Multiples vs. Growth

We are in the "value-trap" innings of the game

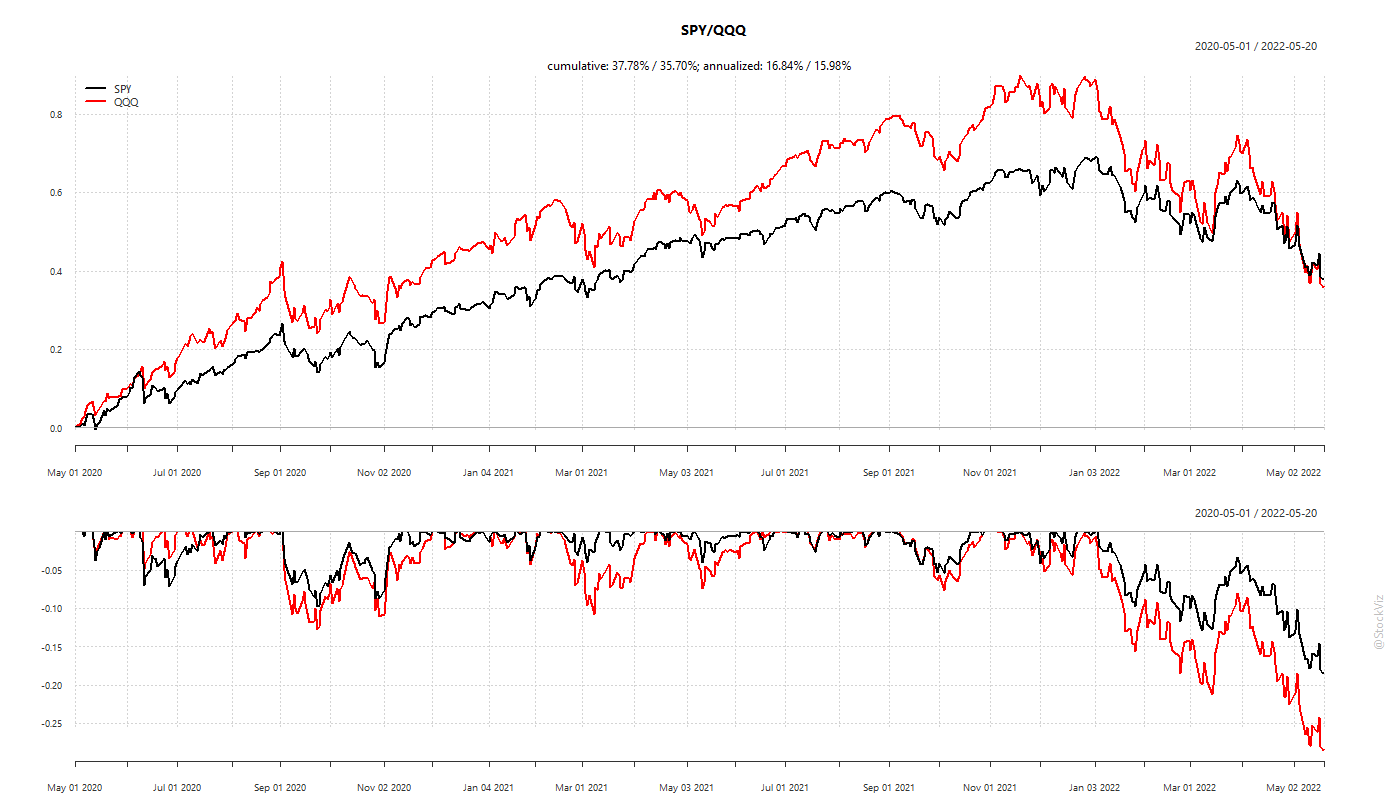

The S&P 500 briefly entered bear-market territory (-20%) this week while the Nasdaq 100 is skimming -30%.

A lot of investors who entered the market during the 2020 Corona Panic have been conditioned to buy-the-dip. However, a lot of things that were true in the last couple of years are no long true now.

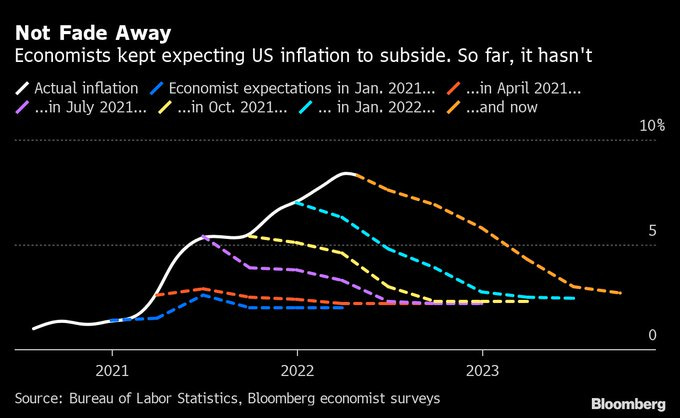

Pretty much every large economy in the world is experiencing above-target inflation. Even Japan, where the BOJ was fighting deflation over the last 20 years, clocked in 2.1% (Japan's inflation hits 7-year high) And this has led to most CBs tightening financial conditions through interest-rate hikes, QT, etc.

So, unless the war ends and China lets go of its Zero-COVID policy, BTFD is unlikely to be a wise strategy.

If you take a step back and think about why equity prices go up, it is basically either multiple expansion (investors are willing to pay more for the same cashflow) and/or earnings growth (free-cashflow grows.)

So far, equity markets have gone down purely on multiple-compression. Most of the prior growth estimates have largely remained intact. Except for some obviously shit business models, analysts have not taken a scythe to forward estimates.

If Putin’s war continues to put upward pressure on energy and food prices, financial conditions are going to tighten to a point where growth turns negative and equity analysts will be forced to cut. We are yet to reach that point.

If the only reason you are buying a stock right now is because it is down 50% from the top, then it is likely to be a value-trap rather than a bargain.

This thread sums it up well:

So, keep your powder dry and remember the sage words of PTJ: “Losers average losers.”

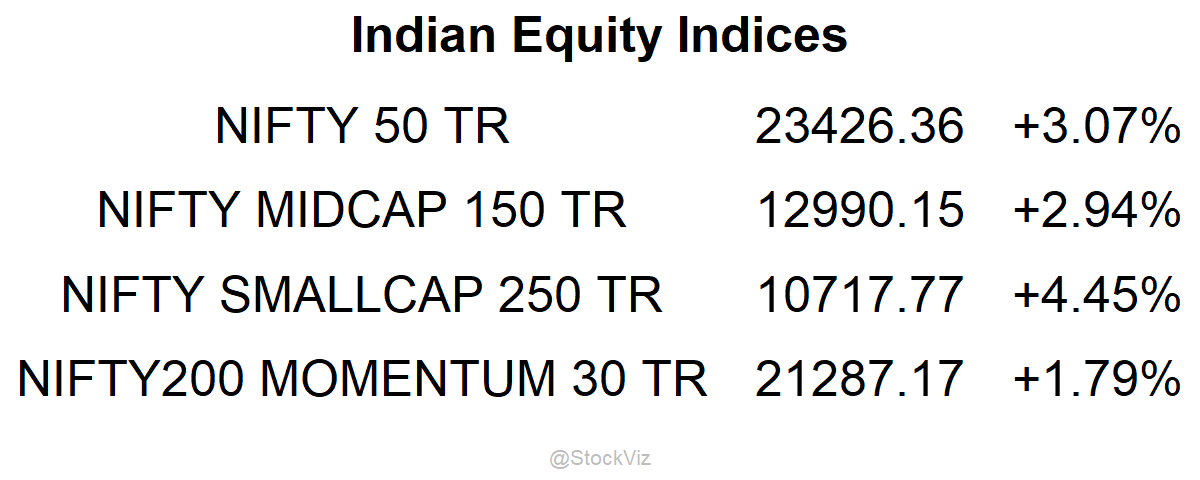

Markets this Week

Links

Apple tells suppliers it wants to manufacture more in India and Southeast Asia. (wsj)

China Insists Party Elites Shed Overseas Assets. Party directive bars senior officials from owning property abroad or stakes in overseas entities, whether directly or through spouses and children. (wsj)

Damodaran: A company with pricing power, low input costs & short term/flexible investments is better positioned to weather inflation.

Neat thread on price-insensitive flows.

Narratives are powerful as long as you don’t drink the Kool-Aid. Ride them when they are strong but don’t forget to get off before the crazies take over.

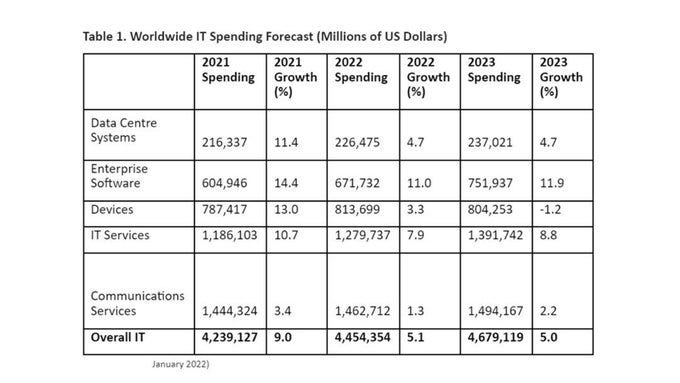

IT spending forecasts coming down.

The ability to generate alpha will continue to persistently shrink. (evidenceinvestor)

Anyone who wants to “teach you" how to make money is a scammer. (thread)

India’s fertility rate drops below 2.1 (ht)

How can Covid-19 affect the human brain? Researchers said the degeneration was equivalent to losing 10 IQ points. (ft)

Meme of the Week

Basically every math textbook