If you cook Indian food, then you would’ve come across the “Kitchen King” garam masala. It’s an intense mixture of North-Indian spices that can be added to pretty much anything. It is a savior of mediocre cooks everywhere - you don’t need to worry about the recipe, Kitchen King will take care of the taste. The dark side of having this spice-bomb in your arsenal is that everything starts tasting the same - like Kitchen King.

Momentum is the Kitchen King of factors.

You add momentum to any strategy, it will overpower everything else and become a momentum portfolio.

Take low-volatility, for example. Low-vol, in itself, is a decent strategy. However, mix-in momentum, and it doesn’t matter what sequence you add it in, it ends up looking a lot more like a momentum strategy and a lot less than a low-vol strategy.

Not convinced? Read more here: Volatility, Volatility of Volatility, and Momentum

Markets this Week

First Republic Bank could be the third U.S. bank to collapse since March, after the collapse of Silicon Valley Bank and Signature Bank. US FDIC asks JPMorgan, PNC for final bids due Sunday.

Investors remained unfazed by the ongoing reginal bank failures and focused instead on the fairly upbeat guidance from tech heavyweights, MSFT 0.00%↑ , AMZN 0.00%↑ , META 0.00%↑ and GOOGL 0.00%↑. Maybe because the end of the Fed rate-hike cycle is near?

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

Which is Worse: Heavy Tails or Volatility Clusters?

Heavy tails and volatility clusters are both stylized facts of financial returns that destabilize markets. The former are extreme events by definition and the latter can accelerate adverse market developments. Our analysis shows that volatility clusters have a greater impact on maximum drawdowns and aggregate losses across all return series. We further find that diversification does not yield any protection from those risks.

FinTech Lending with LowTech Pricing

FinTech lending—known for using big data and advanced technologies—promised to break away from the traditional credit scoring and pricing models. Using a comprehensive dataset of FinTech personal loans, our study shows that loan rates continue to rely heavily on conventional credit scores, including 45% higher rates for nonprime borrowers. Other known default predictors are often neglected. Within each segment (prime/nonprime) loan rates are not very responsive to default risk, resulting in realized loan-level returns decreasing with risk. The pricing distortions result in substantial transfers from nonprime to prime borrowers and from low- to high-risk borrowers within segment.

Monetary policy cyclicality in emerging economies

Central banks in emerging economies lower their policy rates in response to deteriorating local economic activity, yet their pass-through to short-term market rates appears compromised by their exposure to global financial conditions.

Choosing Money Over Meaningful Work

Although meaningful work and high salaries are both perceived as highly important job attributes when evaluated independently, when presented with tradeoffs between these job attributes, participants consistently preferred high-salary jobs with low meaningfulness over low-salary jobs with high meaningfulness.

A.I

Can an artificial intelligence chatbot assistant, provide responses to patient questions that are of comparable quality and empathy to those written by physicians?

In this cross-sectional study of 195 randomly drawn patient questions from a social media forum, a team of licensed health care professionals compared physician’s and chatbot’s responses to patient’s questions asked publicly on a public social media forum. The chatbot responses were preferred over physician responses and rated significantly higher for both quality and empathy.

Generative AI increases productivity of customer support agents, by 14% on average, as measured by issues resolved per hour. (NBER)

