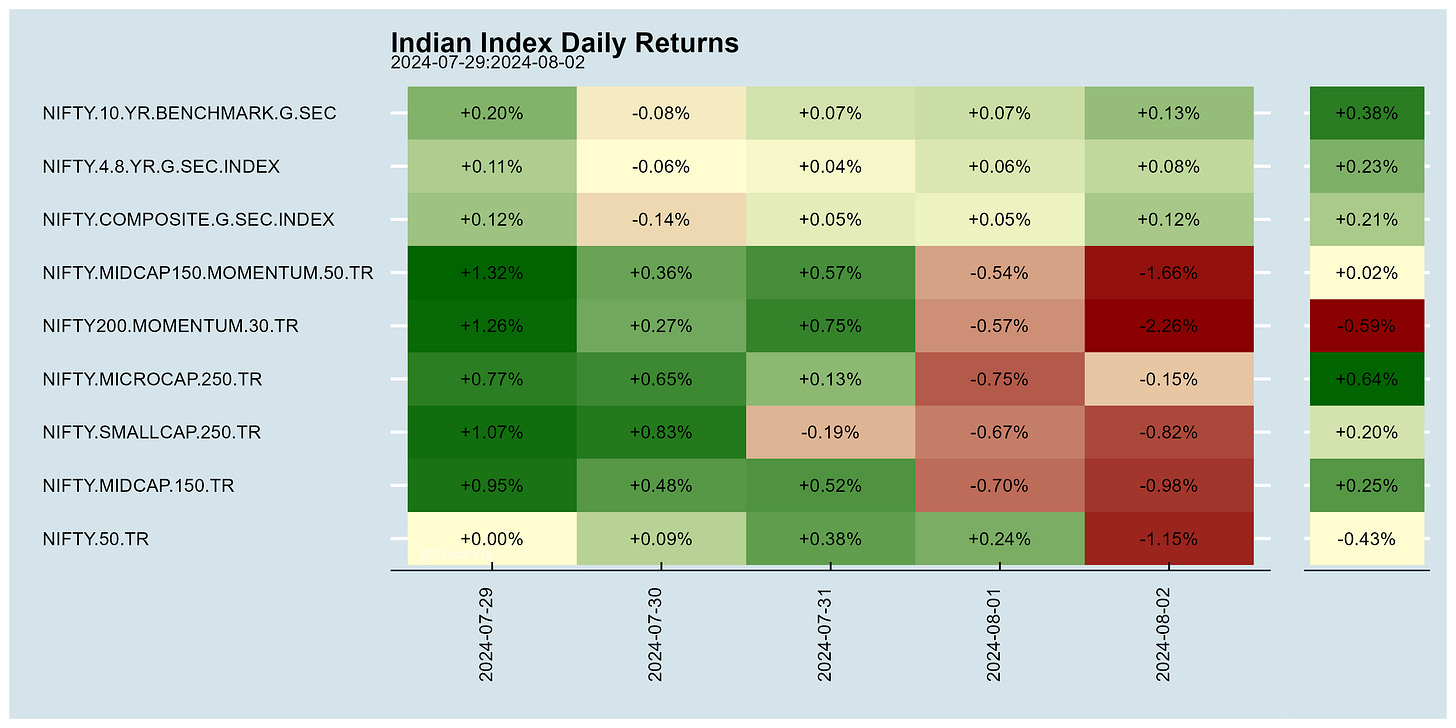

Markets this Week

Carnage in US markets as the Yen carry trade unwinds and the Fed is seen to be behind the ball.

The number of Americans filing for jobless claims hits highest level in a year (apnews)

Has the Fed Waited Too Long to Cut Rates? (morningstar)

Japan hikes interest rates for second time since 2007 (bbc)

How Japan's yen could be ripping through U.S. stocks (cnbc)

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

Echo effect in cross-sectional momentum (SSRN)

For cross-sectional momentum and rank momentum, future momentum performance is significantly influenced by information from the distant-past rather than near-past months, evidencing the momentum’s echo effect. However, for idiosyncratic momentum and 52-week high price momentum, a dominant effect of near-past months on future momentum performance is confirmed.

A Closer Look at 'Cut Your Losses Early; Let Your Profits Run' (SSRN)

This note will explore two cases in the context of investing where the policy of cutting losses quickly and letting profits run can make sense.

Why Do Investors Trade More Following High Returns? (SSRN)

First, investors trade more actively following high returns at various levels. Second, investors trade more frequently subsequent to high returns during periods of high market uncertainty than during periods of low market uncertainty. Third, investors increase their trading drastically after observing positive returns, but decrease their trading only mildly after observing negative returns. Fourth, individual investors trade more actively following positive returns than institutional investors.

Factor Momentum in Commodity Futures Markets (SSRN)

We first show that a commodity factor's past returns positively predict its future returns. This predictability leads to sizable economic profits in a long-short trading strategy, is at its strongest over the one-month horizon.

Servicing Development: Productive Upgrading of Labor-Absorbing Services in Developing Economies (NBER)

Manufacturing generates very little employment in the developing world. Urban jobs are predominantly informal, unproductive, and in services. It seems unlikely that manufacturing will be able to absorb the new increments to the labor force or create more productive jobs for those that are already stuck in petty services. Raising productivity in services has been traditionally difficult, but is now necessary to achieve long-term growth in the standard of living.

India

SEBI came out with a consultation paper outlining some serious changes to the derivatives market in India. Among other things, it proposes to triple lot-sizes. This is the second of the one-two punch to traders. The first one was doubling of STT on derivatives by the finance minister. While nobody denies that there is froth, especially in the 0DTE space, these proposals are like using a chainsaw where a scalpel would’ve sufficed. Did the brokers and stock-exchanges get greedy with an everyday is expiry day and a rack em', stack em', pack em' attitude towards clients? Absolutely. However, the scale of these proposals will likely drive even HNIs out of the market.

This budget continues the trend of a shrinking, revenue-constrained central government that talks big because it can only act small. (economictimes)

Capital gains is the fastest growing income class, can be taxed higher: Finance Secretary (thehindubusinessline)

Capital gains tax hike is 'irrelevant fiddling'; has no impact on India’s fiscal fortunes (moneycontrol)

The Ministry of Corporate Affairs (MCA), may remove as many as 400 Chinese companies in 17 states in the coming three months. (livemint)

Evolve policy to remove quota for SCs, STs in creamy layer: Supreme Court (thehindu)

A 986% surge in financial fraud cases in last five years (cnbctv18)

RoW

China’s extremely competitive manufacturing—and the world’s best transportation and logistical infrastructure—should not be thought of as separate from the country’s extraordinary low domestic consumption. The former exists because of the latter, and one requires the other. (carnegieendowment)

As China’s economy spirals, the Communist Party tightens its grip (thehill)

Heads should roll over the electric car fiasco (telegraph)

How Thousands of Middlemen Are Gaming the H-1B Program (bloomberg)

Who Had Richer Parents, Doctors Or Artists? (npr)