A few years ago, systematic momentum strategies were a rarity in India. Roll-your-own portfolios were the norm. But over a period of time, excess returns in these strategies attracted more competition. 2020 saw the birth of dozens of “advisors” who were selling momentum portfolios. Mutual funds, seeing how popular that these direct-equity strategies were getting, wanted in on the action.

A regulatory nudge is in play as well. Before 2018, Indian asset managers could launch dozens of funds in the same category and hide the mediocrity of existing funds. However, SEBI’s diktat that there can only be one fund in each category meant that the game finally came to an end. The only area for expansion left for them were index funds.

Enter the NSE. They realized that they could take the same 500 stocks, package it in an infinite number of ways and sell it to asset managers who need to launch a new fund every quarter to keep their marketing machine busy.

Is there any difference between NIFTY 50, NIFTY 100, NIFTY 200 and NIFTY 500 indices when you cap-weight them? No. But an asset manager can launch 4 new ETFs and 4 new FoFs of those ETFs to fill-up the NFO pipeline.

It was only a matter of time before they discovered that they could do the same thing with different strategies. Their website, niftyindices.com, lists all the animals in the zoo.

Et voilà! Momentum index funds!

Last year saw UTI launch its large-cap momentum index fund. Then ICICI packaged up their Alpha Low-volatility ETF into a FoF. And last month, Tata MF launched their mid-cap momentum index fund.

