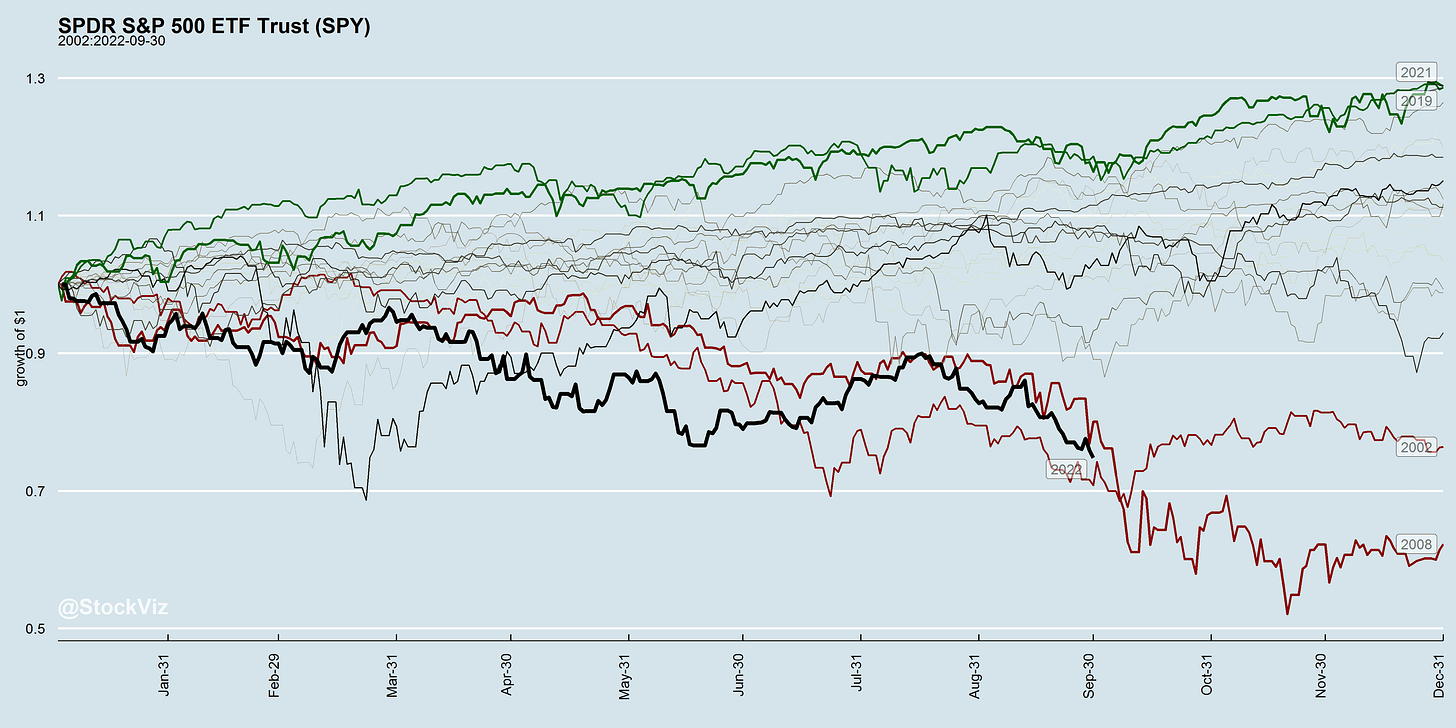

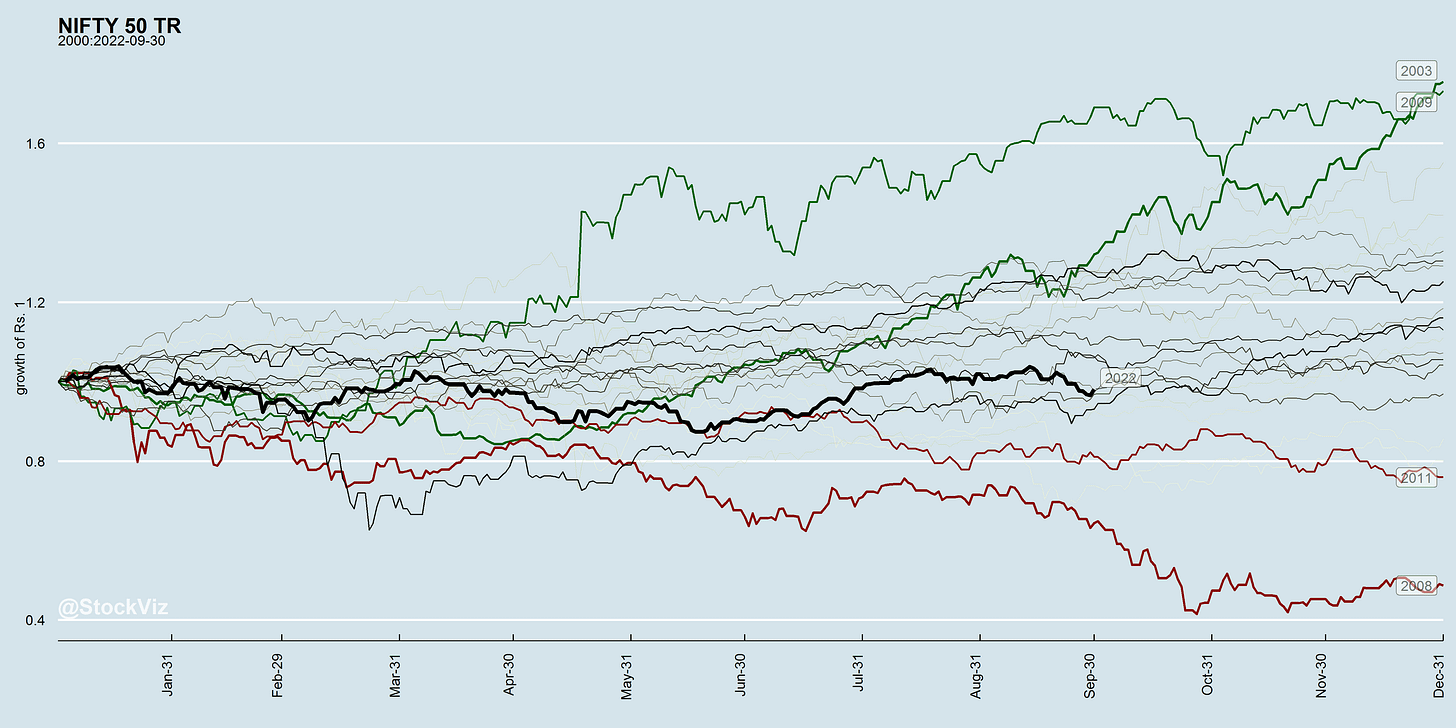

Markets have been bad this year. The S&P 500 has had one of the worst years in a decade and the NIFTY is barely getting by thanks to the BAAP & HODL crowd.