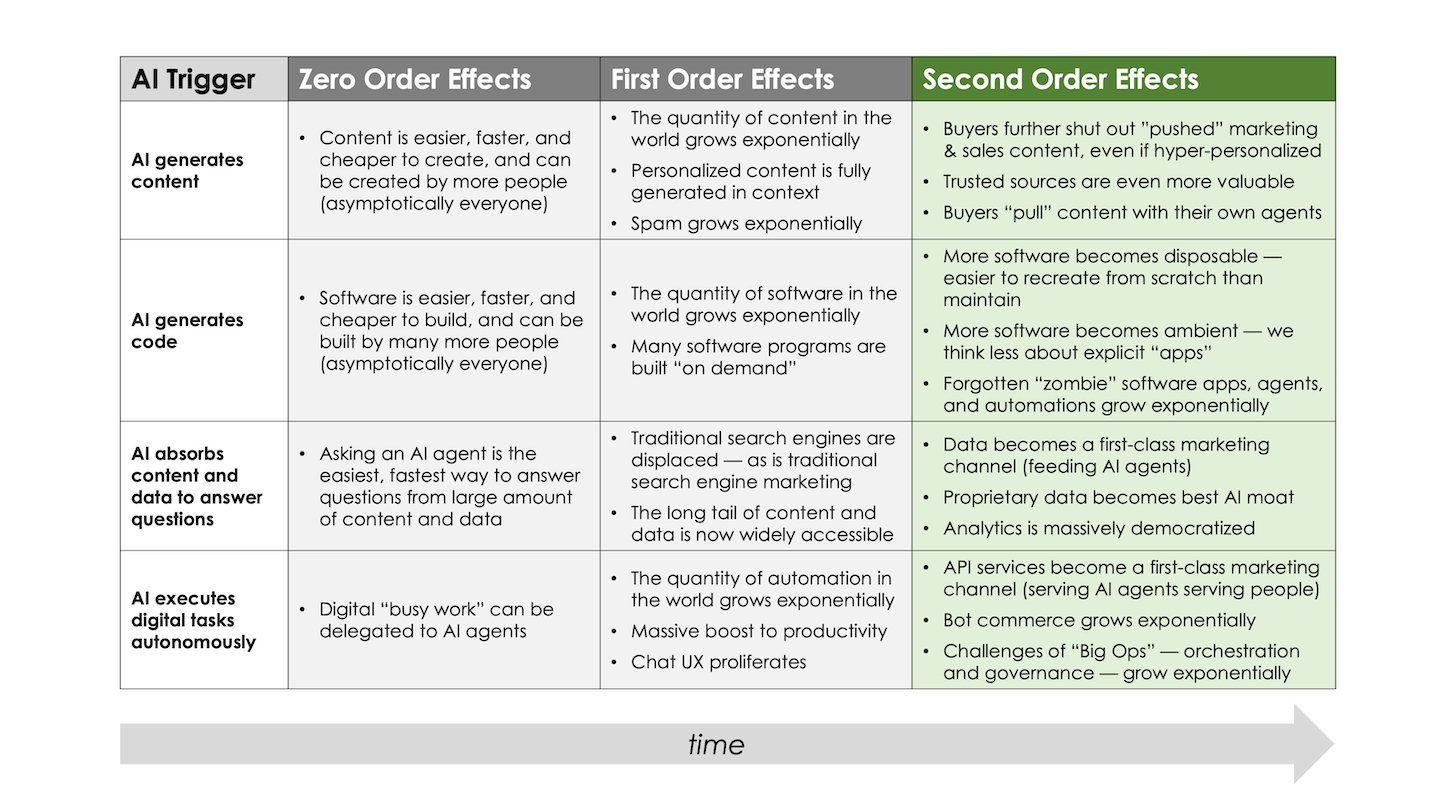

AI impact on marketing and marketing software:

Microsoft is killing it in the cloud

The Azure ML business is roughly on a $900m run rate, with customers growing 10x. Azure’s AI products could achieve a multi-billion dollar run rate by the end of the year, a data point which underscores the idea that AI grow GDP 1000x more than the PC. (@ttunguz)

An AI assistant that explains papers in real-time. Highlight the text to understand it better, understand formulas and tables, and ask papers anything. (SciSpace Copilot)

Investing

Aswath Damodaran on picking active managers:

I think the way we rank managers based nav encourages them to be not just risk takers, but reckless risk takers, because that's how you end up at the top of the alpha list or the best perform... I would never invest in the best performing manager in any year or even over a five year period, because they're going to almost wager that best performing manager has a much greater chance of being the worst performing manager in future periods than the middle of the group. I think that rather than look for the highest alphas, you want to go for consistency, even if it means settling for little or no alpha. The Hippocratic oath of doing no harm should really be first, front and center for anybody's managing other people's money. If it's your own money and you want to make bets, big bets and hope they pay off, fine, but don't play games with other people's money. We take 40% of your portfolio and buy Valiant, which is what some value investing funds did in the five years ago before Valiant blew up and then say, well, we never saw this coming. I know you didn't see this coming, but you didn't have to put 40% of your portfolio into one company.