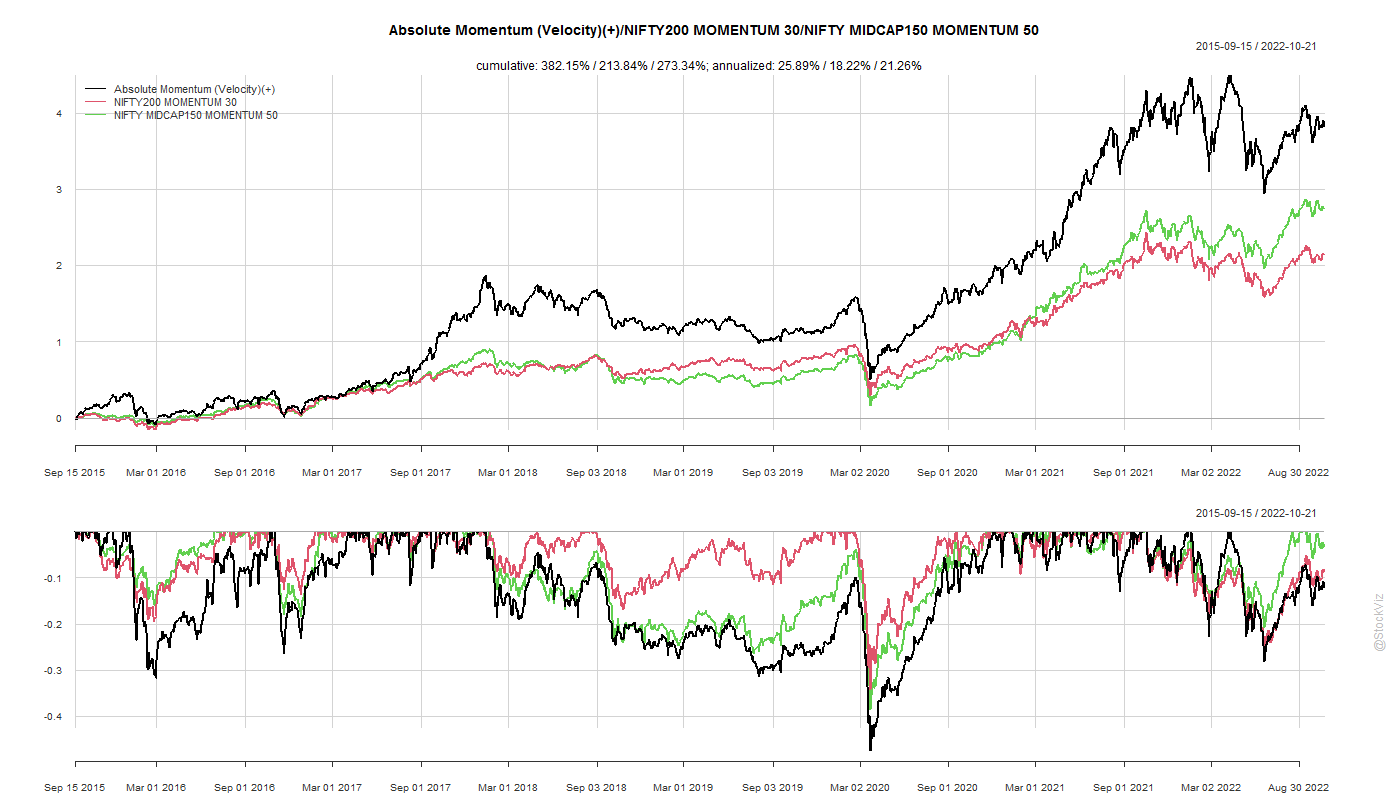

And the backtests are good.

These momentum index funds have a lot of advantages over their direct-equity counterparts:

Set it. SIP it. Forget it. You don’t have to deal with rebalancing trades, worry about margins, or even have a trading & demat account. You can just DCA into these funds.

Cost. You either pay brokerage or advisory fees or both for the direct-equity portfolios. Direct index funds cannot charge you more that 50bps all-in, by law.

Transparency. Most advisors only maintain P&L and stats for their model portfolios. Your personal experience may vary based on when you actually place the trades, what broker you use, etc. With index funds, everybody gets the same NAV and the NAV is transactable.

Taxes! You just have to pay 10% LTCG/15% STCG tax when you redeem. With direct-equity, you need to pay STCG every year.

Stability. I expect mutual funds to be more financially stable than your typical advisor. Is there a guarantee that an asset manager will never shutdown a fund that you have invested in? No. But one hopes that the decision will not be taken lightly. Whereas there have been instances where advisors have simply stopped maintaining their portfolios because they couldn’t get their business to work… Or have retired.

However, there is one big drawback to these momentum index funds. Their algorithms and rebalance dates are well known. Liquidity is not evenly distributed and when the market knows the subset of stocks (what), the process (how) and rebalance dates (when), it is possible to front-run. In which case, I expect faster momentum strategies that rebalance more frequently will end up performing better if investors adopt these index funds in a big way.

Also, if you are paying carry to a portfolio manager to run a direct-equity momentum strategy, then maybe now is a time to have a conversation about benchmarks.

Whichever way things shake out, at least now there are simple and cheap alternatives to direct-equity momentum strategies.

Here’s how a couple of our most popular monthly-rebalanced momentum strategies have performed versus the momentum indices.

You can read more about momentum here: The Momentum Factor.

