In our previous letter, we looked at how using historical standard deviations on a momentum index can potentially reduce its future drawdowns. It showed us how volatility at the portfolio level can be used to manage momentum drawdowns.

This month, our post, Low Volatility: Stock vs. Portfolio, built on that intuition and showed how creating a portfolio of low-volatility stocks doesn’t mean that the entire portfolio is going to have low volatility because of correlations between the components. We back-tested minimum-variance (min-Var) and minimum-expected-tail-loss (min-ETL) optimization strategies to show how a holistic portfolio optimization approach is superior to a basket-of-low-vol-stocks approach.

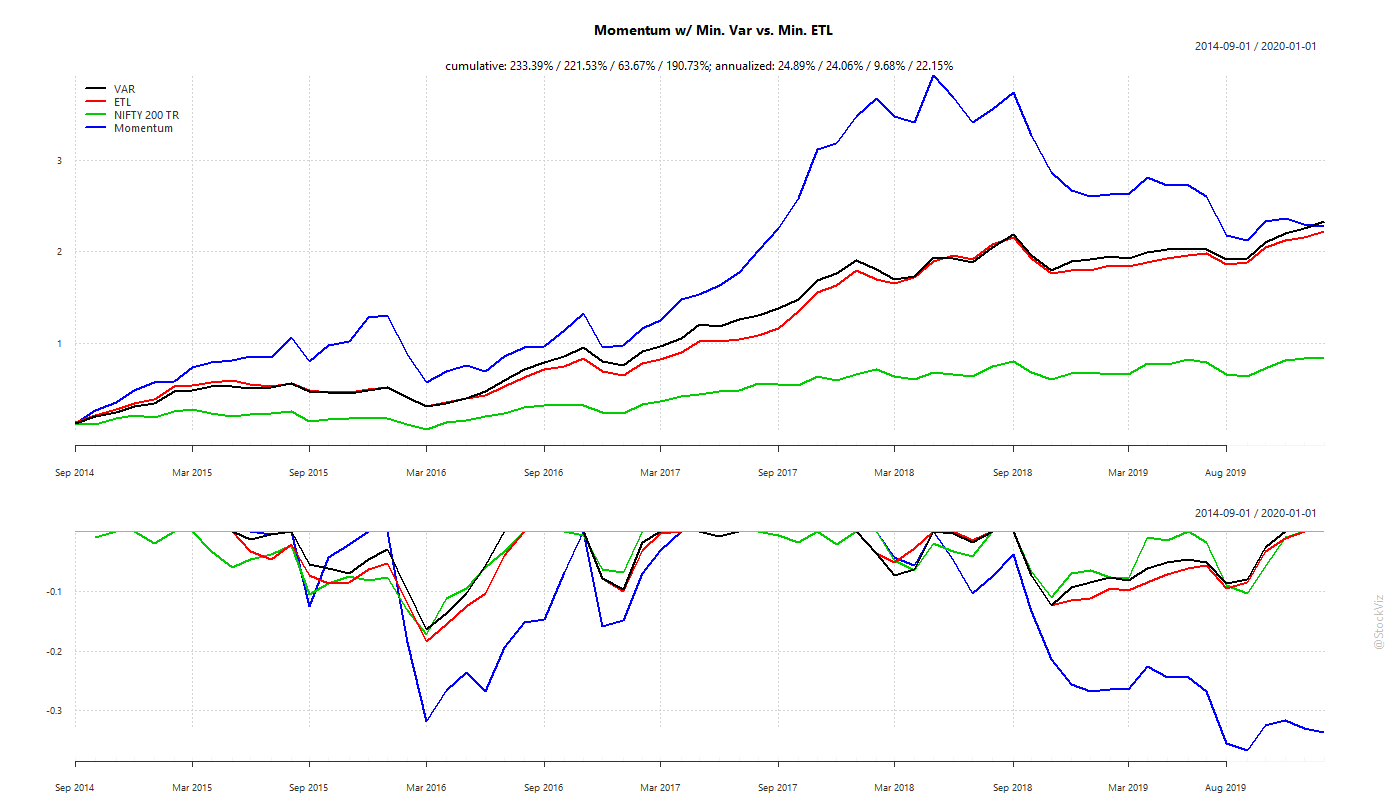

Later, we extended the above back-test to a portfolio of stocks that had high momentum scores.

Turns out, even though “raw” momentum hugely out-performed both the optimized strategies during the bull market, the latter demonstrated much shallower drawdowns during the subsequent bear market. Over a complete cycle, optimized portfolios offer a much better risk-reward prospect compared to “raw” momentum.

These strategies have been setup as Momentum (Min-Variance) and Momentum (Min-ETL) Themes. Drop us a note if you are curious.

Happy Makar Sankranti and Pongal!

PS: I read The Man Who Solved the Market and loved it!