The Three Engines of Value

3 simple factors that drive each stock’s price over time:

Earnings growth

Change in P/E multiple

Change in shares outstanding

Economy

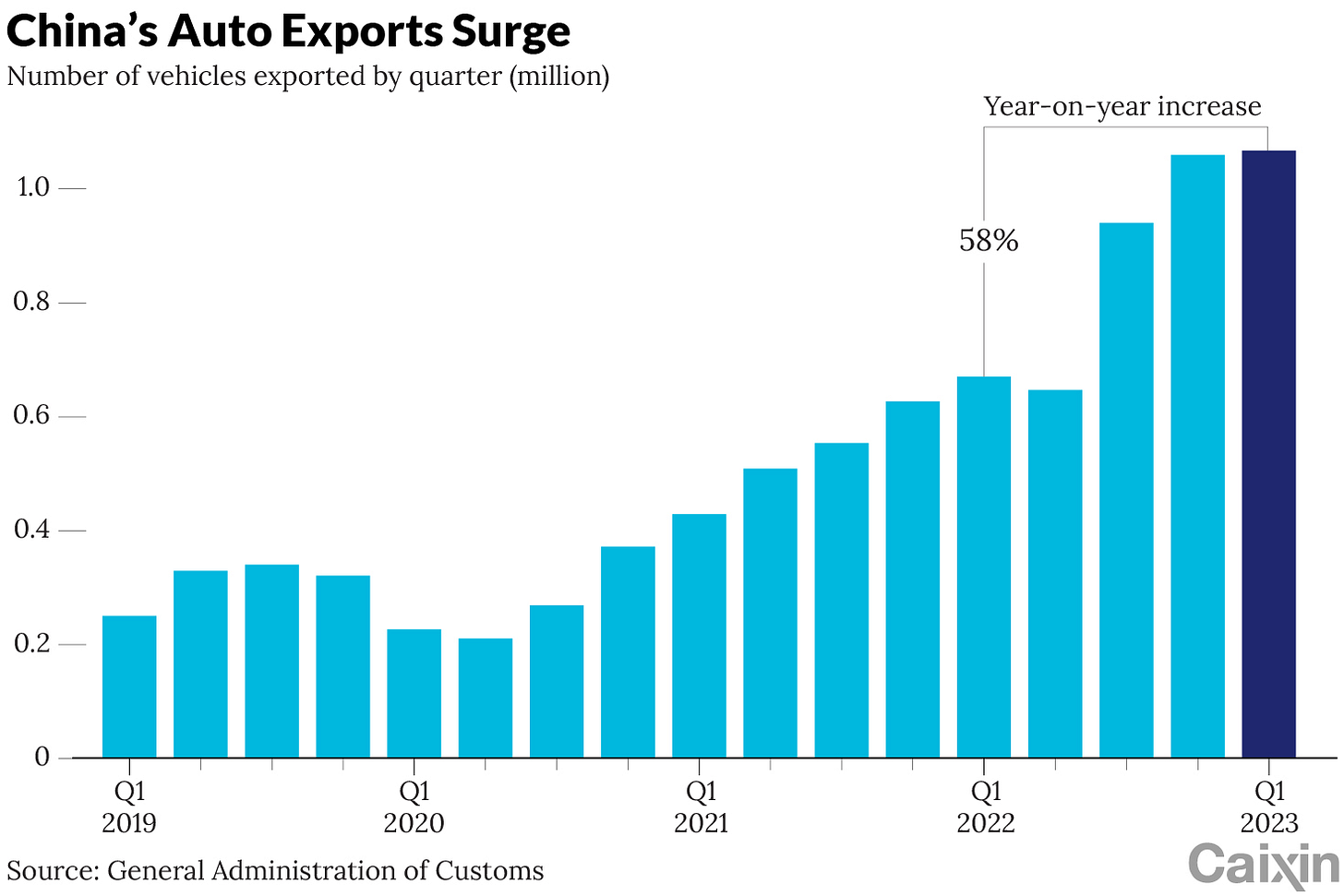

China is now running manufacturing surpluses equal to more than 2% of the rest of the world's GDP. I believe only the US, during WW1 and WW2, has ever run comparable surpluses. (@michaelxpettis)

China Is Now the 2nd-Largest Car Exporter, Ahead of Germany (directindustry)

British people "need to accept" they are poorer to bring down inflation, says Bank of England Chief Economist Huw Pill (bloomberg)

Britain Is Dead

While all of Europe is getting poorer and weaker as the twenty-first century progresses, the UK is unique in its relative incapacity and unwillingness to find solutions in comparison to peer nations like Germany and France. This is a process that has been gathering pace for centuries, stretching back to trends that began in the 1700s even as its empire was still expanding.