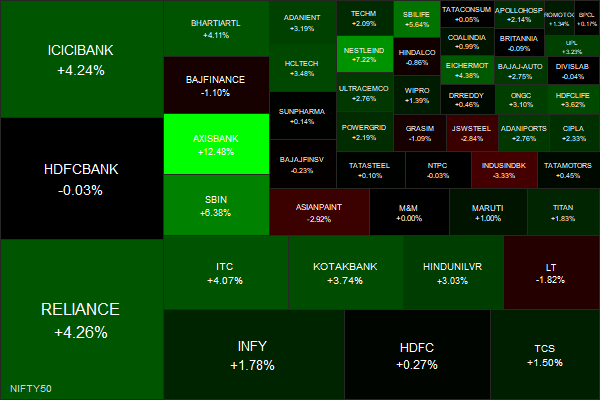

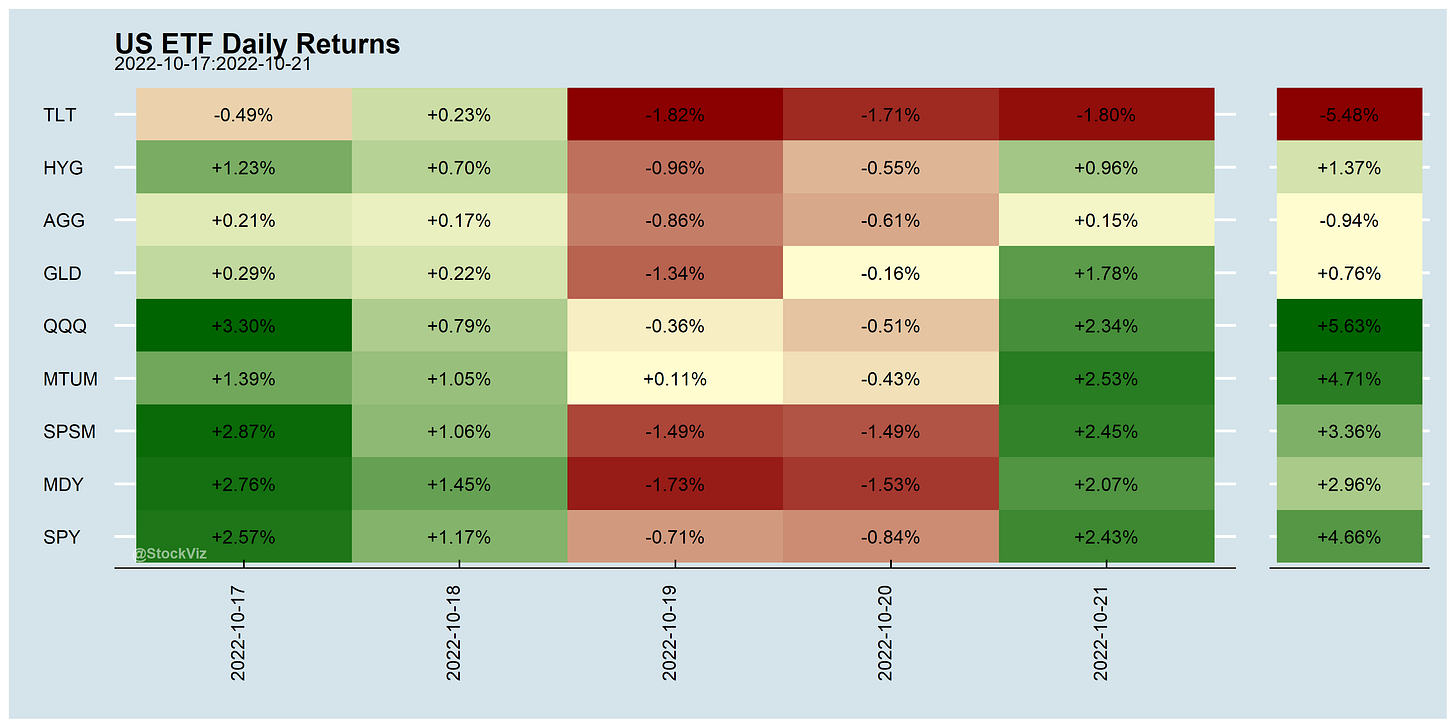

Markets this Week

Equity markets are dishing out max-pain with no clear trend.

INR continues to weaken. The RBI has blown through about 15% of its USD reserves defending the Rupee so far this year. Have they have reached a point where they have given up chasing the Fed and letting the Rupee go? To continue the defense, they will have to get more aggressive with rate hikes. Which will tank the economy. Which will tank the Rupee anyway. So, might as well…

Links

Principal-Agent problem at work:

~

Index and chill.

Whatever 'edge' you had in recognizing something that others 'did not see' is transitory. This business is moatless. (thread)

“i’m going to learn about investing” journey. (thread)

~

Sure, why not? What could possibly go wrong?

AI Shouldn’t Compete With Workers—It Should Supercharge Them. (wired)

Just $10 to create an AI chatbot of a dead loved one. (theregister)

The Synthetic Party in Denmark is dedicated to following a platform churned out by an AI, and its public face is a chatbot named Leader Lars. (vice)

~

Money

It's a gas

Grab that cash with both hands and make a stash

More than 500 retired U.S. military personnel — including scores of generals and admirals — have taken lucrative jobs since 2015 working for foreign governments, mostly in countries known for human rights abuses and political repression. (washingtonpost)

China's armed forces recruiting dozens of British ex military pilots in 'threat to UK interests' (sky)

~

~

Taxes and Quality of Life report card: