American stock-exchanges pretty much set the tone for the rest of the world’s equity markets. Given that our markets have little overlap with them, traders are often wary to take large overnight positions. Or so the story goes.

Turns out, intraday moves of the NIFTY have larger variance than overnight moves. It is not the quite the boogeyman that people make it out to be.

More here: Overnight Volatility

Markets this Week

There was a bit of a scare on Tuesday with micro/small caps tumbling on a rumored fund liquidation. While the rumor remains unverified, the cascade of sell-orders points to very nervous trigger fingers. Those paper-hands are going to push the sell button at the slightest whiff of the party coming to an end…

More here: country ETFs, fixed income, currencies and commodities.

Links

Research

The Child Penalty Atlas

Most countries display clear and sizable child penalties: men and women follow parallel trends before parenthood, but diverge sharply and persistently after parenthood.

Do Anomalies Really Predict Market Returns?

Using new data from U.S. and global markets, we revisit market risk premium predictability by equity anomalies. We apply a repertoire of machine learning methods to 42 countries to reach a simple conclusion: anomalies, as such, cannot predict aggregate market returns. Any ostensible evidence from the U.S. lacks external validity in two ways: it cannot be extended internationally and does not hold for alternative anomaly sets—regardless of the selection and design of factor strategies. The predictability—if any—originates from a handful of specific anomalies and depends heavily on seemingly minor methodological choices. Overall, our results challenge the view that anomalies as a group contain helpful information for forecasting market risk premia.

Gambling Preferences for Loser Stocks Everywhere

I discover global evidence that investors' preferences for gambling mainly involve stocks that have performed poorly in the past. Lotto investors tend to believe that lottery-like stocks with poor performance may have a vigorous rebound shortly, while those with good performance may be less likely to produce a highly positive return given their high prices. Therefore, lottery-like stocks with poor performance have a highly effective lottery-like look, and thus they attract lotto investors.

E-Commerce Live Streaming Data and Future Stock Returns

Using e-commerce live streaming (ECLS) data, including views, likes, comments, and interactions in live streaming rooms, from the top 100 streamers on the Taobao platform, we examine the predictive role of ECLS data in future stock returns of listed companies in China. We document that ECLS data is significantly positively correlated with future stock returns.

Economy

Bank of Japan Could End Negative Interest Rate Policy (japannews)

What will BOJ's policy normalisation path look like? (reuters)

A world-beating deposit of lithium along the Nevada–Oregon border could meet surging demand for this metal. (chemistryworld)

Billions in Russian oil sale profits are stuck in Indian banks. Russia's only option to use the money at the moment appears to be spending or investing it in India. (newsweek)

It is a mistake to refer to China as the global engine of growth. Its growth is indeed the largest component of global growth, but what matters to the rest of the world is not how much or how fast China’s domestic economy is growing, but rather how that growth affects its trade and capital flows.

China’s trade surplus actually represses growth, because it forces China’s trade partners to accommodate and absorb China’s weak domestic demand, with no corresponding increase in foreign demand. Because most Chinese capital outflows are directed toward advanced economies—mostly the U.S.—China’s enormous trade surpluses are more likely to constrain global growth than to boost it. (worldpoliticsreview)

The European Commission announced an “anti-subsidy investigation” into Chinese car firms. (economist, yahoo)

China set to overtake Japan as world’s biggest car exporter (ft)

Indian cough syrup killed scores of children. Why no one has been held to account. (reuters)

Narendra Modi is widening India’s fierce regional divides (economist)

Scammers Have Found An Easy Way To Clone Fingerprints (boomlive)

Investing

India equity MF inflows nearly triple in August; SIP contributions hit record high. (reuters)

About 40 Indian online gaming companies are likely to soon receive show-cause notices from the Goods and Services Tax (GST) authorities for alleged tax evasion. (cnbctv18)

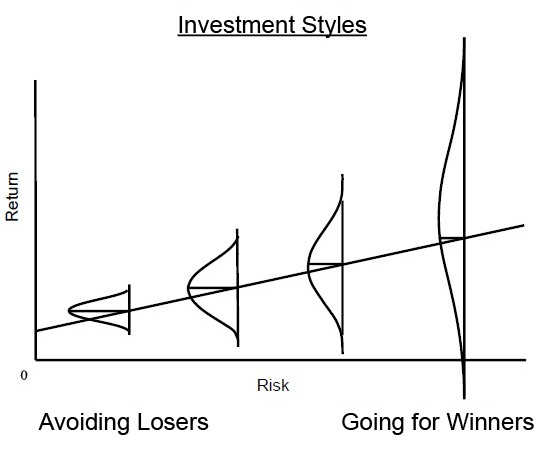

All credit-bois are low-vol-equity bois. (oaktreecapital)

New ETF looks to tap hot market for zero-day options (reuters) Also, 0DTE trading in $SPX options accounts for a record 49% of total trading volume.

Apple's current stock-market valuation reflects unrealistic growth expectations. Given the sheer size of the tech giant's revenue base, it's difficult for it to deliver growth rates that meet investor aspirations captured by the stock price. Somebody needs to tell the market that Apple is a “shrinking company”. - Bill Miller IV (businessinsider)

Private equity firms have started to borrow against their funds to backstop overly indebted portfolio companies. (ft)

A.I.

How Blackstone Sprinted Ahead of Its Peers in AI (institutionalinvestor)

I view AI as an important generational technology wave – just like the internet, mobile, and cloud. It’s an opportunity for the most ambitious entrepreneurs to build new things that change how we work and live. This could be AI-first networks such as labor marketplaces; products where AI unlocks a new category of software entirely; or AI that enables co-pilots in industries including financial services. (greylock)

The AI-Powered, Totally Autonomous Future of War Is Here (wired)