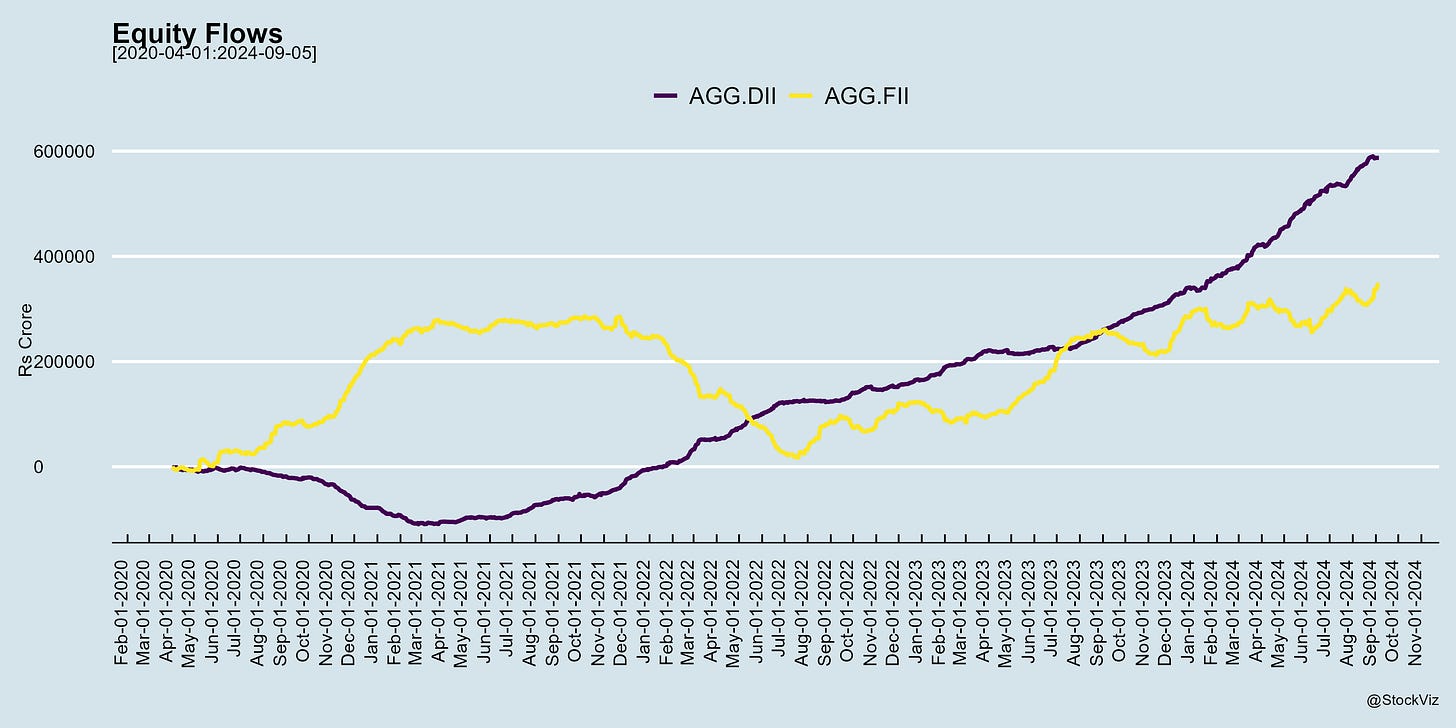

The post-COVID boom in domestic flows is something to behold. Foreigners no long hold the reigns to our markets.

And these flows have grown hand-in-hand with active brokerage clients.

Systematic inflows from monthly DCAs into mutual funds and local speculation have pushed markets to new highs.

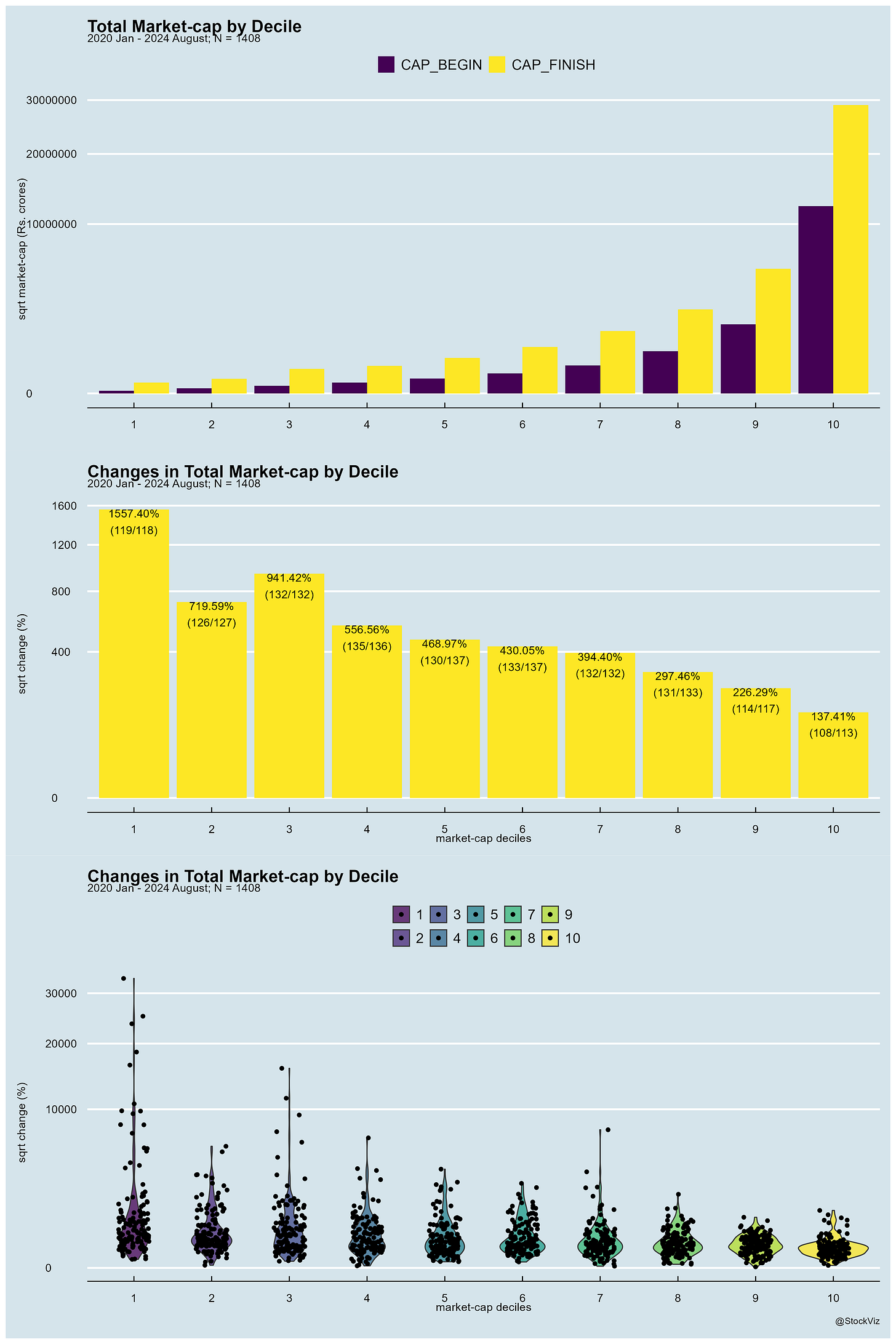

If you plot the changes to total market cap by decile (where 1 represents the lowest market cap and 10 the highest), most of the changes have been in the lower deciles.

And a lot of stocks have migrated up these deciles.

This begs the question: are we at peak exuberance?

There is an argument to be made that starting valuations were low and that growth surprised upwards.

The growth argument could hold for mid-caps but that doesn’t appear to be so for the lower deciles. Besides, it looks fully price-in for mid-caps.

Could it be that when a wall of money hits low-float stocks, the prices go parabolic?

The last time this happened was during the 2015-2018 bull run.

Micro-caps got cut by 50%, small-caps by 40% and mid-caps by 25% by the time 2020 rolled in.

And now, we see a similar ramp.

While nobody can time the market, doesn’t this seem a bit toppy to you?

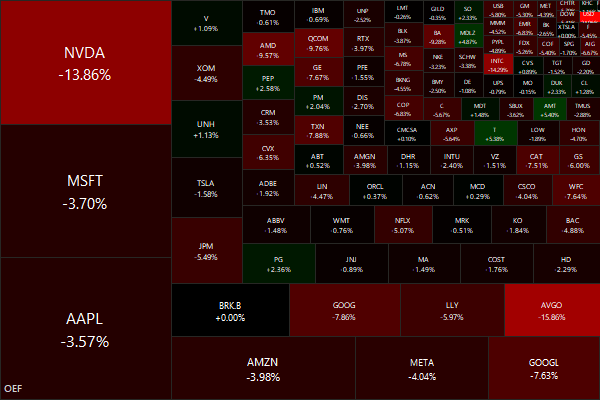

Markets this Week

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

The Disappearing Index Effect (SSRN)

The abnormal return associated with a stock being added to the S&P 500 has fallen from an average of 7.4% in the 1990s to less than 1% over the past decade. A similar pattern has occurred for index deletions, with large negative abnormal returns during the 1990s, but only 0.1% between 2010 and 2020. We investigate the drivers of this surprising phenomenon and discuss implications for market efficiency.

Behind Closed Doors: Preferential Disclosure in Private Meetings (SSRN)

We examine investor relations officers’ (IROs) disclosure decisions in private meetings with investors. We find direct evidence that IROs provide more useful private disclosures to more preferred investors, even when less preferred investors ask the exact same questions. IROs are more likely to provide preferred investors with private access to the CEO, and professional investors believe this access provides even more useful investment information.

The CNN Fear and Greed Index as a Predictor of Us Equity Index Returns (SSRN)

We assess whether the CNN “Fear and Greed” Index can be used to predict returns on equity indices and gold using hand-collected data.

Skin in the Game and Franchising (SSRN)

This research documents the potential signal value of organizational form decisions made by retail chains. Because expansion via company-owned stores requires more upfront investment by the retailer, as compared to franchising, we hypothesize that franchisee-based expansion signals the retailer's unwillingness to put "skin in the game." Using comprehensive data about restaurant chain establishment entry in the United States from 1998 to 2014, we confirm via descriptive analysis that a large proportion of franchisee stores, relative to company-owned stores, is associated with dampened entry growth of new establishments.

So Many Jumps, So Few News (SSRN)

This paper relates jumps in high frequency stock prices to firm-level, industry and macroeconomic news, in the form of machine-readable releases from Thomson Reuters News Analytics. We find that most relevant news, both idiosyncratic and systematic, lead quickly to price jumps, as market efficiency suggests they should. However, in the reverse direction, the vast majority of price jumps do not have identifiable public news that can explain them, in a departure from the ideal of a fair, orderly and efficient market.

Investing & Economy

India

SEBI Saga: Congress alleges Madhabi Puri of insider trading, corruption and property play (economictimes, thehindu, livemint)

India to tighten derivatives rules despite investor pushback (reuters)

Ethanol push turns India into corn importer, shaking up global market (reuters)

India's stock market rally is ramping up its index weighting and creating a dilemma for global fund managers: sit back and watch as their relative exposure shrinks while the market grows, or buy in at increasingly eye-watering prices. (reuters)

Police bust Rs 2,200 crore online trading scam in Assam (indiatoday)

Merging rail finances with the Union Budget has led to less scrutiny, more accidents, and questionable priorities. (frontline)

RoW

Fed policymakers say they are ready to start cutting interest rates (reuters)

Intel Honesty (stratechery)

Boeing’s No Good, Never-Ending Tailspin Might Take NASA With It (nytimes)

Why is Thai health care so good? (livemint)

Volkswagen weighs possible German plant closures (cnbc)

Odds & Ends

Agriculture accelerated human genome evolution to capture energy from starchy foods (berkeley)