The Indian economy hit a growth pocket in late 2024 and markets went into a spiral.

The Indian government on Saturday announced the biggest tax relief in at least a decade to boost consumer demand to revive growth. An individual with an annual income of up to ₹1,280,000 will not have to pay any tax (reuters).

Hopefully, this does the trick 🤞

Markets this Week

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

Winning the Bread and Baking it Too (NBER)

Female breadwinners do more home production than their male partners, driven by “housework” like cooking and cleaning. Men’s housework time is inelastic to relative household wages. Gendered rigidities in the allocation of household tasks result in lower surplus for couples where women out-earn men than vice versa.

Macro

For any investor with a reasonably long time horizon, attempting to ignore whatever the market is focusing on at any given point in time is the sensible (and most lucrative) approach. (behaviouralinvestment)

India

We had a budget! The government cut taxes to the tune of 1 trillion rupees ($11.56 billion). But it may not be enough to spur growth.

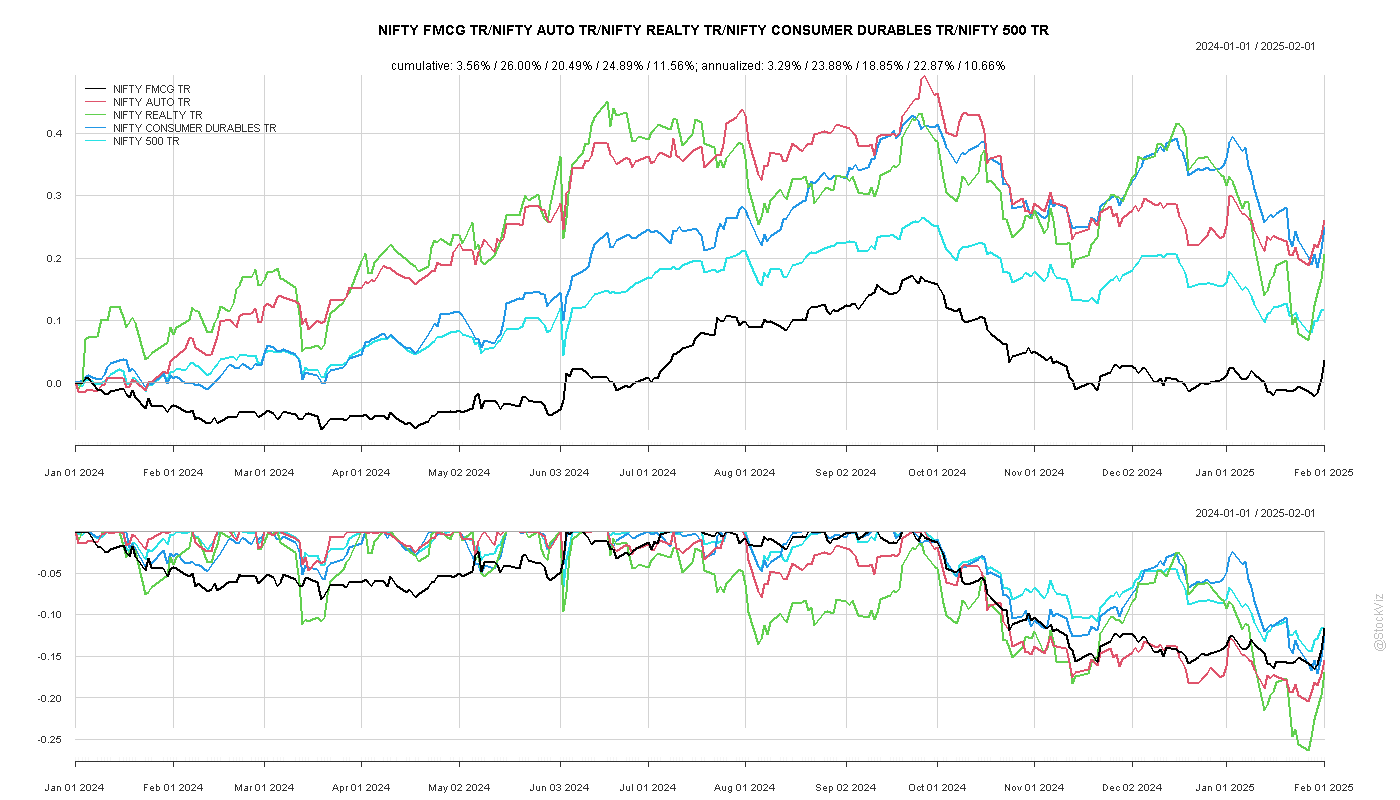

Market verdict: bullish for FMCG, Consumer Durables, Realty and Autos.

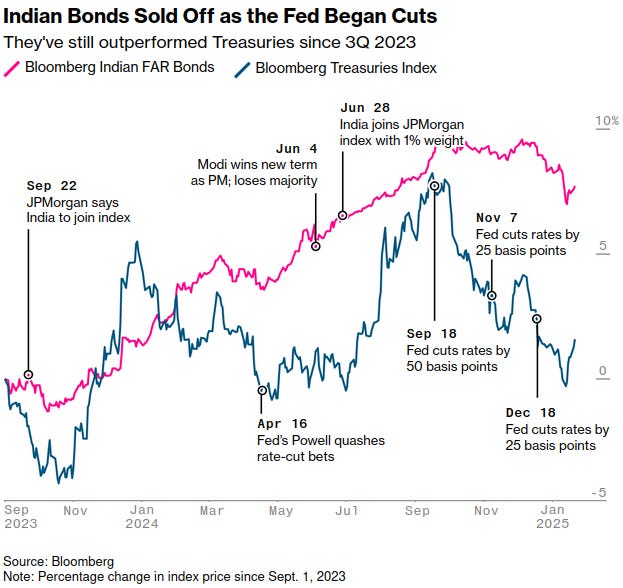

Foreign investors are losing interest in Indian bonds - one of the best-performing emerging bond markets. (bloomberg)

India to ditch privatisation plans, pour billions in state-run firms (reuters)

Public sector lenders to the ailing Mahanagar Telephone Nigam Ltd (MTNL) may agree to a 20% haircut on their Rs 8,144 crore exposure to the state-owned telecom firm, with the loans turning into non-performing assets. (business-standard)

India imports about 65% of its annual requirement of cooking oils; over half of it is palm oil from Malaysia and Indonesia. Once considered to be the cheapest, palm oil is now as expensive as soy and sunflower oil. (livemint)

Social media is driving young Indians into debt (livemint)

Anchors and guests of a stock-market show in the Zee Business Channel got caught insider trading (sebi).

Alcoholic tinctures marketed in India as homoeopathic remedies are a significant public health hazard. (thehindu)

row

President Donald Trump has imposed tariffs on Canada, China, and Mexico (reuters, bbc). Potential economic effects of such tariffs on all four countries: cfr.

Germany under attack from China (telegraph)

China is imposing its justice system on American soil using a web of U.S.-based nonprofits linked to a Chinese Communist Party (CCP) intelligence agency. (dailycaller)

Chinese buyers interested in unwanted German Volkswagen factories (reuters). VW CEO says talking to Chinese partners about their Europe expansion plans (reuters)

China's 'artificial sun' shatters nuclear fusion record by generating steady loop of plasma for 1,000 seconds (livescience)

It's not a crime if we do it with an app (pluralistic)

Why America is in an alcohol recession (thehustle)

U.S. housing is in an interesting spot. The housing stock is increasingly aged. More than 60% of single family houses in the United States were built more than 35 years ago. To complicate things further, homeowners are more frequently electing to stay in their homes for longer. These trends have large implications for investors. (fortunefinancialadvisors)

Odds & Ends

The creators of a new test called “Humanity’s Last Exam” argue we may soon lose the ability to create tests hard enough for A.I. models. (nytimes)

CIA says lab leak most likely source of Covid outbreak (bbc)

Italy’s birth rate crisis is ‘irreversible’. Hundreds of Italian towns and villages had no new babies in 2023 amid an exodus of young people and an ageing population. (telegraph)

OpenAI, the maker of ChatGPT, alleges that Chinese AI startup DeepSeek used its proprietary models to train a competing AI system (timesofindia)

Great article Shyam. India's tax relief initiative is a bold step, but will it be enough to reignite sustained growth? While the ₹1.28 million income tax exemption is a welcome move for many, it's important to recognize that tax cuts alone may not solve deeper structural challenges like slow consumption growth and foreign investor hesitation.