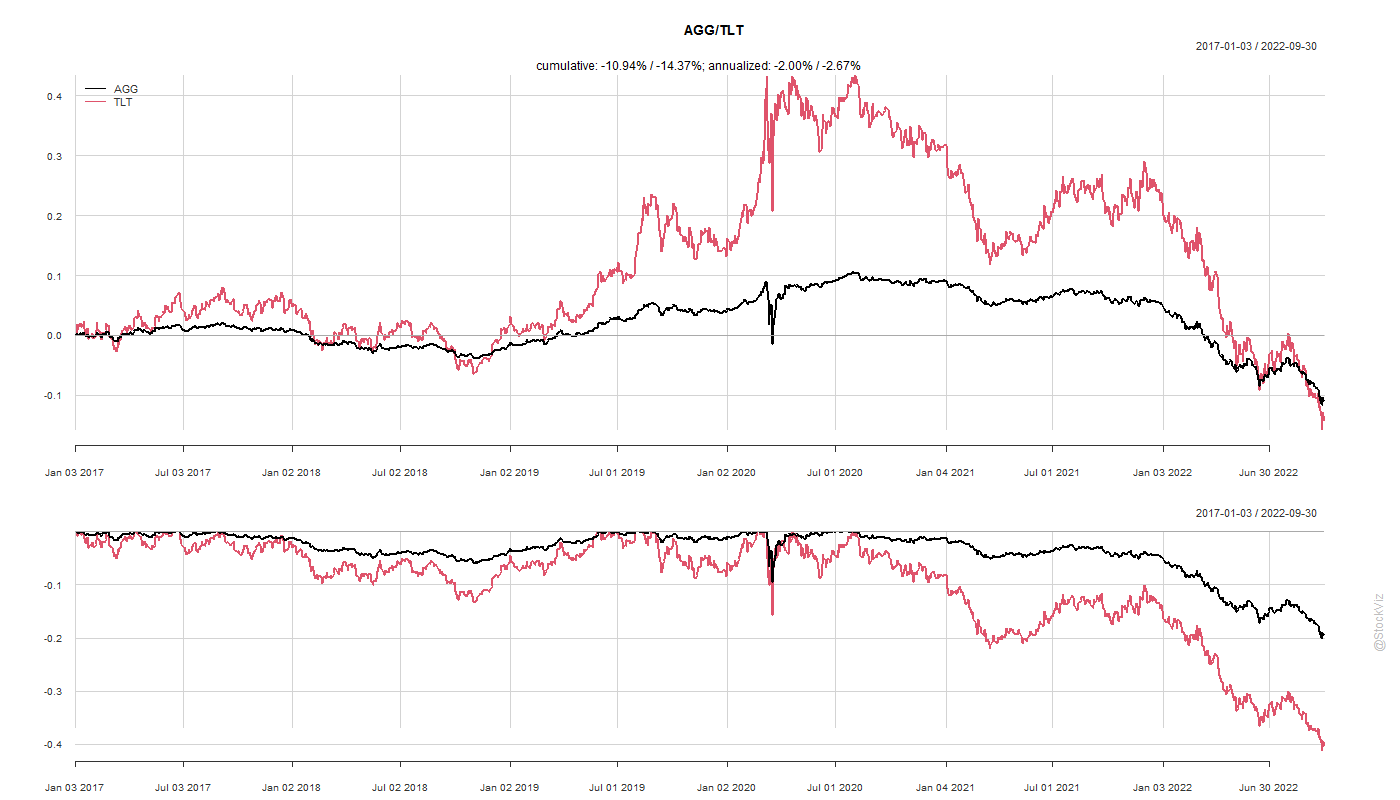

US bonds have had one of the worst drawdowns in history.

The TLT (iShares 20+ Year Treasury Bond ETF), is now down more than 40% from its peak in August-2020.

The US 60/40 investor is down more than 20% while meme-investors have felt a special kind of loss.

So, yes - a lot of pain in both retirement and speculative portfolios. And when there is pain, investors seek out “reasons.” And only the most controversial/scary headlines scale the social-media leaderboard.

THIS IS A LEHMAN MOMENT

- every nutjob since 2010.

Only this time, it is some shitty European bank.

Credit Suisse and Deutsche Bank have been in the dumps for longer that I care to remember. They are both the chronically sick children of the European “extend and pretend” head-in-the-sand approach to cleaning up bank balance-sheets after 2008. And in a weird “If you're not first, you're last” vibe, Credit Suisse has been willing to blow itself up in the pursuit of fees. Archegos, Greensill, and the Citrix LBO, to name a few recent ones.

So, it’s no surprise that CS is down 80% from its Jan-2018 peak.

The Lehman bankruptcy was a “black swan” - the stuff that made Taleb intolerable for the next decade. Thankfully, we don’t live in 2008 anymore. The rules of the game have changed. The system is inoculated - what didn’t kill it has made it stronger. Also, the post-2020 pump was not because of a credit-binge. It was largely a fiscal over-stimulation.

The markets are experiencing a hangover, not an implosion.

Remember, at one time Nike was supposed to be software-platform/social-networking company. And NFTs!!!

Now down more than 50% from its late 2021 peak.

It’s not like they suddenly stopped making shoes or people stopped running. The market just got a bit ahead of itself.

So, relax. This too shall pass.

Markets this Week

Links

Black-Scholes (and related) models, for which Nobel prizes were won: we do NOT use them as models, we use them as normalizations only, as a convenient change of variables. (thread)

~

There are three distinct policies that go under the name of QE. (thread)

The shortest economic suicide note in history? (lse)

~

~

Something to keep in mind while back testing - most of the “inefficiencies” would not have been accessible during that time. Regulations, technology, liquidity and cost of capital play a large but ambient role.

~

I hear about the number of employees in some of these “new-economy” companies and can’t help but wonder what they do all day.

~

VC firms pivoting from hiring from the business school to the law school.

~

We need a G10 wealth-tax.

Schools in England warn of crisis of ‘heartbreaking’ rise in hungry children. (theguardian)

~

Memes of the Week