All investment strategies that have historically outperformed the risk-free rate have, without exception, gaslit investors.

Even something as mundane as equal-weight vs. cap-weight of the same index is not settled science by any stretch of imagination. I don’t like it because with the index on a 6-month schedule, chances of a monthly equal-weight strategy systematically selling winners and buying obviously sinking turds is pretty high. Plus, STT on every trade requires the edge to be high enough to make the transactions worth their while.

However, over the long-run, who knows? Historically, since the year 2000, equal-weighting has out-performed cap-weighting by ~2%. Long-term buy-and-hold worked out.

The problem is, how “long” is long term?

As an index, equal-weight has out-performed cap-weight in 13 out of 22 years. 60% of the time, equal-weight wins.

Before 2017, equal-weight won 11 out of 17 years. Who wouldn’t want that? So, in 2017, DSP launched its equal-weight NIFTY 50 index fund. And guess what?

It went on to under-perform the cap-index right out the gates and investors had to wait for four years before they could see some light at the end of the tunnel.

The fund, on a CAGR basis, is still trailing the cap-weight index by ~4%.

This is pretty much the story of every single market investment. Whether it is quantitative, systematic, discretionary or qualitative doesn’t matter. We only know the historical odds of success. The future is unknowable. And while you wait for the odds to work in your favor, all you get to endure is pain.

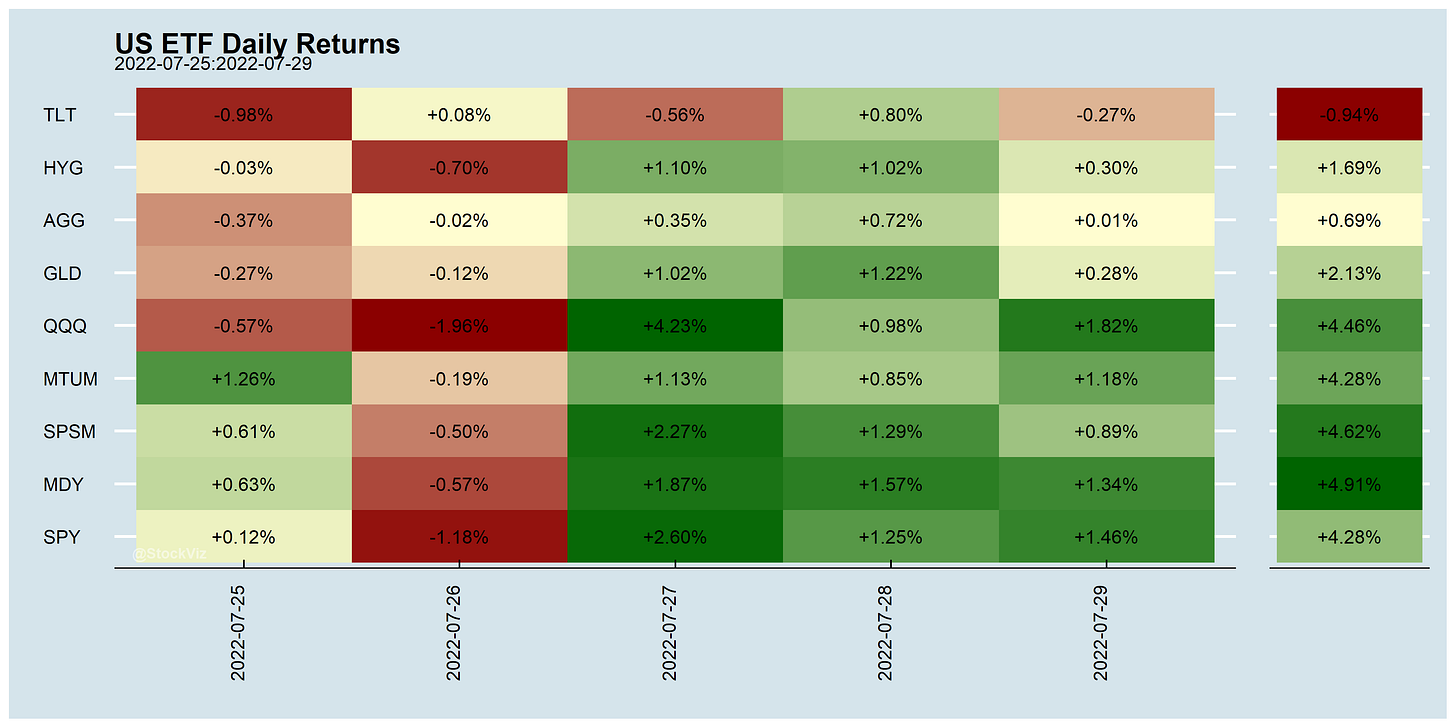

Markets this Week

The bear market rally in the US lifted stocks in India. US tech earnings were not as bad as feared and Indian banks and financial services companies look strong enough to weather whatever is coming.

Links

Aswath Damodaran’s Zomato thread is one for the books. (tra)

~

Exxon’s free cash overtakes Alphabet for first time since 2015. (bloomberg)

Russia's Gazprom says it has stopped gas supplies to Latvia. (dw)

Europe ramps up coal imports as energy supply fears grow. (reuters)

US regulators will certify first small nuclear reactor design. NuScale will get the final approval nearly six years after starting the process. (arstechnica)

~

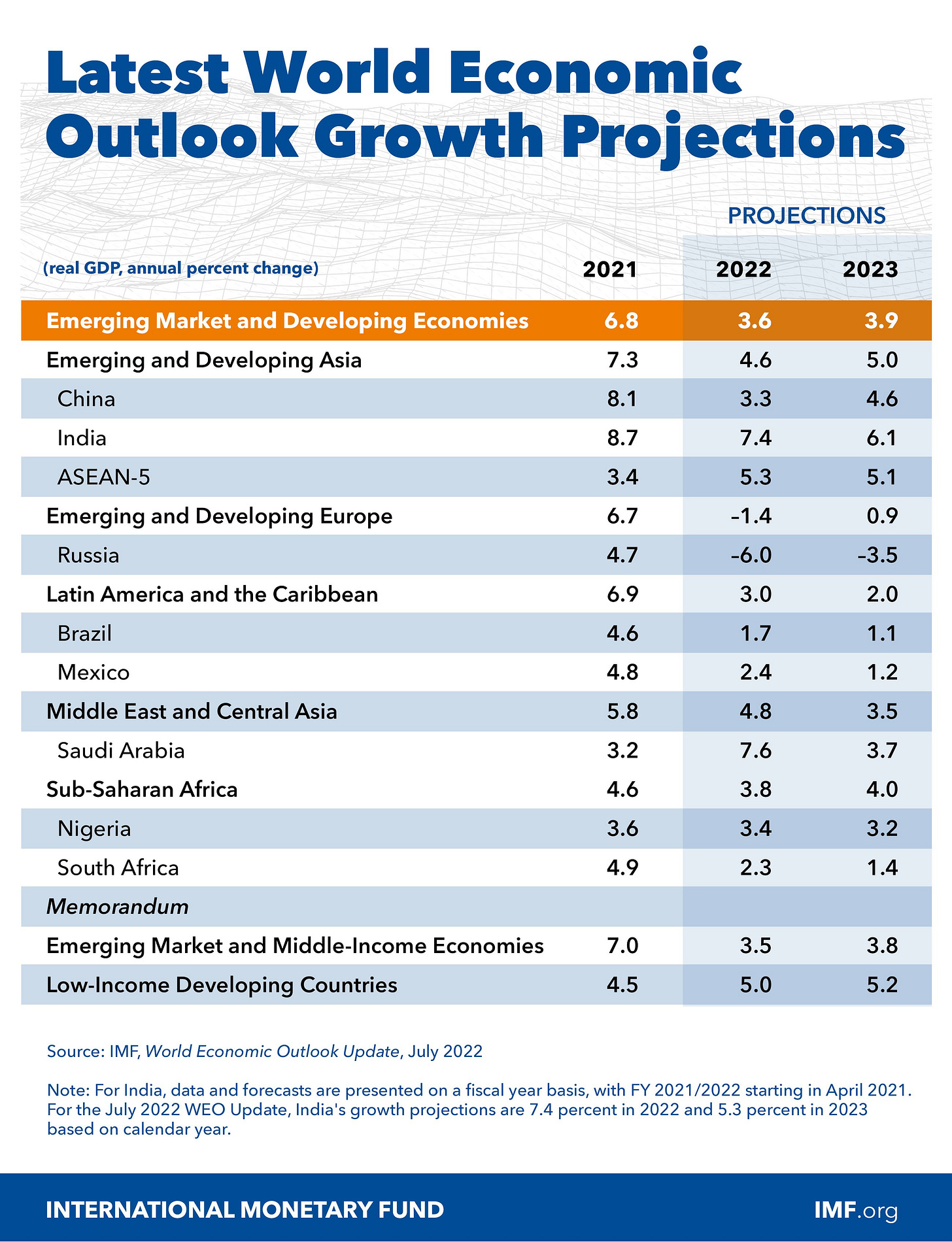

Sack your manager who talks up the prospects of an Asian country’s GDP growth.

Are booming economies good for markets? During the decade from December 2010 to December 2020, when nominal GDP in Asia excluding Japan grew almost 4.5 times faster than global nominal GDP, the former’s equities underperformed the latter’s by 25%.

Investors should prepare to be bombarded with bad economic news. They should also be prepared to ignore it. (man)

~

~

~

BTFD only works on broad-based indices. Don’t try it on individual stocks.

~

TikTok won (garbageday).

Like Bill Gates before him, Mark Zuckerberg is having a ‘Pearl Harbour’ moment. His company’s motto is ‘move fast and break things’ – but if it doesn’t move fast it’ll soon be broke. (theguardian)

~